The energy sector continues to be a gold mine for finding high-yielding companies right now. One that comes to mind is Western Midstream Partners, LP (NYSE:WES) which yields over 8.6% right now. For dividend income investors, having exposure to this industry could be beneficial. The company is quite heavily reliant on strong natural gas prices to drive earnings growth. In 2022, the prices spiked but have since come down. One worrying trend I have noticed with some companies in the same industry as WES is that to maintain the high yields they take on more debt and issue shares. That isn’t the case with WES, and they have done the opposite on both fronts the last few years.

Business Performance

Western Midstream Partners (WES) serves as a gatherer and processor, predominantly catering to Occidental Petroleum (OXY). The core of its operations lies within the prolific Delaware and DJ basins, two of the most sought-after energy regions. One of the standout features of WES’s business model is its robust reliance on fee-based contracts. Remarkably, more than 80% of its cash flows are fortified by minimum volume commitments (MVCs) or cost-of-service contracts. This strategic approach provides a considerable degree of revenue predictability and stability, which can be particularly valuable in the often turbulent energy sector.

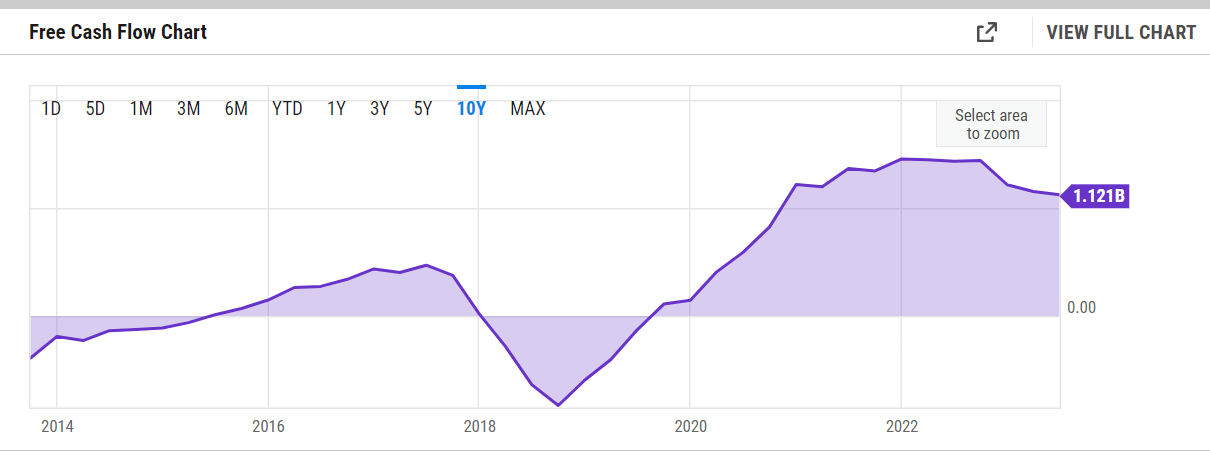

FCF (YCharts)

Looking at the FCF for the business it has maintained very strong the last few quarters and hasn’t been dragged down that much by the volatile natural gas prices. I think this has added to the company being valued at a premium on some remarks. However, it has also left the company with, in my opinion, a very strong and sustainable dividend yield, supported by FCF rather than share issuing or debt increases.

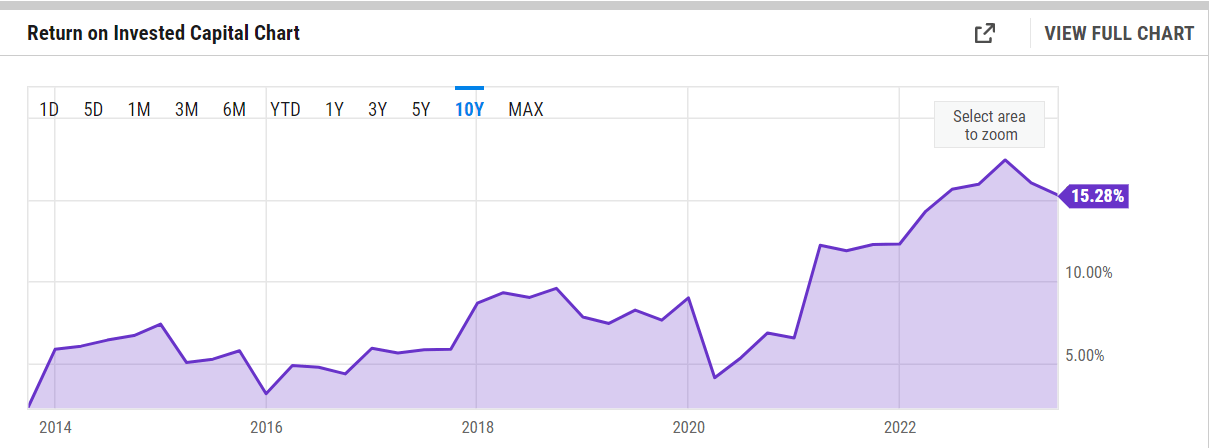

ROIC (YCharts)

During this period, the company has also been heavily improving the ROIC for the business, and now it sits at an incredible 15.28%. During the same 10-year period, the price of natural gas has decreased quite heavily from the peak in early 2014. I think this gives some context to the actual operational efficiency that WES has managed to achieve during those years.

ROI Benchmarks (YCharts)

In comparison to some peers, we see further that WES has managed to outperform heavily. A massive company like Kinder Morgan, Inc. (KMI) hasn’t been close to the same ROIC as WES. With WES also yielding a stronger return just on those basis, I think it offers the best possible returns over the long-term.

Dividend Evaluation

I tend to look quite a lot at high-yielding companies, especially in the energy sector. The best option always tends to be the one where FCFs are maintained through the commodity cycles and the dividend is not built up from debt and share issuing.

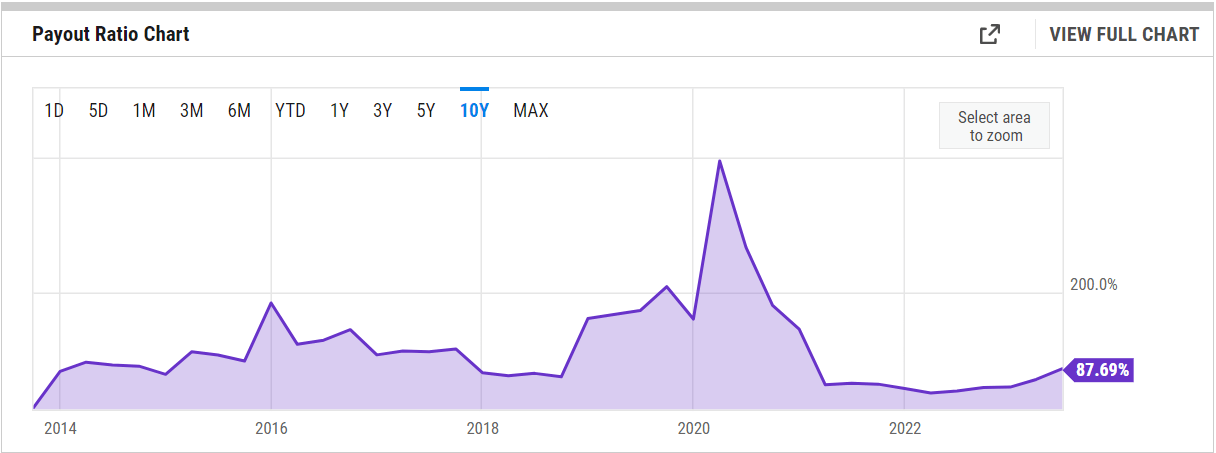

Payout Ratio (YCharts)

WES is a high dividend-yielding company, so I would expect them to have a higher payout ratio as well. Right now at 87%. My preferred threshold is at 90%. Above that, I think you are entering some pretty risky territory, as cutting the dividend will anger investors, and raising debts to maintain it will likely do the same. This is where sustainable earnings and FCF are so important.

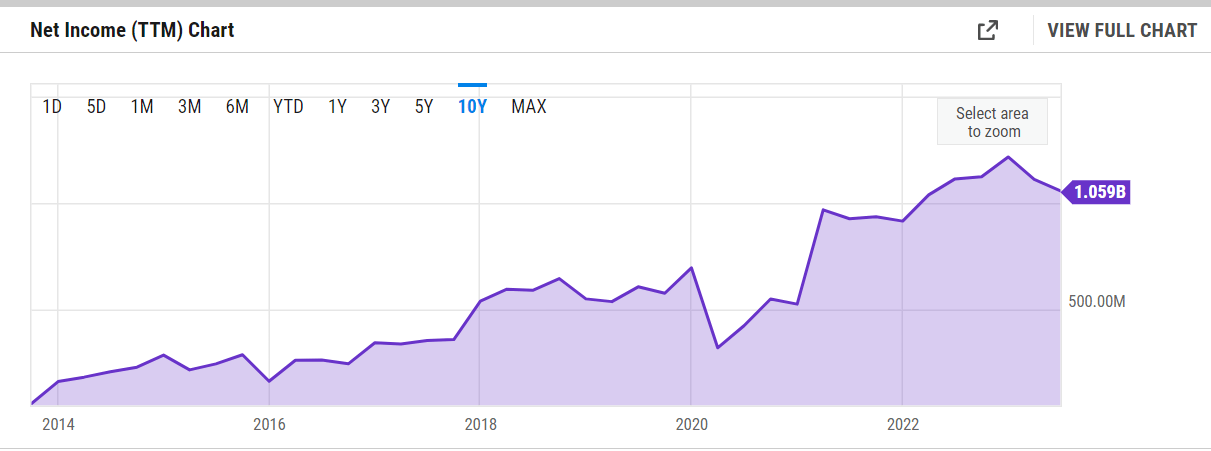

Net Income (YCharts)

Over the last decade, though, the bottom line has been incredibly strong for WES and this has ensured a stable and growing dividend. The company has paid out $928 million in dividends in the last 12 months. With consistent bottom-line growth like this, I think a higher payout ratio is possible, but also highlights why I prefer some under 90%. It gives some margin of safety to the company to maintain the same dividend yield without having to cut it because commodity prices are less favorable.

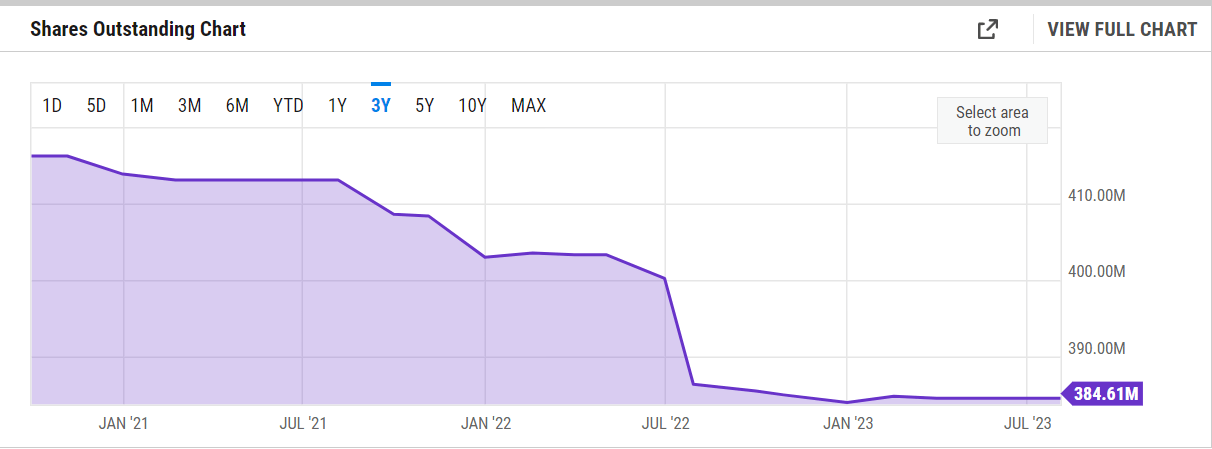

Shares Outstanding (YCharts)

Further driving the shareholder value with WES I think is the solid history of buying back shares. Decreasing from 410 million in 2021 to under 385 million now. Besides, WES has also paid back $1.5 billion in debts in the last 12 months. Practises like this are why I favor WES for the long term, as the leverage is not that high, and it won’t risk affecting the yield.

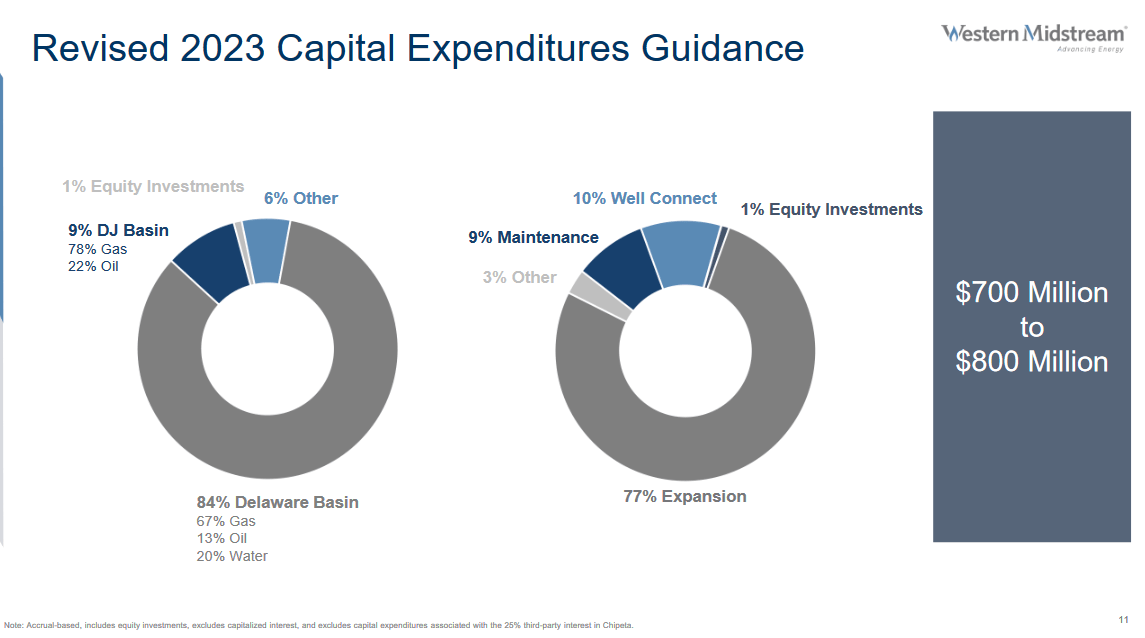

2023 Guidance (Investor Presentation)

Going forward, WES is still investing in their asset base and this should, with the recent uptrend of gas prices, result in higher FCF. The market seems to be equally as optimistic about WES as I am, just looking at the dividend, it’s estimated to grow by 36% between 2022 and 2023. But if the prices remain the same it should be able to continue this way and WES could raise it by at least 5% annually in my opinion. This underscores the shareholder value you are getting here and translates to a strong buy thesis.

Risk/Reward

One of the primary risks associated with our investment thesis pertains to the company’s capacity to sustain its operational volumes in an inherently volatile environment. This challenge is further compounded by the company’s close associations with Occidental Petroleum. While the company has provided robust guidance and exhibits resilience in the present market conditions, it’s crucial to acknowledge that achieving continued success is not an absolute certainty.

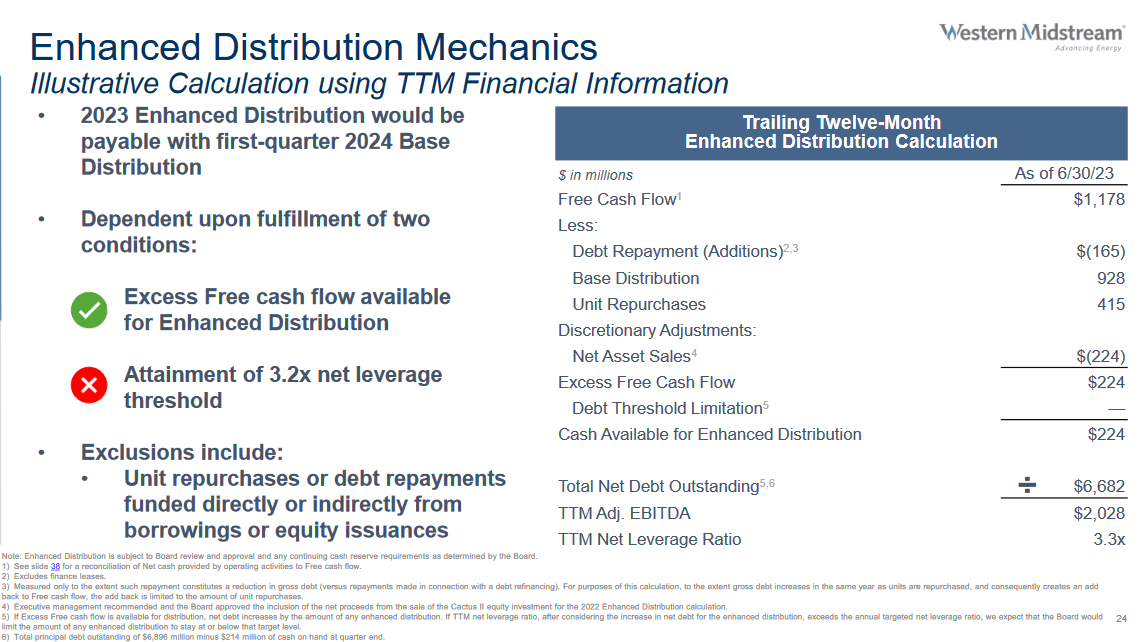

Distribution Highlights (Investor Presentation)

The investment with WES revolves around being able to take a great dividend as the company benefits from strong commodity prices and delivers sustainable FCF during the down parts of the cycle. Where I think that some investors may be concerned is the p/b of the business. It currently displays a significant premium to the rest of the sector. But with the acquisitions like Meritage Midstream, then I think the p/b could decrease some more. However, it is certainly a point to watch that could lead to WES losing more in share price. If the assets depreciate too much, the company looks more expensive.

Key Notes

WES is one of the most solid dividend-paying companies in the energy sector right now, in my opinion. As we have seen, it is supported by a strong increase in net income, and the necessity of raising shares or taking on debt to grow it is not there. A yield above 8% seems sustainable if gas prices continue ticking upward. I like the improvements on the balance sheet as well like debt repayments and will be viewing WES as a buy.

Read the full article here

Leave a Reply