Whirlpool Corporation (NYSE:WHR) manufactures and sells home appliances. The company currently has an alarming amount of debt, but as operations should improve in the future with a better demand climate, I believe Whirlpool can manage the liabilities. I don’t believe the current price represents a very good entry point; I have a hold rating for the stock.

The Company

Whirlpool sells home appliances in North America, Europe, the Middle East, Africa, and Asia. The company’s main products include washing machines, kitchen appliances such as mixers and blenders, dishwashers, refrigerators, and microwaves.

The company operates through multiple brands, of which the most prominent is Whirlpool. Other brands include KitchenAid, Maytag, JennAir, Brastemp, Hotpoin, and Bauknecht; Whirlpool operates under a total of 18 brands. The company’s owned brands are in a constant state of change, though – Whirlpool has a good amount of divestitures and cash acquisitions in the past. Most recently, Whirlpool has been looking to sell a European appliances business, which caught the eye of UK regulators.

Whirlpool’s stock price has traded flat over the past ten years, as the period’s price change is a negative 4%:

Ten-Year Stock Chart (Seeking Alpha)

The main return for investors has been Whirlpool’s dividend; the company has grown its dividend for a long period, and currently, the dividend yield stands at 5.24%.

Financials

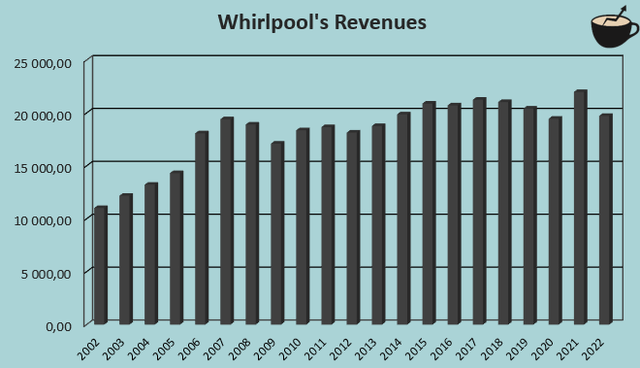

Historically, Whirlpool has achieved a compounded annual growth in revenues of 3.0% from 2002 to 2022 as a result of organic growth and select acquisitions and divestitures:

Author’s Calculation Using TIKR Data

The revenues have not had too great of a run in recent quarters, though; the company has had six consecutive quarters of negative revenue growth despite a high inflation and guides toward a revenue decrease year-over-year for 2023.

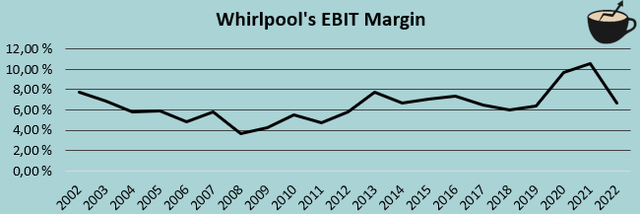

Whirlpool has had an average EBIT margin of 6.5% from 2002 to 2022:

Author’s Calculation Using TIKR Data

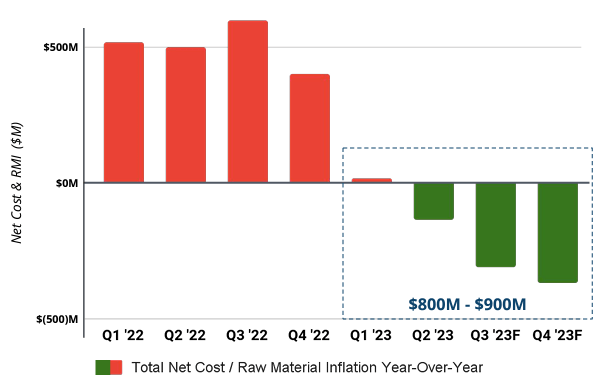

The margin has seen significant pressure in 2022 after a very high margin in 2020 and 2021 – inflation has led to higher costs to produce products. In 2023 and forward, the trend should revert as prices fall; in the company’s Q2 earnings presentation, Whirlpool guides for $800 million to $900 million in cost takeouts as an effect on lower purchasing prices for raw materials:

Cost Take Outs (Whirlpool Q2 Earnings Presentation)

The company should see some margin expansion in coming quarters as a result – Whirlpool could achieve a margin that’s above the long-term average as the company’s gross margin rises back to the historical average.

A worrying aspect of Whirlpool is the company’s leveraged position. The company has $7.7 billion of long-term debt on its balance sheet, of which $1.3 billion is in the current portion – as Whirlpool guides for a free cash flow figure of $0.8 billion for 2023, the company seems to have debt payments exceeding free cash flow in the year. The payment for the current portion should be quite safe, though, as Whirlpool does have a cash balance of $1.3 billion, covering the current payments.

The total $7.7 billion of debt is very significant, as the company’s market capitalization is around $7.3 billion. Whirlpool does have a plan to pay off the debts – currently the management expects to pay down around $500 million of the debts in 2023.

Valuation

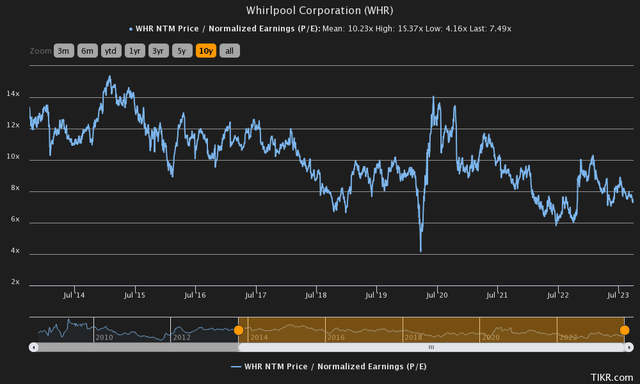

On a price-to-earnings basis, Whirlpool seems very cheap at a forward ratio of 7.5, below the company’s ten-year average of 10.2:

Historical Forward P/E (TIKR)

As the high debt balance leverages risks for shareholders, I believe a more thorough examination of the valuation should be done – as usual, I constructed a discounted cash flow model.

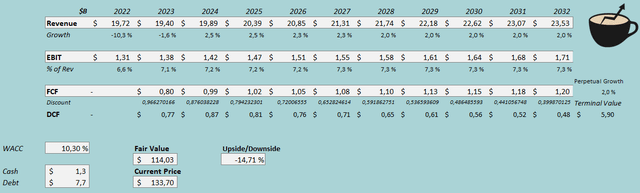

For 2023, I estimate Whirlpool to hit its revenue guidance of $19.4 billion, representing a revenue decline of 1.6% from 2022 in the DCF model. Going further, I estimate a growth rate of 2.5% for a couple of years that eventually slows down into a nominal annual growth rate of 2%, quite near the company’s historical organic rate.

I expect some margin expansion in the model from the 2022 level – I estimate an EBIT margin of 7.1% for 2023, half a percentage point above 2022’s margin. Going further from 2023, I estimate very slight growth from 7.1% to 7.3% in the coming years as the market conditions normalize – the estimated margin is almost 13% above Whirlpool’s long-term average, but I believe that the company can achieve the estimated margin as a result of a higher scale of operations.

The mentioned estimates along with a cost of capital of 10.30% craft the following DCF model scenario with a fair value estimate of $114.03, around 15% below the current price of $133.70:

DCF Model (Author’s Calculation)

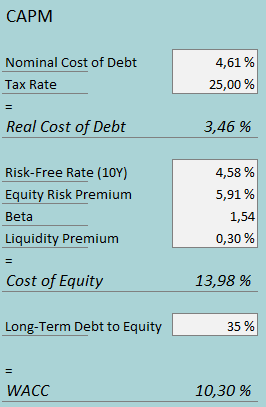

The used weighted average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

Whirlpool had $89 million in interest expenses in Q2. With the company’s current amount of interest-bearing debt, Whirlpool’s interest rate comes up to 4.61%. The company leverages a high amount of debt; I estimate that Whirlpool’s long-term debt-to-equity ratio will be 35%, lower than the current ratio but still elevated compared to many other companies.

For the risk-free rate on the cost of equity side, I use the United States 10-year bond yield of 4.58%. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate. Yahoo Finance estimates Whirlpool’s beta to be 1.54 – I believe the relatively high beta is caused partly by Whirlpool’s large debt position and could have room to shrink in the future. Finally, I add a liquidity premium of 0.3% into the cost of equity, crafting the figure at 13.98% and the WACC at 10.30%.

Takeaway

It seems that Whirlpool’s margin should recover in the upcoming quarters as purchasing prices come down from a period of high inflation. The company seems to have a debt problem, though, as Whirlpool’s long-term debts are at a higher amount than the appliance manufacturer’s market capitalization. As Whirlpool’s stock seems to be valued quite near its estimated DCF model fair value, I have a hold rating for the stock.

Read the full article here

Leave a Reply