While I generally prefer to remain positive and write about investments that I recommend for consideration, I also like to alert my readers to potential pitfalls in my portfolio holdings. In previous articles when I have discussed my Income Compounder Moving My Cheese – An Income Compounder Portfolio Update and my philosophy regarding my holdings, I have mentioned that I have had winners and learners (not losers) over the years that I have been investing in the stock market. I prefer to call them learners rather than losers because I always learn something from those investments that do not meet my objectives for holding them.

One of those recent learners for me is the Virtus Total Return Fund (NYSE:ZTR). Although I never previously covered this fund in detail, I did purchase shares initially back in September 2022, and then added more after the fund did a rights offering and the price dropped below my initial purchase price. The results of the RO were discussed in an article from fellow analyst, Stanford Chemist, Virtus Total Return Fund Rights Offering Results | Seeking Alpha.

The final subscription price was $6.96 per share, which seemed like a good price at the time for a fund with NAV of $7.88 as of the RO pricing date. The fund had just raised $140M in the RO and was offering a high yield distribution of around 15% annually as of the date of the article in October. The RO was slightly dilutive to NAV and there was some concern at the time that the distribution might be cut. However, no cut occurred until almost a year later.

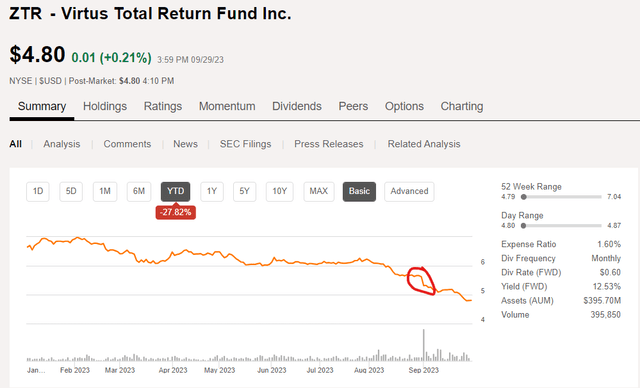

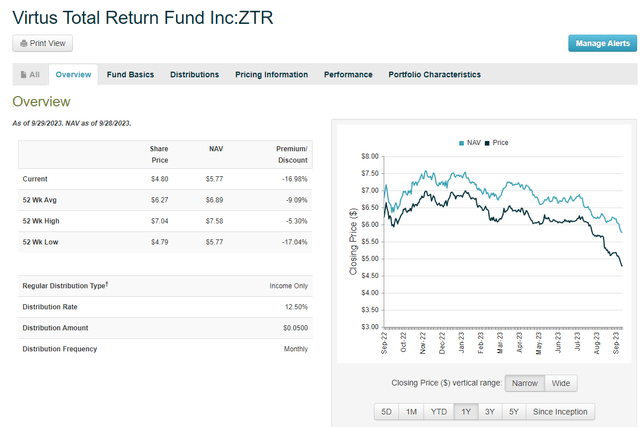

Then, on August 31, 2023 the inevitable cut was announced. The monthly distribution of $0.08 per share was reduced by more than 37% to $0.05 per share beginning in September. Since that announcement, the price has dropped even more now showing a YTD loss of -27%, much of which occurred subsequent to the announcement.

Seeking Alpha

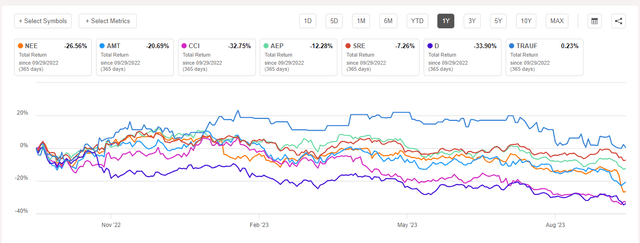

Others had warned as recently as August 3 that ZTR may not be a good investment and that it was simply returning the investors’ capital. The ZTR fund underperformed most of its top holdings over the past several years, most likely due to the leverage employed. And the future of the fund does not look encouraging either, as its top holdings are in a declining pattern as well, mainly due to rising interest rates that look to remain higher for longer.

ZTR Fund Overview

From the fund’s website, the investment objective is explained:

The Fund’s investment objective is capital appreciation, with current income as a secondary objective. The Fund seeks to meet its objectives through a combination of equity and fixed income investments.

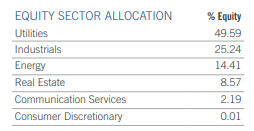

For the equity sector allocation, the fund’s fact sheet shows the percentages based on the holdings as of 6/30/23 with Utilities making up the largest percentage.

Virtus

The fixed income allocation includes a fairly well distributed spread between corporate high quality and corporate high yield bonds, asset backed securities, bank loans, non-agency residential MBS, and a smattering of other fixed income securities. The fact sheet does not indicate what percentage of the overall holdings include equity vs fixed income although in a May ZTR: Widening Discount And High Distribution Rate Make This Balanced Fund Attractive Here from George Spritzer, he suggests that the fund held about 60% equities and 40% fixed income at that time.

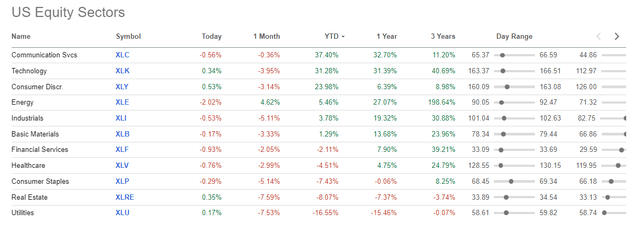

When considering just the equity holdings for a moment, consider that the worst performing sectors over the YTD period have been Utilities and Real Estate with Industrials and Energy not faring much better.

Seeking Alpha

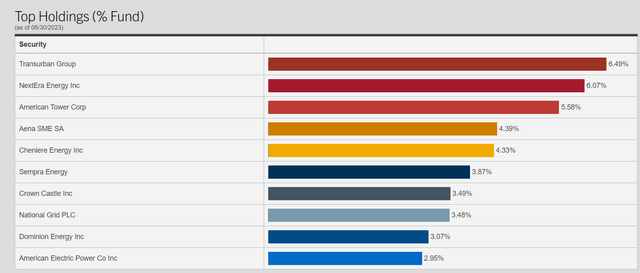

And when looking at the top 10 equity holdings, most of them have struggled in 2023, most recently NextEra Energy (NEE) which has lost more than -31% YTD. With that holding in NEE representing more than 6% of the overall fund holdings as of June 30, that one holding could account for nearly a -2% decline in the fund’s NAV.

Virtus

Other top holdings have not fared very well this year either with American Tower (AMT) down -23% YTD, Transurban Group (OTCPK:TRAUF) down -9%, Sempra (SRE) down -11%, Crown Castle (CCI) down -33%, Dominion Energy (D) down -30% and AEP down -21% YTD. National Grid (NGG), Aena SME, and Cheniere Energy (LNG) are the only top 10 holdings that have had a positive YTD return. Viewed graphically, the 1-year total return of those 7 holdings that did not have a positive YTD return does not paint a pretty picture.

Seeking Alpha

With the Federal Reserve not yet ready to back off raising interest rates, and with the possibility of higher rates for longer, utilities are not likely to bounce back soon. Therefore, even with the massive cut to the fund’s distribution it is unlikely that the distribution coverage will improve considerably in the short term. The NAV of the fund has been declining and the discount widening over the past several months, and the slope of the decline increased even further after the dividend cut was announced.

CEFconnect

The NII (net investment income) generated from the fixed income holdings is likely improving with yields moving higher this year, but it is not enough to offset the losses from the equity portion.

Learning from RA

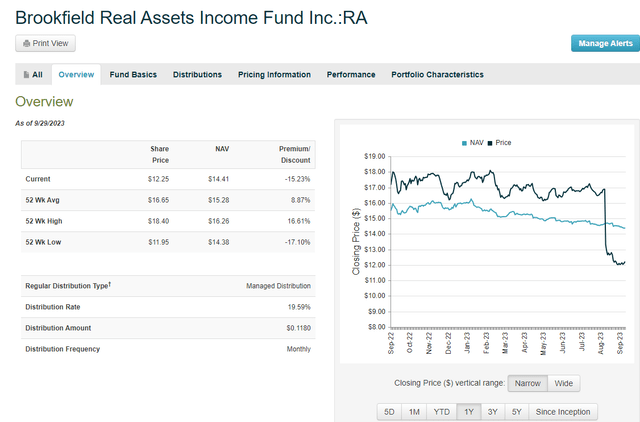

Another fund that is similar to ZTR, which also employs a balanced equity/fixed income strategy that tried that approach of increasing the fixed income allocation, was Brookfield Real Assets Income fund (RA). Late last year and earlier this year, RA began to shift its holdings from around a 50/50 equity to fixed income mix to closer to 97% fixed income and only about 3% equities by August. On August 29, the RA fund announced a massive cut to its distribution.

The market price of RA dropped dramatically after the announcement as it went from a high premium to a wide discount, but unlike ZTR, the NAV of the fund only declined slightly. This lesser decline in NAV is most likely due to the higher allocation to fixed income in the RA fund. While prices of bonds and loans have declined slightly this year, the decrease in value is much less significant than the decline in equity prices. Also, as the prices of fixed income assets come down the yield increases, so the contribution to NII is not as negatively impacted as the loss from capital gains in declining equity prices would be.

That change in market price moving from a premium to a substantial discount to NAV can be seen graphically in this chart of the price of RA compared to NAV as shown on the CEFconnect website.

CEFconnect

While RA has managed to keep a relatively slow decline in NAV under control, the cut to the distribution may be enough to continue covering it going forward. In the case of ZTR, I am not convinced that the fund managers will be able to turn things around soon enough to manage the continuing decline in NAV, or to adequately cover the reduced distribution going forward.

Even if the ZTR fund managers were able to shift to a more heavily weighted fixed income mix of assets, there is likely too much damage from the loss in capital gains to make up the difference with increased income, at least in the short term. The ZTR fund has about $430M in total common assets with $200M in total borrowed debt as of 8/31/23, with effective leverage of around 32%, further exacerbating the problem with declining NAV. The distributions over the past several months have consisted of large amounts of ROC (averaging 77% YTD with 100% in July and 75% in August), which is a further indication that the distribution coverage is lacking.

Summary and Recommendation

If you are currently holding shares of ZTR and are of the opinion that the worst is over and things are likely to improve for the fund, which now trades at an even wider discount to NAV of about -17% and yields about 12.5% based on the new $0.05 monthly distribution, then you may wish to hold your shares and collect the income. It is my opinion that the worst is not yet over with the utility sector still struggling from high interest rates which are not likely to come down soon. I sold my shares at a loss (“cut bait” using the fishing analogy) and will cast my line elsewhere to deploy the capital in a better investment that has brighter prospects for the future.

I would avoid other funds that invest in utilities for now and would focus more on a fixed income fund that offers a high yield and has good dividend coverage. One such fund that recently increased the distribution is Ares Dynamic Credit Allocation Fund (ARDC). On September 11, ARDC announced a small increase in the monthly distribution from $0.1125 previously to $.1175 per share as of September.

The ARDC fund currently trades at a discount of about -9% to NAV and yields about 11% annually based on the increased monthly distribution. The NAV of the fund is rising, and the latest increase is the third increase in the fund’s distribution in the past year. ARDC holds some floating rate loans and CLOs, which should also benefit from rising interest rates. I last wrote about ARDC in December 2022 when I rated the fund a Strong Buy and it has offered a total return of nearly 20% since then.

If you are interested in doing some “bottom fishing”, then ZTR may be of interest to you if you are willing to accept the risk that the price may still have further to drop, and there may be additional distribution cuts in the future if things do not improve soon in the utility sector. The fund now trades at its widest discount in a year and offers a yield of about 12.5%. But I would caution against making a large investment until the NAV begins to improve again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply