The exterior of a Williams-Sonoma store.

For newer supporters of my work or those who need a refresher, my investment philosophy is generally as follows: I am focused on balancing dividend income and safety with growth. This is because safe and steadily growing dividends also typically lead to remarkable capital appreciation over time.

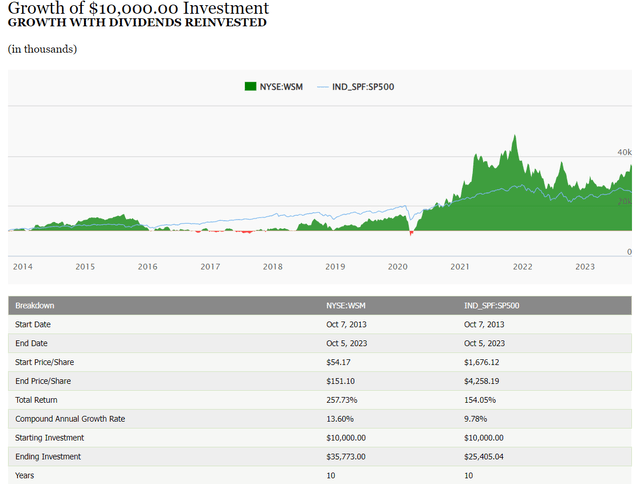

Williams-Sonoma Stock Performance

The omnichannel retailer Williams-Sonoma (NYSE:WSM) has been a remarkable investment. The company has upped its dividend, often at a high rate, for 13 consecutive years. Because this was supported by sizable growth in earnings, that explains how a $10,000 investment in 2013 would now be worth nearly $36,000 with dividends reinvested. For context, that is far superior to the $25,000 that the same investment amount in the S&P 500 index would be valued at today with dividends reinvested. For the first time in over 18 months, I will go over why Williams-Sonoma is the 16th largest stock in my portfolio, accounting for 1.4% of its value. At the time when I last covered Williams-Sonoma, recession risk and an eventual downturn was less obvious. Interest rate hikes were just beginning, and almost nobody predicted the current rate environment at that time. Due to the temporary downturn in profits resulting from this economy, that is why I have downgraded the stock from a strong buy to a buy rating.

The company leaves no doubt on the safety of its dividend. Williams-Sonoma’s 2023 EPS payout ratio will come in at around 25%. This is leagues lower than the 60% payout ratio that is deemed to be safe for consumer discretionary stocks.

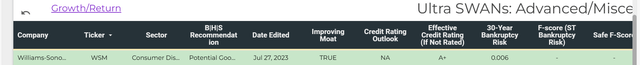

DK Research Terminal

Though not rated by the major credit rating agencies, Williams-Sonoma is a financially healthy business, as we will come to discover. This is why the company’s effective credit rating is an A+, which puts it at just a 0.6% risk of its stock going to zero in the next 30 years. Put another way, the odds of Williams-Sonoma not being in business in 2053 are just 1 in 167.

The stock appears to be priced at a 31% discount to fair value at the current $156 share price (as of October 6, 2023) relative to its $225 fair value estimate. This is a stark contrast to the 6% premium at which the S&P 500 index is currently priced.

Williams-Sonoma’s 2.4% dividend yield, 7% to 9% annual earnings growth prospects, and 3.9% annual valuation multiple upside could generate 13.3% to 15.3% annual total returns for the coming 10 years. This is materially more than the roughly 10% annual total returns the S&P 500 is forecasted to post from the current valuation.

Williams-Sonoma Is An All-Around Amazing Retailer

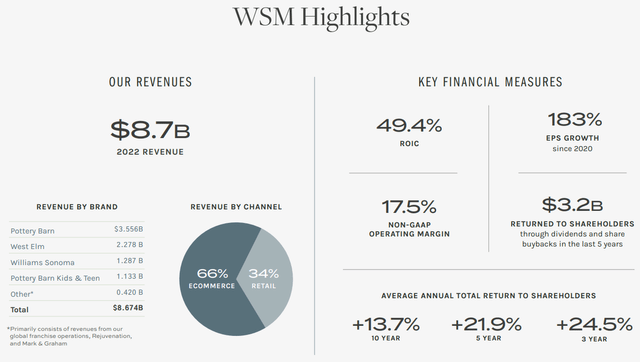

Williams-Sonoma April 2023 Investor Presentation

Williams-Sonoma is a leading high-end retailer of home furnishings and housewares. Its brands include the eponymous Williams-Sonoma, Pottery Barn, and West Elm. Unlike most other retailers, the company was ahead of the curve in realizing consumer preferences would shift to omnichannel – – a blend of e-commerce and physical stores.

This is why over the years, Williams-Sonoma has made the necessary investments to offer both e-commerce and in-store operations to customers. This includes over 500 company-operated stores in the U.S. and Puerto Rico, Canada, Australia, and the U.K., as well as 100-plus franchised locations in Mexico and throughout Asia (page 6 of 71 of Williams-Sonoma’s 10-K filing). The company generated $8.7 billion in revenue in its most recent fiscal year, which ended January 29, 2023. Unsurprisingly, 66% of this sales mix was derived from e-commerce, while the remainder was from physical retail locations.

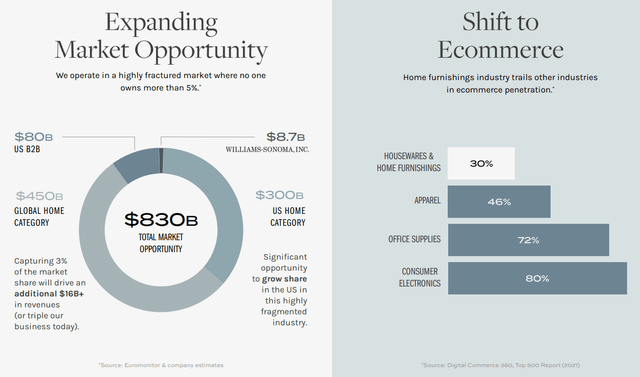

Williams-Sonoma April 2023 Investor Presentation

Williams-Sonoma operates in a very fragmented industry, which is evidenced by its merely 1% share of the $830 billion overall home and B2B categories. Better yet, the industry has a long way to go before catching up to other industries in terms of e-commerce penetration at just 30%.

These are major positives for Williams-Sonoma for the following reasons: The company can leverage its e-commerce capabilities to gain market share as more consumers turn to e-commerce for their needs. This is especially the case because Williams-Sonoma has 15 regional distribution centers and counting to meet this growing demand. Not to mention that the $80 billion B2B opportunity could see the company’s products enter hotels, offices, and so forth. This would further improve Williams-Sonoma’s brand recognition, which could drive even more growth for the company. These reasons are why analysts believe the company’s earnings will grow by between 7% and 9% annually for the foreseeable future.

Williams-Sonoma also had $514.4 million in cash and cash equivalents as of July 30, 2023. Against no long-term debt, this puts the company in a financial position to execute its growth plans without worrying as much about elevated interest rates. That is why Williams-Sonoma has an A+ effective credit rating.

Healthy Dividend Growth Can Continue

Williams-Sonoma’s otherwise decent 2.4% dividend yield probably doesn’t garner much enthusiasm from income-focused investors in this economic environment. But its 13.9% annual dividend growth rate over the past five years makes up for this lower starting yield.

Williams-Sonoma’s dividend is quite safe as well. Besides a well-covered EPS payout ratio, the company also produces more than enough free cash flow to fund its dividend.

Williams-Sonoma logged $698.7 million in free cash flow in 2022. Compared to the $217.3 million in dividends paid during the year, this is an FCF payout ratio of 31.1% (page 42 of 71 of Williams-Sonoma 10-K). That is why I expect more high- single-digit to low- double-digit annual dividend increases in the years ahead from the company.

Risks To Consider

Williams-Sonoma is a wonderful company, but it has risks that investors need to know about upfront before investing.

The company will do okay in the current environment characterized by high interest rates and sticky inflation, but returning to growth will require a positive macroeconomic environment. That is because the present economy’s high interest rates and inflation are weighing on the discretionary income of everybody, even the company’s typically affluent clients. Analysts expect modest 3.1% growth in Williams-Sonoma’s adjusted diluted EPS from fiscal year 2024 (this fiscal year) to fiscal year 2025. The lack of catalysts for the stock in the near term could mean no rally for the near future, while it could fall further if a worse-than-expected recession occurs.

The company has done a great job of giving its customers what they want. However, there is always the chance this could change over time. If Williams-Sonoma doesn’t adapt to changing consumer preferences as smoothly as it has in the past, its operating results could suffer as competitors take market share away.

Another risk to Williams-Sonoma is that as a retailer with personal customer information, there is a chance the company could be compromised in a cyberbreach. Its operations could also be significantly disrupted, as was the case with Clorox (CLX) recently. Such an event could pose the double-whammy of reduced revenue and earnings, as well as litigation.

Summary: Buy The Stock Now And Buy More On Weakness

Zen Research Terminal

Williams-Sonoma’s solid growth prospects and balance sheet free of long-term debt earn it the distinction of being an ultra SWAN currently.

The company’s present share price of $156 could mean the company has a 44% upside to its $225 fair value. With the potential for further downside due to the economy, I would suggest investors buy into the stock gradually. It would also be prudent to be more aggressive in buying on any dips in the months ahead.

Williams-Sonoma’s 2.4% dividend yield coupled with 7% to 9% annual earnings growth can deliver decent total returns. Throw in the potential for 3.9% annual valuation multiple appreciation and the stock becomes a better buy than the S&P 500 over the next 10 years.

Read the full article here

Leave a Reply