Last year, I argued investors should sell Weyerhaeuser (NYSE:WY) as shares would likely be in the mid-to-upper $20’s in a year’s time, with homebuilders representing a far better opportunity. That has played out with shares closing on Tuesday at $28.69 while homebuilders like PulteGroup (PHM) have rallied substantially. However, given the recent weakness in WY stock, and its underperformance over the past year, it is worth re-examining its operating performance to see if now is a better opportunity to buy in. Ultimately, I do not see shares as being compelling yet.

Seeking Alpha

In the company’s third quarter, adjusted EPS came in a penny below consensus at $0.33. This was down from $0.42 last year as adjusted EBITDA declined by $74 million to $509 million. Net sales fell from $2.27 billion to $2.02 billion. In 2021-2022, Weyerhaeuser benefited greatly from higher lumber prices; this has normalized and brought earnings onto a more sustainable footing.

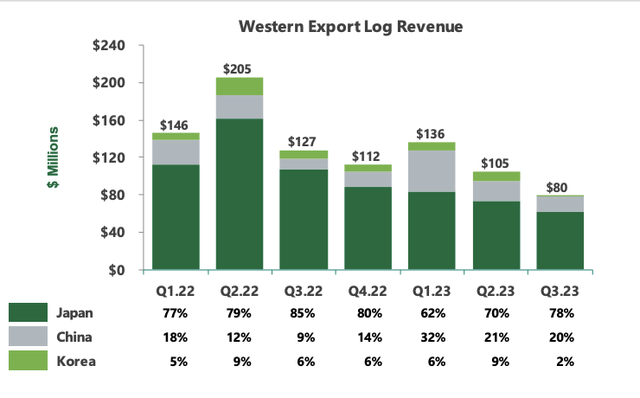

Timberlands EBITDA of $143 million fell by $29 million sequentially and was $25 million lower than last year due to a weakening export market, particularly to Japan. Additionally, the company is facing higher per log costs as wages rise. In aggregate, 3rd party realizations in the West, its largest region, are down 25% over the past year to $119. As you can see below, export revenue has fallen to a new low with declines across all three of its Asian end-markets.

Weyerhaeuser

The Chinese real estate market’s problems are well-known, and a major recovery there in the near term appears to be unlikely. The Japanese Yen has been falling all year to reach new lows relative to the dollar. This reduces Japan’s overseas buying power and makes WY’s wood relatively expensive. Barring a significant reversal in the yen, this is likely to keep Japan’s demand relatively muted.

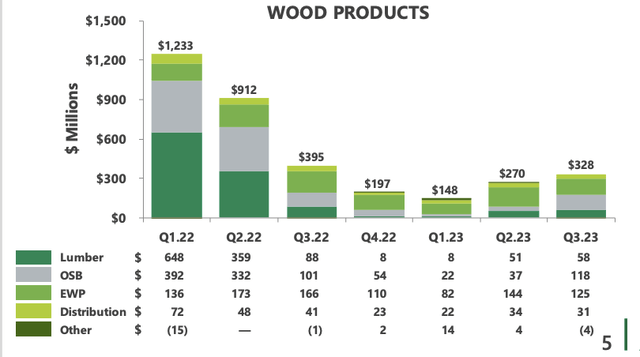

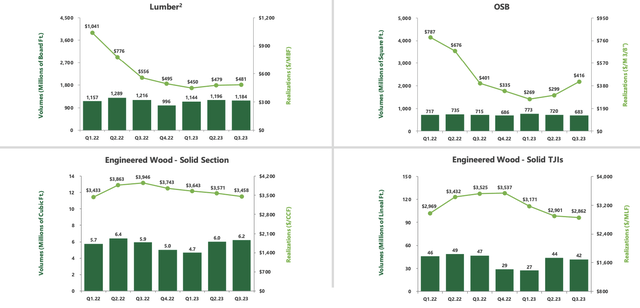

Wood products EBITDA did rise sequentially to $328 million with OSB realizations up 39%, leading to the product’s strongest profits of the year. Engineered products by contrast saw a slight decline in prices. As you can see below, EBITDA has recovered from its Q1 low thanks to improvement in lumber and OSB, but EBITDA remains a fraction of its H1 2022 levels.

Weyerhaeuser

This is because lumber prices have fallen significantly as supply chains normalized after serious disruptions in 2021. That was occurring just as the US homebuilding market came roaring back causing meaningful shortages and a surge in prices. Lumber prices have fallen by more than half but seem to be stabilizing around current levels while OSB prices seem to have found a bottom and engineered products continue to weaken.

Weyerhaeuser

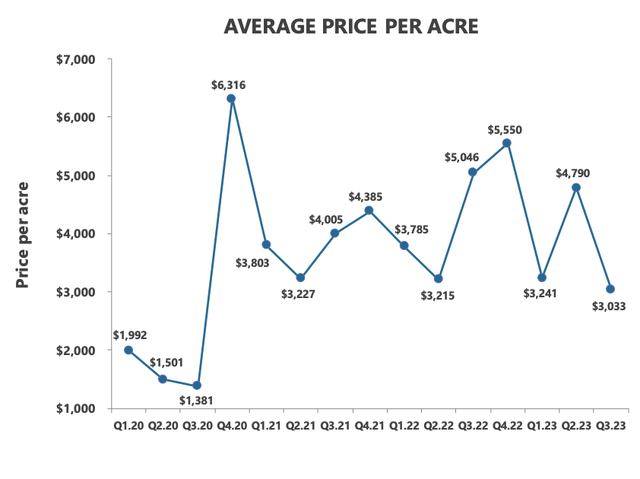

In addition to selling wood, WY also is always making purchases and sales of its land portfolio to optimize its holding. Real estate & natural resource EBITDA of $94 million was up from $70 million last quarter. This can move around significantly quarter to quarter based on what it sells. It sold three times as many acres as in Q2, but profits only rose by 34% because the average sales price was the lowest since COVID. Now as you can see below, sales price does move significantly, but given higher rates lessening real estate valuations and timber prices being down, I suspect we have seen the cycle highs from this segment.

Weyerhaeuser

WY is carrying $1.8 billion of cash and short-term investments. with $861 million of maturities over the next twelve months that it as pre-funded. Management targets a 75-80% payout of cash flow with a base dividend and then special dividends and/or buybacks. Its base dividend costs $138 million/quarter, and management is sticking with a 5% growth target through 2025 on this payout. Year to date it has generated $894 million in cash, meaning it can distribute $693 million. With base cash dividends so far of $417 million, it has $276 million left for discretionary activity. Of that, it has done $109 million of common stock buybacks, leaving $167 million at the mid point of its target.

In Q4, management expects similar timberlands EBITDA but lower real estate and wood product EBITDA, meaning we are likely to see a sequential decline in company-wide EBITDA. As such, I am expecting the company to generate about $250 million in funds available for distribution, or $200 million to be distributed. Subtracting out its base dividend and assuming a similar pace of $25 million in share repurchases, WY will have about $200 million left over.

This would support a special dividend of about $0.28. Combined with its base dividend, that would be a 3.6% yield that investors receive. Share repurchases would account for about 0.6% of the market value, leading to a 4.2% total capital return yield.

In a world where the 10-year treasury is yielding over 4.8%, that is not an immediately compelling capital return, unless you expect meaningful future growth. I struggle to see Weyerhaeuser delivering much growth. Lumber prices are showing little momentum, and the export markets are likely to remain soft. The prices WY received in early 2021 were really the anomaly. They delivered a wonderful cash windfall, but this was largely one-time, and today’s results are more indicative of run-rate cash flow.

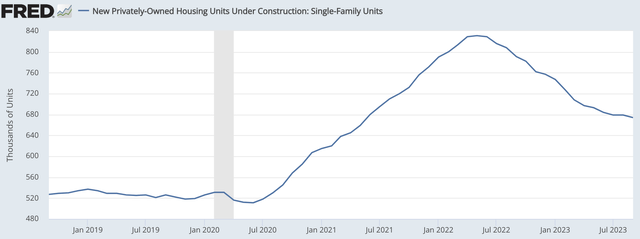

In terms of demand for lumber, the number of US houses under construction has fallen as the builders have pulled back. The rate of descent has improved markedly, and I am of the view we are likely to be nearing a point of stabilization, assuming mortgage rates do not rise materially further, but given where rates and affordability are, I do not think it is likely we see a material acceleration in housing construction activity. Absent an increase in construction, we may see WY’s EBITDA cease declining, but it’s unlikely to start posting meaningful growth.

St. Louis Federal Reserve

Additionally, if one wants to bet on a strong housing market, companies like Pulte trade at 6x earnings. I would argue the homebuilders continue to discount a much worse environment for housing at that multiple than WY at 27x earnings with a 4.2% distribution yield. Now given its vast real estate holdings supporting its value, WY definitely justifies trading at a higher multiple than builders, but in an environment where lumber prices have risen the 15-20% needed to get towards an 8% return, I would imagine the homebuilders will also be doing quite well as they would be building and selling more houses.

WY continues to appear to be pricing in a superior cyclical environment than its end-customers, which to me makes the stock once again unattractive. In fact given the weakness of its major Asian export markets, the cyclical environment is somewhat worse for WY than it had been. Shareholders are receiving 4.2% this year, and I expect their return will be generally similar, between 3.75 and 4.75%, in 2024. That strikes me as uncompelling given the uncertainty it faces and the alternative offered either by going into the bond market or buying a homebuilder if one is bullish on housing demand. I expect to see WY still stuck in the mid-to-high $20’s in a year, and I would sell for better opportunities elsewhere.

Read the full article here

Leave a Reply