My Thesis

In late June 2023, I published an article about the NASDAQ Composite (COMP.IND) (NDX) (NASDAQ:QQQ) taking more and more risks as it approaches a potential pivot point. At the time, I assumed that this reversal would most likely occur in July-August:

Seeking Alpha, my previous take

My calendar now reads September 26, and I have some reasons to believe that my delayed Sell call was correct. I think it’s not too late for investors to sell the NASDAQ Composite and large-cap Tech stocks in general, at least tactically.

My Reasoning

I’ll strive for brevity in my argument to stay focused and avoid getting lost in my own thoughts.

Those investors who continue to expect a rally in the technology sector tend, as far as I can tell, to focus on inflation and its trajectory as a sort of weather vane: the lower inflation, the less initiative the Fed has to tighten monetary policy, the greater the chances that American companies will continue to grow. The technology sector [NASDAQ Composite in particular], which had the highest operating margins in recent decades, should be most comfortable in this picture of the world, and fast-growing companies should soon regain access to cheap money (interest rates will fall), which will allow them to become profitable quickly, justifying the current high valuations. This is precisely the logic I see from forward estimates of the IT sector’s profit margins:

![Yardeni Research [September 18, 2023]](https://finfactories.com/wp-content/uploads/2023/09/53838465-1695717960701369.png)

Yardeni Research [September 18, 2023]

Author’s notes: The blue line is the actual 4Q trailing profit margin; the red line is the implied forward profit margin.

As one of the prominent bulls, Fundstrat Global Advisors recently wrote [proprietary source], inflation remains a key factor for the markets, and so since it’s now on a downward trend, we should expect a positive stock market development by the end of 2023, as the Fed no longer needs to slow down the economy when inflation is on the right track.

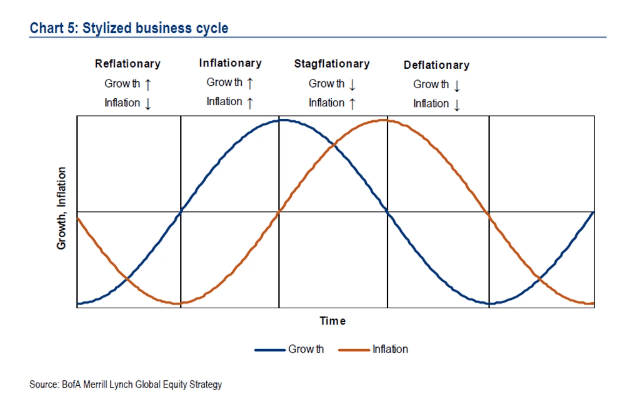

However, in my opinion, bulls forget that there are market cycles that contradict the logic described above. The intense inflationary phase experienced by the U.S. in 2021-2022 is usually followed by a period of stagflation, after which growth generally does not resume but continues to decline, leading to the Deflationary phase shown in the following chart:

Bank of America

Therefore, it is unlikely that the high expectations for margins in the technology sector will come true. Inflation does not occur in a vacuum: it is itself the result of lower prices for various groups of goods, and lower prices lead to lower margins, all other things being equal. The way prices for petroleum products and certain commodities have moved recently, I expect production costs for many companies to remain at about the same level as they have been. But as end-consumer demand slows, which is already happening [based on Morning Consult PRO’s data], margins should adjust in 2024 instead of increasing as priced-in today.

![Morning Consult PRO [September 2023], author's notes](https://finfactories.com/wp-content/uploads/2023/09/53838465-16957199668323483.png)

Morning Consult PRO [September 2023], author’s notes

Analysts from JPMorgan concur with my findings, noting that PPIs tended to show a very strong positive correlation with earnings growth.

![JPM [September 25, 2023 - proprietary source]](https://finfactories.com/wp-content/uploads/2023/09/53838465-16957203216403654.png)

JPM [September 25, 2023 – proprietary source]

The same analysts also wrote that the reasons why consumers accepted the big price increase without much softening in volumes might be behind us as the excess savings are trending lower:

![JPM [September 25, 2023 - proprietary source]](https://finfactories.com/wp-content/uploads/2023/09/53838465-1695720413477466.png)

JPM [September 25, 2023 – proprietary source]

This is the fundamental rationale for my thesis: I believe we are in for a correction with high expectations that will ultimately lead to a cooling of the hottest and most overvalued sectors. The NASDAQ Composite, as the most obvious embodiment of such sectors, should be one of the first to fall under the market’s hot hand.

But these fundamental things are nothing as long as the momentum doesn’t slacken. As the well-known saying of John Maynard Keynes goes, markets can remain irrational longer than you can remain solvent. Therefore, when it comes to timing, we also have to take into account how the market actually behaves, not only how it should behave.

In my previous article, I wrote that we are approaching what could be called a turning point for the markets: Seasonally, it fell in July-August. In fact, it happened at the end of August.

On the daily chart, we see how the NASDAQ Composite, represented by QQQ, has broken through its 100-day moving average and has been unable to hold higher when it tried to in early September.

TrendSpider software, QQQ daily, author’s notes

Order blocks – the blue and green areas you see on the price chart above – help traders spot essential areas with significant buying or selling activity on a price chart. These zones can act as future support or resistance levels by highlighting clusters of orders that impact price movements. Using TrendSpider software, we can clearly see that QQQ has many more sellers than buyers at the current level – especially so on the weekly chart:

TrendSpider Software, QQQ weekly, author’s notes

The demand zone of $150-180 can’t be a target, of course – it’s too deep. But the order blocks can help us get an idea of what the balance of power is in the market today. And apparently, the balance of power has shifted lately from the bulls to the bears, as they say in Wall Street jargon.

The Takeaway

I would like to qualify right away that my thesis is most likely wrong in the long run: the sky is not falling, and the NASDAQ Composite companies should have excellent long-term returns, theoretically much higher than the broad market (due to high beta).

Also, I may be wrong about my short-term timing and the QQQ may grow another 20-30% because inflation is really falling and most macroeconomic indicators are still strong.

I am just going by the targets of tactical positioning, which currently shows clear signals to sell:

- first, a fundamental revaluation of EPS growth potential in the medium term;

- second, the technical weakness of the current rally.

Therefore, I recommend avoiding the technology sector in general and the NASDAQ Composite in particular until there are new signals that are opposite in meaning to the current signals.

Have a nice day!

Read the full article here

Leave a Reply