In a May 25 Seeking Alpha article on wheat prices, I highlighted Russia and Ukraine’s significant position, writing, in 2020, “Russia and Ukraine produced over 110 million tons of wheat together, making them second only to China in world output. The war in Ukraine, Europe’s breadbasket, caused CBOT wheat prices to rise to a record high in 2022 before correcting.”

In late May, soft red winter wheat on the CME’s CBOT division was trading at $6.1450 per bushel for July delivery. The Teucrium Wheat ETF product (NYSEARCA:WEAT) was $6.09 per share on May 25. On September 7, active month December CBOT wheat futures were at the $6.09 per bushel level, with the WEAT ETF trading at $6.05 per share. The prices have declined, but the case for wheat exposure remains compelling. Wheat prices could make the primary ingredient in bread a raging buy at the current price levels.

A record high in March 2022 and a steep correction

As Russia and Ukraine are Europe’s breadbasket, the CBOT soft red winter wheat futures price exploded in early 2022 when Russia invaded Ukraine. Wheat fields turned into minefields, and the critical logistical hub at the Black Sea Ports became a war zone.

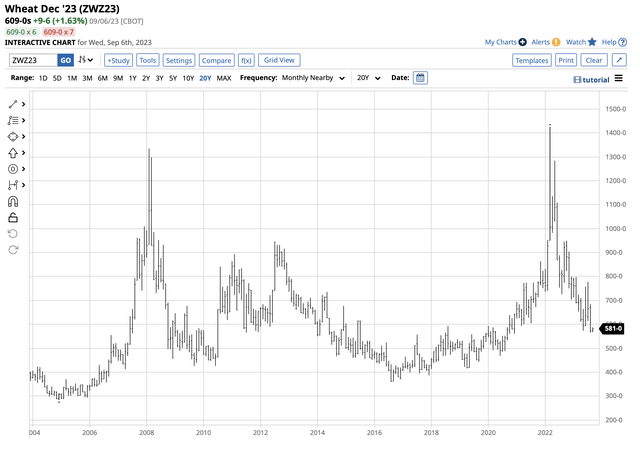

Twenty-Year CBOT Wheat Futures Chart (Barchart)

The chart highlights the March 2022 rise to $14.2525 per bushel, eclipsing the 2008 $13.3450 peak. CBOT wheat futures ran out of upside steam at over $14 per bushel, and the price has dropped steadily, making lower highs and lower lows since the 2022 high.

Nearby wheat futures drop below $6 and are sitting at the lowest price since early 2021

The most recent continuous contract low was $5.6450 per bushel in August 2023. On September 7, nearby September 2023, wheat futures prices remained below the $5.70 level, near the recent low.

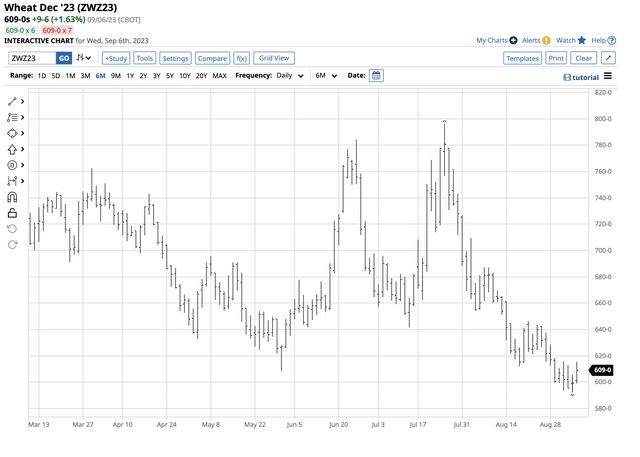

Six-Month CBOT Wheat Futures Chart (Barchart)

The chart shows the active month December 2023 CBOT wheat futures contract that dropped 25.5% from the most recent $7.9625 July 25, 2023, high to $5.9350 on August 31. The wheat futures were near the low at just above the $6 level on September 7. Before May 2023, the CBOT wheat futures were last below the $6 level in March 2021.

The KCBT-CBOT spread remains elevated- A sentiment indicator

In my May 25 Seeking Alpha article, I highlighted the significance of the KCBT hard red winter wheat versus CBOT soft red winter wheat spread. I wrote:

The CBOT wheat futures contract is a benchmark for the price of the grain that is the ingredient in flour that produces bread, a ubiquitous staple food around the world. The KCBT wheat futures contract is often the benchmark pricing mechanism for bread manufacturers in the United States. Therefore, the KCBT versus CBOT wheat spread can tell us a lot about the U.S. versus the global market for the grain.

The KCBT versus CBOT wheat spread is a location and quality spread that can offer clues about the path of least resistance for the primary ingredient in the production of flour and bread.

The long-term average for the spread dating back to 1970 is around a 20-30 cents premium for KCBT over CBOT wheat.

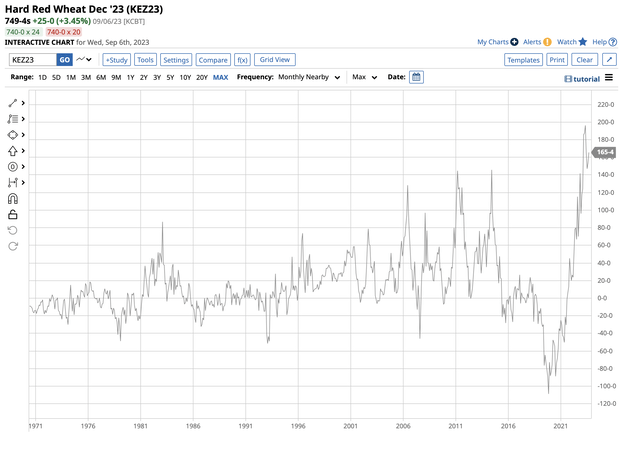

Chart of KCBT hard red Versus. CBOT soft red winter wheat futures (Barchart)

The long-term chart highlights the small premium over the past decades. In May 2023, the spread rose to a record high of nearly $2 per bushel for the KCBT nearby futures contract over the CBOT contract. On May 25, the spread for December futures stood at the $1.6950 premium level. On September 7, December KCBT wheat was $7.4950, with the December CBOT wheat at $6.0900 per bushel. The spread was sitting at the $1.4050 level, below the May 25 level, but still over four times the average. The spread level indicates U.S. consumer’s price and supply concerns in September 2023. Based on the spread, nearby CBOT wheat prices below $6 may be far too inexpensive.

The factors that pushed wheat prices to the 2022 high have not changed and have deteriorated

CBOT wheat futures, the global benchmark, rallied to a record high at over $14 per bushel in March 2022 before collapsing. However, the factors that caused the explosive rally remain a clear and present danger for prices and future supplies.

In September 2023:

- The war in Ukraine continues with no end in sight. Russia continues to use food and energy as economic weapons against countries supporting Ukraine, and wheat is one of the agricultural products that Russia controls.

- Russian fertilizer exports are another economic weapon. Higher fertilizer prices and scarce supplies have increased output costs for wheat producers.

- Russia walked away from an agreement that allowed Ukraine to safely export grain through the Black Sea Ports during the war. On Monday, September 4, Russian President Putin said the grain deal would not be restored until “the West meets Moscow’s demand on its own agricultural exports.” Russia has objected to sanctions that obstruct Russian food and fertilizer exports. Moreover, shipping and insurance restrictions have hampered Russia’s agricultural trade.

- The USDA’s August World Agricultural Supply and Demand Estimates Report projected the lowest 2023/2024 global ending stocks since 2015/2016. Moreover, the worldwide wheat outlook for 2023/2024 declined, citing lower consumption, decreased trade, and lower stockpiles.

The bottom line is while wheat’s technical trend remains bearish, the fundamental data is bullish. Moreover, the KCBT-CBOT spread, a sentiment indicator, remains historically bullish in September 2023.

WEAT tracks a portfolio of CBOT wheat futures contracts

The most direct and liquid route for investment or trading in the wheat market remains the Chicago Mercantile Exchange’s Chicago Board of Trade soft red winter wheat futures and futures options contracts. The Teucrium Wheat ETF (WEAT) provides an alternative for market participants seeking exposure to the world’s leading grain without venturing into the leveraged and margined futures arena.

At $6.05 per bushel, WEAT had over $200 million in assets under management. WEAT trades an average of more than 1.19 million shares daily and charges a 1% management fee, according to Seeking Alpha. There needs to be some clarification over the expense ratio, as Barchart lists it at 0.22%, and the Teucrium website says it is 0.28%.

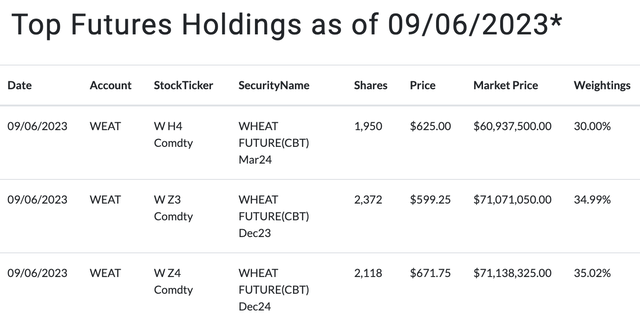

The Teucrium product owns three actively traded CBOT wheat futures contracts, excluding the nearby December contract to minimize roll risks. The most recent top holdings as of September 6 included:

Top Holdings of the Teucrium WEAT ETF Product (Teucrium)

WEAT held the December 2023, March 2024, and December 2024 CBOT wheat futures contracts on September 5. Since most price action tends to occur in the nearby contract because of speculative interest, WEAT tends to underperform on the upside and outperform the nearby contract on the downside.

The most recent rally in the September CBOT wheat futures contract took the price 32.2% higher from $5.8775 on May 31, 2023, to $7.7725 on July 25. The price dropped 27.4% to a $5.6450 low on August 30.

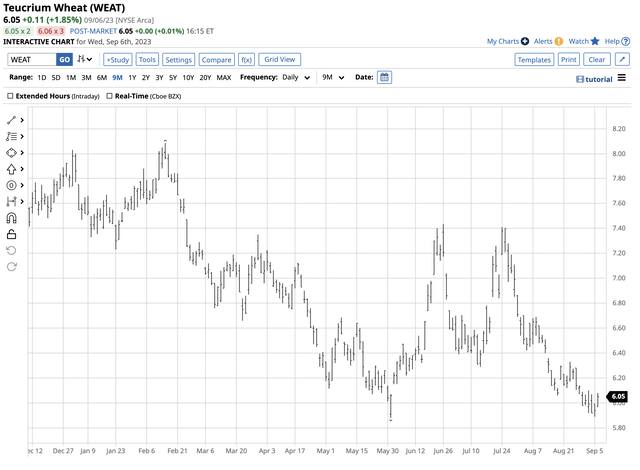

Chart of WEAT ETF Product (Barchart)

Over the same period, WEAT rose 26% from $5.88 on May 31 to a $7.41 high on July 24. The correction took WEAT 20.5% lower to a $5.89 low on September 5. WEAT underperformed during the rally but outperformed the September futures contract during the correction.

At the $6 per bushel level, there is a compelling case for higher wheat prices. The WEAT ETF product does an excellent job tracking a portfolio of CBOT wheat futures.

Read the full article here

Leave a Reply