Investment Thesis

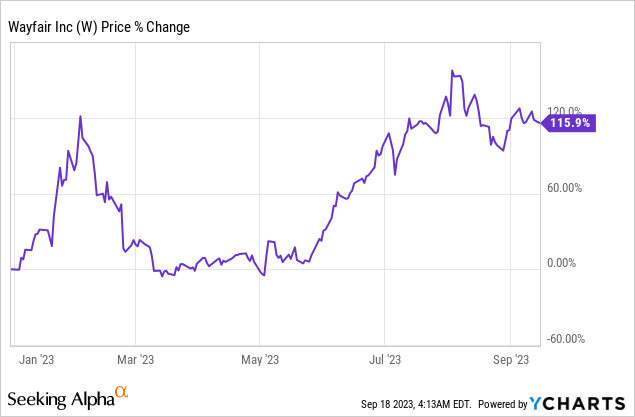

Wayfair Inc. (NYSE:W), the e-commerce platform, has been on a tear in 2023.

As you can see above, the stock is up more than 115% and 2023 isn’t even over yet. A remarkable performance.

In practice, given that the stock has been up in earnest since May, this means that its most recent shareholders only have praise for the stock. And by extension, this new cohort of investors may have a lot of entrenched bias for this name, after all, they’ll only really know a positive return from this stock.

And while Wayfair’s recent results point to a dramatic improvement from its past few years, I believe that the stock is in the best case fairly valued.

Wayfair’s Near-Term Prospects

Wayfair is an e-commerce platform that specializes in selling home furnishings and décor, offering customers a wide selection of products for their homes. The company connects consumers with a vast network of suppliers and provides a convenient online shopping experience for furniture and home-related items.

Wayfair’s business strategy is built on capturing market share and ensuring cost efficiency. The company has outperformed competitors for market share in this soft market environment, with a significant share gain in the home goods market. Key factors driving this success include broad product availability, fast delivery, and competitive pricing.

Wayfair’s focus on promotional activities and customer engagement has contributed to its growing customer base and broad-based improvement in order momentum.

As Wayfair noted during its earnings call, efficiency is a cornerstone of Wayfair’s strategy.

Wayfair’s approach to customer retention involves various avenues, including promotions and advertising, a topic that we’ll soon expand upon. Further, Wayfair contends that its promotions attract customer curiosity, leading to a mix of both promoted and non-promoted product purchases.

To sum up Wayfair’s strategy, Wayfair is seeking to maintain profitability while investing in growth. And now, with this background in mind, let’s analyze Wayfair’s financials.

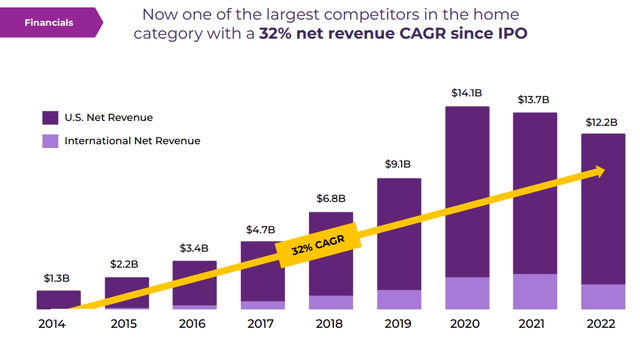

Growth Rates Highlighted at Wayfair’s Investor Day

Wayfair Investor Day

As you can see above, during Wayfair’s Investor Day, Wayfair boasted about its fast-expanding revenue base, which has had a 32% CAGR in net sales since its IPO. Indeed, this verbiage was an echo of its Q2 earnings call, where Wayfair reassured investors that it was committed ”to driving meaningful growth, while improving profitability and free cash flow generation.”

The problem, though, is that if ignore the period of rock-bottom interest rates, its more recent financials don’t quite live up to that narrative.

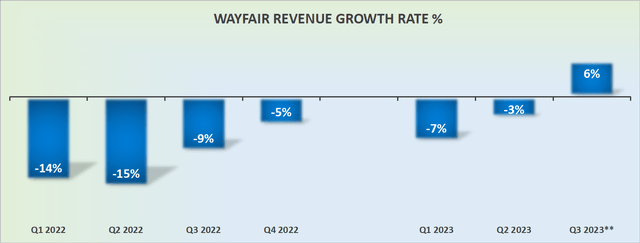

W revenue growth rates

As you can see above, despite its very easy comparables with the prior year, Wayfair is only growing at around 6% CAGR. I’m sure you’ll agree that this is hardly comparable to the 32% CAGR that Wayfair encouraged investors to concentrate on during its recent Investor Day.

Profitability Profile Leaves a Lot to Be Desired

For Q3 2023, Wayfair guides that its free cash flow should be approximately breakeven, while it aspires to ultimately reach positive single-digit free cash flow margins.

Even if we assume single digits to translate to 5% to 7% free cash flow margins, it’s difficult to get excited about this stock.

This implies that if Wayfair were to succeed and reach its targeted free cash flow figures, and we looked out into the back end of 2025, two years from now, perhaps Wayfair’s free cash flow could reach $870 million.

In other words, assuming everything goes right, looking out two years, the stock is priced at just shy of 10x forward free cash flows.

And assuming that, indeed, Wayfair reached its targeted $870 million of free cash flow, I suspect that more than $700 million of that figure would be made up of stock-based compensation. In fact, we should keep in mind that Wayfair is already practically annualizing at slightly more than $600 million of stock-based compensation today!

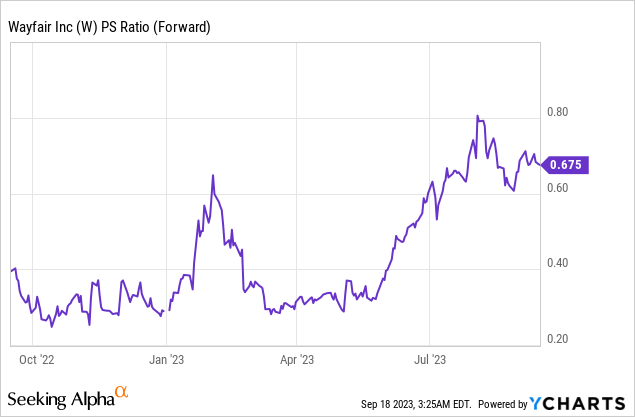

The feedback I often get from my followers is that Wayfair is only priced at less than 1x forward sales, therefore it must be cheaply valued. To that consideration, I argue that investors are not paying for a sticky SaaS business, where customers a locked in.

Wayfair faces competition not only from traditional brick-and-mortar retailers but also from online competitors and its own suppliers’ websites. To expand its customer base, Wayfair must always be attracting new customers. Customers may not only be competing for choice, but Wayfair will also be competing on price, particularly in a soft economy.

Furthermore, as you know, Wayfair relies substantially on paid advertising, as I’m confident you’ll have seen its ads either online or on physical domains. Advertising offline isn’t always particularly effective and targeted. While advertising online can be expensive, particularly within the walled gardens (think Alphabet (GOOG), Meta (META), and others).

For their part, Wayfair believes that its attention to optimizing its advertising efforts can deliver positive results as it conducts channel tests to fine-tune its advertising mix, ensuring it effectively reaches its target audience. Again, I believe that advertising is not cheap, and I’m not fully convinced that Wayfair’s advertising efforts are indeed delivering strong returns on investment.

The Bottom Line

Despite Wayfair’s outstanding outperformance in the past few months, I can’t help but feel a sense of uncertainty about the stock’s true value. While Wayfair has improved its financials, I question whether its stock isn’t already fairly valued?

Meanwhile, Wayfair’s recent financial growth doesn’t quite align with its narrative of driving meaningful growth and improving profitability, especially when compared to its pre-pandemic growth rates.

Profitability remains a concern, with Wayfair targeting only single-digit free cash flow margins in the near term. Even if it achieves these margins, the stock’s valuation doesn’t seem enticing, with a forward price-to-free-cash-flow ratio of nearly 10x. Additionally, a substantial portion of its free cash flow may be consumed by stock-based compensation.

Altogether, I remain cautious about Wayfair’s valuation and long-term prospects.

Read the full article here

Leave a Reply