Introduction

As explained in my previous article, Wolters Kluwer (OTCPK:WTKWY) (OTCPK:WOLTF) is one of the global leaders in professional information where it has obtained a very strong position in the health, tax and accounting and risk and compliance sector. Wolters Kluwer used to be just a publishing house but hasn’t missed the digitalization, and the vast majority of its revenue is generated through digital formats (including software and online subscriptions to services) and that’s definitely very appealing given the recurring nature of that revenue. That’s also what got my attention, but it also is the reason why Wolters Kluwer tends to trade at a premium valuation and investors need to patiently wait on this one.

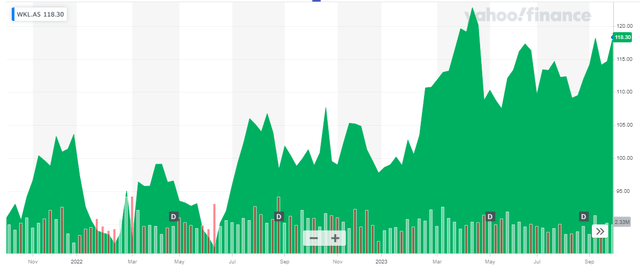

Yahoo Finance

Wolters Kluwer’s primary listing is on Euronext Amsterdam where the stock is trading with WKL as ticker symbol. The average daily volume in Amsterdam is approximately 400,000 shares per day. As the company has 245 shares outstanding, the current market cap is roughly 29B EUR based on the current share price of just over 118 EUR. I will use the Euro as base currency throughout this article.

Free cash flow remains strong

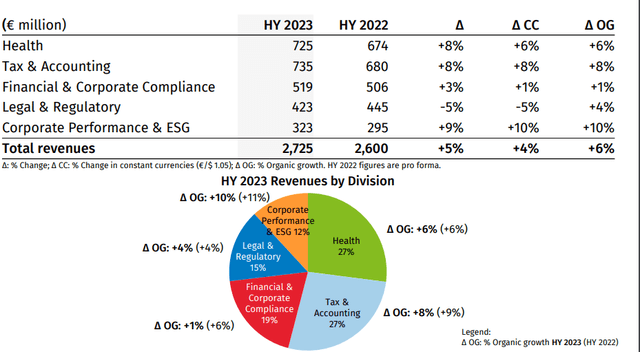

In the first half of this year, Wolters Kluwer announced pretty impressive growth results. As you can see below, health and tax and accounting still accounts for in excess of 50% of the total revenue, and the organic growth in both divisions was 6% and 8%, respectively.

Wolters Kluwer Investor Relations

The total revenue increased by about 5% while the organic growth rate was about 6% throughout all divisions.

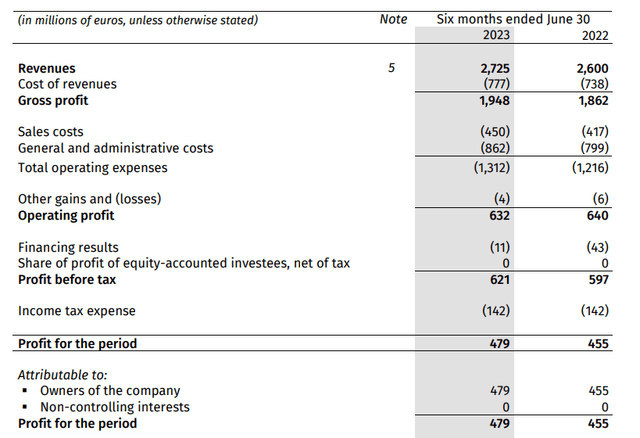

The company’s gross margins remain exceptionally strong. As you can see below, the total COGS increased by just 37M EUR, resulting in a gross profit of 1.95B EUR, a 4.6% increase compared to the first half of 2022. Unfortunately the company had to deal with higher G&A expenses and the total operating expenses increased by about 8% to 1.31B EUR, resulting in a 1% decrease in the operating profit which fell to 632M EUR.

Wolters Kluwer Investor Relations

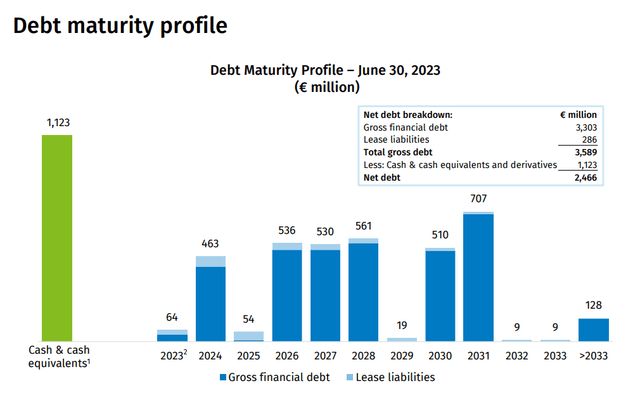

This doesn’t mean the first semester was bad or weak. The company also recorded a net finance expense of just 11M EUR compared to 43M EUR in the first half of 2022. The explanation for this improvement is very straightforward. Wolters Kluwer has about 3.3B EUR in gross debt (mainly at fixed rates) but its balance sheet also contains in excess of 1.1B EUR in cash. And as interest rates in financial markets are increasing, the company is now actually earning money on that cash pile, and that explains the drastic reduction in the finance expenses.

That situation will change as Wolters Kluwer will have to refinance its existing bonds. In May 2024, a 2.5% bond will have to be refinanced and that will very likely have to happen at a higher cost of debt. But the total interest rate won’t be outrageous: Its 2031 bonds are trading with a yield to maturity of 4.1%. So while we will see the total amount of interest expenses increase, those increases should be very manageable.

Wolters Kluwer Investor Relations

So, interest income on the cash pile was a tremendous help in the first semester and that’s the sole reason why Wolters Kluwer was able to report a 4% pre-tax income increase. The net income jumped to 479M EUR which represents about 1.94 EUR per share.

In my previous article I was focusing on the free cash flow profile of Wolters Kluwer. The company reported total operating cash flow of 681M EUR in the first semester, but this includes about 176M EUR in taxes although only 142M EUR was due. There also was a 11M EUR working capital contribution and we should deduct the 34M EUR in lease payments.

This means the underlying operating cash flow was approximately 670M EUR. The total capex was 157M EUR and this means the underlying free cash flow was 513M EUR. Divided over the current share count of 245M shares, the free cash flow was 2.09 EUR per share. Generating half a billion in free cash flow every semester sounds nice but it’s not a performance I’m willing to pay 30 times free cash flow for.

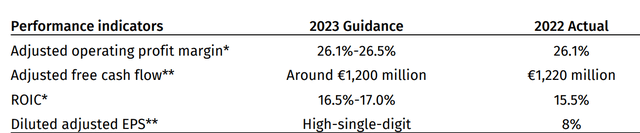

The updated guidance for 2023 doesn’t change my opinion. As you can see below, Wolters Kluwer was able to increase its full-year guidance on the back of a strong first semester and it now expects its EPS to come in around 8% higher than last year. Keep in mind the EPS increase already includes the impact of an anticipated 1B EUR share buyback in 2023.

Wolters Kluwer Investor Relations

The free cash flow guidance looks strong but likely includes changes in the working capital

Investment thesis

Wolters Kluwer is a leader in its sector, and the company is very well-managed on the operational front. However, the main question is whether or not you should pay 30 times earnings for Wolters Kluwer, and in the current investment climate, I’d argue the stock is a “hold” at best. Sure, the revenue and earnings will likely continue to increase at a mid-single digit rate for the next few years, but the analyst consensus estimates call for an EPS of less than 5 EUR in 2025 which means the current share price of 118 EUR would still represent 24 times the forward earnings.

Meanwhile, I’m also not convinced spending so much cash on buying back their own shares at a 3.3% free cash flow yield and I’m surprised that is the best way to allocate cash.

I’m on the sidelines. A great business, but too pricey for me.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply