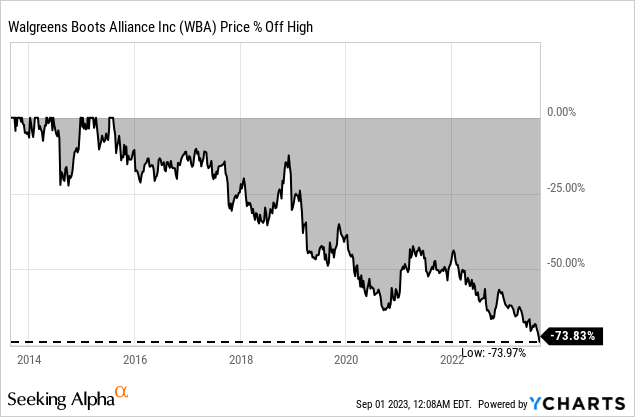

In my last article about Walgreens Boots Alliance, Inc. (NASDAQ:WBA) – published in January 2023 – I asked the question if I am wrong about the business (and stock). And it seems like the answer simply has to be “Yes”: While I was bullish about the stock and the S&P 500 (SPY) increased 13.5% in value in the meantime, Walgreens Boots Alliance lost almost 30% in value (offset a little bit by dividend payments).

My main argument for buying Walgreens Boots Alliance is the extreme pessimism surrounding the business – pessimism that drove the stock 74% lower since its peak in 2015 and led to a downtrend that is now lasting for 8 years. And the business continues to be a huge disappointment and the CEO’s opening statement during the earnings call is certainly accurate:

I’d like to start today’s call with an acknowledgment that our performance in the third quarter did not meet our overall expectations, and we are disappointed to have to change our fiscal 2023 guidance.

We should therefore not be surprised for the sentiment surrounding Walgreens Boots Alliance being extremely negative. But in investing we should resist sentiment as sentiment is often wrong. On the other hand, we can’t just invest in a business to go against sentiment. There must be several good (fundamental) reasons to bet against sentiment – but the last quarterly results were no reason to bet against the downtrend.

Quarterly Results

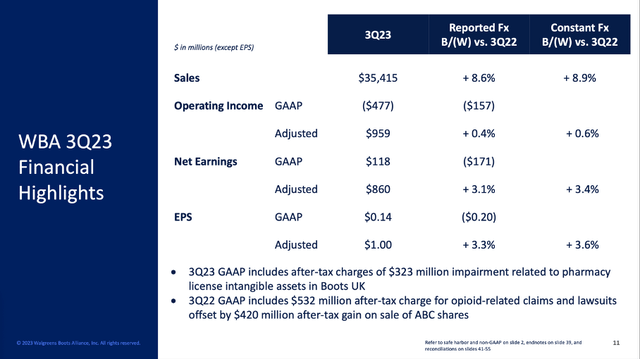

We can once again start by looking at the last reported results, which were not great. For starters, Walgreens Boots Alliance increased sales from $32,597 million in Q3/22 to $35,415 million in Q3/23 – resulting in 8.6% year-over-year growth. And while sales growth is solid, the company once again had to report an operating loss – and compared to an operating loss of $320 million in the same quarter last year the operating loss in this quarter was even $477 million. Despite the operating loss, Walgreens Boots Alliance reported $0.14 in earnings per share – this is a decline of 57.6% YoY compared to the same quarter last year. And instead of $1,258 million in free cash flow in Q3/22, the company had to report a negative free cash flow of $444 million in this quarter.

WBA Q3/23 Presentation

Earnings growth was held back by three factors: Lower than expected COVID-related demand, the rapid softening of the macro environment and finally a drag form a recent weaker respiratory season.

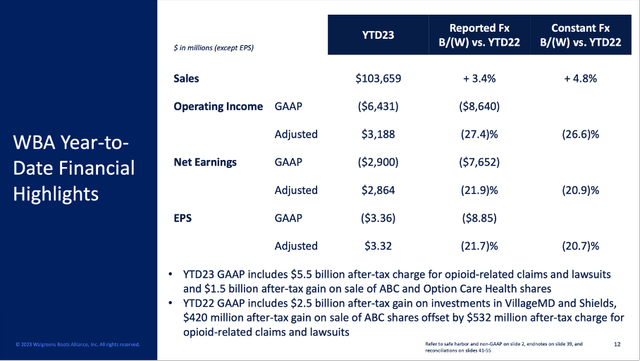

And when not only looking at the last quarterly results, but at the year-to-date results for the last nine months the picture is not getting better. When looking at the nine months, sales increased 3.4% year-over-year from $100,254 million to $103,659 million. And Walgreens Boots Alliance had to report an operating loss of $6,431 million – compared to an operating income of $2,209 million. And finally, Walgreens Boots Alliance generated a loss per share of $3.36 in the first nine months of 2023 – compared to $5.50 in earnings per share in the same timeframe last year.

WBA Q3/23 Presentation

Lowered Guidance

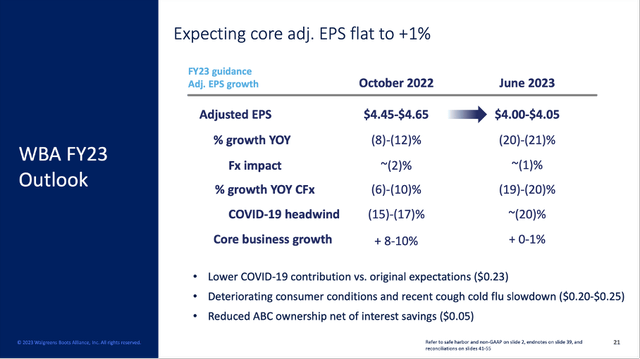

Aside from reporting terrible results for the last two quarters, Walgreens Boots Alliance also lowered the guidance for the full year. Instead of an adjusted EPS between $4.45 and $4.65 in the previous guidance, the company is now expecting earnings per share only to be around $4.00 to $4.05 (adjusted numbers). And while the core business was expected to grow 8% to 10% in the previous guidance, it is now expected to grow only 1% at best.

WBA Q3/23 Presentation

And we always must keep in mind that we are looking at adjusted numbers already – reported numbers according to GAAP will be worse.

Very Weak Moat

One of the problems that is becoming very obvious right now is the missing economic moat around Walgreens Boots Alliance. I argued in the past that Walgreens Boots Alliance might have a narrow moat – for example based on cost advantages the company has due to its size. Walgreens Boots Alliance is mostly a retailer, and it is always difficult to establish a wide economic moat around a retail business. And the company certainly has an advantage over smaller competitors (small pharmacies for example) – however, the main competitors are major corporations, and the cost advantages Walgreens Boots Alliance might have due to its size is approaching zero when competing with companies like CVS Health Corporation (CVS), Walmart Inc. (WMT) or Amazon.com, Inc. (AMZN). And especially Amazon is known for putting immense pressure on its competitors and undercutting prices in an aggressive way.

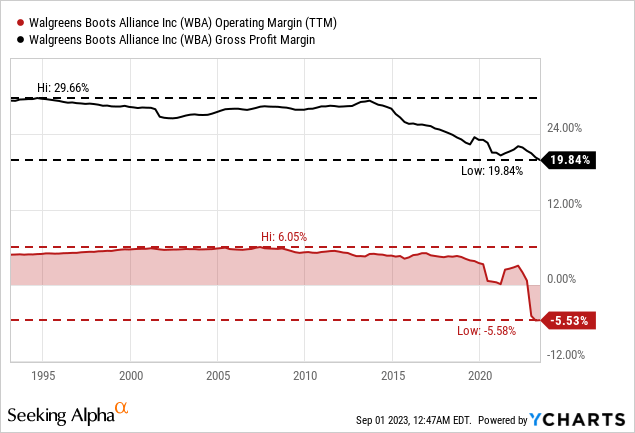

And this is becoming obvious when looking at the different metrics. Retailers have always been a low margin business – and Walgreens Boots Alliance is no exception. However, we see negative trends in the last few years. Especially in the last 10 years, gross margin declined from almost 30% to below 20% right now which is indicating missing pricing power for the business. Additionally, Walgreens Boots Alliance always had an operating margin in the mid-single digits, and we already see a decline starting in the early 2010s, but in the last few quarters margin fell off a cliff.

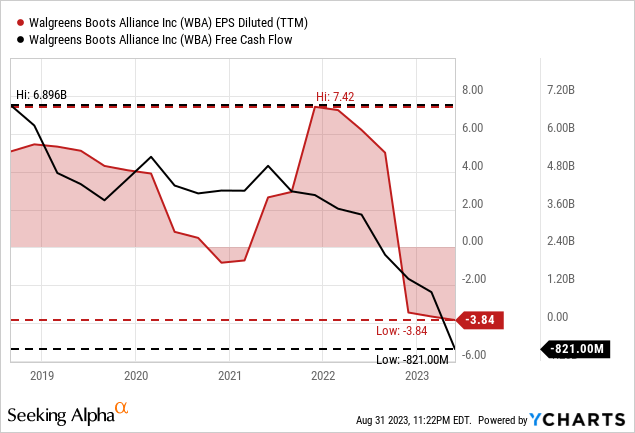

This is indicating that Walgreens Boots Alliance is struggling and obviously has difficulties to defend itself against competitors. And when looking at earnings per share as well as free cash flow we also see negative trends. Free cash flow is constantly declining in the last five years and earnings per share have also been cyclical – and especially in the last few quarters earnings were negative.

Still An Investment?

My argument about Walgreens Boots Alliance being a good (or even great) investment was mostly based on the ridiculously low share price the stock was trading for. We might now make an argument about the stock being extremely undervalued by looking at simple valuation metrics. However – as mentioned above – both free cash flow and earnings per share are negative (when looking at TTM numbers) and therefore we can’t calculate reasonable ratios.

Instead, we use a much more accurate discount cash flow calculation. But while this calculation is more accurate, we also must make more assumptions and the calculated intrinsic value is depending heavily on the assumptions we make. Do we assume Walgreens Boots Alliance continuing its negative trend or are we assuming at least a stabilization? Can we assume moderate growth rates again in the years to come or should we be optimistic and assume high single digit or even double-digit growth rates as Walgreens Boots Alliance did in previous presentations. In my opinion, we should not assume that Walgreens Boots Alliance is a business in constant decline, but I also don’t see it growing in the double digits in a few years from now.

We can make several different assumptions and calculate several different numbers for Walgreens Boots Alliance. We always assume a 10% discount rate and calculate with 863.8 million outstanding shares. Additionally, we don’t assume any growth in the years to come. When assuming only an annual free cash flow of $3 billion for Walgreens Boots Alliance, we get an intrinsic value of $34.73 (and the stock is still undervalued). When being much more optimistic and assuming a free cash flow of $7 billion annually (the highest number of the last five years) we get an intrinsic value of $81.04.

|

Annual free cash flow |

Intrinsic Value |

|---|---|

|

$3 billion |

$34.73 |

|

$4 billion |

$46.31 |

|

$5 billion |

$57.88 |

|

$6 billion |

$69.46 |

|

$7 billion |

$81.04 |

In such a scenario we can take the average free cash flow of the last 10 years (which was $4,291 million). When assuming that amount as free cash flow in the years to come without any growth, the intrinsic value would be $49.68. In such a scenario the stock would already trade for a 50% discount, and we should not forget this scenario is not assuming any growth at all.

I think we can summarize at this point that Walgreens Boots Alliance is trading for a really depressed share price and it does not need much to justify the current price level. And even the slightest positive surprise could be enough to drive the stock price higher. Nevertheless, Walgreens Boots Alliance must demonstrate its business is functional and it can generate stable free cash flow from year to year. In the following section we are looking at the necessary steps for the business to regain investors’ confidence.

Positive News, Positive Sentiment

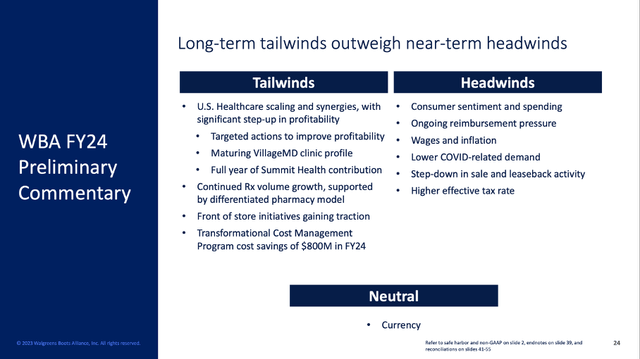

For starters, management is still optimistic that the different headwinds – including a negative consumer sentiment and decreased spending, higher wages, and inflation as well as ongoing reimbursement pressures – are rather short-term and long term the different tailwinds will predominate.

WBA Q3/23 Presentation

An important aspect would be to improve margins again – or at least stop the downtrend for the company’s gross margin. One strategy can be the ongoing cost management program which will have total consecutive savings of $4.1 billion in fiscal 2024 (assuming $800 million annual savings in 2024). Additionally, the company has launched a working capital optimization program and has implemented capital and project spend reductions.

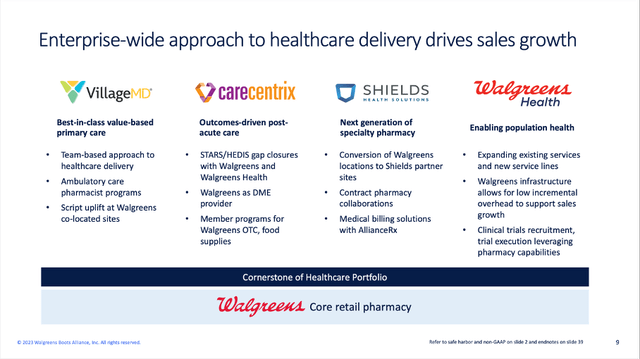

But cost saving programs will probably not be enough to improve margins again. Important will be the U.S. Healthcare segment, which should contribute to sales growth and – in the mid-term – also to profitability and bottom-line earnings. Additionally, this segment is also helping Walgreens Boots Alliance to move away from just being a retailer and in previous articles I already mentioned that the company is taking the right steps (at least in theory). In my last article I wrote about the acquisitions Walgreens Boots Alliance made: The company acquired Shields and bought the remaining stake in CareCentrix. Additionally, VillageMD (of which WBA is the majority owner) bought Summit Health-City MD. These were all acquisitions for the relatively new U.S. Healthcare segments and together with Walgreens Health, these businesses are the cornerstone of Walgreens’ Healthcare portfolio.

WBA Q3/23 Presentation

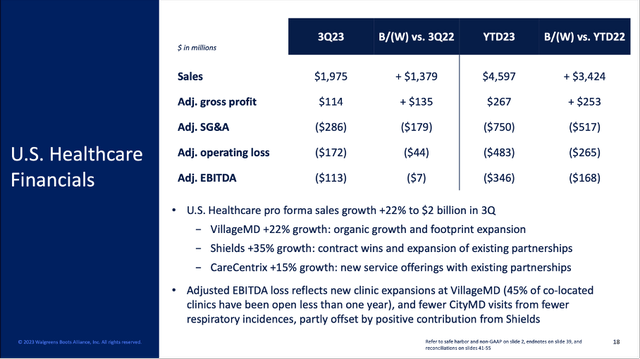

When looking at the financials of the U.S. Healthcare segment, we see strong growth rates for the top line. Revenue increased 231% year-over-year and while this was mostly due to the above-mentioned acquisitions, VillageMD could grow revenue 22%, Shields reported 35% growth and CareCentrix grew 15% YoY. And while the business can report an adjusted gross profit, it still must report a negative EBITDA as well as an operating loss (even on an adjusted basis).

WBA Q3/23 Presentation

And while the U.S. Healthcare business has now a run rate of $8 billion in the third quarter of 2023 and the business growing healthy at least in the mid-to-high teens, reaching profitability is still an issue. During the earnings call the CEO admitted the profit ramp for U.S. Healthcare is slower than expected.

But the optimistic vision is to create a long-term flywheel for the business, which CEO Brewer explained like this:

The flywheel of healthcare and retail pharmacy working together will deliver more affordable, accessible, quality healthcare to our communities and will also deliver sustainable shareholder value. It starts with our trusted brand and pharmacist, national footprint, and digital offerings.

Overall, I think Walgreens Boots Alliance is moving in the right direction but before the business can generate a flywheel a lot must happen. And Walgreens Boots Alliance is certainly several years behind CVS Health, which started to move away from just being a pharmacy a long time ago.

Conclusion

In my last article, I rated Walgreens Boots Alliance as a “Strong Buy” and the stock lost about 30% since then. Logic would dictate that the stock is an even greater bargain right now and we should once again rate the stock as a “Strong Buy”. And while I still see the stock being undervalued and with the potential to double or triple in value in a few years, I don’t know if a high level of optimism is still justified as the positive signs are missing right now. I would rate Walgreens Boots Alliance as a “Buy” – mostly based on the fact that it is trading for a very depressed price and a stabilization of the business is more than enough to justify the current share price.

Read the full article here

Leave a Reply