I downgraded Warner Bros. Discovery (NASDAQ:WBD) stock in November 2023, as I argued why a weaker TV advertising market could worsen headwinds as we headed into 2024. WBD has underperformed the S&P 500 (SPX) (SPY) significantly since my previous article, justifying my caution. However, with WBD falling close to its November 2023 lows, have I reassessed a more constructive opportunity for me to turn more bullish again?

Investors are likely still assessing the recent major announcement, which saw Disney (DIS), Warner, and Fox Corporation (FOX) teaming up to “build a joint sports streamer.” With buying sentiments remaining tepid, it suggests that the market is relatively lukewarm about the opportunity as the trio looks to shake up the sports streaming segment. Investors must understand that the execution risks aren’t clear currently. Will the joint streamer lead to a reduction in its Linear TV opportunity, which is expected to be more profitable? What are the appropriate price levels to capture the segment keen on sports content but not/no longer on Linear TV? Given the forays made by Amazon (AMZN) and Apple (AAPL) into sports-related streaming, I believe the legacy players have likely assessed that they must fight back with a vengeance. However, these companies like Warner also have highly profitable legacy segments to maintain. As a result, I gleaned that the uncertain market sentiments suggest the market remains in a wait-and-see mode, even as the antitrust regulator probes the deal for potential anticompetitive risks.

As a result, I believe the market remains focused on the weakening of Warner’s competitive moat as we head into Warner’s fourth-quarter earnings release with significant uncertainties. Warner is slated to post its FQ4 earnings scorecard on February 23. Roku (ROKU) investors saw a steep post-earnings decline, as Roku cited a particularly weak advertising market through 2024. As a result, I assessed that investors are likely baking in a potentially less sanguine outlook for Warner, worsened by the cord-cutting risks on its competitive advantages. Even Morningstar has decided to lower Warner’s previous narrow economic moat, downgrading Warner to a no-moat company. The research firm articulated that the uncertainties attributed to the increasingly competitive streaming landscape have worsened Warner’s ability to maintain its profitability. Consequently, Warner investors must be prepared for the possibility that its streaming business is “unlikely to ever match the profitability it enjoyed with traditional linear television.” As a result, WBD could be mired in a materially undervalued zone for some time as the industry navigates its transition to a potentially less profitable and more competitive streaming era.

With WBD assigned a “B” valuation grade, I assessed that the market isn’t dumb. It has justifiably priced in significant pessimism on Warner’s transition. Consequently, it suggests that WBD could offer a potentially attractive risk/reward for dip-buyers looking to capitalize on its battered valuation.

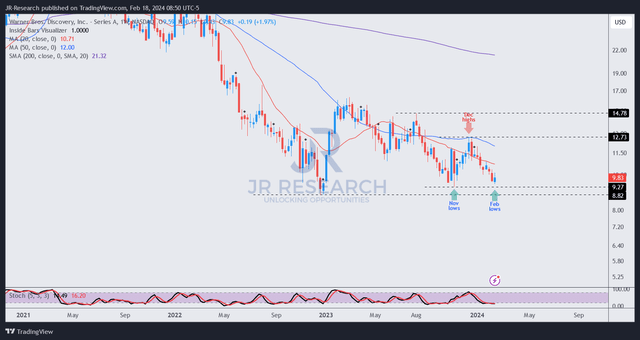

WBD price chart (weekly, medium-term) (TradingView)

With WBD trading close to its November 2023 lows and quite close to its 2022 lows at the $8.8 level, we should anticipate more robust buying sentiments as investors look to buy the dips.

I observed a glimmer of hope last week as WBD finished well. However, the market could force a bear trap (false downside breakdown) against WBD’s November 2023 lows ($9.3 level), leading to a capitulation before a more robust bullish reversal.

Hence, buying at the current levels could introduce unforeseen downside volatility if Warner management offers a worse-than-expected guidance for 2024. Notwithstanding my caution, I assessed that the market has already reflected sufficient pessimism in its valuation, heading into Warner’s pivotal earnings release. As a result, the risk/reward is increasingly favorable for a bullish mean-reversion setup, with a possible profit-taking zone below the $11.5 level.

Rating: Upgrade to Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here

Leave a Reply