Introduction

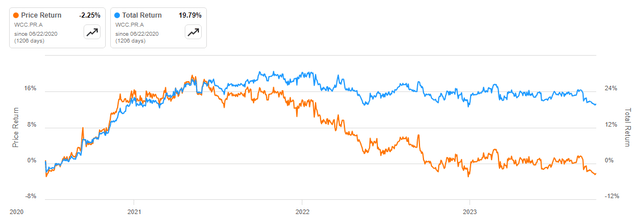

A little over a year ago, I penned Waiting For An Acceptable YTC On WESCO Preferred. At the time, the WESCO International, Inc. DP SH FXRT PFD A (NYSE:WCC.PR.A) was selling near $28, having retreated from over $32 and would provide new investors with a Yield-to-Call (YTC) close to 6.2%. To the best of my memory, 3-YR CDs were probably yielding below 3% at the time. If so, the risk premium was 3.2%, assuming the issued was Called.

With rates approaching a peak (hopefully) and longer-dated ones yielding less than shorter-dated ones, I decided to take another look to see what the trade-off looks like between the Preferred and a CD that matures near the end of June 2025 when I believe the Preferred will indeed be Called once it can be: more on that later.

WESCO International: A brief overview

wesco.com

Seeking Alpha provides this description of WESCO:

WESCO International, Inc. provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally. It operates through three segments: Electrical & Electronic Solutions (EES), Communications & Security Solutions (CSS), and Utility and Broadband Solutions (UBS). The EES segment supplies products and supply chain solutions, including electrical equipment and supplies, automation and connected devices, security, lighting, wire and cable, and safety, as well as maintenance, repair, and operating (MRO) products. This segment also offers contractor solutions, direct and indirect manufacturing supply chain optimization programs, lighting and renewables advisory services, and digital and automation solutions. The CSS segment operates in the network infrastructure and security markets. This segment sells products directly to end-users or through various channels, including data communications contractors, security, network, professional audio/visual, and systems integrators. It also provides safety and energy management solutions. The UBS segment offers products and services to investor-owned utilities; public power companies; and service and wireless providers, broadband operators, and contractors. The company was founded in 1922.

Source: seekingalpha.com WCC

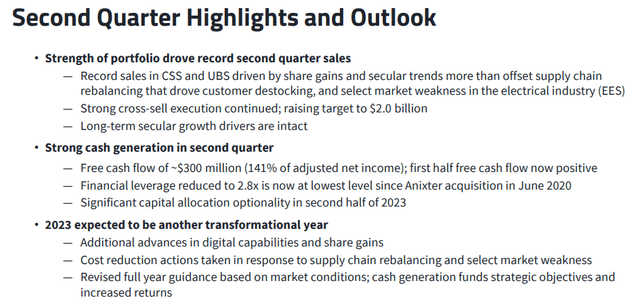

Since owning the Preferred has more risk than a FDIC insured CD, understanding the added risk is a good place to start. Spoiler alert: there is not much. Second quarter highlights, released in August, included the following.

wesco.gcs-web.com Q2 PDF

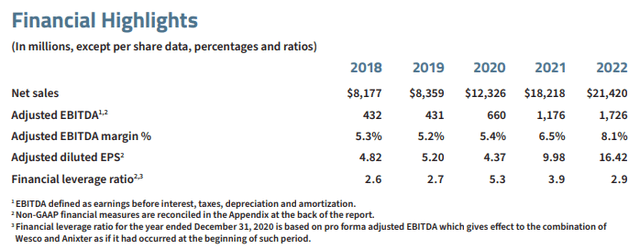

Looking back to 2018, we see steady growth, with the 2020 boost helped by the acquisition of Anixter International.

investors.wesco.com 2022 AR

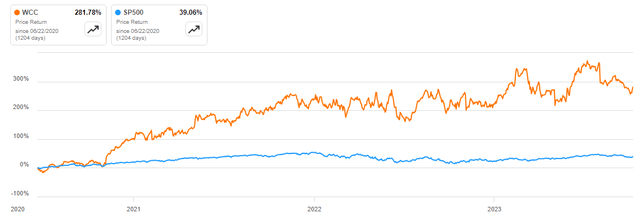

The stock has greatly outperformed the S&P 500 Index since that acquisition.

seekingalpha.com charting

WESCO International PFD: A brief overview

seekingalpha.com charting

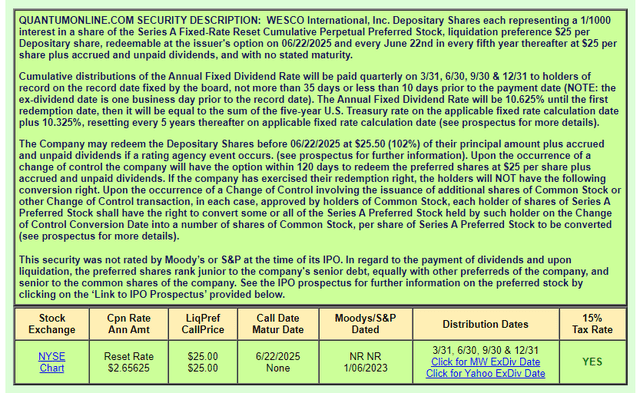

My go-to fixed income site provides this description of the “A” Pfd.

quantumonline.com WCC-A

This issue was one of the three considerations that Anixter International investors received from the merger:

- $72.82 in cash, without interest, after giving effect to certain adjustments set forth in the Merger Agreement (the “Cash Consideration”).

- 0.2397 shares of common stock of WESCO.

- 0.6356 depositary shares of WCC.PR.A, each representing a 1/1,000th interest in a share of newly issued fixed rate reset cumulative perpetual preferred stock.

The key features of the Preferred issue are:

- A 10.625% initial coupon.

- The first Call date is 6/22/2025. As the best I could determine, it is only Callable every five years, trying to confirm.

- A reset rate of 10.325% + the rate on the 5-year UST Note, with a five-year ongoing reset schedule starts with the first Call date.

- Payments fall under the 15% Tax rate.

- Payments are cumulative, which reduces the risk factor.

- If redeemed prior to the Call date, investors will receive $25.50 + unpaid dividends. This requires a ratings event to have occurred, which the Prospectus defines as:

“Ratings Event” shall mean a change by any Ratings Agency to the Series A Preferred Current Criteria, which change results in (i) any shortening of the length of time for which the Series A Preferred Current Criteria are scheduled to be in effect with respect to the Series A Preferred Stock or (II) a lower equity credit being given to the Series A Preferred Stock than the equity credit that would have been assigned to the Series A Preferred Stock by such Ratings Agency pursuant to its Series A Preferred Current Criteria.

Source: SEC

YTC vs CD

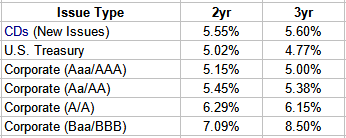

Competing fixed income assets would include the following.

Fidelity.com

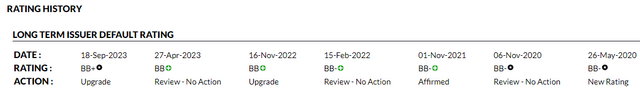

Risk goes up as one reads down the asset list, with the lowest line being the last rating class still within investment-grade. While the Preferred is not rated, here is how FitchRatings has been upgrading WESCO since 2020.

fitchratings.com WCC

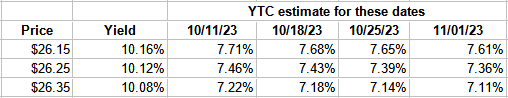

That would rate the Preferred in the rating below the last one shown at best. The next table shows how the YTC move with prices and time. A dime moves it about 25bps; a week’s time only 3-4bps. The YTC fall within the 2Y and 3Y rates for Baa/BBB, indicating investors have a higher opinion than FitchRatings does.

Author’s YTC Calculator XLS

Portfolio strategy

Every investor decides where on the risk/reward spectrum they want each investment they make to fall. Which gets the most emphasis probably changes as we age, collect wealth, and other life events. Here, I will narrow the decision down to wanting a low-risk asset with a highly expected return. I am assuming based on the above rate table, a CD maturing in late June of 2025 will earn our investor 5.6%, assuming interest isn’t compounded. What might the investor get under these two scenarios owning the Preferred instead?

- Called: They get the YTC when bought which as of today would be. Even if rates return to zero, the reset rate would be 10.325%! The historical level for the US 5Y Note is 3.74%. At that level, it would cost WCC over 14%, possibly for five years! As a holder of the Preferred, I am 100% positive they will be Called.

- Not Called: An exiting price near $24.33 results in a YTC near 5.6%, assuming you entered at $26.25 by the end of October. That would make the current coupon approaching a 11% yield. Not getting Called at that yield means we are in a heap of trouble across all of our portfolio!

Final thoughts

I currently hold 600 shares of the “A” Pfd and might add more now that the YTC is almost 7.4%, or about 180bps above a risk-free CD that matures when I believe this issue will be Called. Seeking Alpha rules require me to not trade within the three days before and after publication window.

There are other choices I own and could expand instead, including these two:

| Asset | Price | Matures | Yield | YTC | Article Link |

| Chicken Soup Note | $21.76 | 7/31/25 | 10.9% | 18.8% | CSSN |

| Rithm Cap Pfd “D” | $20.64 | NA | 8.5% | 19.6% | RITM.PR.D |

I do not consider either of these issues close to the risk I see in the WESCO PFD, with the Chicken Soup Note being of very high risk, thus my exposure is limited. I decided to show both to show how the market feels about the WESCO PFD and how one could earn more by taking on more risk.

Read the full article here

Leave a Reply