In my most recent article, I wrote that Virtu Financial, Inc. (NASDAQ:VIRT) remained a good place to hide as it paid a 4.9% yield while its trading business stood to benefit if volatility were to return. Unfortunately, since the brief regional bank crisis in March, financial markets have been very quiet, as volatility plummeted to multi-year lows.

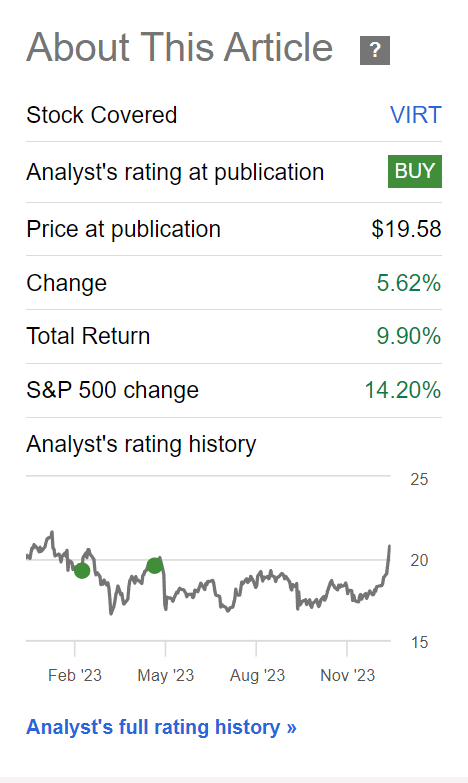

For market makers like Virtu, calm markets are an undesired outcome, as spreads compressed and transaction volumes plummeted, leading to Virtu’s stock languishing for most of the year (Figure 1).

Figure 1 – Virtu’s stock has languished until recently (Seeking Alpha)

However, in recent weeks, Virtu’s stock price has begun to perk up, returning 16% in the past month. What is happening, and what is the outlook for Virtu’s shares heading into 2024?

Brief Company Overview

Virtu Financial is a leading global market maker and broker and provides execution, market making, liquidity sourcing, and analytics to institutional clients.

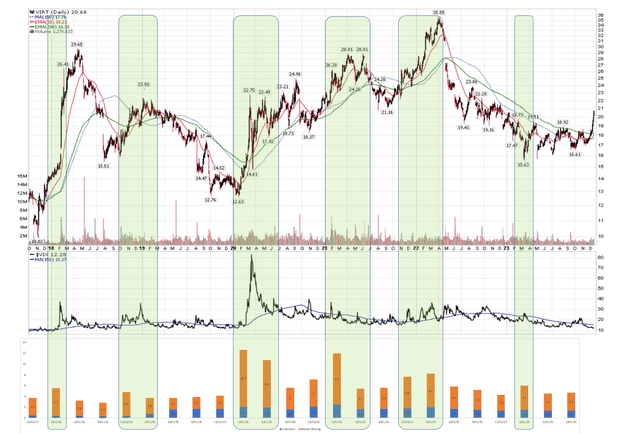

As I have shown in prior articles, Virtu’s financial and stock performance shines during periods of market volatility, as high volatility leads to wider bid/ask spreads which translates into attractive opportunities for Virtu’s market-making business (Figure 2). For example, Virtu’s financial performance shined during the 2020 COVID pandemic period.

Figure 2 – Virtu benefits from market volatility (Author created with data from company reports and price chart from stockcharts.com)

On the other hand, the 2022 bear market was like a well-controlled demolition as financial markets never really panicked despite large drawdowns, and Virtu’s financial results suffered as a result.

Back in April, I thought the regional banking crisis was the start of a much-anticipated recession, as regional banks began to buckle under the Fed’s interest rate increases. However, to the central bank’s credit, the Fed’s Bank Term Funding Program (“BTFP”) and the government’s explicit backing of bank deposits stopped the crisis from spreading, and stock markets rallied back towards all-time highs in the subsequent months.

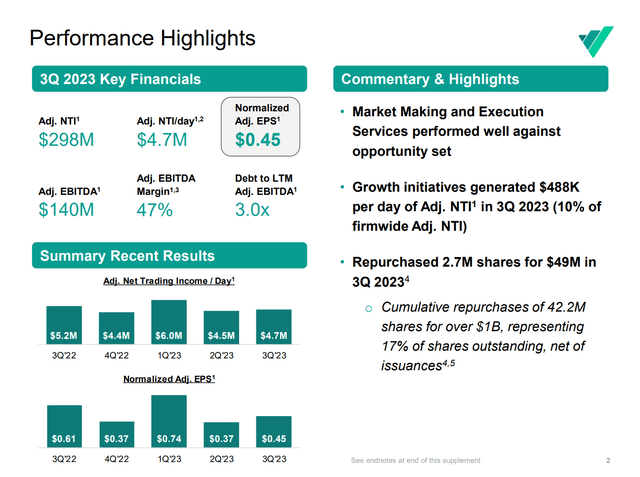

For Virtu, calm markets meant poor financial performance, as Net Trading Income (“NTI”) fell to $4.5 million and $4.7 million in Q2 and Q3 respectively, a steep drop from Q1’s $6.0 million figure (Figure 3).

Figure 3 – Virtu’s financial performance dipped in Q2 and Q3 on calm markets (VIRT investor presentation)

Virtu Continue To Return Capital To Investors

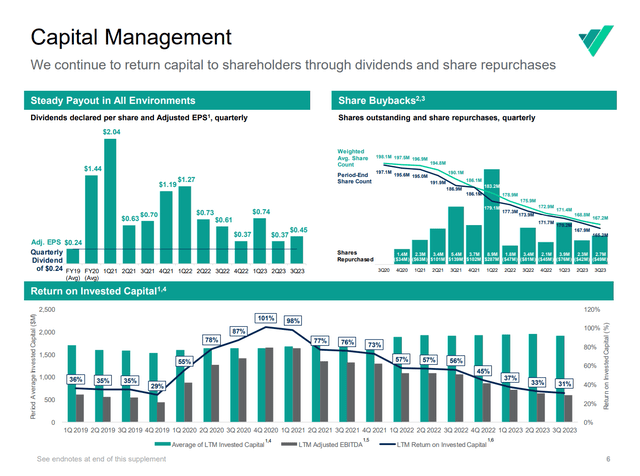

Despite soft financial performance, Virtu continues to be a money-printing machine, as the core business generated ample excess cash beyond what is required to maintain trading capital. Virtu returned this excess capital to shareholders in the form of an attractive dividend ($0.24 / quarter) and share buybacks (Figure 4). So far in 2023, Virtu has bought back $167 million worth of shares and paid $78 million in dividends to shareholders.

Figure 4 – Virtu continued to buyback shares (VIRT investor presentation)

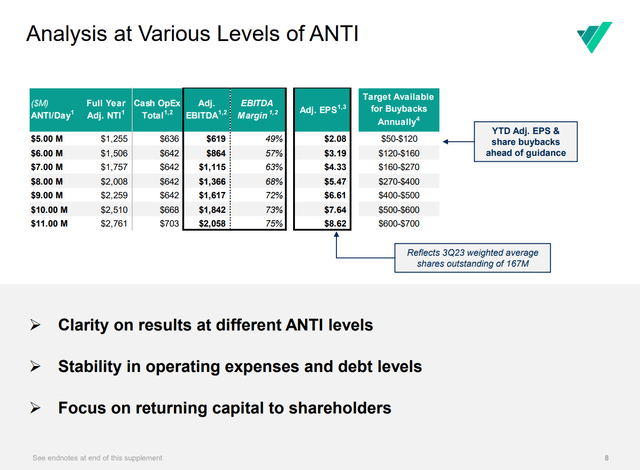

In fact, Virtu has a fairly simple formula to estimate the company’s earnings and how much capital to return to shareholders (Figure 5). When market opportunities are ample and trading income is high, Virtu can potentially earn hefty returns and buyback hundreds of millions in shares.

Figure 5 – Virtu EPS and buyback sensitivity to NTI (VIRT investor presentation)

Return Of Animal Spirits Bodes Well For 2024

In past articles, I have argued Virtu is a positive yielding hedge against market volatility, as it tends to perform well during crises and market drawdowns. So I was a little taken by surprise in recent weeks when Virtu’s stock started to perform well even as the VIX Index plunged to multi-year lows and the S&P 500 Index neared all-time highs. This behaviour by Virtu’s shares is a little counter-intuitive, so what could be going on?

I believe what is going on is that as Fed Chair Jerome Powell recently said that interest rates “are likely at or near the peak rate for this cycle”, investors are looking forward to 2024 and anticipate the Fed to start cutting interest rates.

This has injected ‘animal spirits’ back into the financial markets, reminiscent of the market environment in 2021. For example, bitcoin recently broke out through $40,000 in anticipation of a spot bitcoin ETF and an expected halving in April 2024. Similarly, meme stocks are back in vogue, and it is not uncommon to see ‘0DTE’ (zero days to expiry) options driving individual stocks and indices on a day-to-day basis.

In fact, if we look at Figure 2, some of Virtu’s best financial results in recent years occurred in 2021, when retail traders and meme stocks like GameStop made a big splash in financial markets and led to bonanza earnings for market makers. If financial conditions continue to ease and animal spirits make a full comeback, it is not difficult to imagine Virtu delivering significantly better results in 2024.

Valuation Continues To Screen Attractive With Upside To Estimates

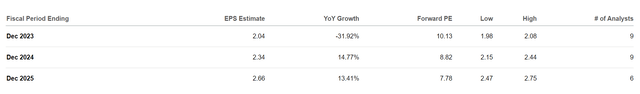

Valuation-wise, Virtu continues to screen attractive, trading at a 10.1x Fwd P/E based on consensus estimates for $2.04 in 2023 EPS. On 2024 earnings estimates of $2.34, Virtu is trading at 8.8x (Figure 6).

Figure 6 – VIRT EPS estimates (Seeking Alpha)

From Figures 5 and 6 above, we can see that consensus estimates basically assume the current NTI/day of ~$5 million will persist for most of 2024 and 2025.

However, if I am correct and animal spirits do return in 2024, then there is a significant upside to Virtu’s earnings. For context, in Q1/2021 during the meme-craze, Virtu’s NTI reached $11.9 million and Virtu earned $4.57 / share for the full year on $7.6 million in NTI.

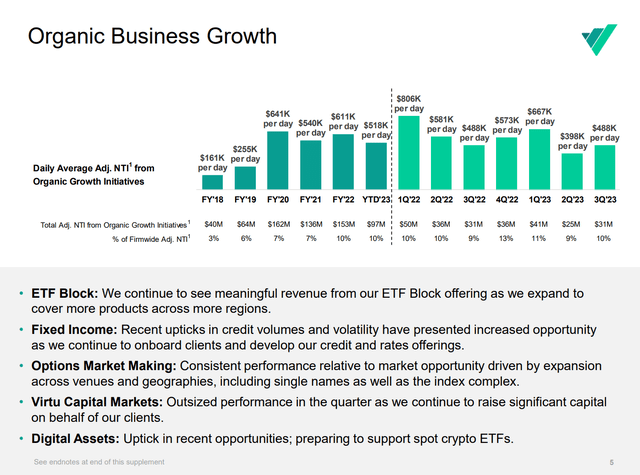

On the downside, if I am wrong and markets stay lethargic, I believe Virtu can still earn decent returns for investors as the company has made many investments to diversify its business into ancillary businesses like corporate bond trading and digital assets trading (Figure 7).

Figure 7 – Virtu has made big investments in ancillary businesses (VIRT investor presentation)

In fact, these organic growth initiatives have helped Virtu weather calm equity markets by adding more than half a million in NTI / day firm-wide.

Conclusion

Virtu remains one of my favourite holdings heading into 2024. On the upside, a return of animal spirits can potentially ignite a retail trading frenzy and lead to attractive returns for Virtu’s market-making business. On the other hand, if markets do suffer a recession/market correction as many pundits predict, Virtu also stands to benefit from increased market volatility. Even if markets remain calm, Virtu should continue to deliver attractive returns to investors based on investments in ancillary businesses like bond trading and digital assets trading. I continue to rate Virtu a buy.

Read the full article here

Leave a Reply