In this column, we provide a quarterly update on the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD). Our opinion? The exchange-traded fund, or ETF, does a great job as it was designed to do, be relatively stable while tracking pretty closely the Dow Jones 100 Dividend Index. That’s it. It also offers a growing dividend over time. However for those who chase yield, usually a poor strategy unless you find the right picks, SCHD should be passed over. But it does offer safe income and longer-term capital appreciation. The biggest complaint aside from the lower yield relative to many other income options, is that the growth side of the equation, at best, market performs. And often, it underperforms. That is a fair assessment. However, for those conscious of risk, but looking for a combination of some growth and some dividend growth and yield, SCHD is a sleep-well-at-night option. It is likely due for a breather with the market, but we continue to think it does its job well.

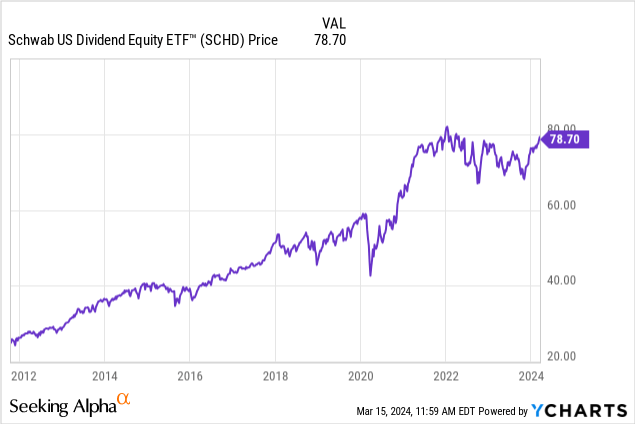

Let’s check in the portfolio and provide insights into the ETF and the holdings. Take a look at the below chart over the last decade plus:

We still think it’s a good long-term buy and hold, but nothing to be incredibly enthusiastic about, while at the same time, we do not understand why it catches so much hate. If you want to find conviction growth ideas, or solid income ideas, talk to one of our members, and consider joining an investing group, but for those that want something simple and can sleep well at night, we reiterate SCHD as a buy. But, we cannot help ourselves. Pick your spots. Buy when the market is red. You could also dollar cost average long-term as well, which catches ups and downs over time. SCHD is not a get-rich-quick investment, nor is it going to tickle the fancy of those who want yield at any cost. However, it does have its place for conservative, long-term wealth building.

Let us describe the ETF for those who follow us who may not know about this ETF.

Update on the holdings of Schwab U.S. Dividend Equity ETF

Since our last update, the Schwab U.S. Dividend Equity ETF is still invested in a total of 104 diversified holdings across a range of sectors. Here are the current top 10 holdings of The Schwab U.S. Dividend Equity ETF, as of Thursday, March 14th, 2023:

Seeking Alpha SCHD Holdings

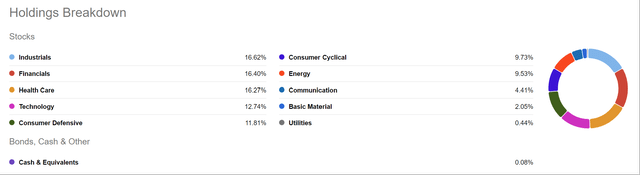

In this column, we will touch on the 5 holdings briefly. So, as we see here, 22.4% of the ETF is invested in these top 5 holdings. While that can be a concentration risk, keep in mind that these are high-quality, blue-chip stocks in the ETF. We should also point out that the holdings are diversified by sector:

Seeking Alpha SCHD Holdings Breakdown

So, you can kind of predict where holdings, etc., are going, since the ETF seeks to mimic, before fees and expenses, the total return of the Dow Jones U.S. Dividend 100 Index. This is a conservative index, and this is why SCHD is a conservative ETF. The industrials sector holds the highest percentage of the overall portfolio, though it is down to 16.62% of the ETF from 18.08% in our last coverage. Then it is followed by financials at 16.40%, roughly in line with 16.49% when we updated you in December. Healthcare is now 16.27% of the holdings, up from 15.76%. Technology is now 12.74% of the index, while Consumer Discretionary rounds out the top 5 sectors at 11.81% So roughly three-quarters of the holdings are in these sectors, not surprising if you track the Dow Jones 100 dividend index. Now, with all of the grief this ETF catches, the fact is that while the index ebbs and flows with the market, the total returns are impressive, even if conservative, and more so considering the dividend returns.

The ETF is influenced by the top 5 major holdings, so let’s take a look at them.

Broadcom

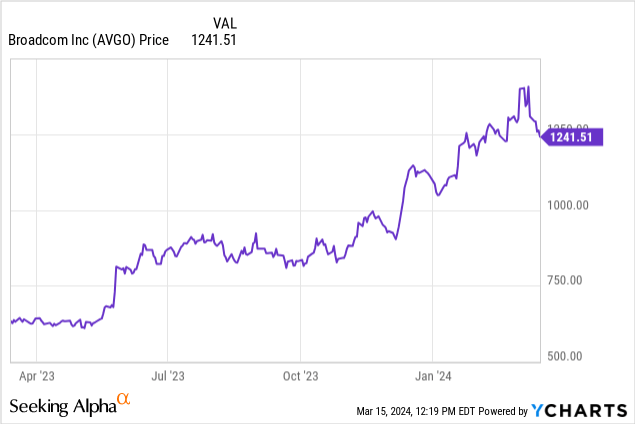

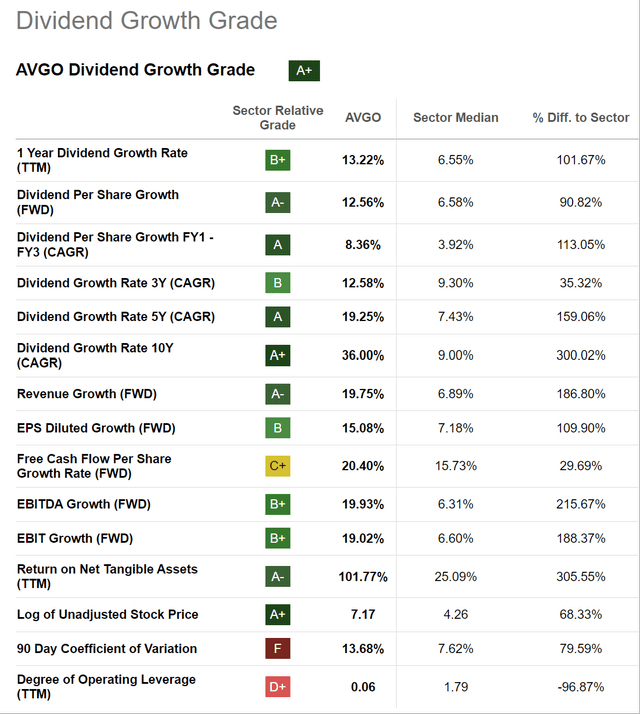

The largest holding is one of our favorite stocks and is a former Investing Group recommendation. That is Broadcom Inc. (AVGO). The performance of this semiconductor stock has been tremendous. AVGO stock represents 4.84% of the Schwab U.S. Dividend Equity ETF, and the stock has had a great run of late. Broadcom also continues to raise its dividend. The dividend growth is A+ rated, as it rises over time, as has the stock. A winning combination.

Seeking Alpha AVGO Dividend Growth Ratings

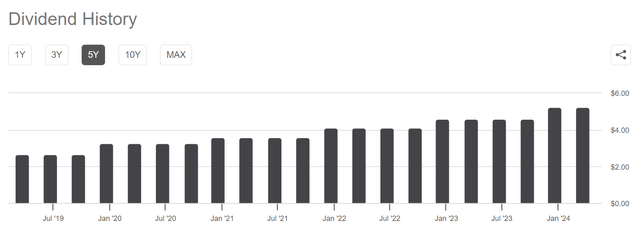

Seeking Alpha AVGO Dividend History

AbbVie

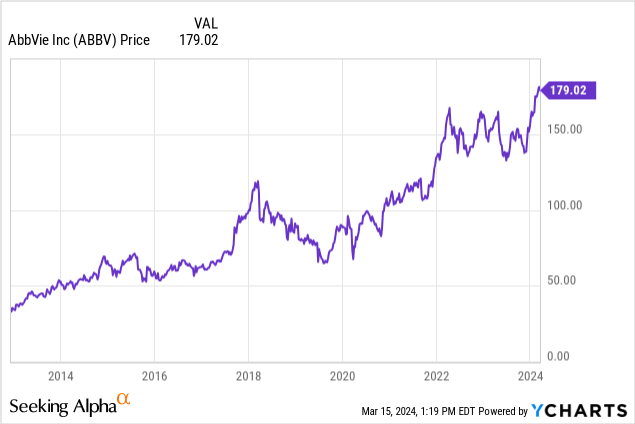

AbbVie Inc. (ABBV) is now the second-largest position of the Schwab U.S. Dividend Equity ETF at 4.70% of holdings, up from fourth in December.

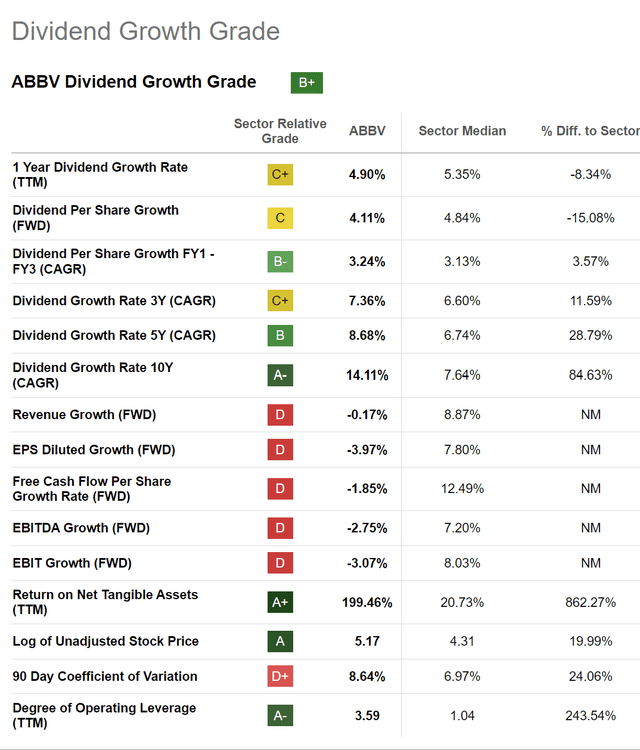

This was also a top pick of our Investing Group several years ago and remains a strong biotech play for both strong growth and a high dividend yield. It currently offers a FWD dividend yield of 3.42%. Like other SCHD holdings, this raises its dividend routinely. The grades on the metrics are also favorable for dividend growth.

Seeking Alpha ABBV Dividend History

Seeking Alpha ABBV Dividend Growth History

The Home Depot

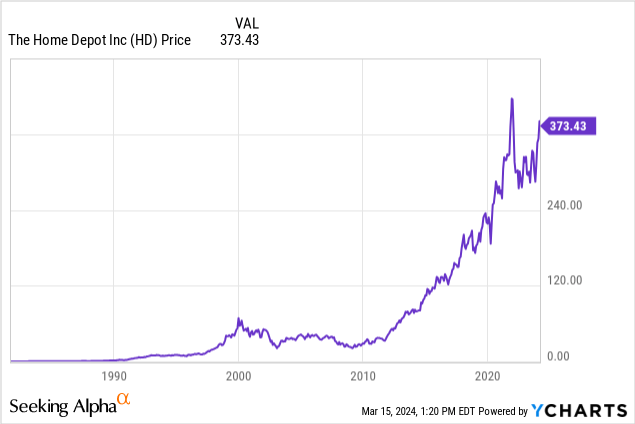

Long-time Investing Group favorite The Home Depot, Inc. (HD) is now making up 4.41% of the ETF.

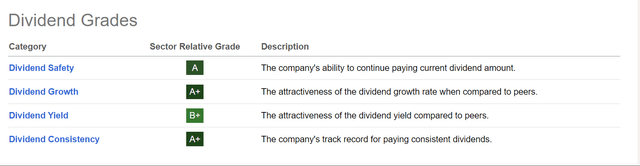

It has been a very stable grower over the years, and a very blue-chip investment, providing great returns for our members and any shareholders, as well as strong dividend growth.

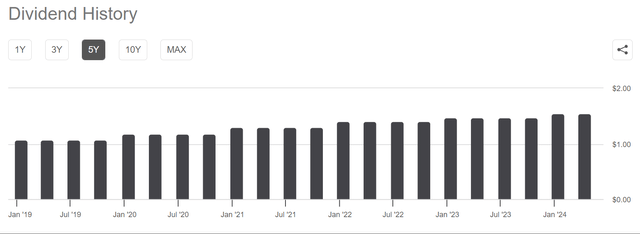

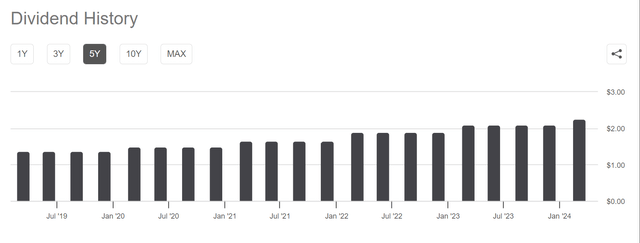

Seeking Alpha HD dividend history

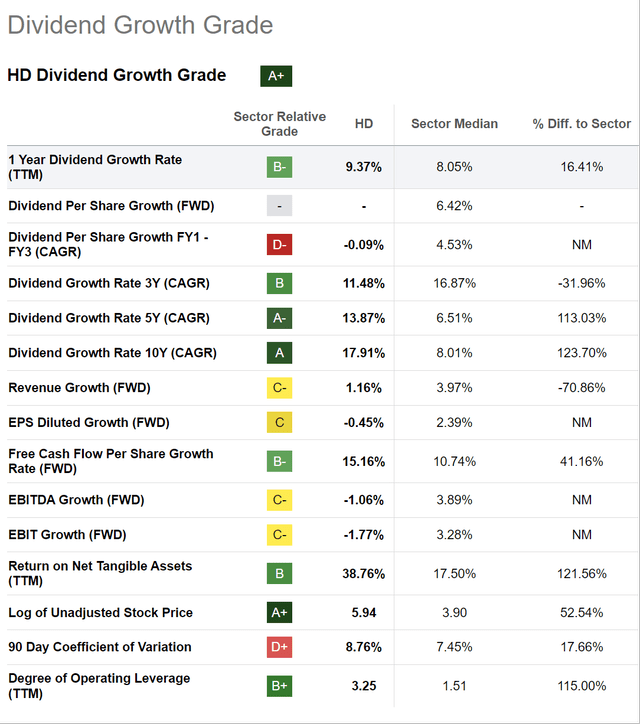

Seeking Alpha HD Dividend Growth

Merck and Texas Instruments

Rounding out the top five holdings are Merck & Co., Inc. (MRK) and Texas Instruments Incorporated (TXN), at 4.38% and 4.07% of the SCHD ETF holdings, respectively. Texas Instruments has solid dividend scores.

Seeking Alpha TXN dividend grades

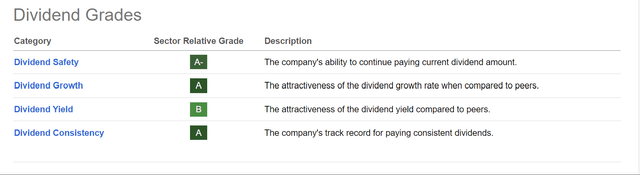

Likewise, Merck also has solid grades.

Seeking Alpha MRK dividend

Now, for the most part, you could purchase these top 5 holdings and have a pretty decent portfolio, though it would not be super diversified. Of course, then you have a single stock risk. By owning this ETF, it reduces single-stock risk. One could argue that you also have to own the bad with the good, but overall, we think our traders and our readers can strongly consider this ETF as one to consider for stable income and long-term conservative growth. Overall. it is a “good” ETF, that does its job as designed.

Sleep Well at Night

Bottom line? Schwab U.S. Dividend Equity ETF is a boring, stable ETF. You can get a much better yield elsewhere. You can also get much better growth. But if you are looking for a stable, conservative, slow-growing, dividend boosting over time ETF, Schwab U.S. Dividend Equity ETF™ is in our opinion, a perfect example of a sleep-well-at-night ETF. Avoid nightmares with this sleep-well-at-night ETF.

Unlike with single stocks, you should never, ever wake up one morning and see the ETF down double-digits on a random headline, or even if there is macro carnage. It is just not going to happen. And if it did, well, it’s a once in a lifetime crash, meaning we have a lot more problems on hand.

Buying this ETF on market dips is wise if you want growing income, and growing capital over time. Critics can share their thoughts below, but you cannot argue that SCHD does its job of tracking its linked index quite well.

This is a conservative, easy-to-own ETF with a paltry 0.06% expense ratio. As far as ETFs go, it does not get much cheaper.

Read the full article here

Leave a Reply