Every weekday the CNBC Investing Club with Jim Cramer holds a Morning Meeting livestream at 10:20 a.m. ET. Here’s a recap of Tuesday’s key moments. 1. U.S. stocks were choppy in midmorning trading Tuesday, with stocks set to close out a third-straight month of losses. The S & P 500 and the Nasdaq Composite were both oscillating between small losses and gains. Jim Cramer said that there’s currently a “disconnect” in the market, but added: “This, too, shall pass.” The market continues to be highly oversold, at minus 6.03%, according to the S & P 500 Short Range Oscillator . Bond yields, meanwhile, pulled back slightly ahead of a closely-watched decision Wednesday from the Federal Reserve on whether to raise interest rates further. The yield on the 10-year Treasury was hovering just above 4.8%. The price of West Texas Intermediate crude oil climbed 0.85%, to trade around $83 a barrel. 2. Club holding Caterpillar (CAT) delivered strong quarterly results Tuesday, even as investor concerns over its backlog and margins peaking sent shares tumbling roughly 6%, to around $227.60 apiece. But Jim said the decline could prove a buying opportunity. “I would like to buy some CAT when it gets to $225,” he said Tuesday. Meanwhile, Club name GE HealthCare Technologies (GEHC) also reported solid quarterly earnings Tuesday, pushing shares up by nearly 7%, to $67.54 each. “This is a $70 stock at a minimum,” Jim said, urging investors not to sell it. Stay tuned for a detailed Club analysis on both earnings reports later Tuesday. 3. New U.S. restrictions on chip exports to China could cancel billions of dollars in upcoming orders for Club holding Nvidia (NVDA), The Wall Street Journal reported Tuesday. A spokesperson for Nvidia said the artificial-intelligence chipmaker is working to allocate those chips to customers in the U.S. and around the world, while reiterating that the export controls will not have a meaningful impact in the near term. Jim said Tuesday that there is so much demand in the U.S. from mega cap technology firms that Nvidia can absorb the hit . (Jim Cramer’s Charitable Trust is long CAT, GEHC, NVDA. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Read the full article here

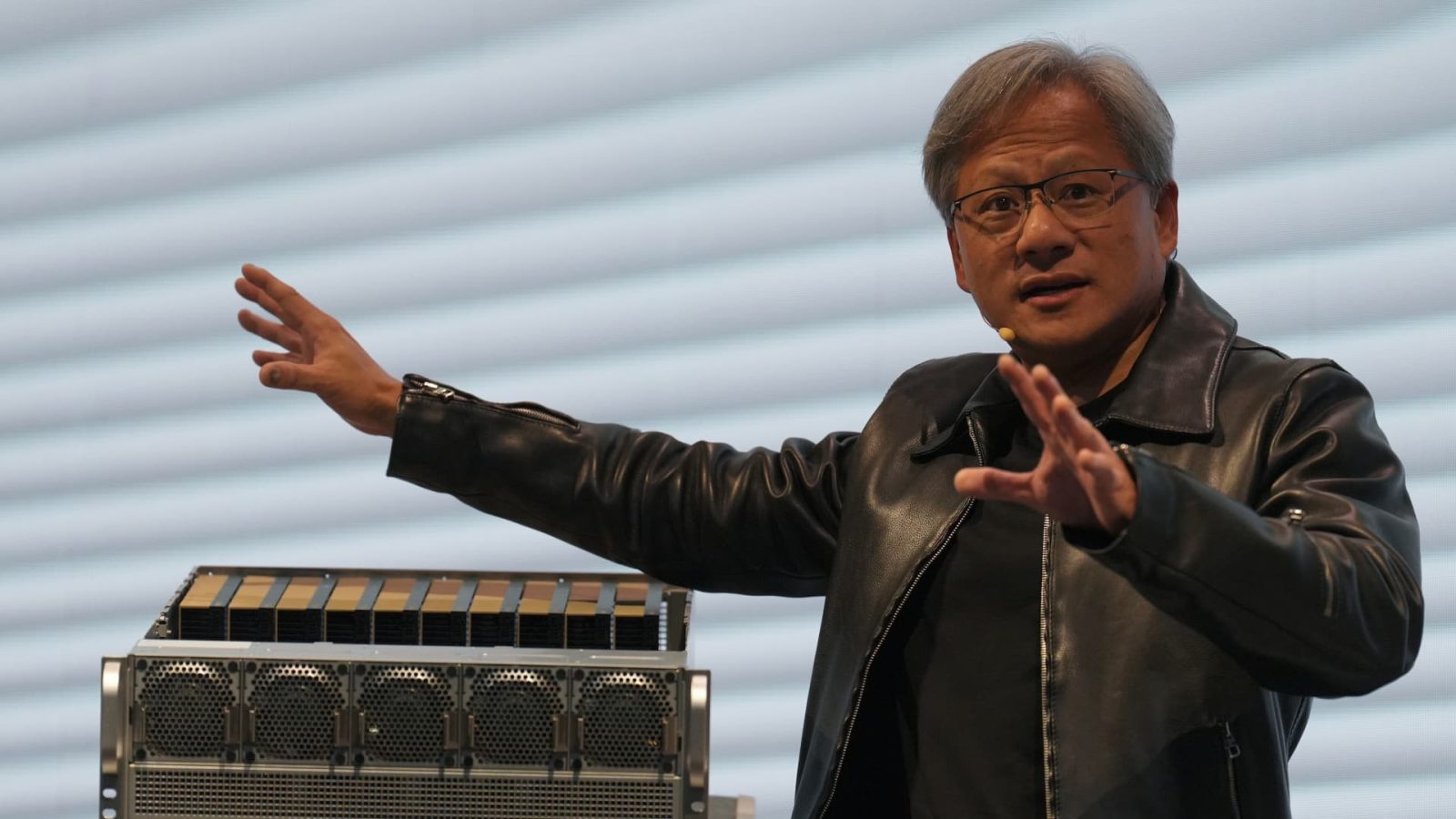

Leave a Reply