Investment Thesis

In continuation with the coverage of Yatsen Holding (NYSE:YSG), we had ascribed a Buy rating on the back of a recovery in Chinese consumer spends, strong growth in its skincare pivot and turnaround of its Perfect Diary (PD) brand. We had ascribed a taIt has continued to report improving operational performance within its skincare segment in Q2 and sequential improvements in its colour cosmetics brand. We continue to reiterate buy as a result of stabilizing trends driving recovery in Chinese beauty market along with YSG’s better momentum.

Continued Earnings Momentum

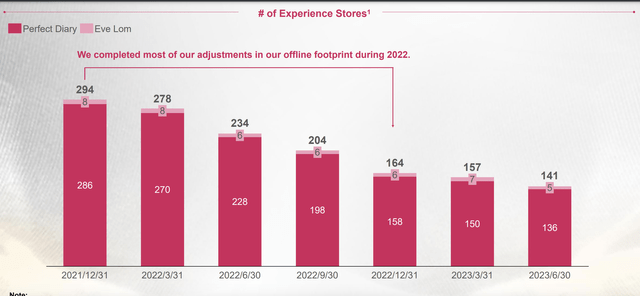

YSG reported a revenue decline of 10% YoY in Q2, at the top of its guidance of 10 – 20% decline it expected. Skin care sales remained solid and grew 2% YoY driven by strength of its Dr.Wu, Galenic and Eve Lom brands (which grew 13% YoY). Skin care now contributes about 38% of total sales compared to less than 20% share sometime back and up from 32% contribution in Q1. Color cosmetics segment continues to recover having declined by 16% YoY (up from 26% YoY in Q1) and is up sequentially 2% QoQ, which remains a silver lining, as a result of steady offline network with bulk of optimization of offline footprint having completed in 2022.

Company Presentation

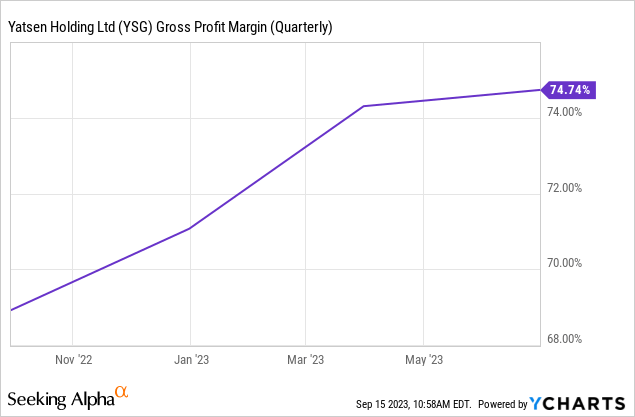

Gross margins remained stellar up 11.9 percentage points YoY demonstrating a clear uptrend since past few quarters. The strong margin expansion was driven by improving product mix, strict discount control and launch of new products with higher margin, particularly within the skin care segment.

Operating expenses continue to decline (-11% YoY) driven by decrease in fulfillment costs as a result of outsourcing of its warehousing operations, closure of non-performing stores partially offset by increase in marketing on digital channels. Non-GAAP Operating loss margin continued to shrink to 8.7% compared to 22.9% last year driven by strong gross margins and cost control measures. Non-GAAP Net loss per share continue to narrow to ($0.01) from ($0.34).

Balance sheet position remains stable with the company ending with cash balance of $355 mn and no debt providing sufficient flexibility.

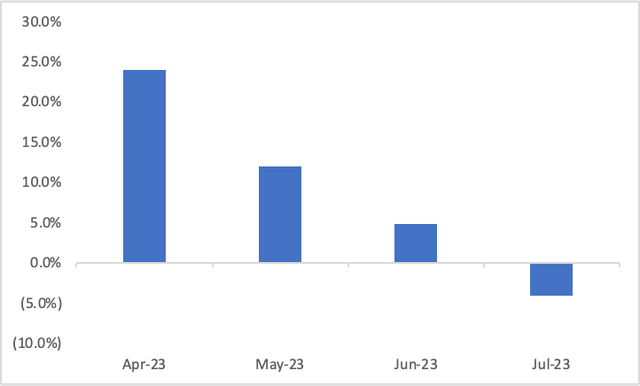

Management guided for Q3 revenues to decline by 10-20%, similar to Q2 but significantly narrowing from its guidance in earlier quarters (20-30% decline in Q1 2023, 30-40% decline in Q4 2022 and 35-45% decline in Q3 2022). However, the recovery within the overall consumer market, particularly the cosmetics market in China with total retail sales for cosmetics goods slowed having declined 4% YoY in July, however, we believe the worst is likely behind and the secular trends points towards recovery.

Total Retail Cosmetic Good Sales Growth in China

National Bureau of Statistics China

We trim our revenue forecasts slightly, however, expect H2 2023 is likely going to regain lost momentum and expect the company to end up 2023 sales in low single digits (down from mid single digits previously expected) driven by multiple product launches including PD’s new foundation products, expansion of Dr. Wu and Galenic product lines along with launch of new colours of its traditional hero products (lipstick and eyeshadow palette). Management announced a massive brand campaign and launch of new PD products during H2 which will drive recovery in color cosmetics segment and its manufacturing hub in Guangzhou (which began operations last month) will further help optimize supply chain and address capacity issues. We expect gross margins to remain at ~74% due to higher contribution from skincare (expect >40% of revenues to come from skin care) and improving product mix. In addition, SG&A leverage due to cost control measures will enable them to achieve EBITDA breakeven in coming quarters and we expect them to turn profitable by next year.

Valuation

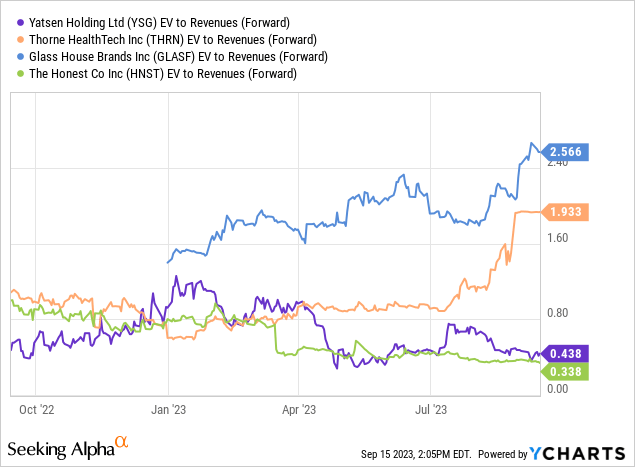

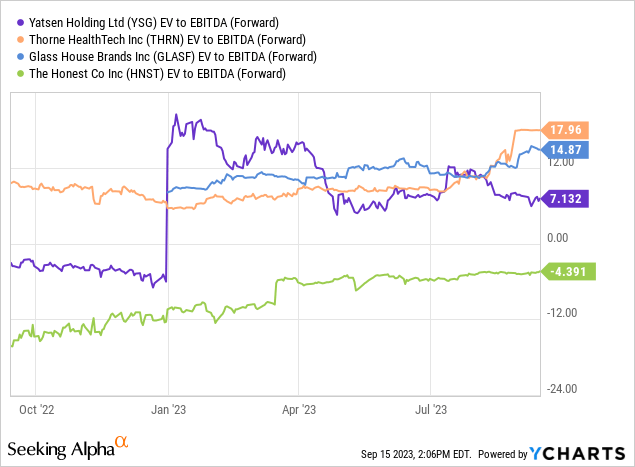

YSG still trades at a significant discount to its peers at just 0.4x EV/ Revenue.

On EV/ Fwd EBITDA basis as well it trades at a significant discount to its relative peers. We reiterate Buy valued at 0.8x EV/ Revenue, factoring a discount of 50% to its peers, increasing the discounting factor slightly due to China exposure and trim the target price to $1.30 (factoring cash/share of ~$0.6), still implying a significant upside.

Risks to Rating

Risks to rating include

1) Consumption slowdown as a result of macro challenges can dampen the recovery of the overall beauty market as demonstrated by a slight decline in the month of July

2) Continued underperformance within its color cosmetic segment may continue for a prolonged period which can further hurt its ability to achieve EBITDA breakeven

3) YSG operates in beauty industry and its inability in launching products which are not upto the customer tastes and preferences could hamper sales growth

4) Investments in brand building would render marketing spends at elevated levels which will further lead to continued operating losses

Conclusion

YSG has taken several steps in the right direction and has shown strong promise in its turnaround efforts significantly improving gross margins and narrowing losses by cost control. Consumer market in China, however, remains volatile and post strong double digit growth in April and May for cosmetic sales, it tempered down to MSD growth in June and a mild decline in July. We trim our revenue forecasts slightly, however, we continue to believe the company is likely to achieve EBITDA breakeven in coming quarters driven by strong sales growth from its new launches and gross margin expansion with cost control measures. We reiterate Buy assigning a slightly higher discount to the peers at 0.8x EV/ Revenue and a target price of $1.30 (from $1.35 previously)

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply