Enphase Energy (NASDAQ:ENPH) is a global leader in solar microinverters. This technology has some major advantages compared with regular solar string inverters. In this article, I will highlight how I believe Enphase will benefit from their technological advantage and why I believe their shares are currently 25% undervalued. I will zoom in on tailwinds and risks for the business and make a quick calculation of their fair share value until 2030 using a couple of rough assumptions about Enphase’s future growth.

What makes Enphase’s microinverters best in best-in-class?

There are some defining features which make Enphase’s products, and especially their microinverters, stand out in the renewable energy segment.

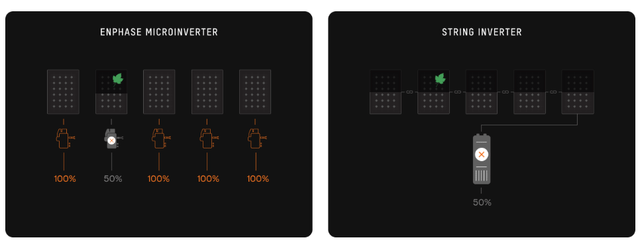

- Using Enphase technology, solar microinverters are installed on each individual solar panel, in contrast with traditional solar string inverters. In this way solar panels are optimized with regard to electricity production and system failures. Microinverters make sure that a partial shade, different orientation or one broken solar panel does not impact the performance of the whole installation. Also, detection of failures or panel mismatch is quick and efficient. In this way, solar panels will be able to run at their peak efficiency more often. This can be best explained using a picture from the Enphase website, where the impact of some leaves dropping on a single solar panel is shown. In the case of Enphase microinverters, only the solar panel power output of the solar panel that is covered with leaves is impacted. For regular string inverters, leaves dropping on a single panel will impact the power output of the other solar panels as well, leading to lower efficiency:

Enphase inverter versus regular string inverter in case of shadow (Enphase website)

- Next to their hardware, Enphase also has a robust monitoring app to track the performance of each individual solar panel. Though monitoring tools also exist for series circuits, the level of granularity which Enphase offers is much greater, being able to detect whether there are issues with a single specific solar panel quickly.

- Enphase products are reliable and safe. As the CEO writes in the 2022 investor letter:

For microinverters, our target is to stay under a 0.05% annual failure rate and, in practice, we operate close to this number.

- Because of this reliability, Enphase is able to offer 25 years of warranty on their inverters, which is quite long compared with the alternatives which often only cover 10-15 years of warranty.

- Enphase microinverters are compatible with many different types of solar panels, installations and power grids worldwide, making them very flexible in their application.

- Because of the microinverters, the voltage on roofs will never exceed 60 Volts, which is different from string inverters. This makes Enphase products safer than some of their alternatives.

- Thanks to the modular design of the microinverter technology, adding additional solar panels to the system is relatively easy.

In most residential areas, where there might exist panels oriented in different directions or partial shadow during some times of the day, Enphase’s microinverters are an excellent option. The added benefit is the modularity, so you can easily detect if there’s an issue with a single individual panel. Enphase’s competitor SolarEdge (SEDG) sells optimizers, which manage the DC voltage and the current in each individual panel. Optimizers also have many of these benefits, but with Enphase’s microinverters the DC to AC conversion takes place inside every panel itself. This can lead to higher energy outputs and a lower voltage on the roof.

So except for very straightforward situations, Enphase’s microinverters are often the best option for a solar installation. In all fairness, it must be said that they are also one of the most expensive options, and whether these additional costs can be gained back depends on the additional efficiency which is reached using Enphase microinverters.

I believe these excellent characteristics and the higher price make Enphase’s microinverters comparable with Apple’s iPhone. Though the microinverters are their flagship product, Enphase also sells EV chargers, batteries and home energy management systems.

Let us now take a look at tailwinds and headwinds for Enphase during the coming years.

Tailwinds

Enphase’s main markets are residential and commercial solar systems. In the current era where sustainability and clean energy are becoming more and more important, Enphase is one of the front runners in the solar industry. Although the company does not produce solar panels, it focuses on microinverters, which convert the electricity produced by solar panels from direct current (DC) into alternating current (AC).

As some parts of the world have dealt with increasing energy prices in 2022 before and during the war in Ukraine, it is clearly visible that Enphase’s products enjoy a positive momentum. In Europe for instance, where electricity and especially natural gas prices skyrocketed, Enphase’s sales grew by an astonishing 132% in 2022.

This increasing popularity has not only happened for sustainability reasons, but also for energy independency. Recent plans of France to double its renewable energy capacity by 2035 underscore this. The global solar market is expected to grow from $189.5B last year to $607.8B, which creates a strong tailwind for solar companies.

For homeowners and companies, solar panel installations are a relatively simple way to decrease the dependency of families and companies on external energy production. Of course, even with Enphase’s products, completely decoupling from the grid is rarely possible and most of the time not desirable for consumers. But by streamlining electricity usage, storage and EV charging, one can come a long way in reducing its own dependency on external energy, except maybe for the darkest winter months when not enough solar irradiation is reaching the solar panels on your rooftops.

As global electricity grids are modernized to the demands of the 21st century with more EVs, more electric heating and cooling and more home battery systems, Enphase has many products which are considered best in best-in-class.

Also, Enphase has a large advantage in that the company makes heavy use of contractors in manufacturing their products, which makes them flexible. The company also likes to mention that they are quite frugal in spending money, which is a benefit, especially in uncertain economic times. As the CEO wrote in his 2022 investor letter:

We are quite frugal when it comes to spending money. We manage our operating expenses tightly with a baseline at 15% of revenue while maintaining necessary investments in innovation and operations. We are CAPEX-lite which means we don’t need to build big factories as we leverage our contract manufacturing partners.

Risks

There are also some important risks for Enphase. First of all, new renewable energy installations growth is (partially) dependent on government policy. Solar energy is already profitable without subsidies in many locations, but government subsidies or attractive loans have the potential to move consumers and companies in the direction of purchasing a new solar installation. In some countries, these subsidies are waning. For instance, in my country the Netherlands, a regulation for solar panel owners to subtract your total energy production from your total consumption is slowly being phased out. This was a very attractive regulation which allowed solar panel owners to indirectly ‘trade’ energy delivered from the panels to the grid (which was usually generated at a time when energy was abundant and cheap, during sunny afternoons for instance) for consumed energy from the grid (which was usually expensive, generated during the night or during the dark winter months).

New solar installations can thus be heavily accelerated or slowed down by government policy.

Another important area of risks for Enphase is the electricity grid. Usually, solar installations are directly or indirectly connected to the electricity grid. In most countries, this electricity grid is not designed to support many decentralized electricity production connections. When the grid of most modern countries was designed, it was planned to operate mostly with centralized production by a couple of very large power plants (usually coal, gas, nuclear or hydropower). In some places of the world with large electricity production by renewables, the grid is already experiencing immense pressure, and this is expected to get worse if more and more EVs chargers, heat pumps and solar panels are being installed. Stable base load needs to be able to supply electricity during the times when the sun is not shining and the wind is not blowing. Batteries, water buffers in hydro power plants and (in the future) storage of hydrogen can help, but are currently not enough. In many countries, fossil fuels which can be scaled up quickly like natural gas are often still indispensable, next to a base load of others, such as coal, hydro and nuclear power.

Of course, Enphase also sells some (partial) solutions to this problem: home batteries and energy management systems. But for most people and companies, these batteries and systems are not nearly enough to become self-sufficient with regard to energy consumption, and pressure on electricity grids is expected to increase quickly during the coming years. If governments or network operators fail to transform the grids quickly enough, this could limit the installation of future solar installations.

Increased competition is another potential risk for Enphase. Relatively recently in 2021, Tesla (TSLA) also started selling its own solar inverter. Although Tesla sells regular string inverters, being such a large and well-known brand, Tesla could become a strong competitor for Enphase on the longer term.

At this moment, Enphase is clearly the market leader of solar microinverters. If more companies enter this market segment, Enphase could experience more competition. Home batteries and power management systems are product segments where there already exists stronger competition.

Share price and valuation

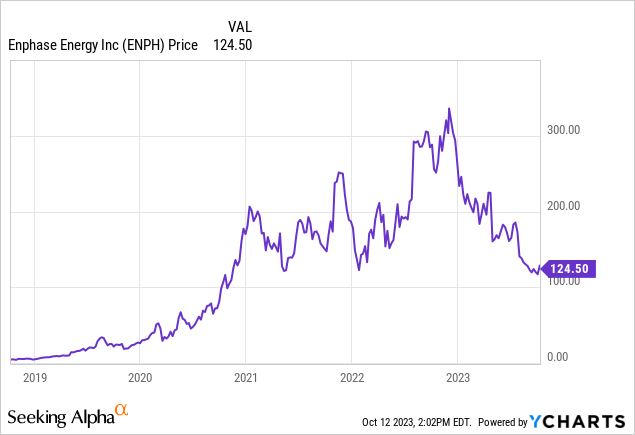

Recently, Enphase’s share price has experienced a major downturn, which was more or less in line with many other renewable energy companies.

Enphase’s share price during the last 5 years

Enphase’s share price has cratered from $336 in November last year to the current price of $124.5, which is an enormous drop of 63%. One would expect that a company that is dropping by this much is also performing abysmally on their financial metrics, but this was not the case for Enphase. Let us take a brief look at their Q2 2023 financial results:

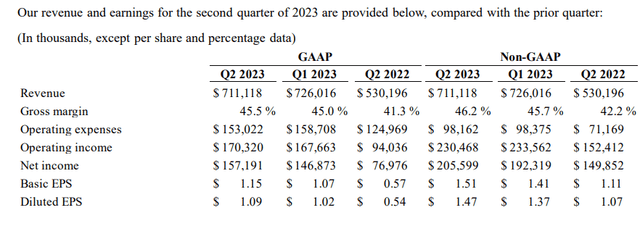

Enphase revenue and earnings for the second quarter of 2023 (Enphase website)

At this moment, Enphase is valued at a P/E of (let us take the Q2 GAAP EPS and multiply it by 4): 124.5 / (1.15*4) = 26.96. This seems like a high ratio. But considering that Enphase is a company which has grown both its sales and its earnings very quickly during the last years, I do not believe it is expensive at the moment.

In 2022, Enphase grew its sales by 69%, they more than doubled their cash flow and slightly improved their margins . During 2023, the company can be expected to reach a lower level of growth, as can be derived from the excerpt of their Q2 financial results above: their GAAP revenue in Q2 is $711M compared with $530M in Q2 2022, which is an increase of ‘only’ 34%.

Let us now make a very rudimentary estimate of earnings and revenue of Enphase over the coming years, and calculate the expected fair share price of the company using a couple of different price to earnings ratios. I will use a couple of assumptions:

- If the global solar market is expected to grow to an annual $608.7B in 2030, this translates to a compound annual growth rate (CAGR) of 15.7%. Being one of the leaders in the solar market, let us assume Enphase will be able to stay in this position over the years, and also grow its revenue by this percentage.

- Let us assume that the 2023 earnings and revenue of Enphase will be double the 2023 Q1 + Q2 values (this is a quite conservative assumption since there will likely be at least some additional growth during H2 2023 as well)

- I will assume that their margins will not significantly change during this time period.

- I am using GAAP numbers.

It is impossible to know beforehand if these are realistic assumptions, and other analysts might use completely different assumptions, but let us work with them.

| Revenue | Net income | Earnings per share | |

| 2023 | 2.8B | 0.61B | 4.44 |

| 2024 | 3.3B | 0.70B | 5.14 |

| 2025 | 3.8B | 0.81B | 5.94 |

| 2026 | 4.5B | 0.94B | 6.88 |

| 2027 | 5.2B | 1.09B | 7.96 |

| 2028 | 6.0B | 1.26B | 9.21 |

| 2029 | 6.9B | 1.46B | 10.65 |

| 2030 | 8.0B | 1.69B | 12.32 |

Table 1: Enphase’s revenue, net income and earnings per share until 2030 using my growth assumptions

Using these earnings per share, we can calculate expected fair share prices using different P/E multiples of Enphase’s share over the years:

| P/E of 15 | P/E of 25 | P/E of 35 | |

| 2023 | 67 | 111 | 155 |

| 2024 | 77 | 128 | 180 |

| 2025 | 89 | 149 | 208 |

| 2026 | 103 | 172 | 241 |

| 2027 | 119 | 199 | 278 |

| 2028 | 138 | 230 | 322 |

| 2029 | 160 | 266 | 373 |

| 2030 | 185 | 308 | 431 |

Table 2: Enphase’s fair share price until 2030 using different P/E ratios

I choose the P/E values of 15, 25 and 35 on purpose. At this moment, Enphase is valued slightly higher than a P/E ratio of 25. I do not personally believe that a P/E ratio of 15 is realistic for a company which grows its earnings and revenue by an annual rate of more than 15%, but during potential future economic downturns, we cannot completely rule it out. A future P/E value of 35 seems on the high side, but for a company which grows its earnings quickly, such a ratio could be justifiable.

As we can see in the table, future fair share prices of Enphase can vary wildly depending on your assumptions. There are so many unknowns here that it is impossible to know what the future fair share price is, but the purpose of these calculations is not accuracy, but it is the show the realm of what is possible using relatively conservative assumptions.

I believe most of my assumptions were quite conservative, especially regarding the 2023 growth, using only GAAP numbers and the expectation of Enphase to grow in line with the solar market. Therefore I think it is justifiable to take a current fair value P/E of 35 for Enphase shares. This means that I believe Enphase shares have room to recover to $155 on the short to medium term. According to this value, Enphase is about 25% undervalued. I believe that in the more distant future, Enphase’s fair P/E value will drop a bit as the solar market gets more mature.

So, Enphase Energy is a best-in-best-in-class producer of microinverters and other home electricity products in a rapidly growing market. The company is a pioneer in the renewable energy industry, and I expects its future growth to be beneficial for consumers, investors, and the planet. My current rating for the shares of Enphase is a strong buy.

Read the full article here

Leave a Reply