Walgreens Boots Alliance Overview:

As wide as participation in the stock market has become in the past decades, most Americans are probably more adept at understanding the economics of homeownership instead of being buried in value investing titles like Benjamin Graham’s The Intelligent Investor or Phillip Fisher’s Common Stocks and Uncommon Profits.

Graham explained how to calculate a stock’s intrinsic value and how to create a margin of safety that reduces risk. Fisher qualitatively enhanced Graham’s insights by realizing that finding the cheapest stocks will often result in ruin if you select stock on accounting metrics alone. In other words, there is much more to understand about a company than what is available in public disclosures.

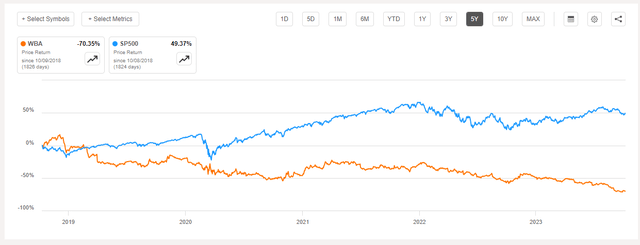

Seeking Alpha

Seeking Alpha

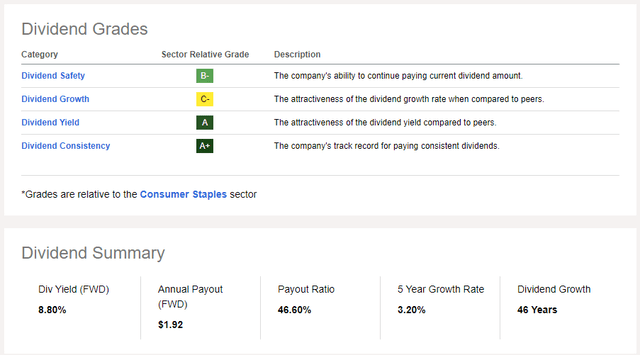

Walgreens Boots Alliance, Inc. (NASDAQ:WBA) is a dividend aristocrat with 46 consecutive years of dividend growth that is expected to report earnings pre-market on Thursday, October 12th. Lately, the company and its peers have been struggling. Rumors have been surrounding an imminent Rite-Aid bankruptcy, and the recent abrupt departure of Walgreens’s CEO has put investors on high alert and led to a significant share drop. The share price has dropped significantly in the last year largely on the following drivers:

- Slow sales growth

- Changing demand from COVID (far less vaccine demand)

- Rudderless management and multiple failed initiatives

- Opioid Settlements are compressing margins.

It is right to ask if Walgreens is a value trap. And to buy the stock is a high-risk proposition given the uncertainty around key drivers. But it is also high, potentially a reward long at these levels for total return seekers. The current dividend will pay you more than a money market fund over the next year, and the downside in price is likely mitigated by dirt-cheap valuation levels.

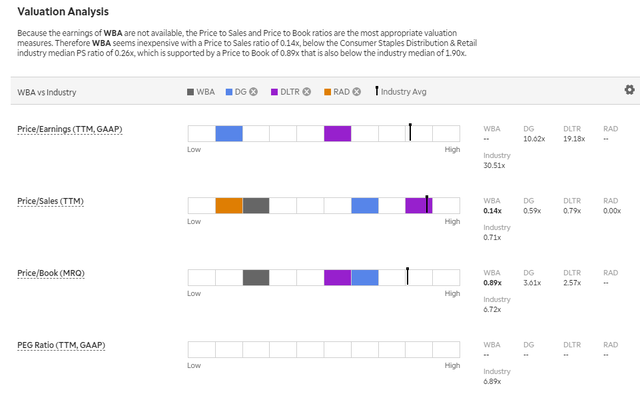

TD Ameritrade

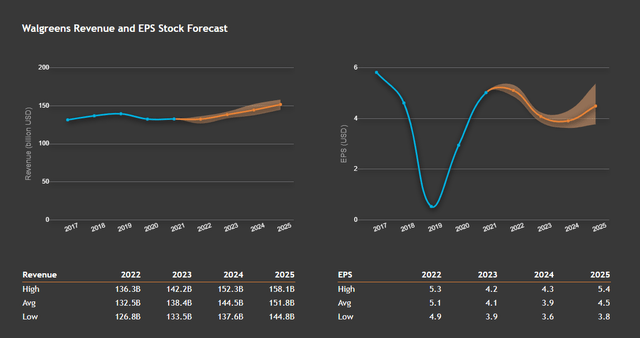

If you look at the top correct number in the valuation analysis below, the upside looks enticing, but when you notice the upside of peers, you can see something that should at least cause you to raise your eyebrow.

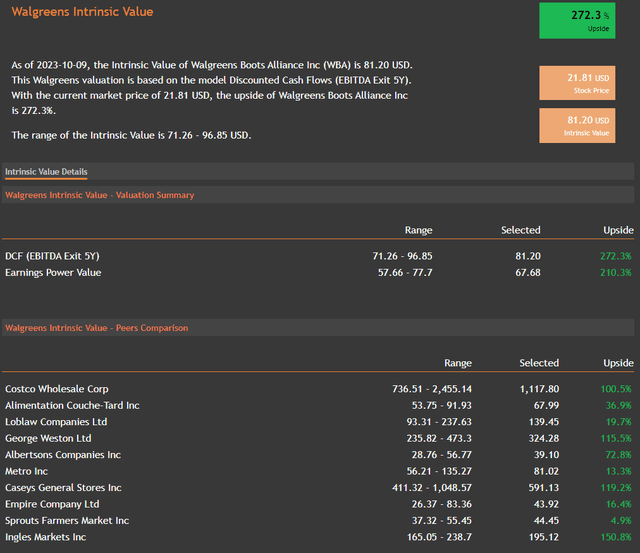

The stock has more than twice the implied upside of all competitors except for one. So, to me, the market is pronouncing that this name could be a value trap. Now, if the market is overly sensitive to the stock’s risks because of a string of bad luck and the strong bones of the business, then this weakness is an opportunity for long-term shareholders.

valueinvesting.io

Even if you haven’t perused these lofty titles, most Americans can understand the appeal of buying a house with “good bones.” Some buyers will enjoy the project of gutting and rebuilding a seemingly dilapidated structure, covering up high-quality innards that can serve as the base for a modernized structure. But that fateful decision has come for Walgreens. Renovate or tear down? Of course, management will be selling renovation plans, and we, as shareholders, must evaluate them. So, is Walgreens a value trap or an opportunity for long-term investors seeking yield?

Walgreen Earnings: This is What We Train For Compounders

Buying a dividend aristocrat at a moment of maximum doubt is inherently not an easy prospect, but it can be very rewarding. What you must ask yourself as a long-term investor seeking compounding is one question. Is the company financially able to sustain the dividend and survive as a solvent entity? Can it even achieve significant price appreciation as well, given the fundamentals of its business?

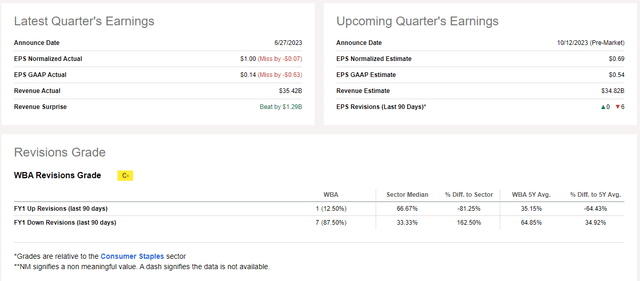

I think the answer for Walgreens is a resounding yes, even though it’s very hard to see through the cornucopia of bad news and worse expectations over the past months. Still, the company’s earnings picture isn’t as bad as you might expect, particularly if a soft landing scenario comes into place. The company’s expectations were very pessimistic in previous quarters with regard to the consumer, and given recent economic strength, it’s possible that this quarter’s earnings will show some undue strength, which is why I will be initiating a position BEFORE the report (today or tomorrow). Revisions look close to bottoming to me as well.

Seeking Alpha

The stock has fallen from the ugly tree and hit nearly every branch over the past few years. They even tried to pivot and modernize years ago by partnering with Elizabeth Holmes’ Theranos, an infamous corporate brigand. But that was the start of the once-regaled dividend aristocrat’s time in the dog pound. Its margins have more recently been pressured by settlements related to the opiate epidemic. Still, for long-term investors oriented toward compounding and total return, even these ignominious missteps can be an opportunity for building wealth.

Seeking Alpha

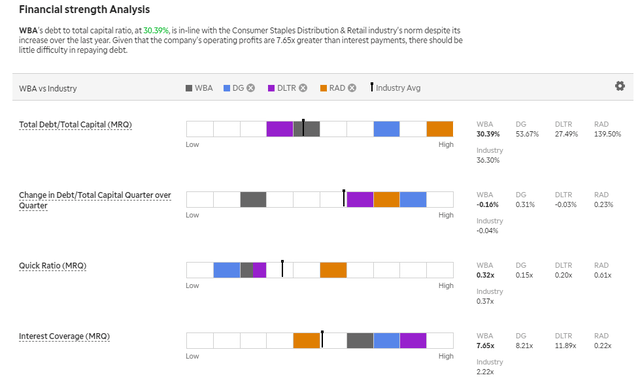

Of course, these projects aren’t for everyone. They are risky, and they can also become money pits. This accessible metaphor is a perfect illustration of how I currently view Walgreens. The company has seemed born to lose over the past years, but that has also allowed investors to snap up an enticing yield in a dividend aristocrat with a record that speaks louder than short-term drivers. The key question in whether a company is a value trap or not is whether it will experience bankruptcy and wipe out shareholders. Walgreens is in decidedly better shape than its most troubled peers in this respect.

Seeking Alpha

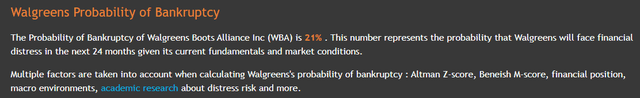

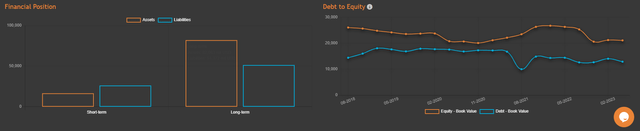

Walgreens had an incredibly unpleasant last couple of months. The stock price has dropped rapidly after what can only be described as a very tough year. But the “B” (bankruptcy) word is very important when you’re considering a long-term stock for compounding. And here, the data is a bit perplexing, but I have chosen to take a contrarian conclusion from it. Again, I did mention this is a high-risk BUY on Walgreens, and I’ll fully admit I thought we were near a bottom when I last recommended the stock. Still, this name has a lot of evidence that fundamentals could also be stabilizing.

valueinvesting.io

valueinvesting.io

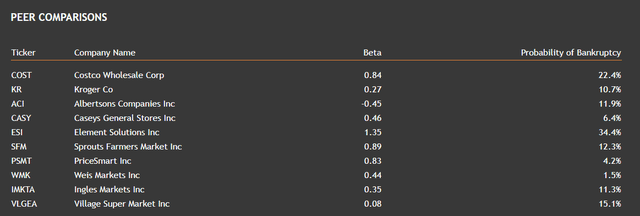

When you look at the bankruptcy analysis, there are two conclusions you can make. Well, Walgreens has a higher chance of going bankrupt than most of its peers. But it also has less of a chance of going bankrupt than Costco (COST) given the valueinveting.io model, which uses a methodology I respect.

I choose to take the glass-half-full look and focus on the latter fact. I think the prospects of a Walgreens bankruptcy are significantly diminished by their increasing cash position and a persistently strong economy.

valueinvesting.io

Furthermore, the company has credible initiatives to restore growth. In terms of risk/reward, this stock is so beaten down that I think the risk/reward in both the short and medium term favors an upside surprise. I think this a great contrarian long that can outperform expectations for the following reasons:

- Economic strength creates the possibility to outperform pessimistic forecasts with regard to consumer spending.

- The bashing from massive changes in consumer spending related to vaccines and COVID has largely been absorbed and priced in, and some of the drivers of this weakness could reverse as winter approaches.

- The company is at a “come-to-Jesus” management moment that could produce a new pep in the efforts to revamp the company.

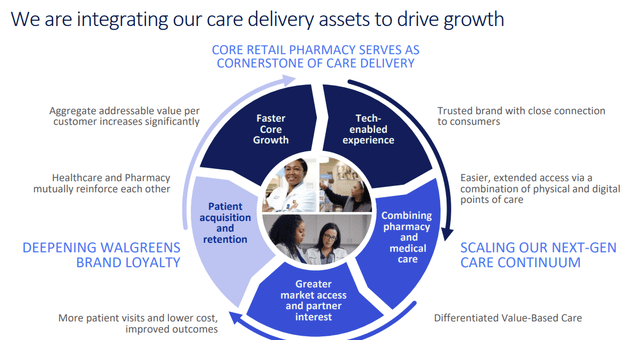

- The company is progressing on key initiatives to bolster shareholder value and turn the ship around.

- I think there is a fairly low chance that the dividend is cut, given the payout ratio and how crucial the dividend aristocrat status is to attracting capital for an embattled management team.

Company Reports

However, I could certainly be wrong. Contrarian investments are high risk and reward, but they are also often wrong. And mine is no exception. I am willing to take the risk and think there are the makings of a great long-term compounding opportunity, but investors with skepticism have ample reason for it.

Risks and Where I Could Be Wrong

One huge risk is if I am wrong, about the dividend. Another Seeking Alpha makes a compelling case for why I could be wrong. However, I still am resting on the fact the temporary drivers of financial weakness caused by COVID demand shocks may subside in a way that creates the opportunity for outperformance. But the major risk for Walgreens in the short and medium term would be, if I am incorrect, about a relatively soft landing coming to fruition in the economy. If I am incorrect about this, then the stock could really suffer. Furthermore, the following risks all present major potential headwinds to the embattled stock.

- CRE blowup freezes credit markets

- Inflation

- Worse-than-expected recession

- U.S. Consumer Confidence Falls

- Healthcare-specific risks get worse

- Management damages brand value.

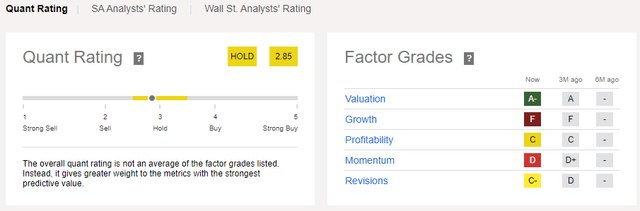

Another major risk is that the firm is undergoing a difficult management transition. However, this is a double-edged sword. If the firm can find a permanent replacement who is a real go-getter and talks the way the Street likes, then there could be some major upside in the short term. I think this is likelier than the firm finding a candidate that results in a negative reaction. It is hard to deny that the Quant Factor scorecard is ugly, but remember this is a contrarian call, so part of the reason I am bullish in the first place is I think there is an excess of negative sentiment.

Seeking Alpha

If the company can turn growth around, a prospect which I think consensus underestimates, then I think the firm will do very well by shareholders. However, if the company continues to find languishing sales and earnings growth, the firm will likely continue to underperform. Another potentially pernicious risk would be if employee satisfaction or labor issues blow up and get headline attention.

Conclusion

Buying stocks at the moment of maximum doubt is never easy and is always fraught with risk. There are ample legitimate reasons for why Walgreens is cheap, but I think they are overdone. It’s hard to say that Walgreens hasn’t been an absolute dog over the past five years. But then consider the converse implication, it is also hard to say that the stock has a lot of downside left if it is in a financial condition to maintain solvency, and it is.

valueinvesting.io

Late-stage management turnaround plans can be perplexing alphabet soups with proverbial meatballs of keywords that should engender excitement in the investing community. But it’s hard to ignore that Walgreens has been making turnarounds on key financial metrics despite the wave of pessimism and doubt. I choose to focus on this fact as a long-term investor rather than a noisy and concerning list of risks. Given the sentiment and legitimate concerns, it is a high-risk investment, but I think it will ultimately provide a high reward.

Read the full article here

Leave a Reply