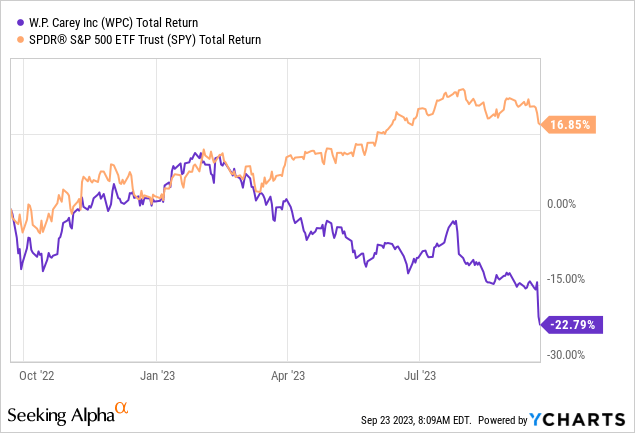

W. P. Carey Inc. (WPC) has been an underperformer in the last year by almost 40% compared to the S&P 500 index (SPY). That is not what you want to see from one of the “safe” dividend REIT stocks. Last week, the decline even accelerated when the company announced it would spin off and sell their office properties. Even while W. P. Carey’s dividend yield might look attractive right now at 7.4%, there are 3 REITs that are likely to outperform and have higher quality properties.

W. P. Carey is a global real estate investment trust (REIT) that specializes in triple net lease properties. Triple net lease properties are leased to tenants under long-term leases, typically 10-20 years, with the tenant responsible for most of the operating expenses, including property taxes, insurance, and maintenance. This makes net lease properties a relatively low-maintenance investment for REITs like W. P. Carey.

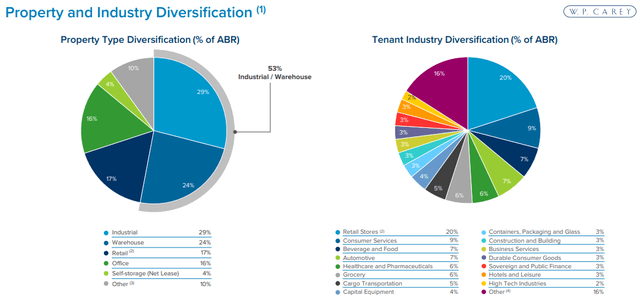

The company owns a diversified portfolio of over 1,475 net lease properties in North America and Europe, with a total square footage of over 180 million square feet. The portfolio includes a variety of property types, including industrial, warehouse, office, retail, and self-storage facilities. W. P. Carey’s tenants include a variety of companies, such as U-Haul, ABC Technologies and Extra Space Storage.

W. P. Carey is one of the largest net lease REITs in the world, with a market capitalization of over $13 billion. The company has a long track record of success, having paid out quarterly dividends to its shareholders for over 50 years. W. P. Carey’s dividend yield is currently 7.4%, making it one of the highest-yielding REITs in the market.

However, the strategic change in plans to spin off and sell the office buildings, which account for 16% of the total properties, will have impact on the dividend. The CFO, Toni Sanzone, mentioned this about the dividend cut in the office exit call:

Moving now to our dividend, after spinning off NLOP, we intend to reset our dividend, reflecting both the reductions to our AFFO that I just discussed and a lower targeted AFFO payout ratio, which we expect to be in the low to mid-70% range. This will enable us to retain higher cash flow going forward, which can be accretively reinvested to further drive AFFO growth.

Further, the timing of the office exit is questionable and everything but optimal. Most of the time a spin-off is done to unlock value, but what value will it give to shareholders to spin off the most depreciated asset of your portfolio. Neither the spin-off, neither the sale of the other office properties are likely to get fair value in the current environment of more work from home.

Investor Presentation 2Q23

Therefore, W. P. Carey’s returns have a high chance to be minimal till everything is figured out and they re-accelerate their industrial property business. Luckily, there are 3 other REITs that specialize in highly demanding properties that we can consider to buy instead of WPC.

VICI Properties (VICI)

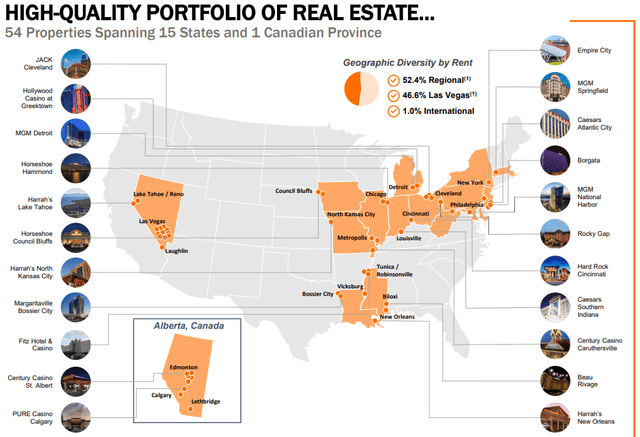

VICI Properties is a real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations in the United States and Canada. VICI’s portfolio consists of 54 gaming facilities comprising 60,300 hotel rooms, 4 golf courses, and more than 450 restaurants, bars, nightclubs and sportsbooks.

VICI’s properties are leased to industry-leading gaming and hospitality operators, such as Caesars Entertainment, MGM Resorts International and Wynn Resorts under long-term, triple-net lease agreements. These tenants have a strong track record of profitability and a commitment to investing in their properties. The company’s portfolio is geographically diverse, with properties in 14 states and one Canadian province.

Investor Presentation

VICI is a relatively new company, having been formed in 2017. However, it has grown rapidly through acquisitions, and is now include in the S&P 500. In 2021, VICI completed its $17.2 billion acquisition of MGM Growth Properties, which made it the largest gaming REIT in the world. The company is very well-managed with a strong track record of execution. It has a diversified portfolio of arguably the highest quality properties in the world leased to industry-leading tenants.

Alexandria Real Estate (ARE)

Alexandria Real Estate Equities is a real estate investment trust, included in the S&P 500, that develops and manages innovative life science clusters. Alexandria’s properties are leased to leading life science and technology companies, such as pharmaceutical companies, biotechnology firms, medical device companies, digital health companies and universities.

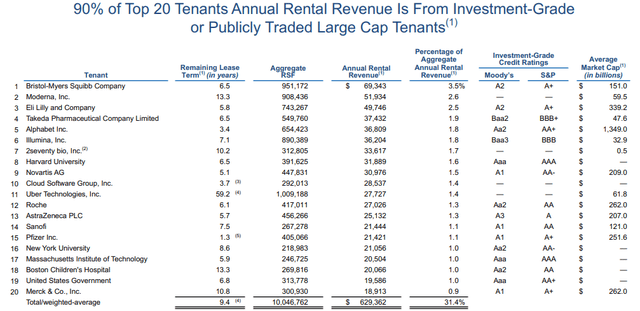

More so, Alexandria is the largest owner, operator, and developer of life science real estate in the United States. The company has a portfolio of 85 campuses in 20 states. Alexandria’s properties are located in major life science hubs, such as Boston, the San Francisco Bay Area, San Diego, and Seattle. In addition, 90% of the top 20 tenants are investment-grade or publicly traded companies that are well-renowned.

2Q23 Presentation

Alexandria is well-positioned to benefit from the long-term growth of the life science industry. The company has a strong track record of developing and operating high-quality life science space in AAA innovation clusters. Further, Alexandria has a long-term leasing strategy, which helps to reduce risk and generate consistent cash flow. The niche business creates low competitiveness and high barriers of entry.

Rexford Industrial Real Estate (REXR)

Rexford Industrial is a real estate investment trust that focuses on industrial properties located throughout infill Southern California. The company’s portfolio comprises 358 properties occupied by a stable and diverse tenant base out of the aerospace, e-commerce, auto/EV and medical industry. Rexford Industrial is a well-respected company in the industrial real estate industry. It has a strong track record of financial performance and is known for its high-quality portfolio and experienced management team.

Rexford is poised to benefit from manufacturing coming back to the United States and long-term supply-demand imbalance in Infill Southern California. The company’s occupancy has been strong at 98.1% with only one unit available. Infill Southern California has almost no developable land due to permanent natural barriers and restrictive zoning, which constrain supply.

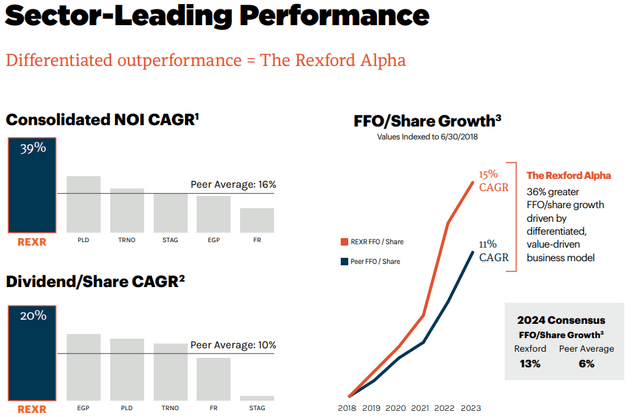

Investor Presentation

3 Superior REITs

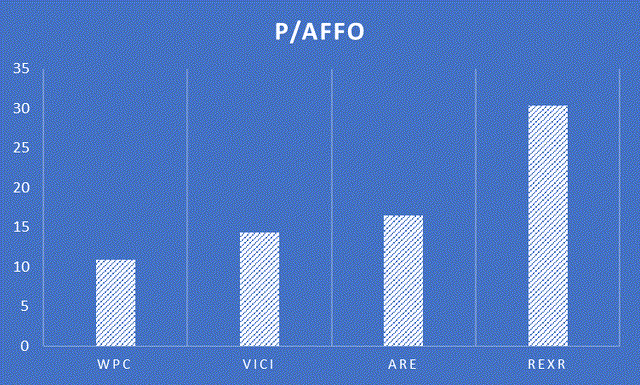

In the following graphs, we will compare the 4 REITs on several important metrics. The first one is price-to-adjusted fund from operations, which is based on the valuation of the businesses. W. P. Carey is by far the cheapest with a multiple of 10.84x. Rexford is the most expensive with a multiple of 30.3x.

Graph made by author (based on data from Seeking Alpha)

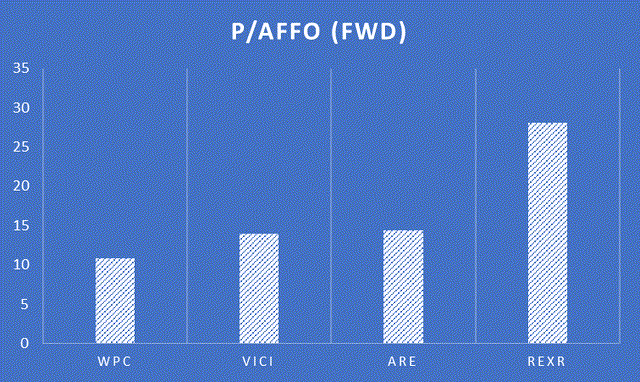

In case that we compare them on forward price-to-adjusted fund from operations, it is visible that VICI and Alexandria are already coming closer in valuation towards WPC with multiples of 13.93x and 14.34x respectively.

Graph made by author (based on data from Seeking Alpha)

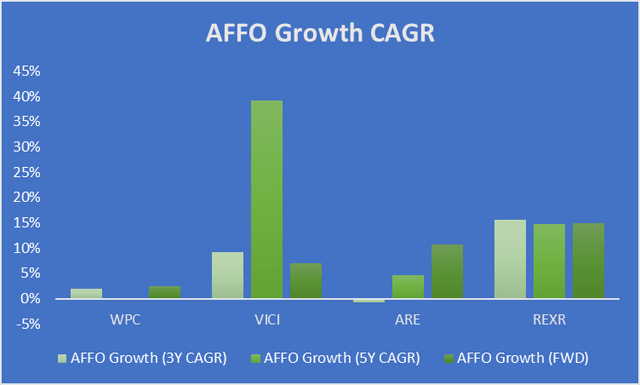

On the other hand, we can also look at growth of adjusted funds from operations. WPC has not been performing well in the last five years in terms of AFFO growth and even saw a small decline. Now that we know W. P. Carey will spin off and sell the office properties, it is unlikely that there will be any AFFO growth in the following years.

VICI has done phenomenal and has been the highest growth REIT by far in the last 5 years. More so, VICI is expected to keep growing 7% year-over-year. Alexandria is another high growing REIT, but saw a bit of a slowdown. However, AFFO is poised to re-accelerate with analysts estimating 10.7% growth year-over-year. The last one, Rexford is the most consistent grower of them all and scores a 14.8% AFFO growth CAGR over the last 5 years. For the following year, expectation remain high for Rexford at 14.98% AFFO growth estimates.

Graph made by author (based on data from Seeking Alpha)

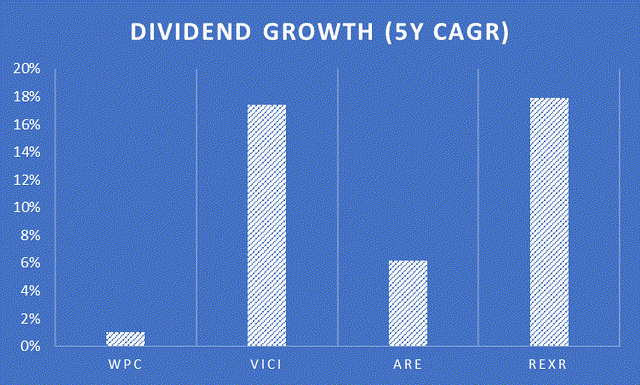

Lastly, I compared the REITs based on dividend growth over the last 5 years. Here we can see that the AFFO growers were able to convert AFFO into an increasing dividend at an incredible pace compared to WPC’s diminishing growth. When we know that VICI, ARE and REXR are expected to grow AFFO respectively 7%, 10.7%, 15% than we should see similar dividend growth in the next year. On the other side, WPC is going to see a decrease in dividend.

Graph made by author (based on data from Seeking Alpha)

Takeaway

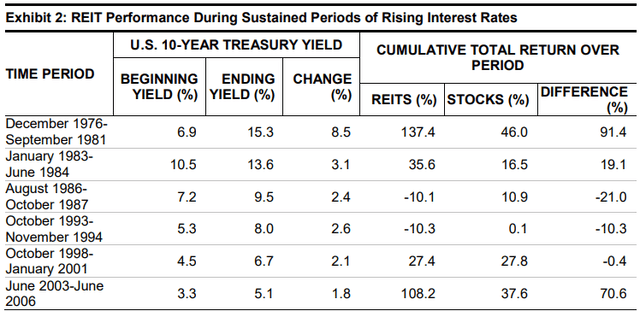

The timing of W. P. Carey office exit seems very poor considering office property valuations have sunk heavily in the past years due to concerns of work from home. That in combination with higher interest rates, which decrease the value of properties, are not a great environment to be selling properties. Nonetheless, higher interest rates are not always an underperforming environment for REITs. Higher interest rates can make acquisitions for well-capitalized REITs more attractive and serve for future AFFO growth. Furthermore, in inflationary periods REITs are likely to increase rents along with rate hikes, for sure in high demand sectors where VICI, ARE and REXR are in the lead.

S&P Global

Although I recently bought a small position in WPC myself, the latest move made me doubt my trust in the management. As a result, I rate WPC a ‘HOLD’. Personally, I think VICI, Alexandria and Rexford offer a much better risk-reward opportunity in the coming years. All three are growing AFFO at a fast pace and have niche premium properties with enormous demand.

Read the full article here

Leave a Reply