All financial numbers in this article are in Canadian dollars unless noted otherwise. Please note that oil and gas prices are always in US$.

Introduction

It’s time to talk about Canadian Natural Resources (NYSE:CNQ), often referred to as Canadian Natural.

On September 25, I wrote an article titled 18% Yield Potential At $100 Oil: Why Canadian Natural Is My Favorite Oil Play.

As you can imagine, that article was about reasons that make the company a great oil investment with elevated dividend potential.

Now, the stock is 6% higher, boosted by terrific earnings that showed strong operations, higher production numbers, and comments regarding its net debt target, which could open the floodgates to a wave of (special) dividends and buybacks next year – especially if oil prices remain elevated.

In this article, I’ll elaborate on all of these new developments and explain why I just told my best friend to buy CNQ over any other oil stock.

We’ll also take a look at the updated bigger picture, as the oil bull case has gotten a new geopolitical layer.

So, let’s get to it!

Why I’m Buying Oil & What I’m Looking For

I have been (very) bullish on oil since 2020. Initially, it was mainly because I expected post-pandemic demand to significantly boost oil prices. I also didn’t believe in the renewables hype back then that caused many people to invest in wind and solar over oil and gas.

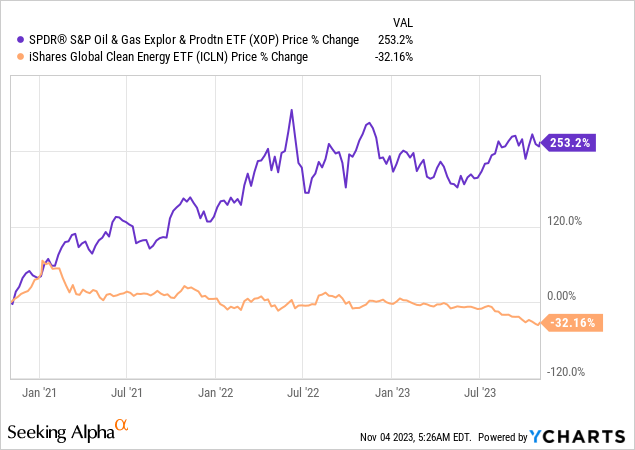

Over the past three years, clean energy stocks have lost roughly a third of their value, excluding dividends.

Oil and gas drillers have added more than 250%!

At this point, I have to mention that I am not against clean energy. The only issue I have is that the global energy transition has been forced, which has resulted in subdued investments in oil and gas despite very strong demand.

This is one of the reasons why oil and gas companies prefer to focus on free cash flow generation over production growth. In prior cycles, U.S. shale producers boosted production so much that lower demand immediately resulted in crashing oil prices.

Producers know that getting outside capital is hard. By focusing on free cash flow, they make future oil crashes much more unlikely and have more money to put into their own pockets.

Some might call it selfish. Others might call it smart business decisions.

Furthermore, production in U.S. shale is running out of steam. Producers are not only focusing on free cash flow for risk management reasons, but they also have to protect Tier One or Tier 1 reserves.

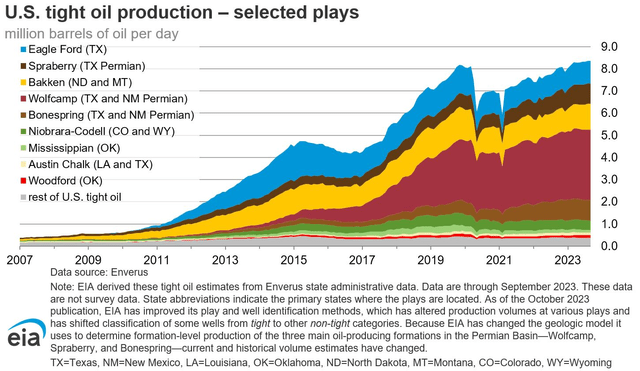

One of my favorite charts is the one below. In 2007, the U.S. barely produced any unconventional oil. That number is now above 8 million barrels per day. Since the pandemic, there has barely been any growth.

Energy Information Administration

Estimates are that even the Permian, the only major basin capable of strong growth, will see peak production in 4Q24.

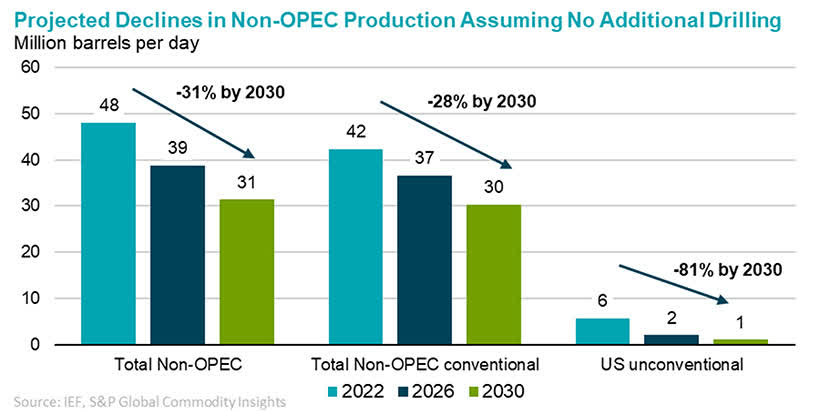

The International Energy Forum estimates that unconventional production in the U.S. could fall by 81% by 2030 unless new drilling is used to (partially) offset production losses.

International Energy Forum

That’s a HUGE deal, as U.S. shale has been the global supply growth engine since the Great Financial Crisis. Believe it or not, it was one of the reasons why inflation was so low most of the time. It indirectly helped fuel the massive gains in tech and growth stocks.

On top of this, it gives OPEC (mainly Saudi Arabia) a lot of pricing power, as U.S. shale is not able to significantly impact supply growth anymore.

It’s one of the reasons why OPEC was so eager to protect $80 Brent through voluntary production cuts. Given how eager they are to keep prices high, I do not expect that OPEC will suddenly turn into a tailwind for lower oil prices.

Here’s why UBS believes in prolonged elevated oil prices (emphasis added):

Fundamentals will be key in driving oil prices, with the effect of the Israel-Hamas war on crude starting to wane, according to UBS. The bank says it expects oil to trade in a band of $90-100 a barrel over the next 12 months, but this will be driven by fundamentals rather than sentiment. “Oil prices rose modestly on the outbreak of war between Israel and Hamas, driven by concerns that the war may spill over into a broader regional conflict that leads to supply disruptions,” UBS says in a note. “But the rally’s strength has ebbed, as there has been no disruption to oil supplies.” It added that instead, shortage concerns should drive prices with OPEC’s voluntary production cuts currently providing support to markets. Brent is 0.7% higher at $86.96 a barrel.

While oil is prone to corrections due to elevated economic risks, I also believe that oil will remain elevated.

It seems that we are in a new era of oil prices. Despite downside risks, it is unlikely that we encounter the same cycle lows we saw before the pandemic.

I even believe that there is a very high likelihood of sustained triple-digit dollar oil prices once demand improves. After all, oil is currently above $80 in an environment of very low consumer sentiment, massive economic woes in China, and manufacturing recessions in most developed nations.

Imagine what happens if demand growth returns!

So, to get back to the start of my article, I am not cheering on higher oil prices. The biggest part of my portfolio does best when inflation is low. Also, I don’t wish high inflation on anyone, in general.

Oil stocks are a hedge for me.

- I want producers with very deep inventories/reserves, which will prevent forced M&A to maintain production rates.

- I want producers with healthy balance sheets. In general, that’s a good thing. However, companies with healthy balance sheets can focus on shareholder distributions.

- I want drillers who commit to distributing most of their free cash flow to shareholders, not just drillers who have the ability to do that but focus on other issues instead.

- I want companies that emphasize dividends over buybacks. As much as I like buybacks, in the energy sector, I prefer dividends, as I see energy stocks as income tools. This is a personal preference. There is nothing wrong with buyback-focused stocks like Marathon Oil (MRO).

This brings me to Canadian Natural.

I Honestly Believe Canadian Natural Is The Best Of The Best

The other day, I got a message from my best friend, who was a bit disappointed that Exxon Mobil (XOM) had hiked its dividend by only 4.4%.

While this is in no way an attempt to get people to sell Exxon, I also sold Exxon a while ago to buy higher-yielding oil stocks that, I believe, will come with a better risk/reward.

CNQ just raised its dividend by 11% to $1.00, making it the second dividend hike this year, after hiking by 5.9% on March 2.

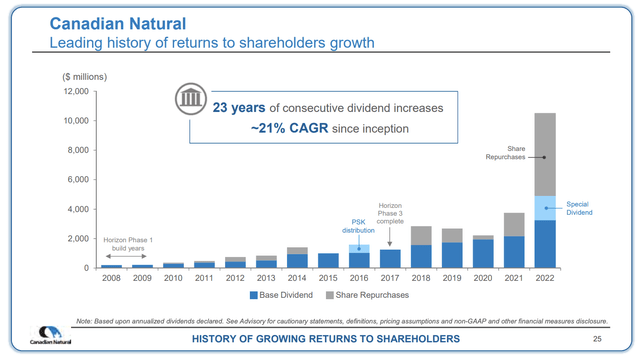

It now has a 4.4% base dividend. It has hiked its dividend for 23 consecutive years. That’s almost unheard of in the upstream energy business.

Moreover, last year, buybacks were as high as total dividends.

Canadian Natural Resources

Before I continue discussing the dividend, let’s take a step back.

Canadian Natural is my favorite energy stock for a wide number of reasons.

For starters, the company has some of the best oil assets in the world.

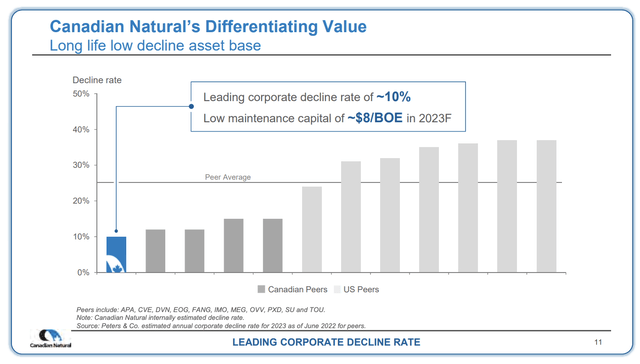

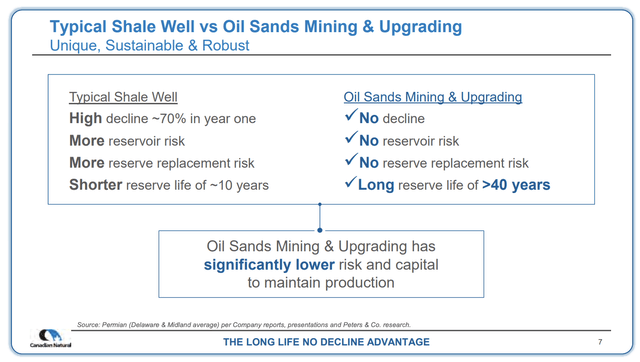

- The company has oil sand operations, thermal oil production, and conventional oil production. Thanks to these operations, the company has very limited decline rate risks. Oil sands operations have a 0% decline rate.

In other words, CNQ’s assets have a much better longevity than most (almost every single one) of its peers. It also has a maintenance capital of just $8 per barrel of oil equivalent.

Canadian Natural Resources

Furthermore, roughly 27% of the company’s production consists of natural gas, making the company the second-largest natural gas producer in Canada.

It also produces close to 1 million barrels of oil liquids, making it the largest producer in Canada.

In the just-released 3Q23 quarter, the company reported record quarterly production of roughly 1.39 million barrels of oil equivalent per day. This production included record liquid production at approximately 1,035,000 barrels a day and natural gas production at approximately 2.15 billion cubic feet a day.

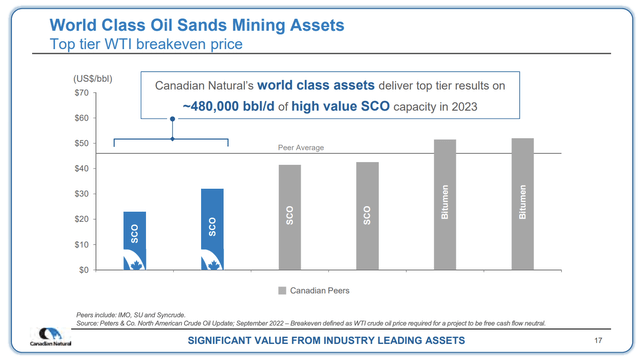

Even better, the company has very efficient production. Its thermal production is breakeven at roughly $40 WTI. Its sand mining assets are breakeven in the low-$20 and low-$30 range.

Canadian Natural Resources

With regard to its reserves, CNQ has some of the biggest reserves anywhere in the world.

The company has total proved oil reserves of 13.6 billion barrels!

That’s close to 28 years of production based on its 2023 guidance. Including probable reserves, that number rises to more than 36 years.

In addition to having no reservoir, decline, and replacement risks, its oil sands have a reserve life of more than 40 years.

Canadian Natural Resources

A few years from now, when companies will increasingly struggle to find decent Tier 1 inventories, CNQ will be in a very good spot, as it has to do absolutely nothing to maintain its operations.

It is also capable of expanding its production. After all, it does not need to be too careful with its reserves.

In its 3Q23 earnings call, the company said it saw significant production growth in its thermal in situ areas, with Kirby reaching approximately 65,000 barrels a day. This growth was due to the development of four Steam-Assisted Gravity Drainage (“SAGD”) pads, with the first pad reaching full capacity in 3Q23.

On a full-year basis, total production is expected to be 5.5% higher compared to 2022.

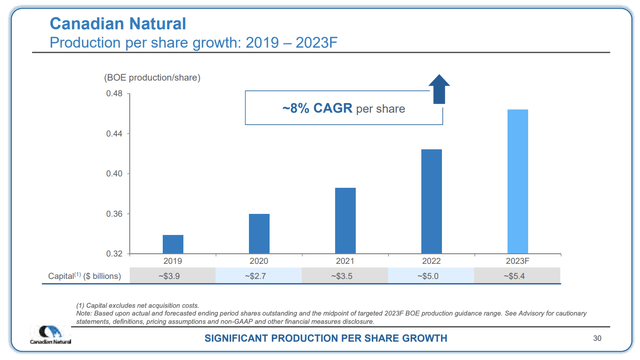

On a per-share basis, production has grown by 8% per year since 2019!

Canadian Natural Resources

Having said all of this, shareholders are in an increasingly good spot.

So Much Cash!

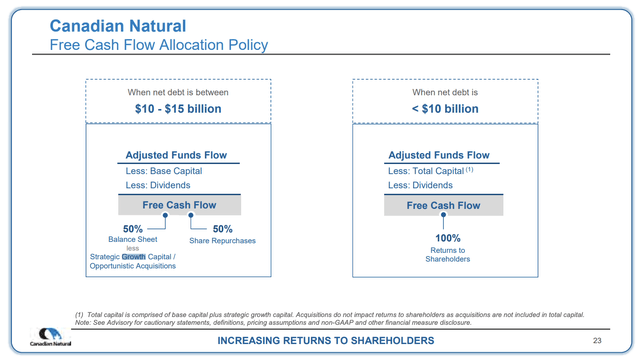

Another reason why I’m writing this article is the company’s plans to distribute 100% of its free cash flow to shareholders. Every single penny will be returned to shareholders!

This was dependent on one thing: net debt needs to fall below $10 billion. Currently, half of its post-base-dividend free cash flow is used to reduce debt.

Canadian Natural Resources

Well, we’re now very close to that happening!

As noted during its 3Q23 earnings call, CNQ’s financial position is robust, with a debt-to-EBITDA ratio of 0.7x at the end of Q3.

The company also maintains strong liquidity, which includes revolving bank facilities, cash, and short-term investments. Liquidity at the end of the quarter was approximately $6.1 billion. It has an investment-grade credit rating of BBB-. I expect that rating to gradually rise to BBB+ over the next few years.

With that in mind, based on current strip pricing, the company is on track to achieve a net debt level of $10 billion in 1Q24.

At that time, the company aims to increase returns to shareholders to 100% of free cash flow.

In other words, we’re maybe just two quarters away from the goal that so many investors have been longing for.

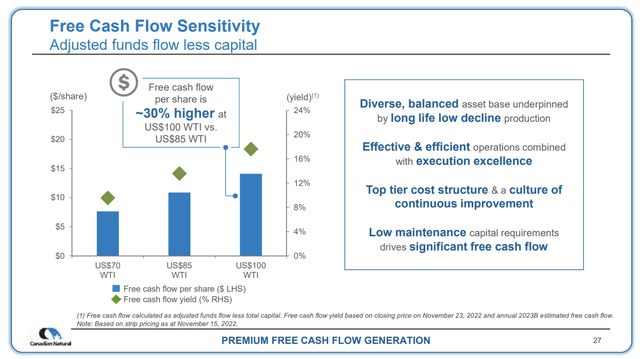

Now, the question is, how beneficial is this for shareholders? How much is 100% of free cash flow?

The overview below shows us what kind of returns are likely. Please note that this is based on the company’s market value on November 23, 2022. Toronto-based CNQ shares were trading at $80 back then. Now, they are 15% higher.

- At $85 WTI, the company can generate more than $10 in free cash flow per share. This translates to an 11% free cash flow yield based on current prices! So, even at $85 WTI, shareholder returns are likely to be north of 10%!

- At $100 WTI, the company could generate between $14 and $15 in per-share free cash flow. That’s a 16% yield!

Canadian Natural Resources

Now, imagine if CNQ shares fall 10% to 15%. The aforementioned yields would rise to more than 12% and 18% at $85 and $100 WTI, respectively.

That’s why I’m consistently buying CNQ on weakness.

If we get a bigger sell-off, I’m likely to deploy a huge portfolio of my cash into CNQ, even if this prevents me from adding new companies to my portfolio, which is what I’m also trying to do.

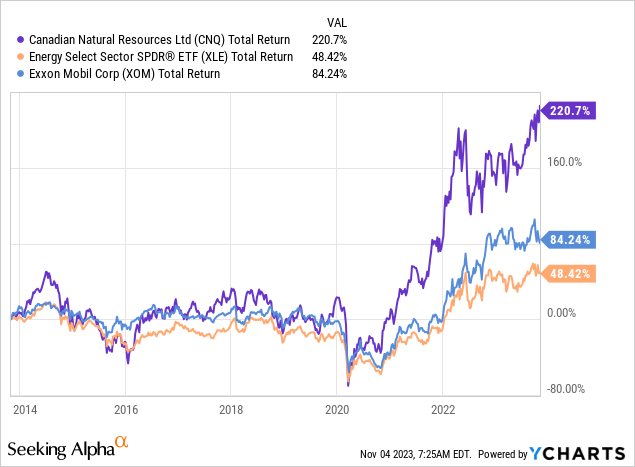

NY-listed CNQ shares also have a history of outperforming their peers, which I expect to continue, as it’s hard to beat the value CNQ brings to the table.

Based on what we discussed so far, I believe that CNQ is attractively valued. This is based on its free cash flow potential, especially if oil prices continue to rise – and remain at elevated levels.

This would mean that higher per-share oil production meets additional buybacks.

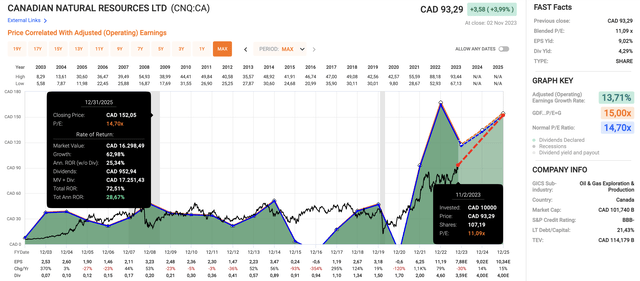

CNQ is also cheap based on its normalized valuation. Using the chart below, we see a number of things (based on the current oil price).

- Since 2002, CNQ has traded at roughly 14.7x earnings.

- Currently, CNQ trades at 11.1x earnings.

- A return to its normalized valuation by incorporating 14% potential EPS growth in 2024 and 15% growth in 2025 could result in 28% annualized returns to a fair price of roughly $150 (in Toronto).

FAST Graphs

This would imply that CNQ is roughly 60% undervalued.

I believe that Toronto-based CNQ shares have the potential to reach this “target” price over the next three to four years – maybe earlier *if* we get a scenario where oil rapidly rises beyond $100.

The bottom line is that I will continue to buy CNQ aggressively.

I honestly believe it’s the best oil stock money can buy. I also have others on my list that I like a lot (for diversification), which I will focus on in the weeks and months ahead.

Takeaway

Canadian Natural Resources stands out as my top choice in the oil sector for several compelling reasons.

- The company boasts impressive oil assets, including oil sands, thermal oil production, and conventional oil production, with minimal decline rate risks.

- CNQ also has substantial reserves, with a reserve life of more than 30 years, making it well-positioned for the future.

- Additionally, their commitment to distributing 100% of free cash flow to shareholders once their net debt falls below $10 billion is an enticing prospect for investors.

As oil prices are expected to remain elevated, CNQ’s potential for strong returns and value growth makes it a standout choice in the energy sector.

I wholeheartedly believe that CNQ is the best oil stock to invest in, and I’m personally considering increasing my stake in the company, especially on any potential market weakness.

Read the full article here

Leave a Reply