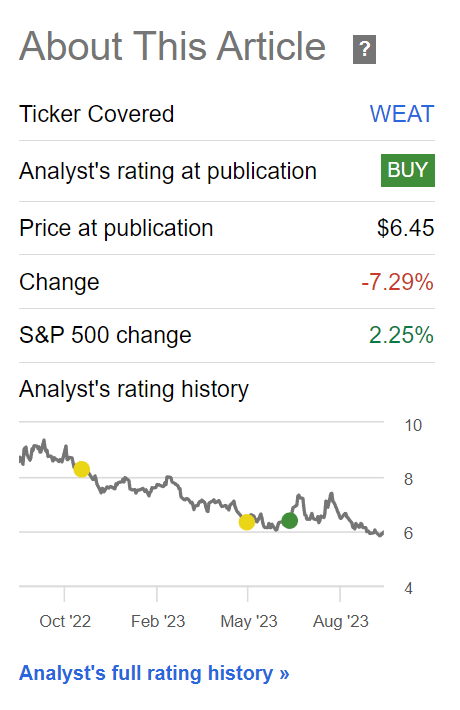

At the beginning of summer, I raised the Teucrium Wheat ETF (NYSEARCA:WEAT) to a buy based on the potential negative impact of a developing El Niño, as well as rising geopolitical tensions between Ukraine and Russia.

So far, my upgrade appears to be miss-timed, as the WEAT ETF had a few false starts, but failed to sustain any upward momentum (Figure 1).

Figure 1 – WEAT has failed to gain momentum (Seeking Alpha)

What happened to my bullish wheat thesis in the past few months and am I still bullish on the prospects for the WEAT ETF?

Fund Overview

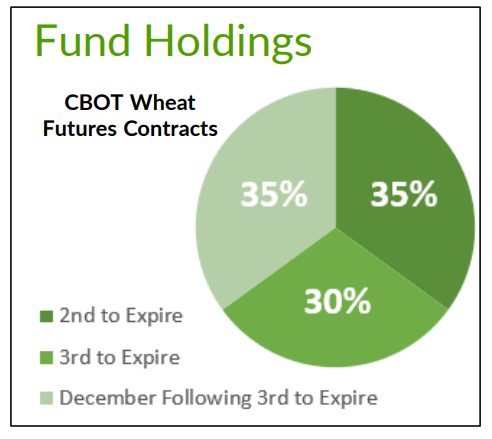

First, for investors not familiar with the Teucrium ETF products, the Teucrium Wheat ETF is a futures-based fund that does not hold physical wheat commodities. Instead, it owns a basket of wheat futures that are rolled as each contract matures (Figure 2).

Figure 2 – WEAT overview (teucrium.com)

Due to the contango nature of commodity futures where longer-dated futures tend to be higher in price, the WEAT ETF suffers from ‘roll decay’ when expiring contracts must be sold and proceeds used to buy more expensive futures contracts with more time to maturity. Therefore, the WEAT ETF may not be suitable for a ‘buy and hold’ strategy.

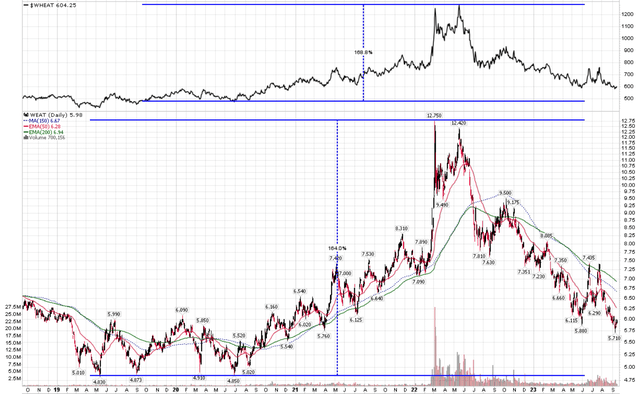

However, for short- to medium-term trades, the WEAT ETF does offer the desired exposure to the underlying commodity. For example, in 2020 to 2022, when spot wheat prices rallied 169% from $4.80 / bushel to $12.00 / bushel, the WEAT ETF delivered similar returns of 164% (Figure 3).

Figure 3 – WEAT can be suitable for short- to medium-term trades (Author created with price chart from stockcharts.com)

Wheat Price Soft On Sufficient Supplies

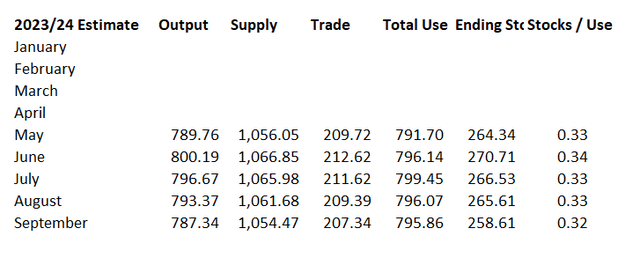

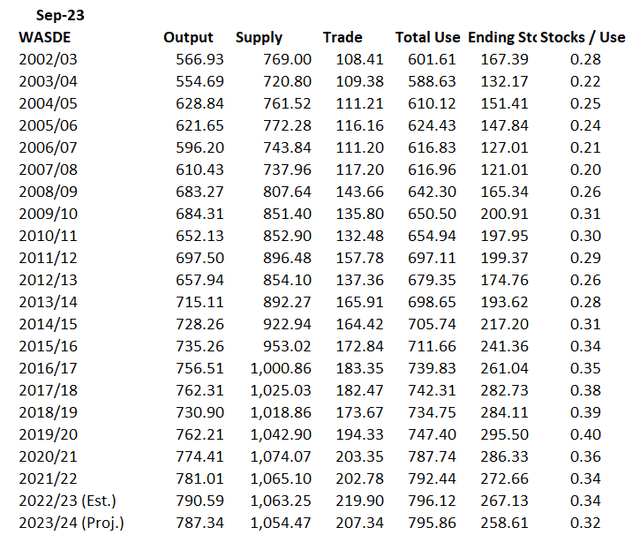

I believe the primary reason for the short-term decline in wheat futures prices in the past few months is because in recent WASDE reports, the USDA has been estimating ample supplies and have kept their forecast for prices constant at $7.50/bushel.

For example, for the 2023/24 harvest, the USDA initially estimated 1,056 million tons of supply and ending stocks of 264 million tons (Figure 4). However, that estimate was bumped up to 1,067 million tons of supply and 271 million tons of ending stock in the June WASDE. Subsequent WASDE reports kept estimates of global supply high, even though other agriculture reports showed that the U.S. crop quality was declining due to drought conditions.

Figure 4 – WASDE 2023/24 wheat supply / demand estimates (Author created from USDA WASDE reports)

Basically, the relatively static WASDE estimates tempered the fundamentally bullish news of worsening weather conditions affecting crop quality and quantity.

Is WASDE Finally True-ing Up Estimates?

However, the most recent September WASDE report suggest the forecasters at the USDA are beginning to ‘true-up’ their estimates to reality, as the report showed 2023/24 supplies are projected to decline 7.2 million tons YoY to 1,054.5 million due to lower production estimates across the globe.

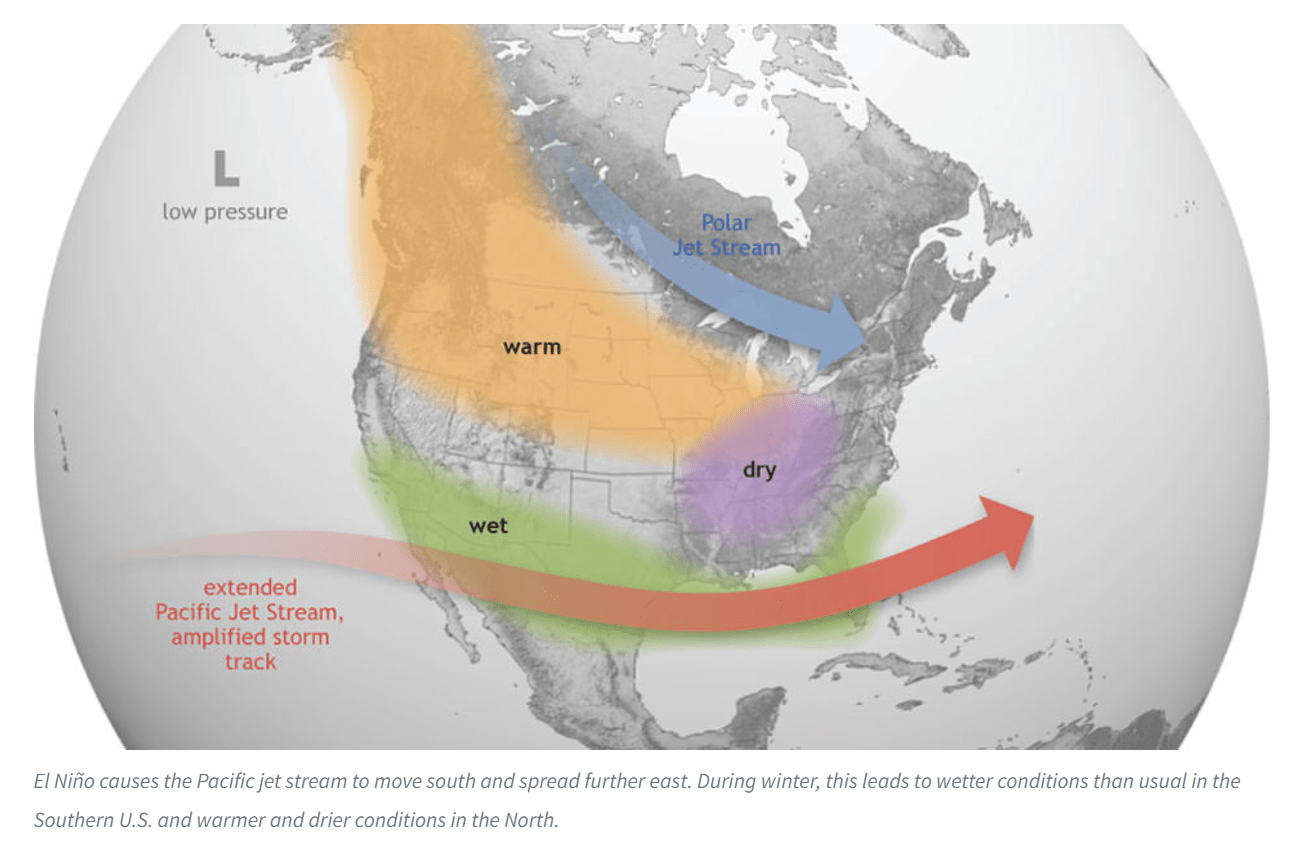

The report cited dry weather in Australia and Canada as main reasons for the reduced estimates. These are precisely the expected effects of El Niño that I noted in my previous articles: “El Niño tends to cause areas in the northern U.S. and Canada to be dryer and warmer than usual, which could be detrimental to wheat production” (Figure 5).

Figure 5 – El Niño could bring dryer and warmer weather (NOAA)

Furthermore, I cited reports that the Australian government was projecting wheat production to decline by one-third in 2023/24 due to the unfolding El Niño. It appears the WASDE forecasters are finally catching on.

If the reduction in global production is realized, this would be the first year-to-year decline in global wheat production since 2018/19. Importantly, based on the September estimates, ending stocks of wheat will be at 258.6 million tons, the lowest since 2015/16 (Figure 6).

Figure 6 – Annual wheat supply/demand statistics (Author created with data from WASDE reports)

Wheat Is Cheap On A Fundamental Basis

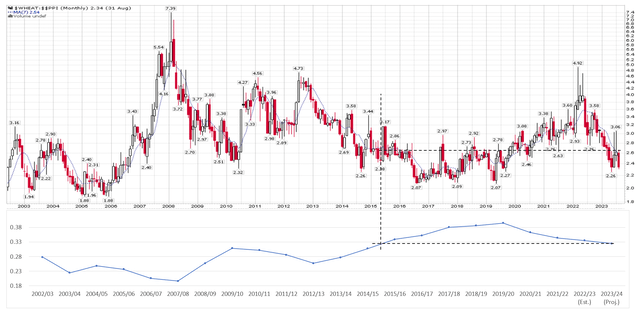

In fact, if we analyze wheat prices using the most recent Ending Stocks / Use ratio estimate of 0.32, we can see that wheat prices, discounted by inflation, is now approximately 10-15% cheap (Figure 7).

Figure 7 – Wheat price discounted by PPI inversely correlated to global stock/use ratio (Author created with price chart from stockcharts.com and data from WASDE reports)

This is the same model I used back in November, when I warned investors there might be 20% downside in wheat prices as the ending stocks / use ratio did not support the then $9 / bushel wheat price.

As production estimates are ratcheted down in future months, I expect the ending stocks / use ratio to trend lower, which should support higher wheat prices.

Russia Using Grain Deal As Bargaining Leverage

As I noted in my prior article, one wildcard for the global wheat market is the ongoing Russia/Ukraine war. Recently, Russia allowed the Black Sea Grain Deal to expire in July. Without a grain deal, it is difficult for Ukrainian wheat to be exported to global markets, as Ukraine is basically a landlocked country.

Following the expiry of the grain deal, Russia has stepped up its attacks on Ukrainian ports, citing cargo ships as potential military targets. This has deterred grain ships from going to Ukraine and has effectively shut Ukraine out of the global grain markets.

Russia’s goal is to use the Black Sea Grain Deal as a bargaining chip to reduce western sanctions on Russian exports. It is unclear whether western countries will give in to Russia’s demands.

Ukraine is one of the world’s largest wheat exporter, and any disruptions of Ukrainian wheat, combined with reduced production in the rest of the world due to El Niño, may lead to a surge in wheat prices.

Conclusion

We are finally starting to see forecasters incorporate the negative impact of El Niño into their wheat supply estimates. Based on current estimates of ending stocks / use ratio, wheat prices are 10-15% cheap. I expect this ratio to worsen in the coming months, which should support higher wheat prices.

Furthermore, with Russia blockading Ukrainian wheat from global markets as a negotiating ploy, the world could see a shortage of wheat in the coming months.

I continue to rate WEAT a buy.

Read the full article here

Leave a Reply