Introduction

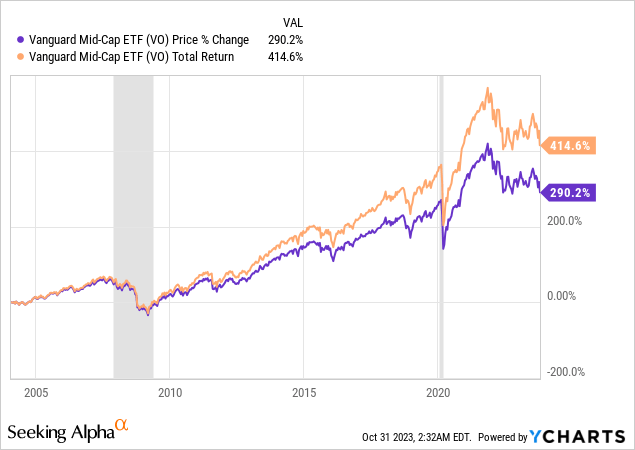

We wrote an article about Vanguard Mid-Cap ETF (NYSEARCA:VO) back in May 2020. It was during the beginning of the outbreak of pandemic. At that time, we gave the advice that it was better to own large-cap funds instead of mid-cap funds as large-cap stocks tend to have better balance sheets to weather any major storms. Many things have changed since we wrote that article. Therefore, we think it is time to analyze VO again and provide our analysis and recommendations.

ETF Overview

VO owns a portfolio of about 340 mid-cap stocks in the United States. The fund seeks to track the CRSP US Mid Cap Index. Mid-cap stocks have experienced both forward earnings contraction and valuation contraction since late 2021. As a result, these stocks are now quite attractive especially given the fact that these stocks have strong long-term earnings growth outlook. However, macroeconomic is not favorable in the near term. With a possible recession arriving in the first half of 2024, investors may want to exercise caution, and wait on the sidelines.

YCharts

Fund Analysis

VO is re-testing its October 2022 trough

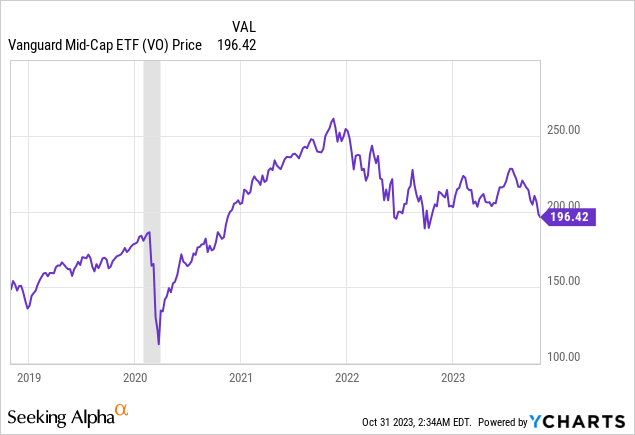

Since reaching the peak in late 2021, VO’s fund price has been in a downward trajectory. Its fund price declined sharply in most of 2022 due to the Federal Reserve’s aggressive rate hike and reached its trough in early October. Although it has rebounded for about 8 months since October 2022, this rebound appears to be unsustainable. In fact, VO’s fund price has declined quite a bit in the past few months, and is now not too far from the trough reached in early October 2022.

YCharts

VO’s valuation is very attractive right now

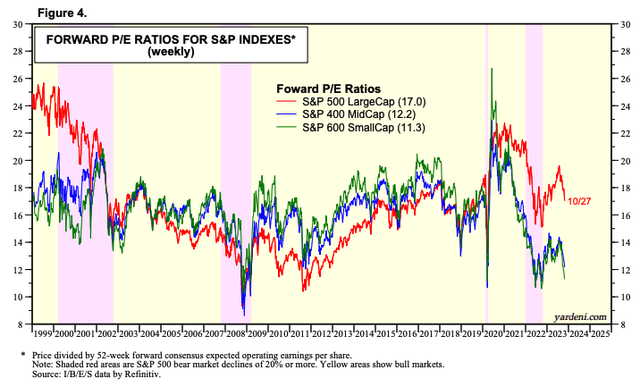

To know whether VO’s fund price will drop further or will soon stabilize, we will first check VO’s P/E ratio relative to its historical average. Below is a chart that shows the forward P/E ratios of the S&P 600 Small-Cap, S&P 400 Mid-Cap, and S&P 500 Large-Cap indexes in the past 25 years. We will pay attention only to the S&P 400 Mid-Cap’s historical forward P/E ratio. Although VO’s portfolio of about 340 stocks is not entirely the same as the S&P 400 index, which consists of 400 mid-cap stocks, it has significant overlaps. Therefore, it will still help us gauge the valuation of VO. As can be seen from the chart below, the current valuation of the S&P 400 index is about 12.2x. This is significantly lower than its 16x historical average. Only twice (Great Recession in 2008/2009, and the 2020 Pandemic) in the past 25 years has the S&P 400’s valuation been trading at a valuation lower than its current valuation right now. Therefore, we think VO is currently undervalued and very attractive.

Yardeni Research

Downward earnings revision appears to be ending

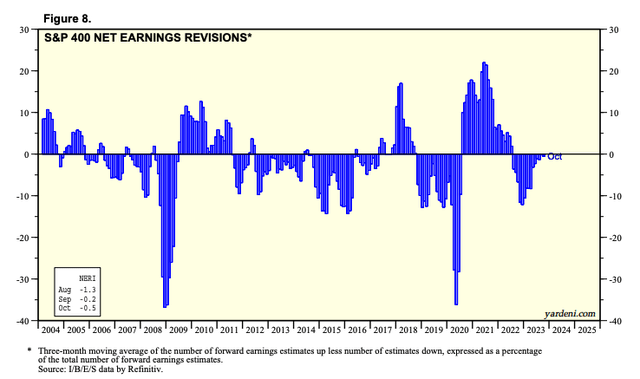

Another metric we will look at is the earnings revisions. It is important to look at the earnings of stocks in VO’s portfolio because earnings do affect the price in the P/E equation. Assuming valuation remains the same, if earnings (“E”) decrease, the price (“P”) in the equation will have to decline. Fortunately, downward earnings revision may have ended or will be ending very soon. As can be seen from the chart below, net earnings revisions of the S&P 400 index is about to turn positive. This means that the “E” in the P/E ratio equation is likely to stabilize. This should also result in a stabilization of the fund price.

Yardeni Research

Strong growth outlook

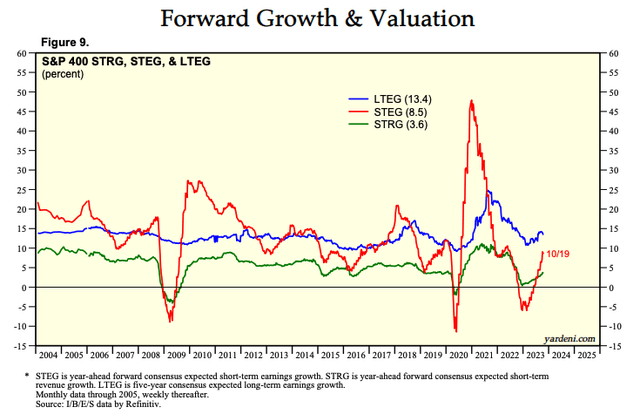

VO has a strong growth outlook. As can be seen from the chart below, its long-term earnings growth forecast according to the consensus of analysts for each of the next 5 years is 13.4%. This is consistent to its historical long-term earnings growth rate. This growth rate of 13.4% is also comparable to the S&P 500 index’s long-term earnings growth rate of 13.6%.

Yardeni Research

A recession is not too far away

Based on our analysis so far, VO’s valuation appears to be quite attractive. However, before we draw our conclusion, we need to also look at the macroeconomic environment. The biggest risk investors should take into consideration is a possible recession. While the U.S. economy appears to be resilient with a strong job market and retail numbers, a recession may not be too far. This is because the Federal Reserve is likely to continue to adjust the rate higher and for longer to completely bring inflation under control. This may likely tip the economy over towards a recession. The reason we have not seen a recession is that monetary policy typically takes 6~12 months to fully propagate through the economy. Hence, a recession may eventually arrive in the first half of 2024.

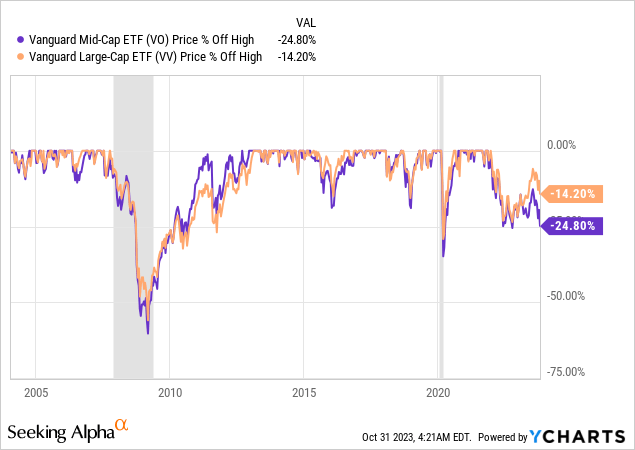

If a recession arrives, VO’s fund price might be under pressure again. Below is a chart that shows how VO performed from their peak in previous recessions. As can be seen from the chart below, VO endured a loss of about 60% during the Great Recession in 2008/2009. In contrast, its large-cap peer fund Vanguard Large-Cap ETF (VV) declined slightly less by about 55%. In the outbreak of the pandemic in 2020, VO declined by about 38%. In contrast, VV declined only by 34%. In each of the two recessions, VO underperformed its large-cap peer VV.

YCharts

In the possible upcoming recession, it is difficult to determine exactly how much more VO will drop from the current level. It not only depends on the severity of the upcoming recession and also depends on how the Federal Reserve will respond. One thing we do know is that inflation can be quite sticky and the Federal Reserve may not have much room to lower the rate in the upcoming recession. Otherwise, inflation may flare up again. Hence, the magnitude of the decline will likely be more than the recession in 2020. Hence, significant risk remains.

Investor Takeaway

VO is currently trading at an attractive valuation. However, a possible recession may result in further declines in VO’s fund price. Therefore, we think investors may want to exercise caution and wait on the sidelines.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here

Leave a Reply