Dear readers,

I cover a lot of REITs here on Seeking Alpha and one of the most common comments I get is that it’s too early to buy and REIT prices will fall much lower as a result of high interest rates.

I don’t know what the future holds and can’t time the exact bottom. But there are reasons that give me strong conviction that today’s valuations are very good from a long-term perspective.

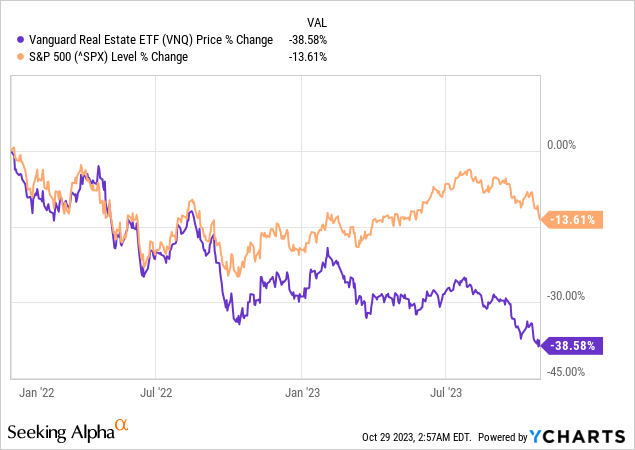

Over the past two years, VNQ has fallen by nearly 40% and has completely decoupled from the S&P 500 (SPX). I believe this has created a great opportunity for value and income investors to load up on some cheap high-yielding REITs.

Today I want to have a look at a popular REIT ETF – Vanguard Real Estate Index Fund ETF Shares (NYSEARCA:VNQ) and share with you why I feel so strongly about the sector and why a third of my portfolio is invested there.

What will drive REIT valuations?

Let’s start by talking about interest rates because this is the sole reason (ignoring sector-specific challenges such as WFH for offices) why REITs have fallen as much as they have.

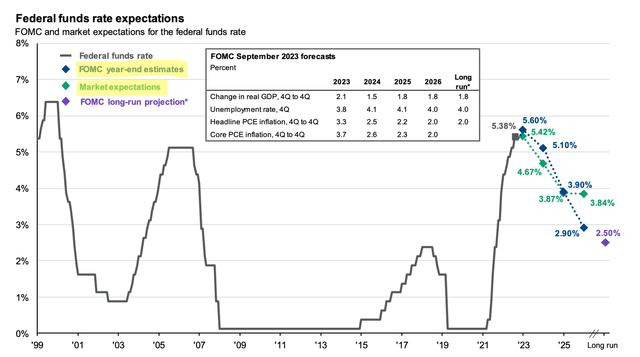

Market expectations for future interest rates are currently more optimistic than the Fed’s forecast in the short-term (2024-2025), but more pessimistic in the medium-term as the market expects a 3.84% interest rate in 2026 vs 2.90% forecasted by the Fed.

J.P. Morgan Asset Management

REIT valuations are sensitive to interest rates and as expectations change, so will valuations. I’ve previously explained why I think that the Fed will cut interest rates sooner, rather than later. I assign this scenario a 50% probability, but because I can’t predict the future, I want to focus on two risk scenarios here:

- Rates stay higher for longer. There will be a maximum of one more rate hike and then rates will plateau for a year or two, before finally declining to a lower level. This scenario is similar to the early 2000s, 2007, and 2018 and is quite likely unless the economy slips into a recession or inflation spirals out of control. I assign it a 40% probability.

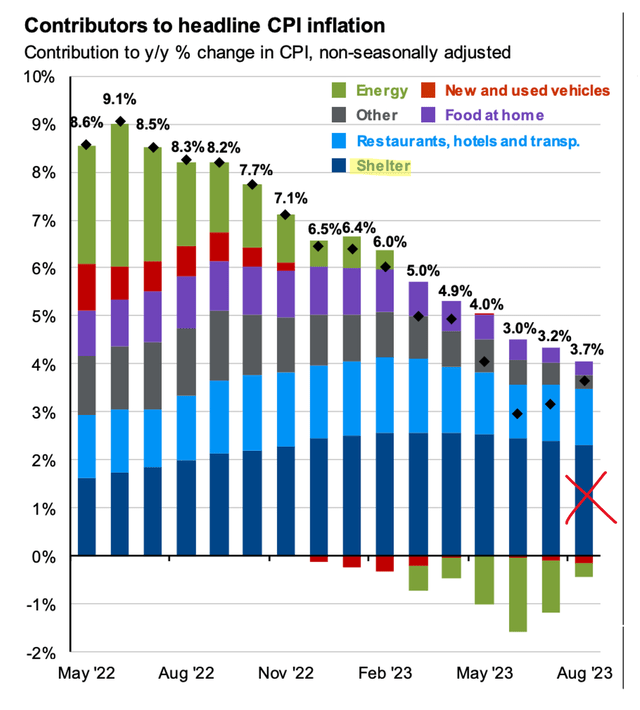

- The Fed continues to hike. If inflation re-accelerates again, the Fed could increase interest rates further, maybe to 6% or 7%. So far, I haven’t seen any evidence pointing towards this scenario so I assign it a low probability of 10%. The reason is that inflation has already declined meaningfully and if we exclude the lagging effect of shelter CPI, we are already within the Fed’s target of 2%.

J.P. Morgan Asset Management

These scenarios reflect what could happen to interest rates over the short and medium term, which is what will drive volatility and price movement over the next 12-24 months. As long-term investors, we don’t really care about that, because we’ll be collecting nice dividend while we wait for the upside. All that matters is that at some point in the future (say in 5-10 years), interest rates decline.

So why do I think that interest rates at today’s level are not sustainable?

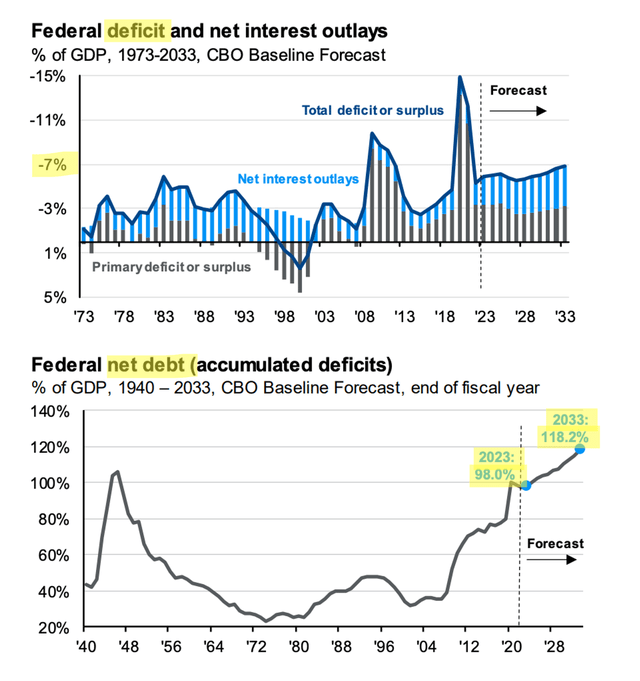

Two words – national debt.

The government continues to operate with a significant deficit. In fact, it financed 23% of this year’s budget by borrowing. As a result, national debt has continued to climb. And this trend is almost certainly going to continue into the future. With net debt over 100% of GDP, I expect significant pressure from the government to decrease interest rates to decrease the interest burden on the national budget. This pressure could be especially pronounced come election year.

J.P. Morgan Asset Management

The way I see it, there’s a high (I think about 90% chance) that interest rates have peaked and will decline over the next 24 months.

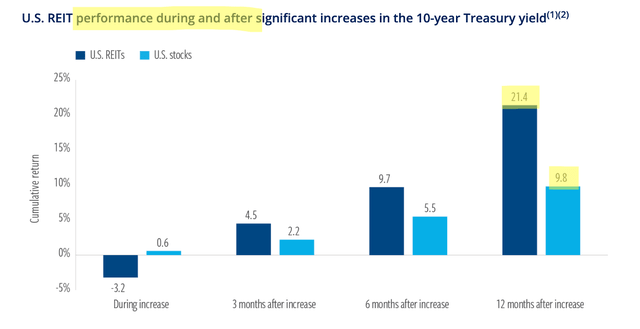

And lucky for us, this is all we need for REITs to do well. You see, history tells us that it doesn’t matter if interest rates went high, all that matters is that they have stopped rising. And during the 12 months following the peak, REITs tend to return double that of the S&P 500.

Cohen & Steers

This may seem strange at first. After all REITs are leveraged companies so high interest rates should hurt them, right?

But this just isn’t the case, because REITs have an ability to increase rents which in many cases more than offsets the increased net interest expense.

Let’s have a look at an example

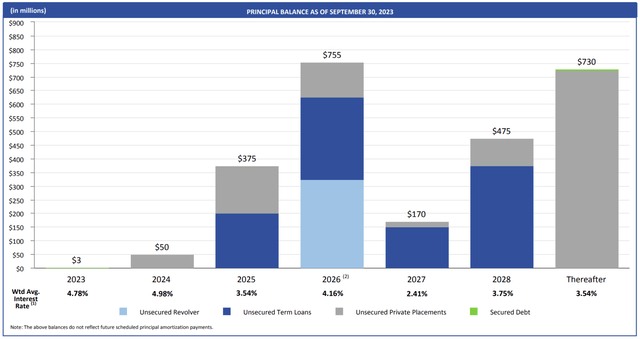

STAG Industrial (STAG) has a net debt / EBITDA of 5x and while all of its long-term debt is fixed rate, the revolving credit line accrues interest at SOFR + 0.75%. The REIT also has minimal near-term maturities next year, but in 2025-2026 it will have to refinance $1 Billion worth of debt which is a lot considering the stock has a $6 Billion market cap.

If we assume that interest rates stay at today’s level (SOFR of 5.3%) until the end of 2026, STAG’s interest expense will increase by about $10 Million in 2025 and by a further $15 Million in 2026.

STAG Presentation

But here’s the thing. This is a company that has been able to re-lease their space at 30-40% cash rent spreads. As about 10% of leases expire each year, the REIT is able to increase its NOI by 3-4% from new leases alone. Add to that build in 1.5% rent escalators on their whole portfolio and the NOI is likely to grow by 5% per year without any need for new acquisitions. With an NOI of roughly $400 Million per year, a 5% increase is roughly $20 Million of additional NOI each year.

So over the 2024-2026 period, STAG is very likely to increase their NOI by a cumulative $60 Million, while their net interest expense increases by a cumulative $25 Million. That’s still an overall $35 Million increase in FFO / cash flow over three years. And this is assuming the higher for longer scenario with interest rates at today’s level until the end of 2026.

I just don’t see how this is a risk scenario. Sure, the multiple is unlikely to expand as long as rates remain high, but investors get paid a solid 4.6% dividend to wait for the eventual decline. And frankly, there are REITs that are even better positioned for a higher for longer scenario than STAG.

Of course, if the Fed continues hiking well past current rates, the whole stock market (including REITs) will tank. But, with growing cash flows, dividends will still likely be paid and if rates decline eventually, there will still be upside from today’s levels. It’s just that there will be a lot of volatility (and paper losses) between now and then.

Bottom Line

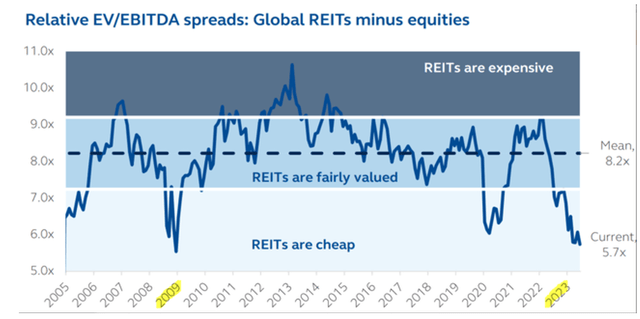

REIT valuations have declined to the lowest level since the Great Financial Crisis.

Principal Asset Management

I think the market has overreacted to the increase in interest rates and continues to ignore the fact that most REITs will be able to grow their cash flow even at 5% interest rates.

Moreover, with the ever-increasing national debt, I expect significant pressure from the government to decrease interest rates, especially come election year. As a result, I think that interest rates will decrease at some point and when they do, significant upside will get unlocked for REITs. In the meantime, investors will get paid high dividends to wait.

Higher for longer is not a risk scenario for REITs. The only real risk is further rate increases towards 6% or 7%. That’s hardly a REIT-specific risk though as it would tank the whole market. I like REIT and while I prefer investing in individual companies, I rate the VNQ as a BUY here.

Read the full article here

Leave a Reply