A few months ago, I penned a cautious article on the Vanguard Mortgage-Backed Securities Index ETF (NASDAQ:VMBS), as I was worried about a ‘higher for longer’ Federal Reserve keeping interest rates high and causing duration losses for long-duration assets like mortgage-backed securities (“MBS”). Furthermore, VMBS, with its 2.6% distribution yield, was fast becoming unattractive compared to treasury bills which were yielding north of 4%.

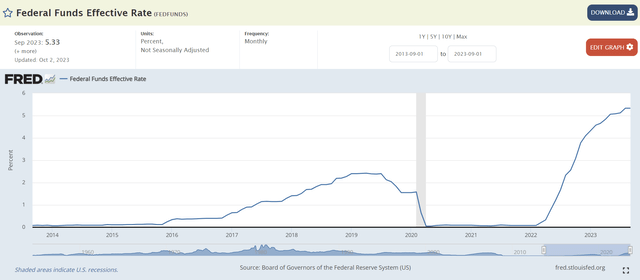

Since my article, the Federal Reserve have indeed stuck to their guns and raised the Fed Funds rate a total of 525 bps in the past 18 months, taking short-term yields to the highest in the past decade (Figure 1).

Figure 1 – Fed Funds rate the highest in the past decade (St. Louis Fed)

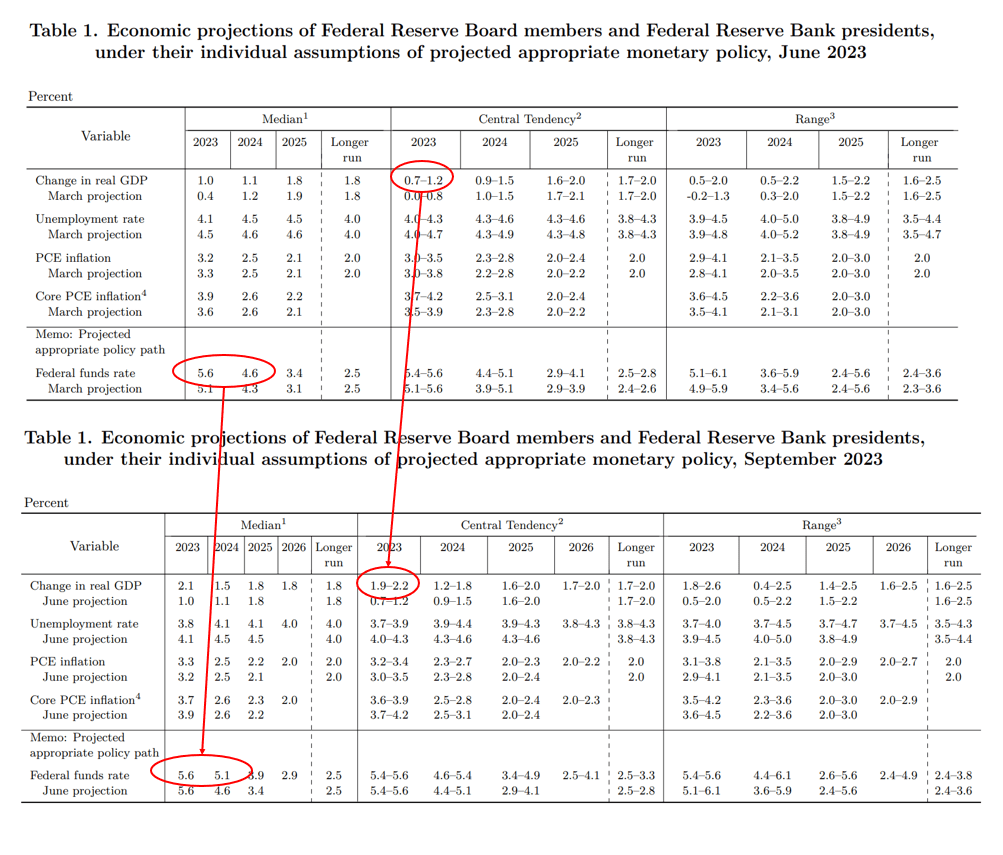

In fact, after the Federal Reserve recently raised their economic forecasts in the September Summary of Economic Projections (“SEP”), boosting their outlook for 2023 U.S. GDP from 0.7-1.2% to 1.9-2.2% and 2024 Fed Funds rate from 4.6% to 5.1%, investors took the SEP as a sign that the Fed will maintain restrictive monetary policy for most of 2024 and have raised long-term bond yields dramatically in recent days as a response (Figure 2).

Figure 2 – Fed have raised economic projections in latest SEP (Author created)

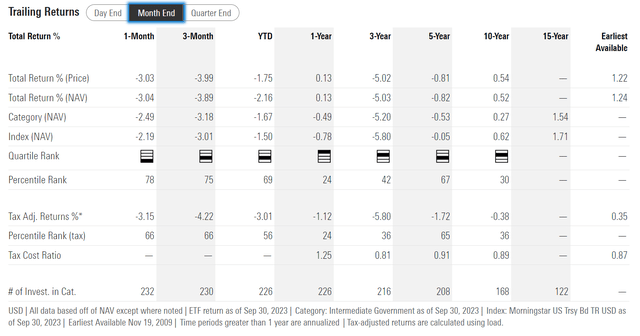

The rise in bond yields, with the 10 year treasury yield recently touching 4.88% intraday, have caused declines for the VMBS ETF, with the fund now looking at a second consecutive year of losses with YTD losses of -2.2% to September 30, 2023 (Figure 3).

Figure 3 – VMBS historical returns (morningstar.com)

However, despite poor recent returns for the VMBS ETF, I believe there may be a way to hedge away the rising interest rate exposure of VMBS through a position in the FolioBeyond Alternative Income and Interest Rate Hedge ETF (RISR).

A 40/60 portfolio of VMBS/RISR would have delivered a strong CAGR return of 10.0% while paying a 4%+ distribution yield since RISR’s inception.

Brief Fund Overview

The Vanguard Mortgage-Backed Securities ETF (“VMBS”) invests primarily in U.S. agency MBS securities to generate modest level of current income to investors. The VMBS ETF only invests in securities issued by Ginnie Mae (GNMA), Fannie Mae (OTCQB:FNMA), and Freddie Mac (“FHLMC”), so VMBS’ portfolio is considered to have no credit risks.

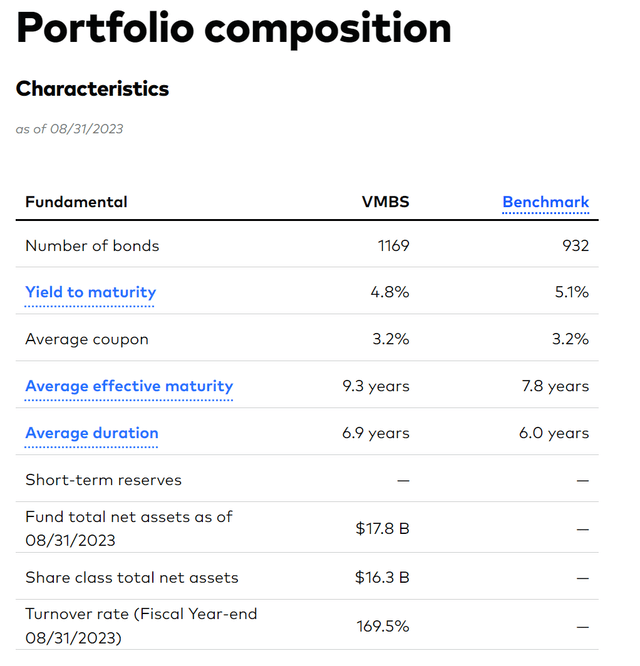

Figure 4 shows the portfolio overview of the VMBS ETF. The fund has close to $18 billion in assets and over 1,100 securities in its portfolio, with a portfolio average duration of 6.9 years.

Figure 4 – VMBS overview (vanguard.com)

MBS Have Prepayment Risk

As I explained in my prior article, MBS securities have prepayment/extension risks that are not found in other fixed income instruments. This is because MBS are basically bundles of home mortgage loans packaged together and sold through the federal agencies like Fannie Mae and Freddie Mac. When interest rates decline, MBS securities may have shorter duration than originally expected as homeowners prepay and refinance their mortgages at the lower prevailing interest rates.

On the other hand, when interest rates are rising, MBS securities may have longer duration than originally expected as homeowners stay in their existing homes. Currently, with 30 year mortgage rates near 8%, the U.S. housing market is essentially frozen, and few transactions are occurring, so MBS securities are much longer duration than originally assumed.

RISR Uniquely Positioned To Hedge VMBS Risks

Recently, I came across a newly launched ETF that appear to be uniquely qualified to hedge the interest rate and prepayment risks associated with the VMBS ETF.

The FolioBeyond Alternative Income and Interest Rate Hedge ETF (“RISR”) owns a portfolio of interest-only (“IO”) mortgage-backed securities (“MBS”) and U.S. treasury bonds.

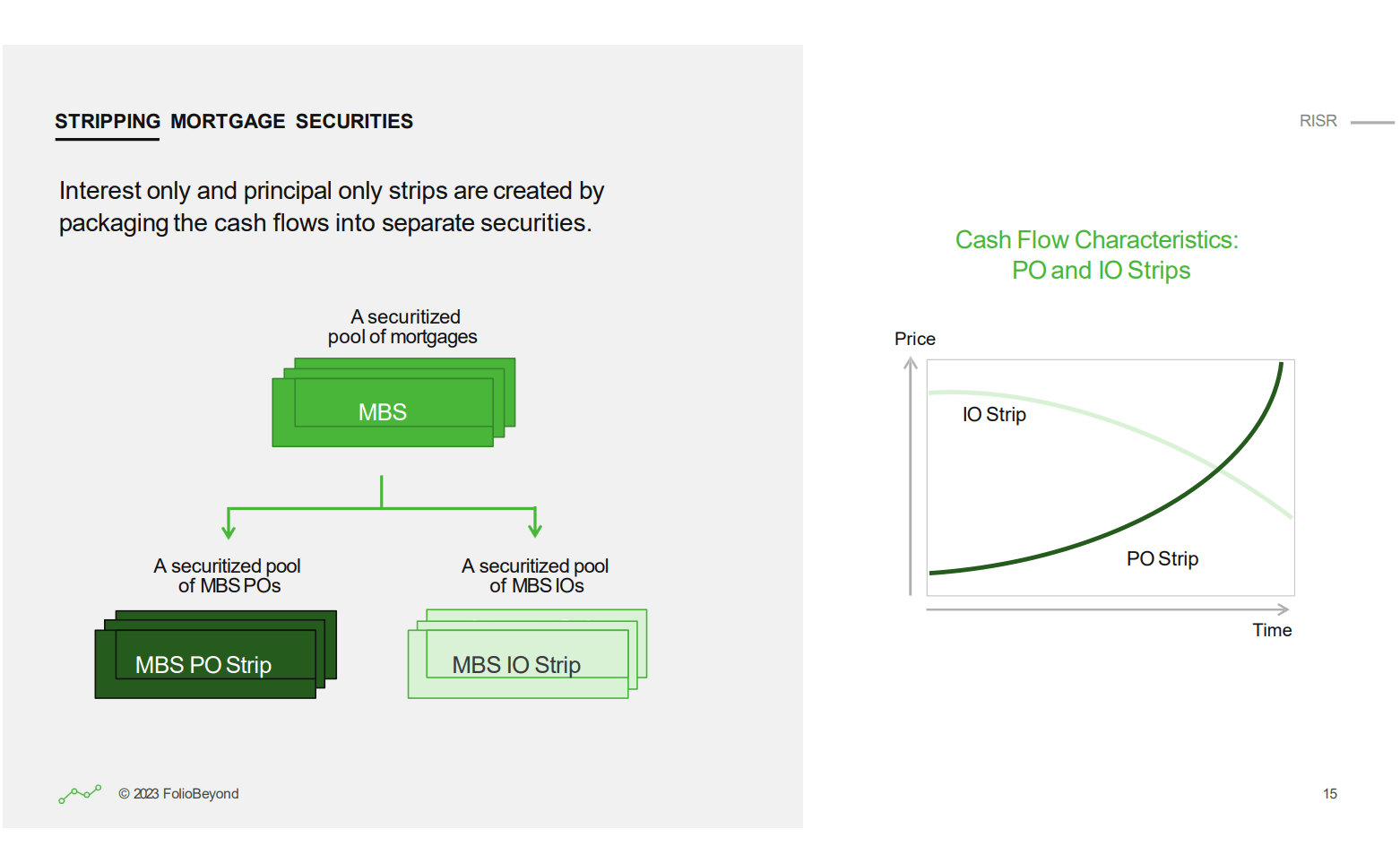

MBS IO strips are the interest-only cash flows stripped from regular MBS securities (Figure 5).

Figure 5 – Illustrative MBS IO example (RISR investor presentation)

Since homeowners tend to have lower propensity to refinance their mortgages when interest rates are rising, a portfolio of MBS IO securities will therefore have negative duration (as prepayments decline due to rising interest rates, MBS IO strip value increases) while collecting positive carry.

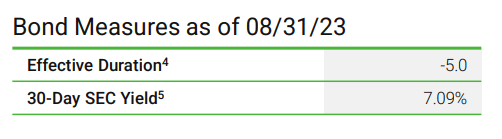

In fact, the RISR ETF has enviable portfolio statistics of having a -5 year portfolio effective duration and a 7.1% 30-Day SEC yield (Figure 6).

Figure 6 – RISR has negative duration and positive carry (RISR factsheet)

40/60 VMBS/RISR Appear To Be A Winning Formula

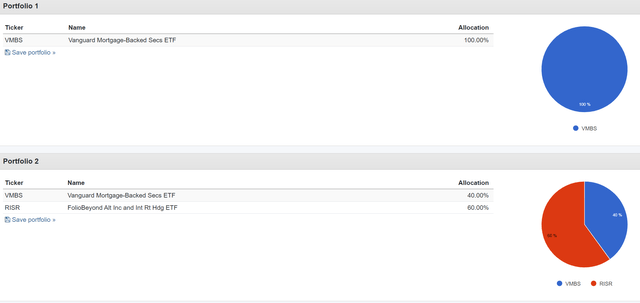

Looking at the VMBS and RISR ETFs in concert, if we design a portfolio with 40% invested in VMBS and 60% invested in RISR, then the overall portfolio duration will be effectively zero (0.4 * 6.9 + 0.6 * [-5] = -0.24) while the portfolio may be to generate a mid single digit yield (Figure 7).

Figure 7 – Simple portfolio of 40/60 VMBS/RISR (Author created with Portfolio Visualizer)

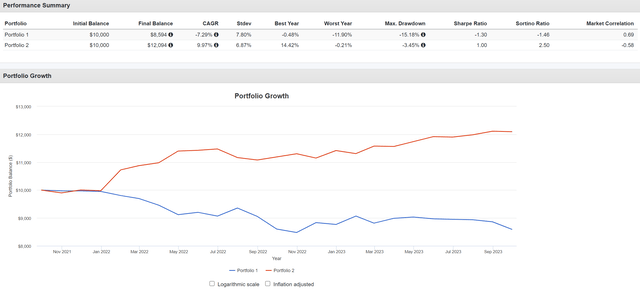

Figure 8 shows the historical modeled returns of this strategy compared to VMBS by itself since RISR was incepted in October 2021. This 40/60 portfolio of VMBS/RISR has a 10.0% CAGR return with 1.0 Sharpe ratio and a -3.5% maximum drawdown.

Figure 8 – 40/60 VMBS/RISR portfolio characteristics (Author created with Portfolio Visualizer)

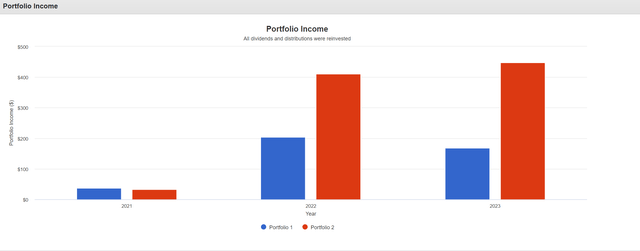

This portfolio also would have paid a ~4.0% distribution yield in 2021 and 2022, far surpassing the VMBS ETF’s modest yield (Figure 9).

Figure 9 – 40/60 VMBS/RISR pays a 4%+ yield (Author created with Portfolio Visualizer)

Too Good To Be True; What is The Catch?

On paper, the 40/60 portfolio appears too good to be true, as it effectively hedges out duration and prepayment risk while delivering a 10% total return. Who doesn’t want a 10% ‘risk-free’ return?

I believe the remaining risk of this strategy is that the two assets are not perfect hedges, i.e. there is ‘basis’ risk. Furthermore, we have not yet seen the performance of the RISR ETF during an interest rate declining environment. As interest rates decline and prepayments rise, will the 40/60 portfolio suffer losses?

Without historical data as reference, I can only estimate that total returns will not be as robust in a declining interest rate environment: The VMBS position should benefit, but less so than similar duration treasuries due to rising prepayments. The MBS IO strip should still generate positive carry, but may lose value as duration is shortened. Finally, the long treasury position should gain in value as interest rates decline, mitigating some of the MBS IO value declines. The net result may be negative to low single digit total returns, depending on how aggressive interest rates decline and homeowners refinance, causing the MBS IO strips to lose value.

Conclusion

The VMBS ETF provides low-cost exposure to mortgage-backed securities issued by the Federal agencies like Fannie Mae. In a rising rate environment, owning MBS securities is a recipe for poor returns, as MBS have both duration risk and extension risk. However, investors may be able to hedge away rising interest rate risks associated the VMBS ETF by owning the RISR ETF as a hedge.

RISR owns a portfolio of MBS interest-only securities and treasury bonds that have a negative duration but positive carry. A 40/60 portfolio of VMBS/RISR may neutralize duration risk while delivering mid single digit distribution yields and high single digit total returns in a rising interest rate environment.

Read the full article here

Leave a Reply