This Analysis Assigns a Buy Rating to Western Copper and Gold Corporation

This analysis upgrades the rating on Western Copper and Gold Corporation (NYSE:WRN) (TSX:WRN:CA) stock to a “Buy” rating from the “Hold” rating assigned in the previous analysis.

In the previous analysis, the company received a “Hold” rating because the macroeconomic and geopolitical situation did not predict a recovery in metal prices, on which the shares of this company are heavily dependent. This context was also not expected to create further difficulties for the shares, and most of the headwinds were already embedded in the share price.

Because of the Different Outlook, the Stock Now Deserves a Buy Rating

An explorer and developer of mineral projects in Canada, the company owns a mining mineral project in Yukon, Canada, for the future production of copper, molybdenum, gold, and silver.

If one were to evaluate the contribution of each production to Western Copper and Gold Corporation’s future revenues as a function of current metal prices and estimated production over the entire 27-year project life, copper, gold, and molybdenum would be 42%, 29.5 %, and 26.5%, respectively of the total turnover. Silver’s contribution is actually very marginal.

The heavy exposure to these metals means the stock would continue to suffer from the headwinds of “Higher for Longer” interest rates from the Federal Reserve (Fed), whose hawkish stance is neither an ally of copper, as the stance dampens the demand outlook for the red metal, nor gold, as the stance dampens the investment in the precious metal as this gives no return.

However, higher interest rates pose the risk of a recession that could trigger a bull market for gold, and since this stock has a good relationship with the yellow metal, similar to what happened after the regional banking crisis in the United States, the stock could experience a quick and significant recovery.

The Current Situation Sets the Stage for an Economic Recession

Until the labor market gives the Fed clear signals that the U.S. core personal consumption expenditures (PCE) price index – the Fed’s preferred inflation indicator excluding food and energy – is definitely on the way back to the 2 percent target, the headwinds will continue.

Labor market conditions remain tight, as initial jobless claims in the United States show near nine-month lows, and this could even lead to the need for another rate hike.

High rates and core annual inflation of 3.7% in September are weighing on consumption and investment, which are showing signs of slowing. Also, experts say the economy is headed for recession, even as many continue to push the soft-landing narrative as the only possible scenario for the economic cycle.

As far as consumption is concerned, last week brought the following developments that were anything but reassuring to proponents of the soft-landing thesis:

- Paying off more than $1 trillion in student loans is putting even more pressure on families’ finances, and many of them now appear to be struggling to meet even their basic needs.

- The specter of a loss of growth momentum emerges from the Q3 2023 earnings report of Mastercard (MA), as the slowdown reflected in the US credit card giant’s recent consumption trends is a valid indicator of the health of US consumption.

- UPS (UPS) had to lower its 2023 revenue forecast due to, “surprisingly”, weakening demand for its services.

- Tobacco consumption, which is usually characterized by quite rigid demand, is also losing ground significantly under the pressure of the factors mentioned above. In this regard, the third quarter 2023 earnings report of Altria (MO), the US tobacco giant and marketer of the well-known and widely used Marlboro cigarette brand, is very telling: an 11.6% decline in domestic cigarette shipment volumes forced the company to reduce the adjusted EPS forecast for 2023.

The decline in consumption is already a major blow to growth, as consumption accounts for almost 70% of the US GDP, but the decline in investment also plays an important role in the worsening of the economic cycle.

A clear indication of sluggish corporate investment given the volatile outlook comes from the following major corporations:

- General Motors (GM) will postpone its electric vehicle production plan so that the conversion of its Orion assembly plant to electric truck production will not occur before 2025, it seems for investment optimization reasons.

- Due to the high borrowing costs that Tesla owner Elon Musk is apparently very afraid of, i.e., the impact these could have on the profit margins of his Tesla, he now considers as necessary to delay the planned construction of an electric car factory in Mexico.

- The outlook for Morgan Stanley’s (MS) margins is likely to be bleak right now as investment banking (M&A and IPO) and trading activity revenues bear the brunt of investor risk aversion amid heightened volatility.

These economists predict an economic recession:

Michael Pearce, chief US economist at Oxford Economics, Chryssa Halley, chief financial officer of the US Federal National Mortgage Association (Fannie Mae), and David Rosenberg, economist at Rosenberg Research. Most recently, former US Treasury Secretary Larry Summers believes that a soft landing is unlikely, but a recession will instead come as early as 2024 as the next business cycle.

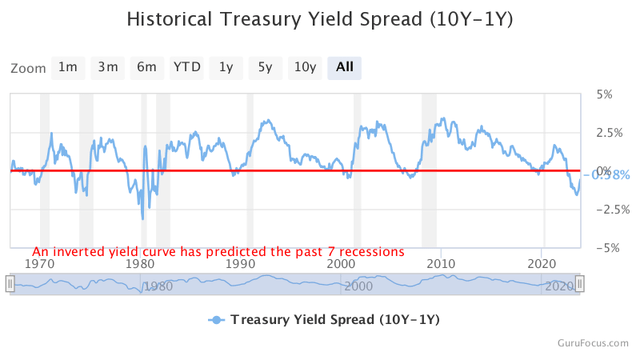

Monitor the US Treasury Yield Curve

The U.S. Treasury’s inverted yield curve, an almost unbeatable indicator of an economic recession – it has correctly predicted economic downturns seven out of eight times in the last 58 years – is still at a one-year yield of 5.435% versus a 10-year yield of 4.873%. Normally, it should be the other way around: the longer the maturity, the greater the risk of financial insolvency of the issuer and the higher the yield paid. This means that investors currently view the short-term outlook as unusually risky.

Source: GuruFocus.com

Many of you will notice that the spread will narrow over time and eventually normalcy with both shorter and longer-term returns will soon be restored. However, this does not mean that the recession loses its value in favor of a soft landing. Not at all. The trend is currently mainly due to uncertainty rather than the expectation of rising interest rates. Investors are selling the underlying securities of long-term loans and turning to shorter-term loans or the money market or preferring to keep their savings in their accounts as their prospects become more uncertain over time. “Concerns about the economy”, reports Yahoo Finance, plus the fallout from geopolitical issues, and the Federal Reserve’s continued “higher for longer” policy caused the 10-year Treasury yield to top 5 percent last week for the first time in 16 years.

It follows that the deterioration in the economic cycle will trigger a shock in the stock markets and gold will likely act as a safe haven from the consequences for the assets in portfolios. Investments in gold and gold-backed securities will be in high demand to implement the hedging strategies and then the price of these assets is likely to witness a bull market.

Western Copper and Gold Corporation Is Positioned to Benefit from Rising Gold Prices Predicted by Analysts

Analysts at Trading Economics expect the precious metal, which was trading at $1,997.15 an ounce at the time of writing, to rise to $2,029.25 an ounce before December 31, 2023, and then continue to rise up to reach $2,100.07 per ounce at about this time in 2024.

Although Western Copper and Gold Corporation will likely one day be known more as a trader of base metals than precious metals, investors may still be interested in using this stock to position themselves ahead of the next rise in gold prices. It concerns retail investors who, because they do not have the financial strength to invest directly in the physical metal, still want to benefit from the change in the price of the physical metal through the listed shares of the companies that produce it, and perhaps they see the Western Copper and Gold Corporation as one of these exploitable vehicles.

Western Copper and Gold Corporation could become a valuable publicly traded stock – the company is working on its project in Yukon, Canada – and give retail investors the opportunity to participate in the profitable energy transition market. Copper and molybdenum – the key components of many projects that replace environmentally unfriendly technologies with more sustainable ones – will account for the bulk of the company’s future production and profits, and profits are the main driver of share prices even among miners.

However, it may take some time before Western Copper and Gold Corporation joins the list of producing companies and potentially becomes a suitable vehicle for medium and long-term strategies to capitalize on the metals markets. Meanwhile, the company’s shares remain highly exposed to the volatility of the metals markets and are therefore strongly inclined to record as many declines as gains today.

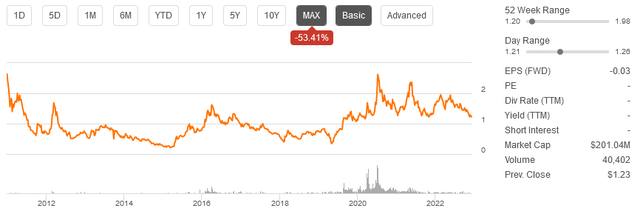

Source: Seeking Alpha

In addition, no dividend is paid, which is not possible because the company does not produce metals and does not generate profits. The medium/long-term strategies would therefore result in capital being kept unproductive for too long, while it could instead benefit from the interest rate increase elsewhere. In addition, there is a risk of loss if divestitures become necessary to recover funds after the stock has been affected by the decline in metals prices.

So, this analysis provides the idea of using Western Copper and Gold Corporation shares as leverage to benefit from the expected bullish sentiment around gold as the market becomes increasingly aware of the threat of an economic recession.

The Positive Correlation Between Western Copper and Gold Corporation and the Metals

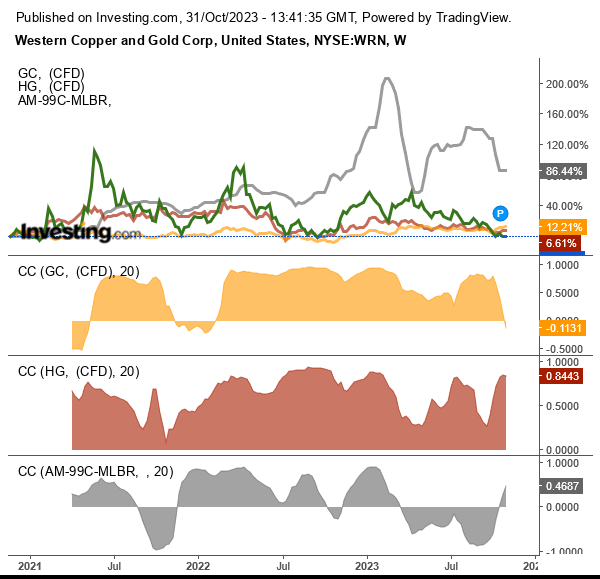

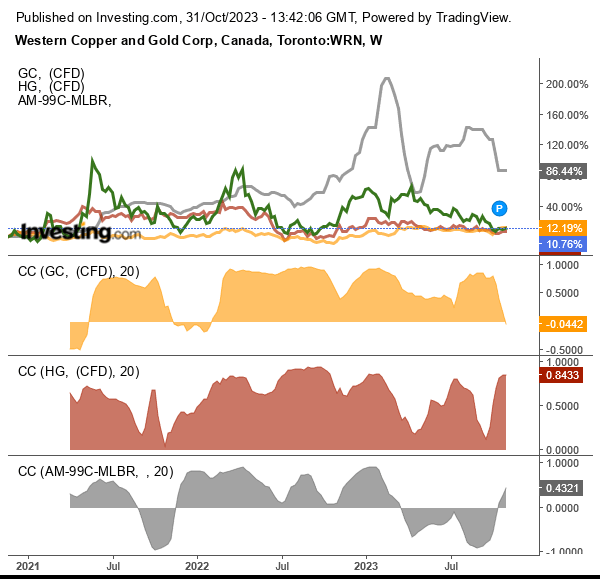

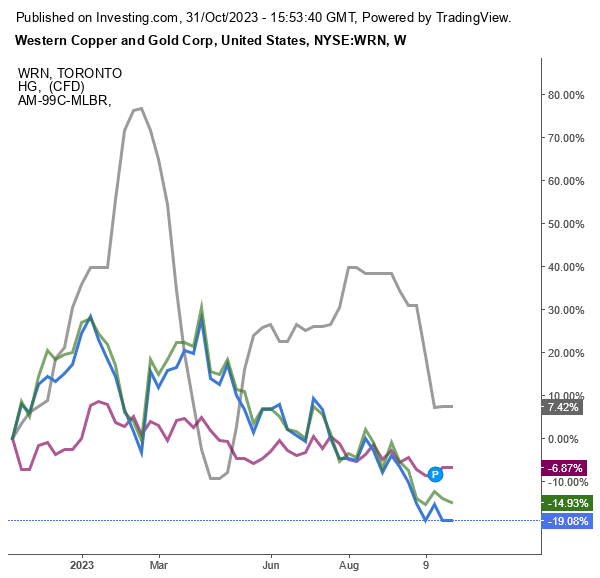

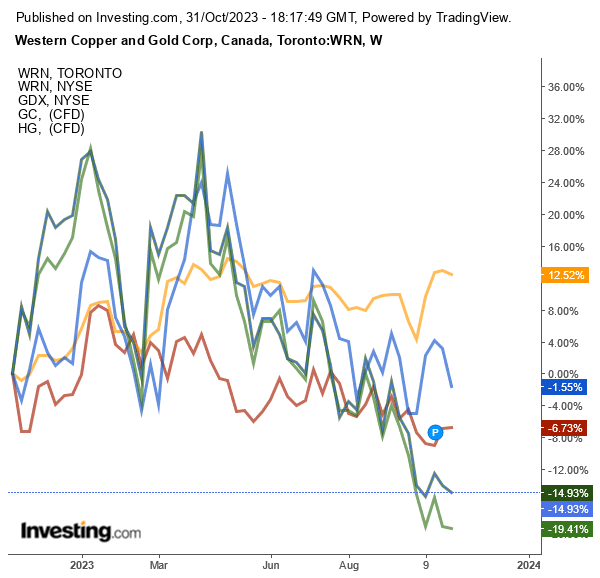

Below are two charts that show that shares of Western Copper and Gold Corporation actually have a positive and significant correlation with the price of gold, enough to make you consider using this stock given the precious metal’s next rally.

The readers are cautioned not to limit themselves to the value of the correlation coefficients (“CC”) in the boxes below the main graph, but to take a look at the trend of their curves.

The value (-0.11 for gold, 0.84 for copper, 0.46 for molybdenum) reflects the trend at the time the chart was created, while the curves instead show the relationships between Western Copper and Gold Corporation stocks (WRN on the NYSE American and WRN:CA on the Toronto Stock Exchange) and three metals: gold, copper, and molybdenum.

Although the shares have the strongest positive correlation with copper prices, as the copper red area is always above zero while the other two metals are not always above zero, their correlation with gold nevertheless tends to be significantly positive and is very often just a whisper away from the upper limit of CC’s range of -1 to +1.

This is the chart showing WRN stock prices (green line) versus gold futures (yellow line) versus copper futures (red line) and the molybdenum commodity, represented by AM-99C-MLBR Molybdenum Bar 99.9% Min China Spot (grey line).

Source: Investing.com

This is the chart showing WRN:CA stock prices (green line) versus gold futures (yellow line) versus copper futures (red line) and the molybdenum commodity, represented by AM-99C-MLBR Molybdenum Bar 99.9%Min China Spot (grey line).

Source: Investing.com

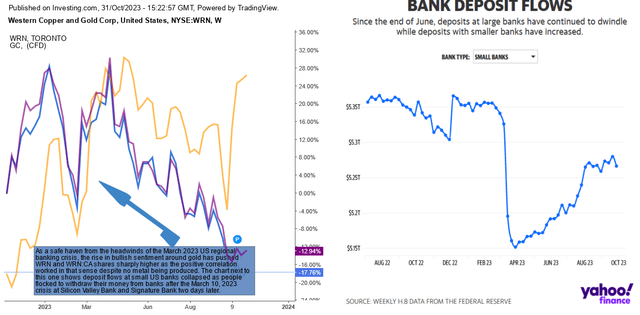

The chart below shows why retail investors choose to have shares of Western Copper and Gold Corporation in their portfolio, consistent with the “Buy” rating in this analysis. They want to take advantage of the catalyst for higher prices that lies in the safe haven of gold against fears of an impending economic recession.

The regional banking crisis in the United States in March 2023 led to a dramatic drop in deposits at small banks, as many panicked after the closure of Silicon Valley Bank in March 10,2023 and Signature Bank two days later and flocked to the branches to withdraw their money. The resulting headwind caused gold futures prices (yellow line) to skyrocket in a very short time and due to the strong positive correlation with the precious metal, shares of Western Copper and Gold Corporation were even able to record a significant gain of over 30%.

Source: Investing.com and Yahoo Finance

All of this happened while the other two commodities, copper (red line) and molybdenum (gray line), the main drivers of Western Copper and Gold Corporation’s future sales, performed poorly under the negative pressure of high-interest rates and high core inflation.

Source: Investing.com

The downside risk in demand for copper and molybdenum remains, but there is a good opportunity for a new strong rise in the gold price with a recession in sight. So, the conditions are currently in place for Western Copper and Gold Corporation shares to deliver good returns, just as they did in March 2023.

The Stock Valuation

Due to the risk of the US Federal Reserve’s continued restrictive interest rate policy, WRN and WRN:CA stocks linked to the stock market via a 24-month beta of 1.17 (scroll down this page or this page of Seeking Alpha to the “Risk” section) could become cheaper before recession fears greatly boost the safe haven properties of gold.

Maybe investors want to wait a little bit before implementing a Buy rating in order to profit from more compelling entry points than current levels.

Source: Investing.com

As of this writing, shares under the symbol NYSE:WRN are trading at $1.230 apiece while shares under the symbol TSX:WRN:CA are trading at CA$1.71 apiece.

Shares of NYSE:WRN are trading significantly below the 200-,100-, and 50-day simple moving averages of $1.580, $1.448 and $1.353, respectively. Shares are also trading significantly below the middle point of $1.59 in the 52-week range of $1.20 to $1.98. Under the symbol NYSE:WRN the stock has a market cap of $201.04 million.

The stock under the ticker NYSE:WRN has a 14-day relative strength indicator of 38.87x, which means there is enough room for shares to reach lower levels.

Shares of TSX:WRN:CA are trading significantly below the 200-,100-, and 50-day simple moving averages of CA$2.14, CA$1.96 and CA$1.85, respectively. Shares are also trading significantly below the middle point of CA$2.16 in the 52-week range of CA$1.64 to CA$2.68. Under the symbol TSX:WRN:CA the stock has a market cap of CA$277.91 million.

The stock under the symbol TSX:WRN:CA has a 14-day Relative Strength Indicator of 40.54, meaning there is a good opportunity to use more attractive entry points to get an edge on the expected gold price rally.

The Risk

A Buy recommendation for Western Copper and Gold Corporation shares carries the risk that gold prices will not experience the expected rally.

In this regard, this analysis excludes the possibility of high risk, as all the above indicators and trends clearly seem to point to a significant deterioration in the economic situation, which would strengthen the safe haven properties of gold.

If anything, there appears to be a risk as the bleaker outlook for copper and molybdenum – as long as higher for longer interest rates and elevated core inflation impact consumption – could significantly offset the positive impact of bullish sentiment on gold prices. This scenario could occur because the positive correlation previously examined appears to be stronger between stock prices and copper prices than between stock prices and gold prices.

However, the risk is low here too, check out the following chart to understand the reason: While the rise in gold prices drove shares of Western Copper and Gold Corporation higher in the wake of the regional banking crisis in the US, copper, which complained of low prices, failed to blunt the stock’s upward trend in both markets.

In no way did NYSE:WRN and TSX:WRN:CA make their shareholders regret not being shareholders of other stocks in the VanEck Gold Miners ETF (GDX), which also saw an amazing recovery.

Source: Investing.com

If past trends count, there is no reason to believe that things should be any different today than they were in March/April 2023, assuming gold is experiencing a bull market due to the upside catalyst of the economic downturn.

About Western Copper and Gold Corporation

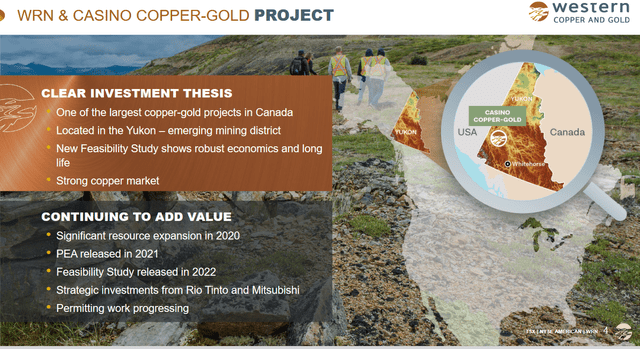

As of June 30, 2023, Western Copper and Gold Corporation had approximately $29.4 million in cash and short-term investments and no relevant debt to continue with its own mining project to operate a multi-metal deposit in the Yukon Territory of Canada.

The project is called the casino mineral property comprising 1,136 full and partial quartz claims and 55 placer claims located in the Yukon, Canada. The screenshot from the company’s October 2023 presentation gives a better idea of the project’s geolocation.

Source: Western Copper and Gold Corporation’s Corporate Presentation October 2023

The Casino Project and surrounding property in the Yukon Territory appears to be a large copper-gold project in a rapidly growing mining district.

Prominent shareholders include Rio Tinto Canada, which belongs to Rio Tinto ADR (RIO), a London-based metals and mining giant with an 8% stake in the outstanding shares of Western Copper and Gold Corporation, and Mitsubishi Materials Corporation, a Tokyo-based industrial metals and mining company in Japan with a share of 5%.

Rio Tinto and Mitsubishi Materials are eligible to have an officer on Western’s board if they manage to raise their ownership to at least 12.5%.

The Casino metallic project has a feasibility study released in 2022, and according to this technical document, the deposit consists of 46% copper, 34% gold, 4% silver, and 17% molybdenum. More specifically, the site appears to contain 7.6 billion pounds of copper to be developed from measured and indicated resources, in addition to 14.8 million ounces of gold from measured and indicated resources. Approximately 66.5% of the copper resources are in mineral reserves, most of them in ore sulfide grading 0.19%, while approximately 68.6% of the gold resources are in mineral reserves, most of them in ore sulfide grading 22 grams of precious metal per ton of ore.

The casino project provides for the operation of an open-pit mine and the material resulting from the mining activities will be supplied to a processing plant that will process 120,000 tons of material per day. Under the project, copper and molybdenum in concentrate will be produced from sulphide ore using conventional flotation technology, while gold and silver will be recovered as part of the copper concentrate.

The Casino project will also process 25,000 tons of oxide per day and operate a heap-leach facility and SART (Sulfidation, Acidification, Recycling and Thickening) technology, with the aim of recovering the precious metal for forging doré bars and recovering the copper contained in the oxide ore.

According to the economic analysis part of the feasibility study, the project should generate an internal rate of return (IRR) of 18.1%, which is not very high as investors usually expect a return of 25-30% for a profitable mine. This estimate is based on price assumptions of $1,700 per ounce of gold and $3.60 per pound of copper, which seem reasonable compared to average metal prices over the past five years.

At a discount rate of 8%, the project has a net present value of 2.334 billion Canadian dollars or ≈ US$1.686 billion.

The mine is currently under construction and once operational, the company will produce the metals for more than 25 years. Until then, the share price is fully exposed to changes in the prices of gold, copper, and other metals.

Conclusion

Western Copper and Gold Corporation seeks to begin production of copper, gold, molybdenum, and silver at the Casino Mineral Project in Yukon, Canada.

Until production begins, the stock price will be exposed to metal price changes completely. This stock could soon rebound sharply on gold’s rally as the looming recession reinforces gold’s safe-haven properties.

Influenced by higher for longer interest rates, shares may become cheaper ahead of the expected gold bull market. Retail investors should consider a Buy recommendation. Higher interest rates are hurting demand for copper and the recession will be even worse for the red metal, so prices are likely to remain subdued. However, they should not offset the positive effects for the shares of Western of the rising gold price.

Read the full article here

Leave a Reply