A COVID Story

You couldn’t write a better story if you tried. Imagine this: an airborne virus pandemic sweeps the globe, and you’re the CEO of a household-name disinfectant company. What could go wrong?

Well, if you’re Clorox (NYSE:CLX), a lot.

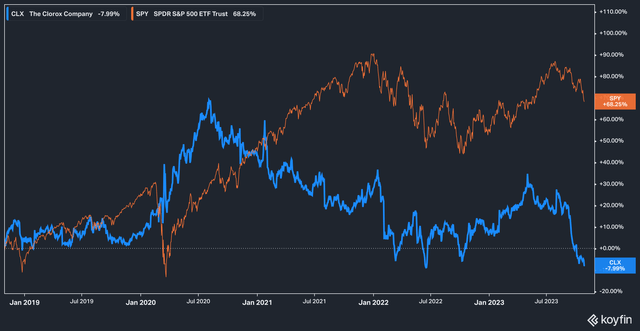

After surging more than 60% while the broader S&P 500 (SPY) tanked around the end of the first quarter 2020, Clorox stock has proceeded to grind steadily downward since then, much to the chagrin of shareholders.

Koyfin

On a total return basis, Clorox has delivered a negative 5.9% return to investors over the past five years (negative 20% on a price return basis). 2023 has not been kind to the stock either. This year alone the disinfectant maker has fallen almost 16%.

Part of this, of course, has to do with the nature of the business. Consumer staples have been steady over the last few years, but have markedly underperformed the broader market, which is dominated by tech. In the last five years the SPDR Consumer Staples Select Sector fund has gained only 23% while the wider market has appreciated by 54%.

Shareholders of Clorox will doubtless find that to be cold comfort, however, since the stock has underperformed even its sector benchmark.

This begs the question–what’s next for Clorox?

Today, we will attempt to answer that question. Let’s dive in!

Valuation

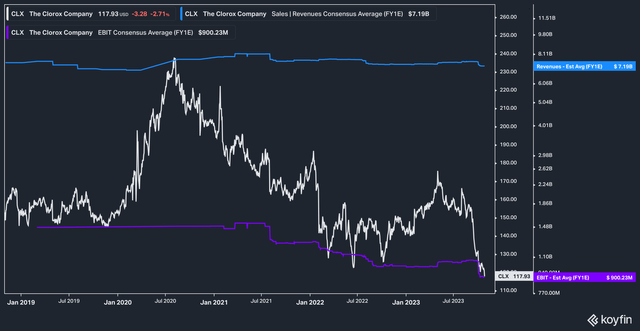

To start, let’s take a look at the company’s forward revenue and operating income estimates against its stock price over the past five years.

Clorox Stock Price, Forward Revenues & EBIT (Koyfin)

What’s curious about the above chart is that while the price of the stock has fallen and the expected operating profit for the company has eroded slightly, revenue estimates have stayed roughly the same.

A big reason for the decline in stock price has to do with the company’s margins, which were squeezed in 2021.

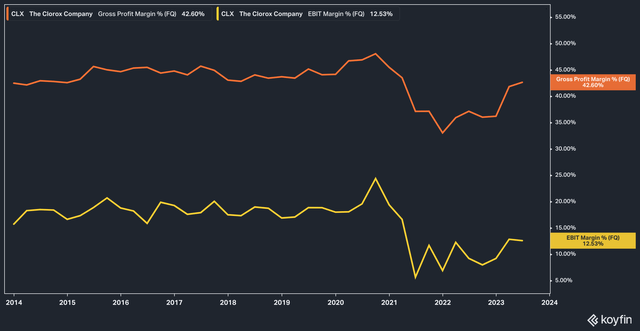

CLX Margins (Koyfin)

We think that the margin compression that occurred in 2021 and, in the case of operating margin, still exists to this day makes up the lion’s share of the stock’s trouble. This compression was the result of higher input costs for the company as a result of inflation, setting off a flurry of activity within the company to cut costs and raise prices.

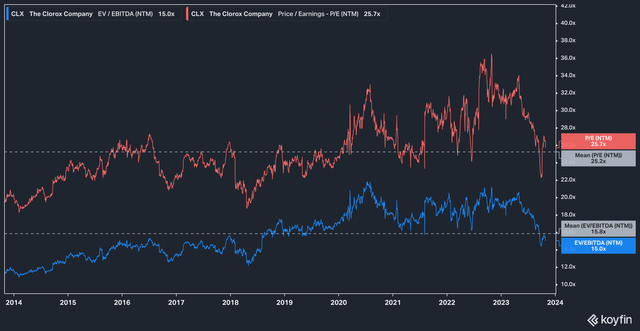

Support for this thesis can be seen in the stock’s historical valuation metrics.

Koyfin

Today, Clorox trades hands at 25.2x forward earnings estimates and 15x EV/EBITDA. Both of these figures are in line with the stock’s 10 year average of 25.7x and 15.8x, respectively.

All of this begs the question–is there any alpha to be had in Clorox stock?

What’s Ahead

One of the biggest drivers of Clorox’s business is (unfortunately) the severity or mildness of the upcoming flu season, which we in the Northern Hemisphere are in the early stages of for 2023-2024.

To forecast how mild or severe cases may be this year, then, we must look to the Southern Hemisphere for clues. According to DrugTopics.com, the Southern Hemisphere’s flu season has been a toss up, with some countries experiencing mildly worse or better flu seasons than last year. (While tracking the flu variants in the Southern Hemisphere isn’t a foolproof method for forecasting flu season severity up north, it is nonetheless useful.)

For their part, Clorox management appears to have the same trajectory for this flu season in mind. Set to report earnings for the first quarter of FY 2024 on November 1st, management guided in Q4 that “Net sales are expected to be flat to up 2% compared to the prior year. Organic sales are expected to be up 2% to up 4%” for the full fiscal year.

Importantly, the company also expects a material improvement in gross margin, forecasting an improvement of 150-175 basis points for FY 2024. Referencing the chart earlier in the article, this would restore gross margin to roughly the company’s average pre-pandemic level.

Analysts, however, don’t seem to be sold on the story provided by management–but you wouldn’t know if just from taking a look at average price targets.

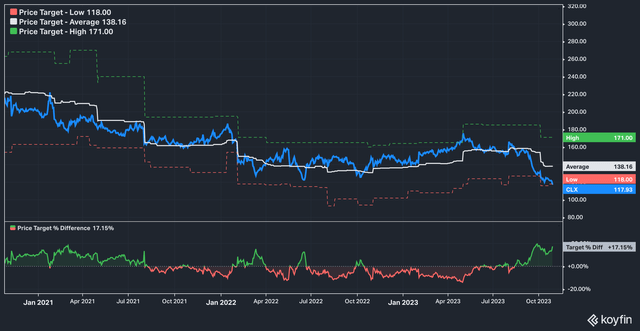

CLX Analyst Estimates (Koyfin)

After spending quite a while trading above the average analyst price target, the recent slump in Clorox’s price has created a 17% differential between it and the average analyst target price.

This, however, belies the attitude of analysts in general:

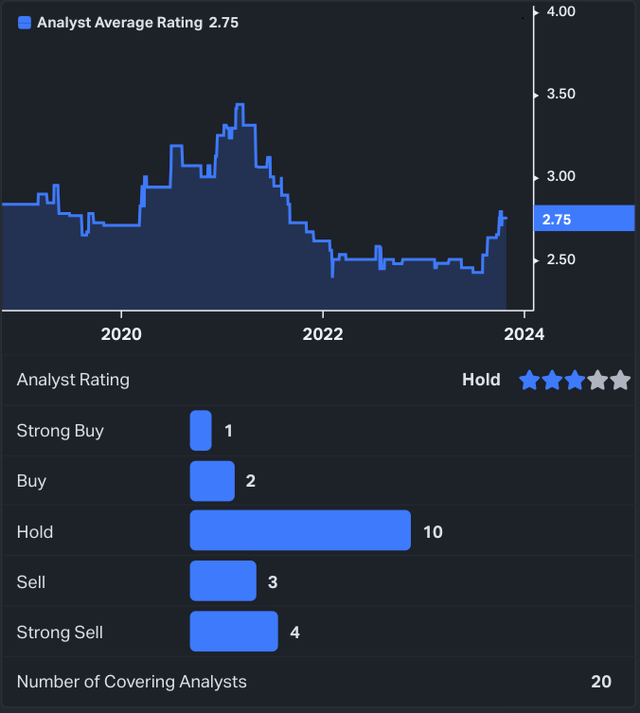

Analyst Ratings (Koyfin)

Of the 20 analysts who cover Clorox, a majority rate the stock a hold or worse, with only 3 assigning the stock a buy or strong buy rating.

Looking out ahead to the expected numbers for the first quarter, analysts believe that Clorox will print $1.3 billion in top line revenue (a 24% decline year over year) and adjusted EBITDA of $51 million (a 77% decline year over year).

Given the low expectations analysts have for the stock, we would not be surprised to see Clorox beat the estimates from the street. That doesn’t guarantee a day in the green for the stock, however–guidance is likely to play a larger role in what happens for Clorox stock than the print.

The Bottom Line

Clorox is a steady-state company that has had a difficult few years, facing rising input costs, inflation, and a form of ‘comp hangover’ from the highs of COVID. With this backdrop, it doesn’t seem like anyone expects much from the stock. Normally, this kind of pervasive negativity would attract us to think of the stock as a potential buy. However, the expected mildness of the upcoming flu season and a lack of resurgence in COVID-19 cases has us thinking that the stock is currently fairly valued against expectations.

Read the full article here

Leave a Reply