Thesis

Despite a strong rally since the beginning of the year, the stock market has sent some troubling signs over the past few weeks, as interest rates are rising once again. As the markets realize that despite signs of slowing growth, the Fed is likely to keep interest rates elevated, the outlook, especially for growth stocks, becomes less optimistic.

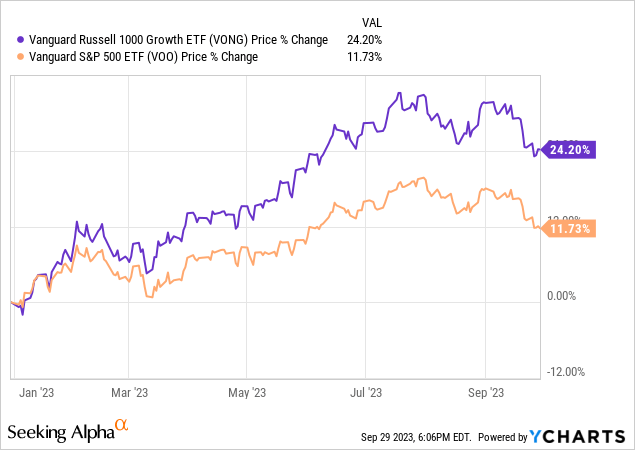

One of the growth ETFs offered by Vanguard that has gained in popularity over the past few years, in the midst of prolonged growth factor rallies, is the Vanguard Russell 1000 Growth ETF (NASDAQ:VONG). For the trailing 12 months, VONG has recorded a 24.2% gain, despite the recent dip, widely outperforming the broader market (S&P returning 11.73% for the same time period). While analysts might view this as a bullish sign going forward, it should be noted that the recent rally, has also increased the already-elevated valuations across the growth stock universe. In that sense, it could be argued that more sell-offs are likely to occur ahead for growth stocks, as they revert to their mean valuations in this challenging macroeconomic environment for equities.

VONG Fund Overview

Vanguard’s Russell 100 Growth ETF is a large-cap growth fund that tracks the performance of one of the most popular growth indexes, the Russell 1000 Growth Index. Incepted in 2010, the fund charges a low 0.08% expense ratio, while also, currently maintaining a decent 1.0% dividend yield. Through VONG, investors can access a diversified range of U.S. equity with growth characteristics, with an emphasis, in terms of exposure, to the sectors of Technology (51.3% weighting), Consumer Discretionary (19.4% exposure), and Industrials (10.5% exposure).

Apple (AAPL) is the fund’s largest holding (12.3% weight), while mega-cap names like Microsoft (MSFT), Amazon (AMZN), and Google (GOOG) (GOOGL) also occupying large weightings. In total VONG has over $12B of Assets Under Management and 440 equities, at a large, $500B median market cap)

A Bet on Cyclicality

Apart from its overweight exposure towards large caps, VONG is, as mentioned, largely a cyclical growth ETF. Sectors like Technology, Consumer Discretionary and Industrials follow the overarching economic trend and tend to perform well during expansionary times and poorly during recessions. Investing in VONG, or other large-cap growth ETFs for that matter, is essentially a bullish positioning on the economy, especially for investors that customize buying and selling timing rather than engaging in dollar-cost-averaging.

As broader economic growth seems to weaken and interest rates remain elevated, this is hardly an ideal time for a convincing bullish macroeconomic perspective. Moreover, the growth factor has been in historically higher valuation multiples compared both to itself and the value factor for some time now. As such, a pullback rather than further expansion looks like the more probable outcome, at least over the near term.

Vanguard’s Growth Funds Compared

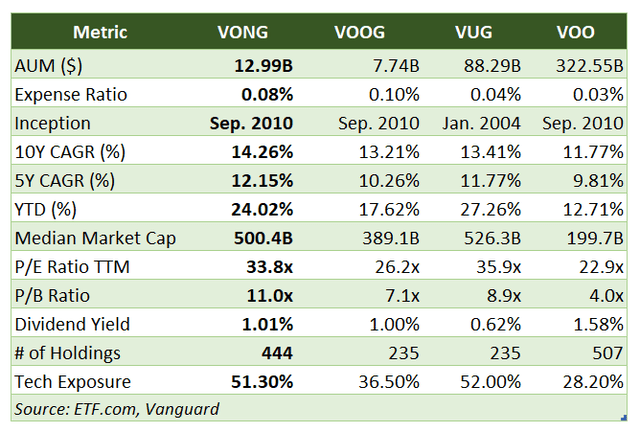

There is little doubt that Vanguard offers an exceptional range of ETFs, with some of the most popular ones focusing on the growth factor. Tracking different indexes, Vanguard’s Russell 1000 Growth ETF (VONG), Vanguard’s S&P 500 Index Fund ETF (VOOG), and Vanguard’s Growth Index Fund ETF (VUG) represent the company’s most popular growth ETF offerings. While in many aspects similar, the funds display differences in terms of performance, composition and other attributes.

While VUG is by far the most popular and also the oldest ETF of the group, all three growth funds have large Assets Under Management and are well-established in the growth investing universe. VUG is also the least expensive ETF, with VONG, however, also charging a relatively low 0.08% expense ratio. Historical performance is a critical area where VONG outshines its peers, with a 14.3% 10-year and a 12.0% 5-year CAGR, beating VOOG and VUG, and the broader market as well.

All three growth funds are more heavily weighted towards large caps and technology stocks than the S&P 500 Index, and also naturally display higher valuation multiples. Both VUG and VONG are quite expensive both by relative and historical standards, with P/E ratios over 30x and P/B ratios of 8.9x and 11.0x respectively. VONG, however, does offer a much better distribution yield than VUG and also broader diversification in terms of its number of holdings.

ETF.com, Vanguard

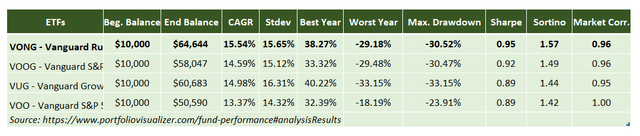

A second stage look into the return and risk parameters of the funds, employing the tools offered by Portfolio Visualizer, confirms the previous performance edge that VONG seemed to possess. Going back 12+ years, we can see VONG returning a very impressive annualized 15.54% return, transforming a $10,000 initial investing balance into $64,644 (dividend reinvesting is assumed throughout the analysis). VONG also outperforms its peers in terms of risk-adjusted returns, displaying Sharpe and Sortino ratios of 0.95 and 1.57 respectively. Overall, VONG’s performance appears to have been very strong over the ETF’s lifespan (12+ years) both in relative and market-comparison terms.

Portfolio Visualizer

Final Thoughts

While VONG is a very respectable ETF choice within the growth equities space, recording strong risk/return performance compared to its peers, the growth factor’s outlook remains precarious over the mid-term. With valuations already at historically high levels, a scenario where growth, and consequently VONG underperform in the near term, is more likely than not. With this in mind, I would currently rate VONG as a hold.

Read the full article here

Leave a Reply