Why We Monitor VIZIO?

VIZIO (NYSE:VZIO) released its third-quarter earnings on November 9th. Since then, its stock price has climbed over 27%. This comes on the back of a 25% decline since we first initiated Neutral coverage back in April. We think Vizio is an interesting small-cap company to watch. As a small-cap player with a market capitalization of around $1.37 billion, it has much more room to run compared to giants like Roku (ROKU) at $14 billion and Xiaomi (OTCPK:XIACF) at $49 billion. And unlike many tech names these days, Vizio is actually profitable on a GAAP basis. Between its strong Walmart partnership, differentiated ad-based revenue model, and proven product-market fit, Vizio has a lot going for it.

Analysis of Q3 Results

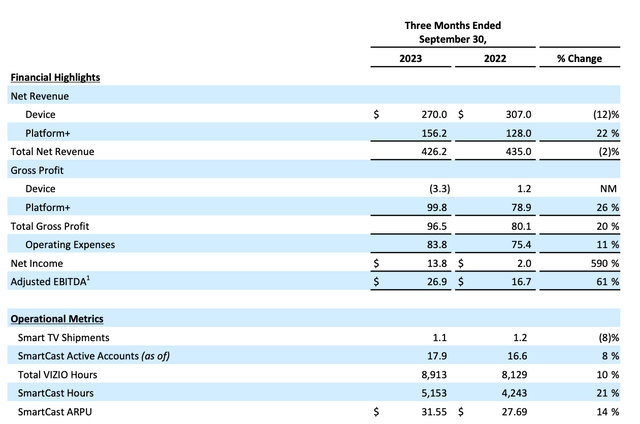

Drilling into the Q3 results, total revenue declined 2% year-over-year. Not amazing on the surface, but it did mark an improvement from the steeper 6% drop last quarter. Perhaps most impressively, Adjusted EBITDA skyrocketed 61% amid the revenue contraction. This just demonstrates the potential of Vizio’s platform business to drive margins over time.

VZIO

The core driver was a 14% increase in average revenue per user on the platform side, stemming from more viewership and advertiser spending per household. At the same time, device revenue fell given an 8% slump in TV unit sales – better than Q2’s 11% decline but still lackluster. It seems demand is still rather weak amid inflation and recessionary fears. With razor-thin margins on the actual TV hardware itself, it’s clear why Vizio is focused so intently on bumping up value from its advertising units.

Management’s Device Strategy

On the earnings call, management talked about further optimizing its device strategy to weather the storm. Specifically, they are now emphasizing marketing and distribution around larger-screen TVs more heavily:

“Given these monetization tailwinds, we are further refining our device strategy and emphasizing larger screen sizes, which tend to be the primary TV in the home. We expect these larger units will generate greater economic value over the long-term.”

This focus on 65″+ TVs that tend to serve as the central hub of home entertainment makes a ton of sense. Larger screens equate to higher engagement, which then feeds back into platform revenue via more viewing and ad impressions. The strategic logic is sound. Of course, Vizio faces intense competition from brands like TCL and Amazon (AMZN) that boast stronger consumer awareness in the crucial premium TV segment.

Beyond the shift to big screens, management also hinted at potential licensing arrangements to get Vizio software and tech into third-party devices. However, we are skeptical about the feasibility here. Smart TV capabilities and software are clearly the next frontier of differentiation and growth in the TV market. It seems unlikely that major manufacturers would license out key platform advantages, instead seeking to retain that high-margin IP and user data in-house. When you consider giants like Roku and Xiaomi with strong incumbent software advantages outside the US, Vizio may face substantial barriers to entry.

Zooming out, we note a couple other drawbacks for Vizio – namely, its reliance on a single consumer electronics category and lack of competitive differentiation beyond price. Unlike Xiaomi’s broader ecosystem spanning home appliances, wearables, smart home and more, Vizio’s fortunes are wholly tied to the TV market. And within the core TV business, they compete mostly on affordability rather than unique features. This makes growth quite dependent on mainstream TV demand.

Valuation

Flashback to our April coverage initiation – our base case assumed no growth in 2023 and 3% long-term terminal growth, supporting a valuation of around $4.70 per share.

We make the following assumptions based on management’s guidance and current market conditions:

- 20 % WACC

- 3 % terminal growth rate

- 5% free cash flow margin

- Net debt -346 million (Q42022)

- Outstanding shares 202 million (Q42022)

Applying the DCF method, we can arrive at an equity value of 961 million ($4.7 per share), which implies a 48% decline from the current stock price.

Based on the earnings results and the latest management commentary, we don’t see anything to dramatically alter that thesis. The strategic pivots to big screens and advertising make sense and should sustain profitability. But with TV demand still stagnant and competitive intensity rising, unit volumes may continue to struggle.

Risks

Vizio operates in a TV industry undergoing rapid technological change. As an upstart rival to titans like Samsung, constant innovation across hardware, software, and services is imperative to stay competitive. This requires large, sustained investments just to keep pace to enhance display quality, smart functionality, viewing experiences, and more. Tough resource allocation decisions arise on where to focus among endless improvement fronts.

Revenue growth also hinges on advertising, a volatile market undergoing shifts in consumer behavior, regulation, and new platforms. Vizio has made encouraging progress boosting engagement and ad dollars through its viewership data and targeting. But smaller players experience exaggerated ripples as budgets contract. Additional streaming competition like Fire TV+Prime video’s ad model are unlikely to help. In this dynamic landscape, nimble execution is critical. Vizio must accelerate its innovation flywheel across products and advertising to carve out durable share gains versus diversified giants.

Conclusion

Vizio’s narrow product focus and reliance on competing via price point leave it vulnerable. While the initiatives to boost platform average revenue per user are promising, gains may be constrained by secular hardware saturation. As such, substantial near-term upside looks unlikely. We reiterate our Neutral view on the shares.

There are surely some exciting elements percolating under the surface for Vizio long term. But between macro uncertainty and product segment constraints, returns may continue to hover around the cost of capital near term. As the TV market – and ad-based streaming model – evolves, we would keep an eye on Vizio to see if any sustainable edges emerge versus the Roku’s and Amazon’s of the world. This small-cap still has lots of market share up for grabs if the execution goes well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply