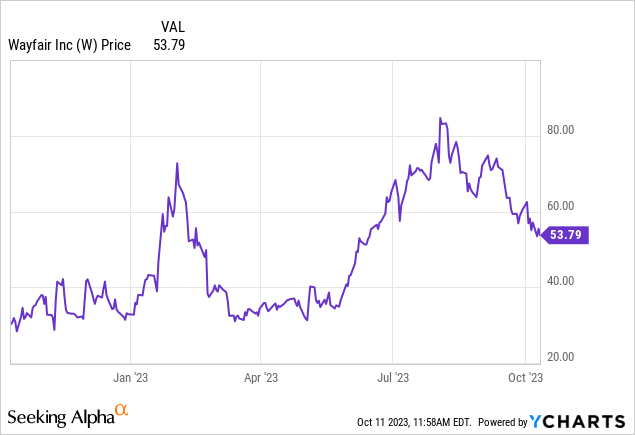

It has been a tough year fundamentally for Wayfair (NYSE:W), the online furniture company that experienced its biggest heyday during the pandemic when people were rushing out of cities and eager to fill new homes. Wayfair stock remains up more than 60% year to date, but is well off highs as the markets digest both the impact of higher interest rates as well as the overhang of revenue declines. All the while, Wayfair – which is currently sitting at north of a $6 billion market cap – is still barely profitable (and only on an adjusted basis), and struggling to justify why it should be worth that much.

Earlier this year, I wrote a bearish opinion on Wayfair when the stock was sitting in the mid-$60s. Since then, the stock has both released Q2 results (which I interpreted as a considerable sequential improvement from Q1) and suffered a ~20% price drop to the low $50s. So while I acknowledge that there is still considerable risk in this name, I am now more sanguine on Wayfair’s prospects and I am upgrading my viewpoint on Wayfair to neutral.

I now see an equally balanced bull and bear case for Wayfair. On the positive side of the coin:

- Though pandemic-era lifts were temporary, the business has scaled dramatically since pre-COVID. Prior to the pandemic, Wayfair generated roughly ~$9 billion in annual revenue; now, it is doing closer to $12-$13 billion in revenue. In a business that relies so much on economies of scale, this added revenue scale is helping Wayfair push closer to profitability.

- Variety of brands to capture all market segments. Wayfair’s eponymous brand may be known for its accessibly-priced furniture, but at the other end of the spectrum, the company’s other brands like Perigold and Joss & Main capture more upscale customers. In my view, Wayfair’s diversity of brands and its solidified category leadership have given the company a defensible niche that Amazon (AMZN) has struggled to break into.

At the same time, however, we have to be careful of the following risks:

- Replacement cycles may elongate. Customers are holding onto everything for longer: cars, technology, furniture. As the current recession prompts more and more households to rein in their budgets, sales at Wayfair may continue to slow.

- Barely profitable. Right now, Wayfair is barely at single-digit adjusted EBITDA profit margins, while at the same time dealing with negative revenue compares. In a business with such low gross margins, it’s difficult to understand what catalysts Wayfair has under its sleeve to propel it to meaningful profitability to justify its valuation.

- Debt load. Wayfair has ~$2 billion of net debt on its books. The good news is that the company is now barely FCF positive, but in a high-interest environment, Wayfair’s debt will dampen its earnings potential.

The bottom line here: while I am not advocating for an all-in position on Wayfair, I do think that the stock’s recent ~20% dip from YTD highs compensates for the added fundamental risks that we’ve seen this year with slowing revenue growth. In the low $50s, I don’t see substantially more near-term downside for this stock, but neither would I recommend moving off the sidelines just yet.

Q2 download

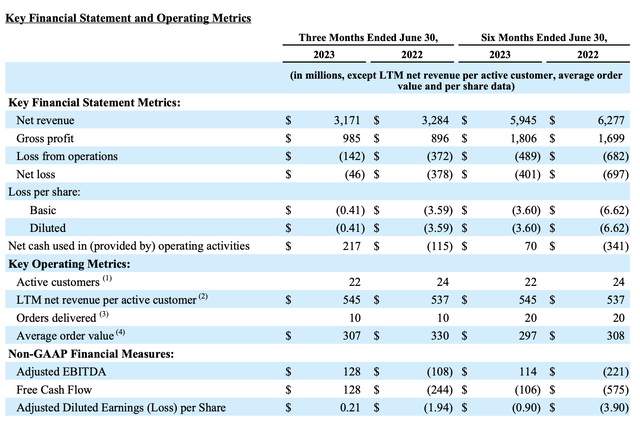

Let’s now go through Wayfair’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Wayfair Q2 results (Wayfair Q2 earnings release)

Wayfair’s revenue declined -3% y/y to $3.17 billion in the quarter, as it continues to face tough compares from the end of pandemic-era demand last year. On the brighter side, however, results did beat Wall Street’s expectations of $3.10 billion (-6% y/y), and also accelerated from a -7% y/y decline in Q1.

Even better news: Wayfair estimates that it has taken market share in the furniture space, based on data on credit card spending. Per CEO Niraj Shah’s remarks on the Q2 earnings call:

Q2 proved to be a quarter of two continuing themes for Wayfair, share capture and cost efficiency. I’ll start with the share capture piece and the results really speak for themselves. Wayfair meaningfully outperformed the competition this spring with net revenue down 3% year-over-year in Q2 compared to a category that continues to be down 10% to 20% for widely tracked estimates in credit card and e-mail receipt data.

Our team spent significant time at various trade shows over the past few months, and we have heard resounding feedback from our suppliers that the platform they want to lean into is Wayfair. Benefits of our enormous marketing reach, considerable merchandising investments and proprietary logistics capabilities, make Wayfair an unparalleled partner to our suppliers.

Since last fall, we have seen strong market share capture on the back of our core recipe. The combination of broad availability, fast delivery and sharp pricing continues to be a powerful flywheel to drive both customer and supplier engagement. And across the Board, we’re setting new benchmarks on these metrics. Availability and speed badging continue to climb in Q2. And with further wholesale cost normalization as well as our operational cost savings efforts, we now consistently see ourselves as a price leader across our most popular items. Our recipe is back intact.”

Another positive point to note: Wayfair had planned for a denser promotional calendar including for Way Day 2023 (Wayfair’s shopping event, which sits at the end of April and is included in Q2 results), which is partially responsible for the acceleration in revenue growth. In spite of this, however, gross margins rose sequentially to 31.1% in Q2, from a 29.6% margin in Q1.

It’s key to note that the only other time Wayfair has seen gross margins exceed 30% is during the pandemic – but what’s driving margin gains this time is sustainable efficiencies worked into Wayfair’s operations and supply chain.

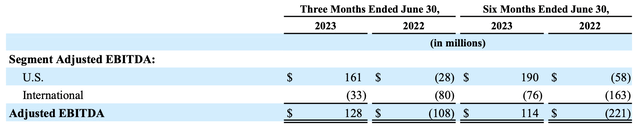

Adjusted EBITDA, meanwhile, swung to positive $128 million, or a 4.0% margin – versus the company’s initial expectations for a 0.5-1.5% margin in this second quarter.

Wayfair adjusted EBITDA (Wayfair Q2 earnings release)

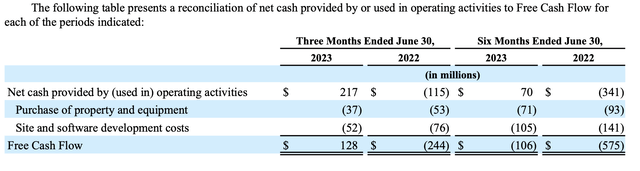

Free cash flow also swung to positive $128 million in the quarter, matching adjusted EBITDA:

Wayfair FCF (Wayfair Q2 earnings release)

Key takeaways

With improving gross margins and adjusted EBITDA, and a path toward starting to reverse revenue declines and return to growth despite tough macro conditions, there’s more hope for Wayfair now, especially at a more muted share price. Still, however, I’d exercise caution and wait from the sidelines for the stock to drop to the mid-$40s before considering a buy.

Read the full article here

Leave a Reply