Investors count on the management teams that run the companies that they invest in to behave in ways that create the most value at the end of the day. From time to time, there can be a disconnect between what management thinks is best and with the market believes to be best. When these opinions diverge, you can see a significant movement in share price. The latest example of this was seen on October 16th when shares of Vista Outdoor (NYSE:VSTO) plunged, closing down nearly 24%. This movement came in response to Vista Outdoor announcing a change in its strategic plan. Previously, management expected to split up the company into two separate firms by means of a spinoff, with the Sporting Products operations serving as one enterprise and the Outdoor Products serving as another.

Unfortunately for shareholders, this all changed on October 16th. Management announced that the company would be selling off its Sporting Products business in an all-cash transaction while the Outdoor Products firm would be all that’s left for shareholders to own a piece of. As you will see, the actual transaction is a bit more complicated than that. But with the prospect of a potentially significant tax bill and concerns over the health of the surviving company, the market did not take too kindly to this maneuver.

It is worth noting that this isn’t my first rodeo with Vista Outdoor. I did write about the company previously, the last time in 2021. In that article, I rated the company a buy because it had started showing nice progress. Unfortunately, due in large part to this recent plunge, shares are now down 38.3% compared to the 6.8% decline seen by the S&P 500 over the same window of time. Even though sales continued to rise from 2021 to 2022, profits dropped, falling to a loss of $9.7 million compared to the $433.2 million gain seen the year prior. Even if we look at operating income without the firm’s large improvement, margin contraction took its profits down from $646.2 million in 2021 to $482.2 million last year. In fact, it’s this kind of weakness that almost certainly encouraged management to explore strategic alternatives.

An abrupt change

Back in May of 2022, the management team at Vista Outdoor announced their plans to separate the two separate companies into separate publicly traded enterprises. Up until October 16th, there was no indication that this plan would change. But on that date, management announced that they were selling off the Sporting Products operation for $1.91 billion in cash. Although this is being positioned as a sale publicly, the transaction is a bit more complex than that. Technically, Vista Outdoor will split off its Outdoor Products business from what is currently the parent company. They will then merge that with a subsidiary of the acquirer, Czechoslovak Group, with the cash from that transaction being combined with the shares of the Outdoor Products operation, and being hand it over to the current shareholders of Vista Outdoor.

| Standalone Outdoor Products Company (Revelyst) | Financial Data |

| Debt | $986.01 |

| Less: Current Cash | $63.16 |

| Less: Purchase Cash | $1,910.00 |

| Net Debt: | -$987.16 |

| Market Cap | $1,446.00 |

| Enterprise Value | $458.84 |

According to management, this Outdoor Products business will be rebranded as Revelyst. The Sporting Products operation would be unloaded on a cash free and debt free basis. That means that the $986 million in debt that Vista Outdoor currently owns will be kept by the surviving enterprise. But when you add in the $1.91 billion in cash and the $63.2 million in cash that the enterprise currently has on its books, you see that debt, on a net basis, has been wiped out. $750 million of this cash will be allocated toward shareholders of Vista Outdoor (or, technically, the new Revelyst) with at least some of that going to pay taxes since the transaction will constitute A taxable sale of the stockholders in Vista Outdoor for the shares of the new company they are receiving and its cash consideration.

I cannot opine on the tax situation myself since that is not my area of expertise and since each person’s tax situation differs. But it’s safe to assume that it’s this tax picture that has shareholders angry. If there is a positive side to this, it’s that the tax treatment of this transaction will improve the picture for Revelyst, bringing its tax bill down to only $50 million compared to the $380 million management said that an asset sale outright would result in. If this maneuver on its own is not frustrating enough for shareholders, there’s also the fact that management also decided to let investors know of a rather significant revision in financial performance for the 2024 fiscal year.

Author – Vista Outdoor

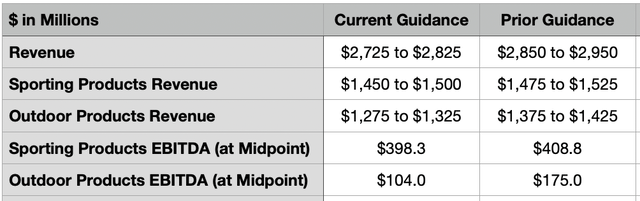

Previously, management had forecasted revenue for the year of between $2.85 billion and $2.95 billion. That has now been reduced to between $2.725 billion and $2.825 billion. Weak market conditions can really be blamed for this. But it’s also important to point out that this weakness is mostly affecting the part of the company that shareholders will be left with. Prior guidance for the Sporting Products part of the company had been for revenue of between $1.475 billion and $1.525 billion. That has been reduced only modestly by $25 million on both ends of the range. By comparison, the Outdoor Products business was previously expected to generate revenue of between $1.375 billion and $1.425 billion. That has now been reduced by $100 million on the top and bottom lines.

Similar weakness is now forecasted on the bottom line as well. For instance, using the midpoint of guidance for the EBITDA margin, the Sporting Products business should now generate around $398.3 million of EBITDA for its 2024 fiscal year. That’s down only slightly from the $408.8 million previously forecasted. By comparison, the Outdoor Products company should go from generating EBITDA of $175 million to only $104 million. Management still maintains, at least, that the long-term outlook for the Outdoor Products business is vastly superior to the outlook for the Sporting Products business. The latter of these was estimated to have a market opportunity for investors of $10 billion or more. But the former has been forecasted to have a market opportunity exceeding $130 billion, with $30 billion of this being for the core market in the US alone.

Author

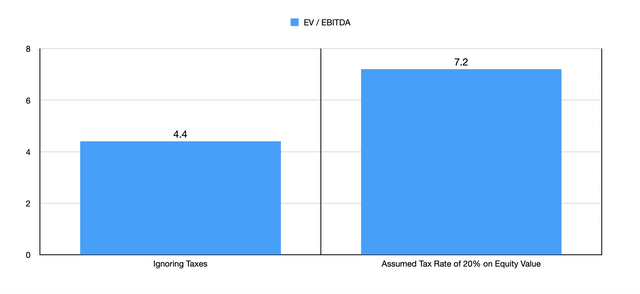

Although this drop is undeniably painful, it does now create what could be a rather interesting opportunity for investors. Even if we assume that financial performance will not improve beyond what the Outdoor Products operation should generate for 2024, the company is now trading at a forward EV to EBITDA multiple of 4.4. Of course, we do need to factor in the tax side to this. If, for instance, we assume a 20% tax rate on the current market capitalization of Vista Outdoor, this would result in the EV to EBITDA multiple of the company being quite a bit higher at 7.2. But in the table below, you can see how five similar firms are priced. Without this tax scenario factored in, the Outdoor Products business is the cheapest of the group. And with it factored in, three of the five companies are still more expensive than it.

| Company | EV / EBITDA |

| Vista Outdoor | 4.4 to 7.2 |

| Topgolf Callaway Brands (MODG) | 8.4 |

| Sturm Ruger & Co. (RGR) | 7.7 |

| Smith & Wesson Brands (SWBI) | 7.6 |

| Malibu Boats (MBUU) | 5.4 |

| Dick’s Sporting Goods (DKS) | 5.1 |

Takeaway

If I were a shareholder of Vista Outdoor right now, I would be very angry. This maneuver does not seem optimal to me and it is clear that market participants were both surprised and frustrated by it. It leaves shareholders in uncharted territory and might have been, at the end of the day, an inferior strategy to other strategic transactions or even keeping the company together. Now that the stock has fallen, however, I would make the case that shares are definitely cheap enough to warrant consideration. But I can also understand why investors would have an issue trusting management after such a disastrous downturn.

Read the full article here

Leave a Reply