I imagine many readers of this article may already have preconceived notions about Trump Media & Technology Group Corp. (NASDAQ:DJT). To those seeking a deeper understanding of the company’s business model, I suggest exploring the multitude of bearish articles available here on Seeking Alpha. I believe each new analysis piece should offer fresh insights, which is why I’m crafting today’s thesis not solely based on widely known market sentiments regarding DJT. From what I’m seeing today, I think speculators (and especially investors) shouldn’t be shorting Trump Media stock, given the significant risks involved.

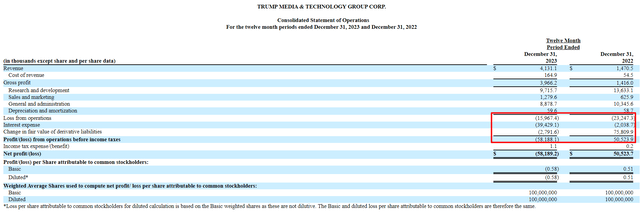

First off, I should devote some attention to the description of the business processes and the fundamentals of the objects of my investigation (DJT in this particular case). Looking at Trump Media’s financials, it is clear to me that its existing business model is not sustainable. I like how fellow SA analyst, Greathouse Research, shared their thoughts on this topic recently.

Let’s expand on this concept, starting with the example of a T-shirt business; due to the strength of your brand, you believe you can sell a T-shirt for $25. Let’s say that every shirt sold costs ($10 to make, $3 in Fabric, $3 in Labor, and $4 to transport and other costs); your profit on each shirt works out to be $15. Logos and designs can be created for a few thousand dollars (on the high end), and few support roles are required to maintain ongoing operations. The business model’s low costs and simplicity are precisely why so many social media personalities (such as Trump) sell branded merchandise; when done right, branded merchandise is a cash cow.

Social Media is an entirely different beast from the T-shirt business; the economics are radically distinct. First, there are massive barriers to entry; it can be very costly to develop a social media website, which will require coders and an IT staff. Then, assuming you can pull that investment off, you’ll need to hire people to control the spread of inappropriate content.

Once you’ve invested millions into building the platform and agreed to supply millions of dollars in compensation, you need to figure out how to keep an audience of readers engaged and active on the platform so that you can either advertise to or sell premium upgrades. After all, if the users aren’t engaged and generating the content, the site becomes stale. More users, more content, more engagement: that is the magic flywheel.

So let’s put it in relatable terms: imagine choosing between starting a lemonade stand or investing millions into creating an elaborate theme park instead. While lemonade stands have straightforward costs, theme parks come with massive upfront investments and ongoing expenses. In the case of Truth Social, Trump’s venture into social media, the comparison is similar. Unlike selling T-shirts with his name on them (which would be more logical considering Trump’s political career), running a social media platform involves significant technical development, content moderation, and user engagement efforts. These translate to hefty expenses, which are hard to justify, when the potential user base is limited by the platform’s controversial brand.

DJT’s 10-K filing, Oakoff’s notes

As you may know, social media relies heavily on network effects: the more users, the more valuable the platform becomes. However, Truth Social’s polarizing nature makes it challenging to attract a broad audience beyond Trump supporters. This limits growth opportunities and makes it less appealing to advertisers seeking a diverse user base.

Moreover, the platform in its current form seems ill-suited to achieving sufficient engagement to continue to grow and scale – the user experience on Truth Social leaves much to be desired, judging by third-party reviews.

Twenty-four hours of scrolling through posts from “Truthsayers” on the two-year-old platform explained why the site is tanking. In short, partisan echo chambers are stale, musty spaces that lack the sort of oppositional views needed to make social media tick. Truth Social feels like a MAGA town hall in a ventless conference room, where an endless line of folks step up to the mic to share how the world is out to get them.

Source: Los Angeles Times

While small businesses can often thrive by staying lean and agile, Truth Social faces the opposite problem. Despite generating minimal revenue, the company incurs disproportionately high expenses, especially in executive compensation. According to Seeking Alpha, just recently, Donald Trump increased his ownership stake in DJT to 64.9%. This move follows a regulatory filing indicating that Trump received an additional 36 million shares as part of an “earnout” provision from the company’s merger deal in 2021. So as a result, Trump now holds a total of 114.75 million shares in the company.

But why do I recommend not shorting DJT at its current high prices?

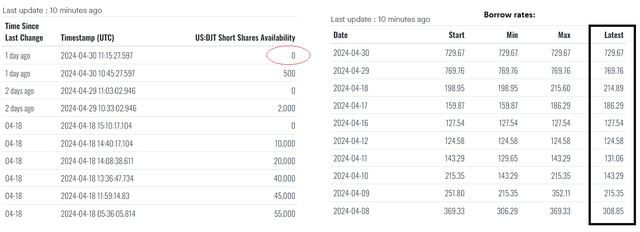

You may be familiar with the concept of market efficiency, which suggests that markets effectively process and respond to information, accurately (or almost accurately) reflecting it in stock prices. However, in the case of Trump Media, the current price of ~$45/share may not necessarily reflect its fundamental growth potential. Instead, I think the market sentiment prices in a very high likelihood of Trump Media’s stock collapse within the next year, judging by the borrowing cost of shorting currently at ~730%. In simpler terms, a speculator who borrows shares from a broker and returns them after a year could incur a cost equal to 730% of the position size.

DJT stock, Fintel data, Oakoff’s notes

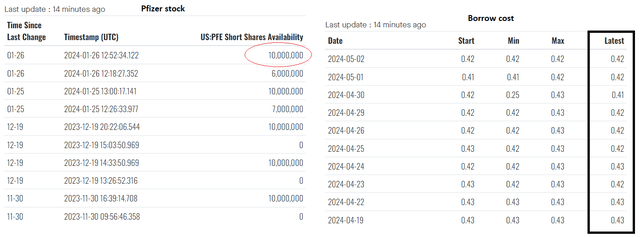

Consider comparing these indicators with those of Pfizer (PFE), for instance. While Pfizer is inherently unrelated to Trump Media, it may serve as an illustration of a large and reputable company for comparison purposes.

PFE stock, Fintel data, Oakoff’s notes

The difference is truly impressive.

I firmly believe that the only way to beat the market is to take positions that deviate from the prevailing consensus. Take, for example, an investor evaluating the growth prospects of a stalwart like Pfizer. Despite strong and steadily rising financial metrics, the stock chart reveals a persistent downtrend that seemingly disregards recent improvements and future earnings forecasts. If you invest in Pfizer under these circumstances, you’re essentially betting against market sentiment and believing that the growth potential is greater than what Wall Street recognizes. That’s what an “out of consensus” bet is all about.

In the case of Trump Media, the market seems to be looking at the company’s business model with a clear eye. It likely recognizes that competition from industry giants like X and Meta Platforms (META) is fierce and that Trump Media’s future viability is uncertain. As a result, analysts are reluctant to provide forecasts on future financial metrics (sales and EPS), as evidenced by the lack of such estimates in Seeking Alpha’s tables.

In the absence of estimates, it seems the market is betting against Trump Media as a sound investment. As potential investors or speculators, we can’t find fault in this logic, given the obvious flaws in Trump Media’s financials and growth prospects. Moreover, Donald Trump’s approach to developing the company (in my non-political opinion) detracts from its attractiveness. As a result, there’s little reason to buy shares, as this would simply be following the market consensus. Conversely, shorting Trump Media shares is also unwise due to the exorbitant borrowing costs. In the current situation, it’s pointless to attempt capitalizing on short-term price fluctuations, as the stock’s movements appear irrational and unpredictable.

So what to do with DJT?

In short – nothing. When we can’t bet against consensus, we can’t get an abnormal return. Thus, I advise against seeking quick gains from Trump Media; they’re simply not there. Engaging in short plays could prove costly, and holding shares long-term may incur even greater losses. Therefore, it’s prudent to pursue more promising investment prospects that offer greater potential returns.

Good luck with your investments!

Read the full article here

Leave a Reply