I’ve never walked the same path other people found comfortable and I’m not going to start now.”― Lora Leigh.

The “Soft Landing” thesis continues to gain advocates and has quickly become the consensus opinion among investors and within the market. Bloomberg just reported that Treasury Secretary Janet Yellen is now more confident of the U.S. economy achieving this almost mythical scenario. Meanwhile, Goldman Sachs recently lowered its probability of a U.S. recession in the next 12 months to 15% from 35% previously.

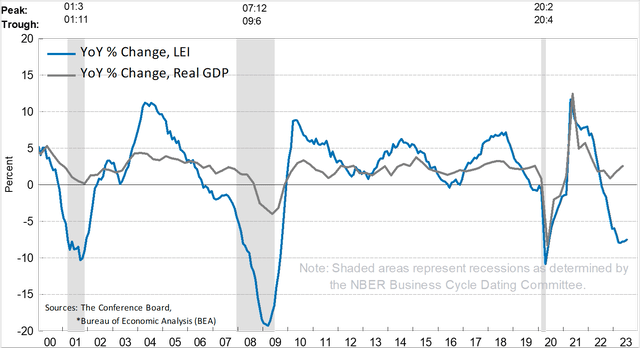

I would love to buy into this rosy scenario, as it sure would make my investing decisions easier. However, I still can’t buy this “soft landing” thesis. The yield curve still remains deeply inverted, historically a sign of recession on the horizon. In addition, the monthly Leading Economic Indicators have now declined for 16 straight months now.

The Conference Board

There are also three key reasons I still believe recession is better than a 50/50 proposition over the next year.

The Consumer:

The consumer, who drives roughly 70% of all economic activity, is facing headwinds on multiple fronts. Inflation has come down significantly. However, prices have risen some 17% since the beginning of 2021 and the average American household has lost three percent of their buying power over that time. And this is if you believe government reporting, which in mine and many opinions undercounts inflation.

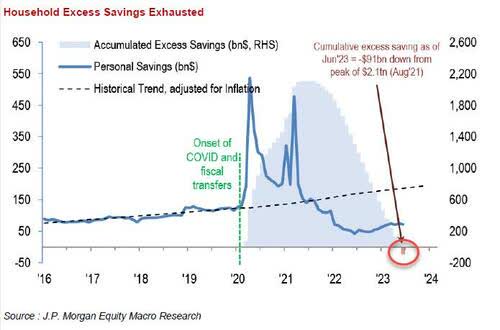

Zero Hedge

Savings from Covid related stimulus programs have now largely have been spent. July robust retail sales numbers were largely supported by the consumer drawing down savings by some $146 billion to $706 billion and a solid prime week from Amazon (AMZN). Obviously, this is not sustainable. August’s retailer sales numbers that come out this Thursday are likely to give us a better reading on the economy. According to the latest Markets Live Plus survey from Bloomberg, 56% of Americans believe that personal consumption in the U.S. will turn negative in 2024. Another recent survey had 61% of all Americans living paycheck to paycheck.

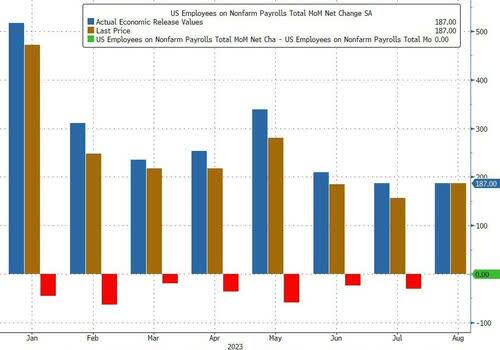

Zero Hedge

In addition, the deteriorating jobs market can’t be helping consumer sentiment or confidence. According to Bureau of Labor Statistics, full-time employment fell by just over 600,000 positions in July and August combined. The jobs numbers in both months were positive only because of a surge in part-time employment, which historically has been a sign of an impending recession. I am expecting a negative monthly job print by the end of the year. Either when the first numbers are posted or in a subsequent revision (every BLS monthly jobs number has been revised down so far in 2023, after all). This is almost a slam dunk if the coming UAW strike against the Big Three lasts more than a few weeks, which is a plausible scenario given how far the two party’s opening negotiating positions start from.

Global Growth Engines Sputtering:

The U.S. economy is unlikely to get much of a boost from economic growth overseas either. The European Commission just cut is growth forecast in Germany, the largest economy in Europe. The EC now sees economic activity contracting by .4% in 2023 down from their previous projection of .2% growth for this year. The continued conflict in Ukraine, and the impacts of higher energy prices on the country’s manufacturing base were cited as key factors for this downward revision.

More concerning is that China’s economy is facing headwinds on multiple fronts as the country has been a key global growth driver for more than a quarter century now. Reflecting this, Hong Kong’s Hang Seng Index (HSI) slid into a bear market last Friday and is now down more than 20% from its last peak this January. The Chinese yuan also recently fell to its lowest level in 16 years against the dollar.

The Chinese economy is facing myriad issues. Youth unemployment in the country recently hit record highs and has gotten so bad, the Chinese authorities are no longer reporting these figures. China’s real estate crisis also seems to be accelerating. A large investment company and a major homebuilder recently missed payments on their debt obligations. Meanwhile consumer prices are falling as deflationary forces are rising to the surface and the country’s exports are also in a slump. In short, investors can’t expect much help from the second largest economy in the world in the coming months and quarters.

Monetary Lag:

A lot of investors also seem to be forgetting that the Fed’s monetary policy always acts with a substantial lag. The last time the central bank implemented such a robust, sustained and restrictive monetary policy was over a decade and a half ago. The last Fed Funds hike from that policy implementation occurred in April of 2006. It wasn’t until late 2007 that major cracks became apparent in the credit markets and the economy. These came soon after the Federal Reserve chairman at the time proclaimed that the subprime housing crisis was now “contained.”

We are seeing myriad signs that the 525-bps hike since March of 2022 to the Fed Funds rate is starting to be felt across the economy. One of the parts of the economy that is most impacted by the huge surge of interest rates is the commercial real estate or CRE market. The CRED iQ CMBS (Commercial Mortgage-Backed Securities) delinquency rate reached 5.07 percent in August 2023. This is a to 40 bps increase from July prior and a 177 bps since January. With some $2.5 trillion of CRE loans that need to be rolled over, look for rising delinquency rates to have increasing impacts on bank write offs. More stringent credit criteria from banks in response will other be a significant headwind to the overall economy. I highlighted the myriad problems in the CRE market recently in an article called ‘Shades of 2007‘.

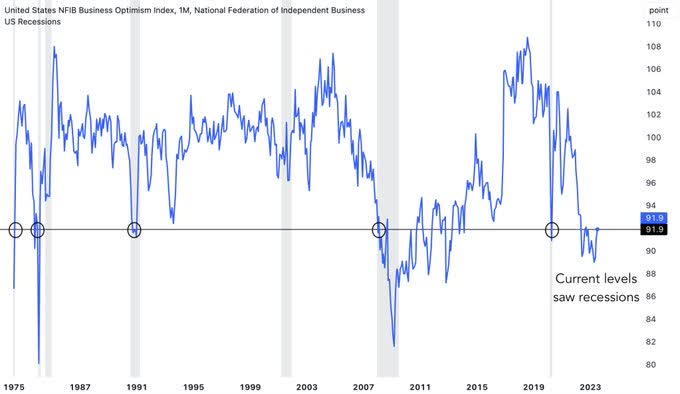

This developing “credit crunch” will particularly hit small businesses which account for more than half of the jobs in the United States. Yesterday, the NFIB Small Business Optimism Index fell to a reading of 91.3 in August from 91.9 in July and a bit under expectations of 91.7. This index has only reached these depressed levels since 1975. Each time a recession directly followed it should be noted.

NFIB Small Business Optimism

Finally, corporate bankruptcies are already spiking before the full impacts of the Fed’s monetary policy are fully felt throughout the economy. August corporate bankruptcies rose 54% from the same level as one year ago. I expect news on this front to get much worse as debt maturities come up and corporate debt has to be rolled over at much higher rates.

Given all of this, my portfolio allocation is extremely conservative and will be until we get a substantial downward break in the markets. Roughly half of my portfolio is in short-term treasuries now yielding 5.5%. 40% is in conservative covered call positions with the rest in cash along with a smattering of out of the money long-date bear put spreads against overvalued individual stocks as well against index ETFs like the Invesco QQQ Trust ETF (QQQ). With volatility still low by historical standards, this type of ‘portfolio insurance’ is both cheap and prudent to pick up.

In summary, I would love to see a “soft landing” scenario play out. However, chances of a significant economic storm on the horizon seem more than plausible in the quarters ahead. I have positioned my portfolio accordingly.

The future is uncertain, but the end is always near.”― Jim Morrison.

Read the full article here

Leave a Reply