Investment Action

Based on my outlook and analysis of The Vita Coco Co. (NASDAQ:COCO), I recommend a buy rating. I expect COCO to continue tracking against its growth targets, albeit with a slowdown in FY24 due to the private label transition. The strong growth and EBITDA margin expansion should support its current premium multiple against peers.

Basic Recap

COCO operates as a healthy beverage production company. The company offers coconut water, oil, and milk, as well as energy drinks and flavored protein-infused and packaged water. The business has experienced tremendous growth, from $283 million in revenue in FY19 to $465 million in LTM. Notably, the business has more than doubled its EBITDA margin over the same period, indicating the business is experiencing profitable growth and not like other VC-supported cash-generating businesses.

Industry

COCO, in my opinion, is in a very promising market that should sustain its rapid growth at the present low-teens clip. The global non-alcoholic beverage market is expected to increase to $1.2 trillion in 2030 from its 2023 levels, of which COCO is a part. Below is a brief overview by Datam Market Research that supports my bullish long-term view.

“According to the DataM market research report, the Global Non-alcoholic Beverages Market reached US$ 750.6 billion in 2022 and is projected to witness lucrative growth by reaching up to US$ 1,242.3 billion by 2030. The market is expected to witness a 6.5% CAGR during the forecast period 2023-2030. The global beverage industry is taking advantage of a wave of fundamental change. It is constantly changing due to the non-alcoholic beverages market’s growing associations with social and cultural roles.”

Especially regarding COCO, I believe that as people become more conscious of their health, health beverages will experience rapid growth. Drinks made from plants have become increasingly popular among consumers, as reported by Grand View Research, due to their health benefits, nutritional properties, and low contribution to the global carbon footprint.

Review

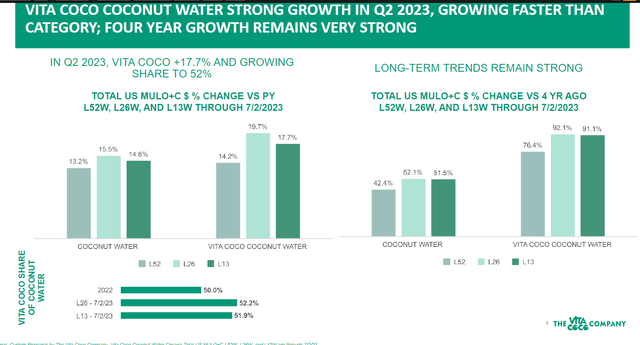

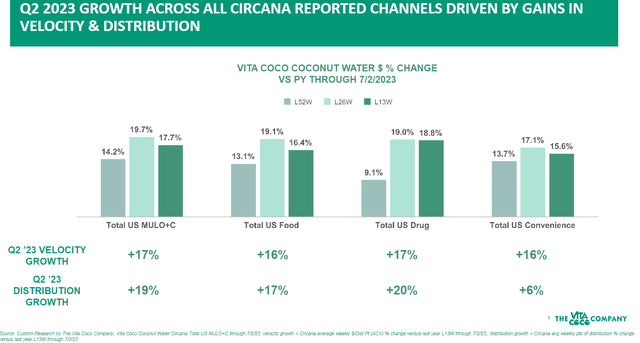

In a nutshell, sales of Vita Coco Coconut Water grew by 23% year over year, contributing heavily to the 21% growth in the top-line that was reported for 2Q23. Notably, volume growth drove top-line expansion by 17.4%, with pricing expansion accounting for only 3.1%. The 11-point increase in gross margins to 36.6% compares favorably with the much lower gross margins of Q1 (27.4%). Improved ocean freight transportation costs, top-line leverage, and a more expensive mix of Vita Coco Coconut Water drove the increase in gross margin. Consequently, the EBIT margin increased by 11 percentage points, to 14.9%. The company’s adjusted EBITDA was $24 million, and its EPS of $0.31 was significantly higher than the consensus estimate of $0.16.

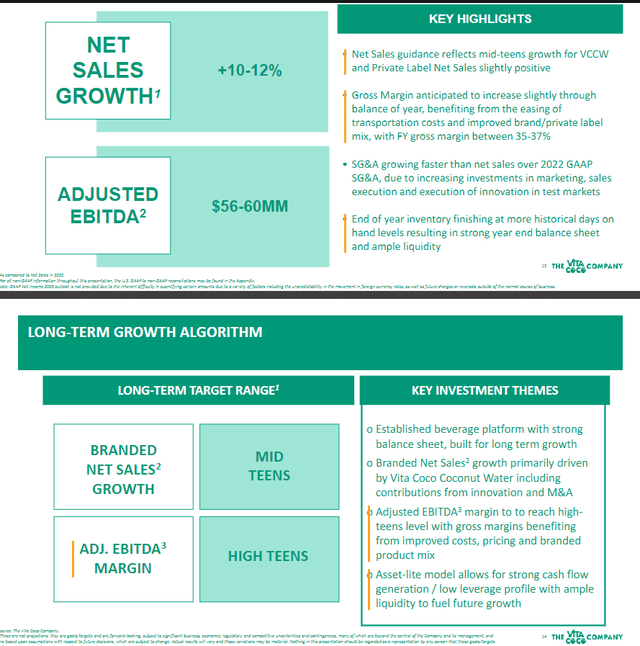

Since 2Q23, my outlook on the company has shifted to be more bullish due to COCO’s strong top-line growth, which exceeds the company’s long-term mid-teen growth algo. Strong gross margin improvement can be seen below the top-line as a result of the synergy between price increases from the previous year, a more favorable cost environment, and increased savings from supply chain efficiencies. In light of the strong momentum and improving cost trend, management increased their forecasts for FY23 in terms of net sales, gross margin, and adjusted EBITDA. In my opinion, this is a very encouraging sign of optimism and significantly lowers the probability of COCO missing FY23 consensus estimates.

Starting in 4Q23, I believe the next debate for COCO will center on the company’s ability to successfully transition the business away from its large private label customers. Since the transition timeline is unclear to the market and management has not previously disclosed that the loss of private label volume will be a drag on top-line beginning in 4Q23 and continuing through FY24, I am concerned that it could cause short-term business volatility. In particular, FY24 sales could be down by the mid-single digits, according to management projections. However, I agree with this decision because it helps the company become more sustainable in the long run, thanks to the improved margin benefits, and because it better aligns with management’s long-term own-brand growth objective. Importantly, management’s continued optimism that it can grow its adjusted EBITDA and gross margin by double digits in FY24 reflects the company’s conviction in the strength of its core Vita Coco Coconut Water business and the boost it has seen from innovations.

Eventually, once the private label transition is complete, I anticipate growth to resume at a healthy clip thanks to expanded household penetration for its branded business, improved distribution, higher prices, and COCO’s ability to continuously roll out new and innovative products that match consumers’ preferences. Given its substantial growth potential and prospect for a swift margin recovery, I think COCO represents a rare investment opportunity in the world of non-alcoholic beverages. Since COCO is shifting its focus to branded products, which typically have higher margins, I anticipate the company will experience a period of faster and more profitable expansion. The upside catalyst here is that as visibility improves on the transition plan and, assuming the branded business continues to thrive, management might increase guidance.

COCO

COCO

Valuation

Author’s work

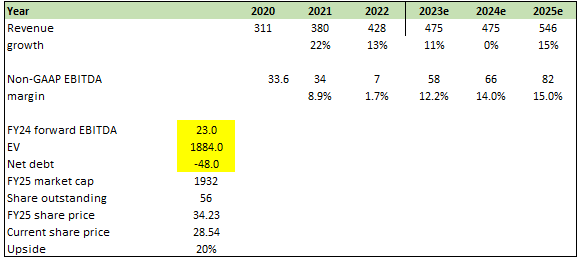

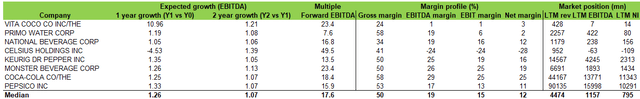

At the rate that COCO is growing and progressing, it is well on track to meet its long-term target range. FY23 guidance is for revenue growth of 10 to 12%, which should not be a problem given the performance so far. I modeled FY24 to see flattish growth as I am not sure of the impact of the private label transition, so being conservative is better. As for FY25, growth should track back to COCO’s long-term target range. At the EBITDA margin level, profitability should continue to increase as the mix of private label brands goes down and COCO sees fixed cost leverage. Given that COCO has the highest expected EBITDA growth prospect, I believe multiples should continue to stay at this premium.

COCO

Author’s work

Risk and Final Thoughts

Coconut consumption may follow the pattern of many passing trends and decline over time. In such a scenario, the demand for COCO could experience a sharp decline. COCO might face challenges in diversifying into new product categories, given that a substantial portion of its earnings and profits are generated from the sale of coconut water. In conclusion, I recommend a buy rating for COCO based on its robust performance and alignment with growth targets. COCO, operating in the healthy beverage production sector, has shown impressive growth, with revenue increasing from $283 million in FY19 to $465 million in LTM. The company’s EBITDA margin has also doubled over the same period, indicating profitable growth. COCO operates in a promising market, with the global non-alcoholic beverage industry expected to reach $1.2 trillion by 2030. The company is well-positioned to benefit from this growth, particularly as health-conscious consumers increasingly favor plant-based beverages. Looking ahead, COCO’s focus on branded products with higher margins should drive continued growth. As visibility improves on the transition plan and the branded business thrives, management may further increase guidance.

Read the full article here

Leave a Reply