Introduction

Usually, I don’t incorporate old articles in my research – let alone use them as an introduction. However, I cannot stop thinking about an article I read in January, which was titled Americans Can’t Stop Pampering Their Pets – Companies Want In.

Wall Street Journal

As I have a dog, I’m part of the group that believes that dogs are family.

However, I had no idea how far some companies are going to benefit from this.

To quote the Wall Street Journal article I just mentioned:

Hilton Worldwide Holdings Inc. is adding hundreds of hotels where animals can stay the night. It offers virtual “pet expert teams” to address health and behavior issues they might have while traveling, teaming with Mars Inc., the parent of veterinary operator VCA and Pedigree pet foods.

Snack-bar maker Clif Bar & Co. this summer started selling a line of jerky treats for dogs. Global food giant

Mondelez International Inc. took over Clif in August. More pets and growing demand for all-natural dog food prompted the move, a spokeswoman said.

One company that benefits from this like no other is Zoetis Inc.(NYSE:ZTS), the world’s largest provider of animal medicines, vaccines, and diagnostic products.

I have covered the company a few times in the past. The most recent article was written slightly more than three months ago, when I focused on its dividend growth characteristics.

In this article, I want to go a step further and focus on the company’s progress and growth opportunities – especially after this month’s annual Morgan Stanley Global Healthcare Conference gave us a lot more data to work with.

So, without further ado, let’s get to it!

A Mix Of Secular Tailwinds

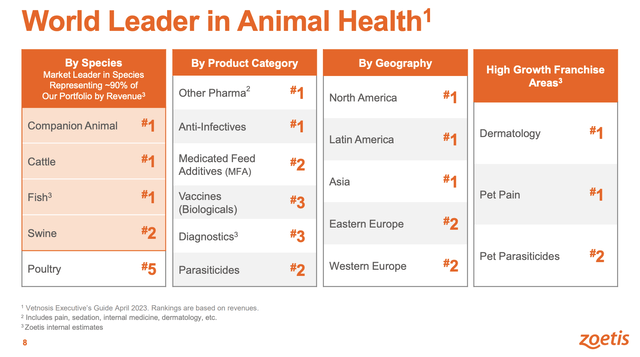

I like Zoetis for many reasons. One of them is the anti-cyclical nature of its business coupled with its size. With more than $8 billion in annual revenue, Zoetis is a leader in its business. Thanks to 15 blockbuster drugs and roughly 300 product lines, the company dominates two key markets:

- Companion animals, like cats and dogs.

- Cattle.

Besides that, the company is the leader in North America, Latin America, and Asia.

Zoetis Inc.

Having said that, and with regard to the two key markets it dominates, let me give you a few numbers the company mentioned in its most recent investor presentation.

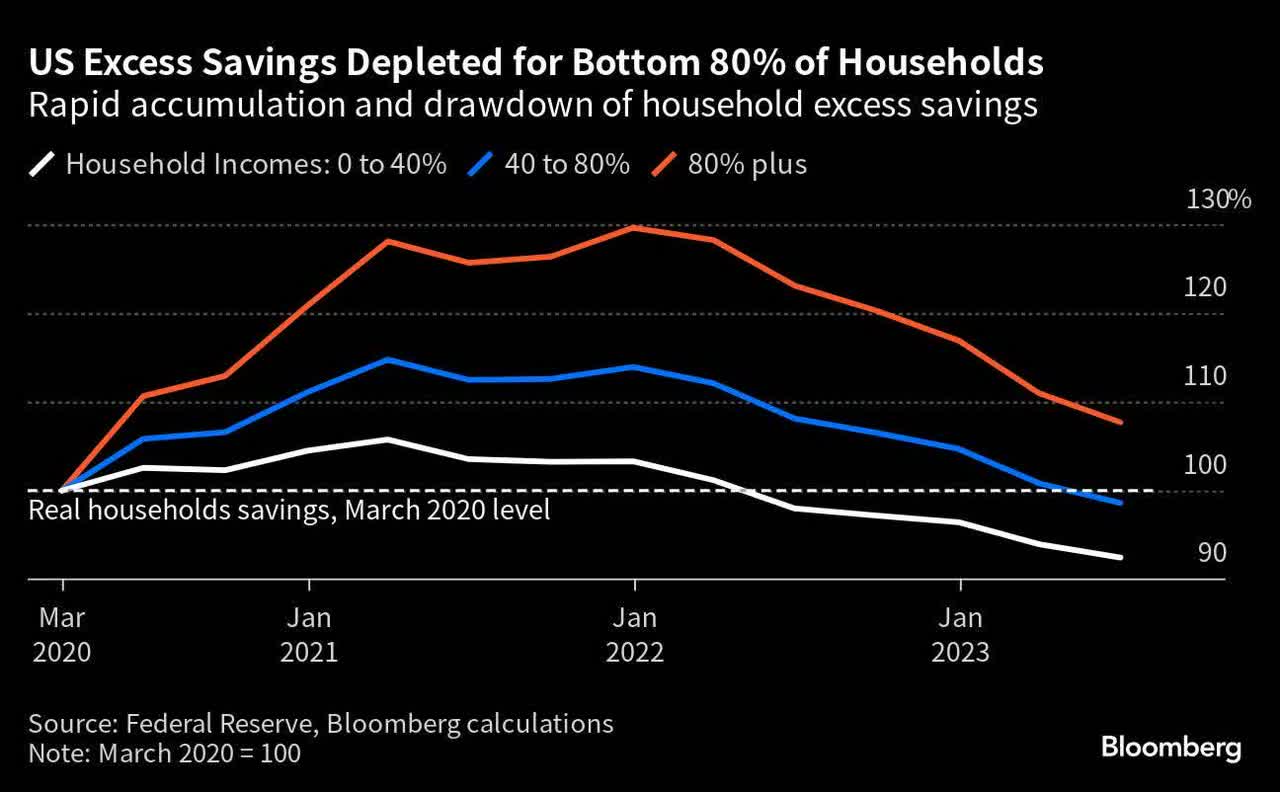

- While animal health, in general, is anti-cyclical, the compassion animal segment is the most anti-cyclical part of its business. The company noted that even in a situation where a household’s budget falls 20%, pet owners will not spend less on their pets. Right now, we’re in one of the toughest financial periods in a very long time for millions of households in both the U.S. and Europe – to name two major markets.

Bloomberg

- Meanwhile, cattle is a market that thrives because of the global need for protein and related products. Zoetis noted that with the outlook for 2 billion more people by 2050, the demand for healthcare products will skyrocket. This is not only caused by the number of animals but also because we need to deal with new health risks. For example, we’re seeing a lot more focus on animal health, like the headline from the U.K. Government below.

U.K. Government

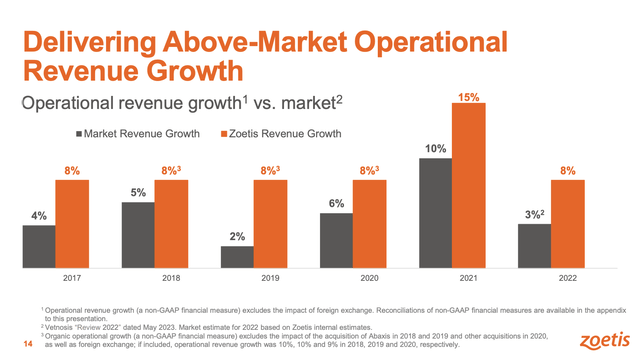

Thanks to strong secular growth, the company was able to grow fast over the past few years. However, it’s not only secular growth that benefits ZTS and its shareholders. Having the right products and the right strategy allowed the company to outperform its market on a very consistent basis.

Zoetis Inc.

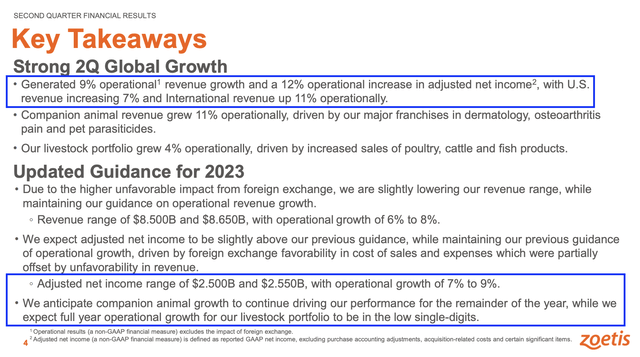

Strong growth continued in 2023. During the aforementioned conference, Zoetis started by addressing its operational growth guidance for the year, initially set at 6% to 8%.

The impact of destocking in the first quarter was an issue, especially within the U.S.

Despite this, the company anticipates a strong performance in the second half of this year and beyond, aligning with the mid-to-high-end of its full-year growth projection.

Notably, the second quarter saw a significant 9% operational revenue growth rate, which I highlighted in the slide below.

Zoetis Inc.

The company also made clear that it anticipates robust growth in companion animal health, driven by innovation and a growing commitment from pet owners to prioritize their pets’ health.

In contrast, livestock growth is expected to stabilize at low single-digit figures in line with industry trends.

Zoetis aims to sustain a 3-point premium over market growth in the long term by leveraging its broad product portfolio, innovation cycles, and bundling capabilities, which would mean that the company will continue the aforementioned trend of outperformance.

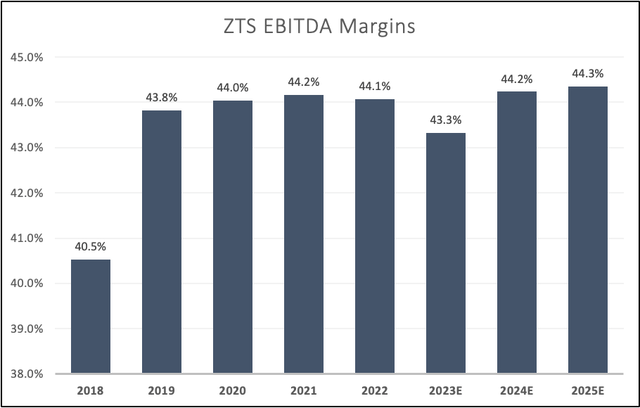

On top of that, the company aims to optimize the mix between companion and livestock animal health products, leveraging the higher margin profile of companion animal health.

Strategic investments and successful product launches are expected to positively impact the company’s margins.

Hence, analysts expect the company to quickly recover from the current slump in margins.

Leo Nelissen (Based on analyst estimates)

Adding to that, Zoetis historically has been able to implement price increases while sustaining volume growth (pricing power!). They observed a slight increase in pricing this year, about 4% in the second quarter. They attribute this to a careful strategy to maintain a healthy balance in their business operations.

Going back to drivers of long-term growth and potential competition risks, the parasiticides market is a significant segment exceeding $6 billion globally, with the U.S. constituting a substantial portion, approximately 2/3 of the market.

Despite new competition, Zoetis remains optimistic, given its 3.5-year head start with a triple combination product.

The first competitor with a competitive label has entered the market, and Zoetis anticipates aggressive promotions and longer-running promotions due to the timing of approval.

Zoetis has seen a 5% growth in the second quarter but is confident in its product’s superior efficacy, high satisfaction levels, and strong market penetration.

They expect to continue driving growth in the parasiticides segment, projecting a long-term growth range of 5% to 6%, which is a tremendously high number for a company that is seeing increased competition.

While the company didn’t comment on market share in the parasiticides market, its Trio product grew by 25% in the second quarter.

In addition to aggressively expanding in parasiticides and dermatitis, the company knows it can exploit a rapidly changing innovation cycle.

So far, potential next billion-dollar franchise areas, including atopic dermatitis and cardiovascular, chronic kidney disease, or oncology, have been identified.

Zoetis continues to invest in life cycle innovation to extend existing franchises and introduce new products in response to evolving market dynamics, which should support its ambitious growth target and maintain above-average growth on a very long basis.

Valuation

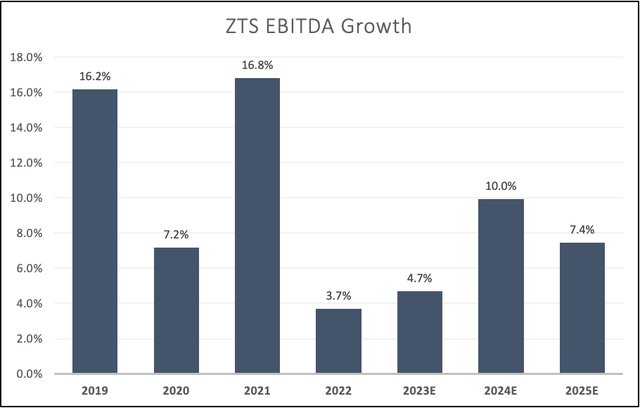

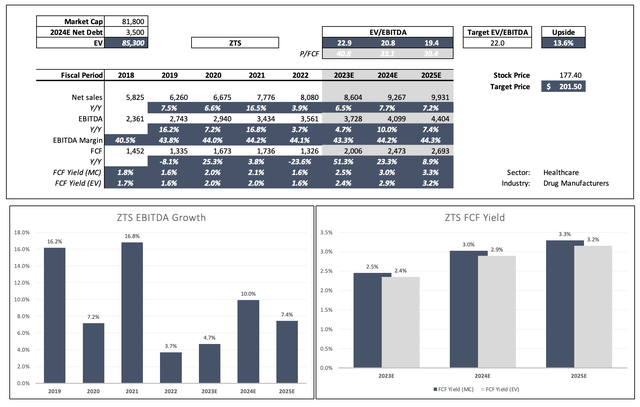

On top of improving margins, analysts expect ZTS to maintain strong EBITDA growth. While we won’t see growth rates like in 2021 (pandemic) anymore, the company is expected to maintain high-single-digit to low-double-digit annual EBITDA growth on a prolonged basis. This is in line with the company’s own guidance.

Leo Nelissen (Based on analyst estimates)

Free cash flow is expected to show similar growth rates, potentially resulting in $2.7 billion in 2025E EBITDA, which translates to a 3.3% free cash flow yield. This protects the current 0.9% dividend yield and paves the way for debt reduction and M&A.

Zoetis is also actively seeking opportunities for mergers and acquisitions, particularly focusing on smaller deals due to antitrust considerations.

They are mainly looking for smaller companies to buy R&D.

Regarding its balance sheet, net debt is expected to fall to $3.5 billion next year, which indicates a sub-1.0x leverage ratio.

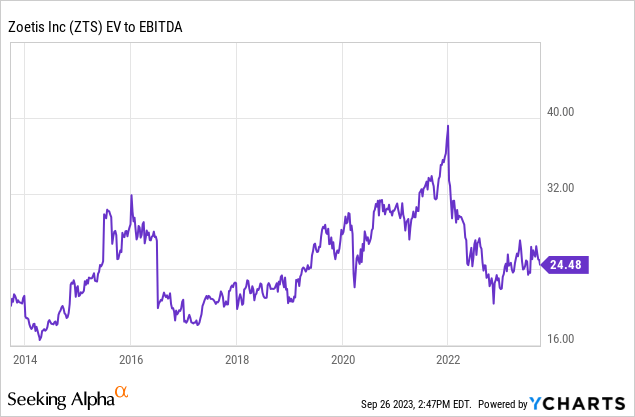

The company’s current valuation is 24.5x LTM EBITDA. This is close to the longer-term median.

If we apply a 22x multiple to account for slowing growth rates (ZTS becoming more mature), we get a fair value of $202 per share, which is 14% above the current price.

Leo Nelissen (Based on analyst estimates)

The current consensus price target is $223.

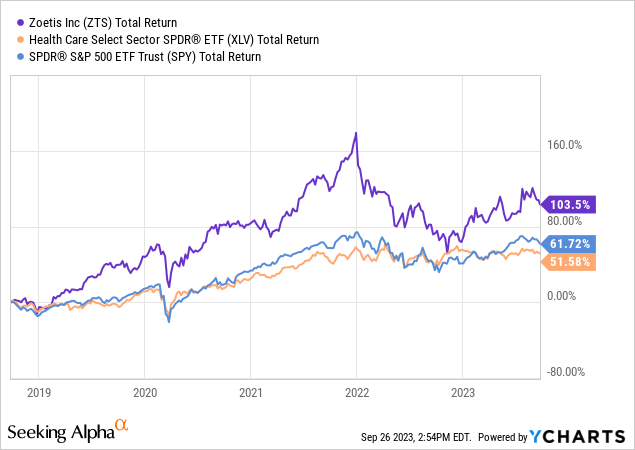

I stick to what I wrote in my prior article, which is that I expect ZTS to return roughly 12% per year, based on an unchanged valuation multiple and low-double-digit annual EBITDA growth.

I also expect ZTS shares to keep outperforming the healthcare sector and the S&P 500 (SPY).

Having said that, the market is currently in a bit of turmoil. It’s hard to say where ZTS shares will bottom, as it depends on the Fed’s fight against inflation. Markets are currently nervous due to a toxic mix of sticky inflation and weakening economic growth. The Fed is risking keeping rates elevated going into a potential recession.

Hence, investors interested in buying ZTS shares might be better off buying gradually instead of starting a full position at current prices. By buying gradually, investors can average down if the market keeps weakening. If the market takes off, investors have a foot in the door.

Takeaway

In a world where pets are increasingly considered family, companies are capitalizing on this bond.

Zoetis, a powerhouse in animal medicines and vaccines, strategically navigates anti-cyclical markets, staying resilient even in tough financial times.

Its focus on companion animals and the thriving cattle industry positions the company for substantial growth, underscored by robust second-quarter numbers and a clear growth strategy.

Despite market fluctuations, Zoetis projects sustained growth through innovative products and strategic investments, setting a target of 3-point premium market growth.

With a strong financial outlook and a diversified portfolio, Zoetis appears poised to outperform, making it an intriguing choice for investors, potentially offering a 12% annual return amidst market uncertainties.

For prudent investors, a gradual approach to entering the market seems wise, given the current economic landscape.

Read the full article here

Leave a Reply