Investment Thesis

Virtu Financial, Inc.(NASDAQ:VIRT) has been on a downward trajectory, losing more than 17% over the last year. From a technical analysis perspective, the company was approaching its support zone, as will be discussed later in this analysis. However, the bearish trend has taken another dimension following the recent SEC’s lawsuit against VIRT.

In my view, this lawsuit has caused a lot of uncertainty, which has caused variations in trading volumes and share volatility. Its uncertain verdict further causes a potential future volatility catalyst, which adds to the expected Q3 earnings report on November 2023, which could be another short-term share volatility catalyst.

Following these uncertainties and guided by my technical analysis, this company can be a buy, sell, or hold depending on investor’s risk tolerance and their view and belief on the lawsuit’s potential outcome. As for me, I believe the best investment decision is to hold as we wait for further evidence and maybe the outcome of the lawsuit, especially for long-term-oriented investors.

The SEC’s Law Suit: How Has Events Unfolded?

The Securities and Exchange Commission charged Virtu Americas LLC and its parent company, Virtu Financial Inc. (collectively, Virtu), with making materially false and misleading statements and omissions about information barriers meant to prevent the misuse of sensitive customer information.

The lawsuit has triggered a massive sell-off of the company’s shares as investors reacted to the allegations of false and misleading disclosures and lack of information barriers to protect sensitive customer data. I believe it has also raised questions about the company’s reputation, compliance, and competitive advantage in the market. VIRT’s trading volumes and share prices have been affected by the SEC’s lawsuit in the following ways:

Trading volumes: Since the SEC announced the accusations on September 12, 2023, VIRT trading volumes have grown dramatically. In September 2023, the average daily trading volume of VIRT was 1.2 million shares, 32% more than the average daily trading volume of 0.9 million shares in August 2023. The highest trading volume of VIRT in September 2023 was 2.8 million shares on September 13, 2023, the day after the SEC’s statement.

Share prices: The company’s stock price has plummeted after the SEC announced the allegations. VIRT closed at $18.84 on September 12, 2023, 7.6% lower than the closing price of $20.38 on September 10, 2023, the last trading day preceding the SEC’s alert.

Aside from the company’s trading volumes and share volatility, The SEC’s lawsuit has had various long-term effects on VIRT’s share performance, including:

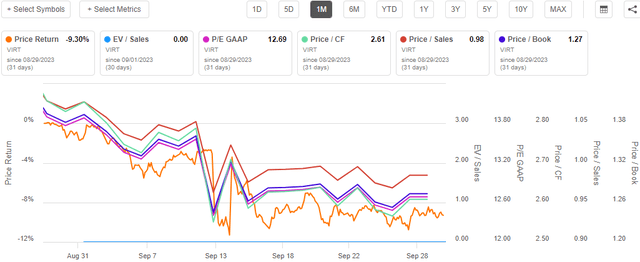

Valuation: The SEC’s action has impacted VIRT’s valuation, as investors have changed their expectations and opinions of the company’s future earnings and growth potential. Since the SEC’s statement, VIRT valuation indicators such as price-to-earnings (P/E), price-to-sales (P/S), price-to-book (P/B), and price-to-cash flow (P/CF) ratios have all decreased.

Seeking Alpha

Following the accusation, this may reflect the heightened risk and uncertainty inherent in the company’s business model and operations rather than indicating that the company is undervalued or desirable.

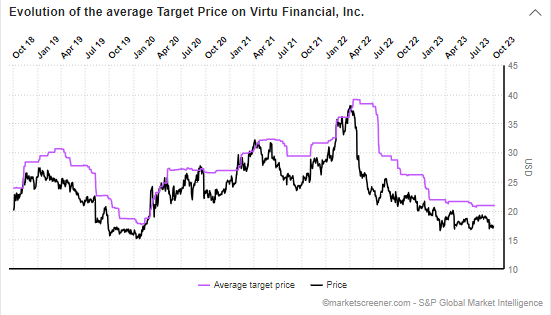

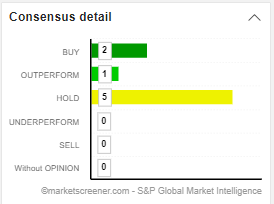

Sentiment: Since the SEC’s statement, VIRT’s analyst ratings, short interest, and put/call ratio have all declined, indicating that the market is more pessimistic about the company’s prospects. For example, the analyst consensus rating of VIRT has dropped from a buy to a hold, with a lower target price of $20.88.

Market Screener

Market Screener

Additionally, the short interest of VIRT has increased from 4.5% to 5.6%, indicating that more investors are betting against the company. Also, the put/call ratio of VIRT has risen from 0.5 to 0.8, meaning that more investors are buying put options to hedge or speculate on a decline in the company’s share price.

In conclusion, the SEC’s recent lawsuit has affected its trading volumes and share prices significantly in the short term and its valuation and sentiment negatively in the long term. The company may face further challenges and pressures from regulators, customers, competitors, and shareholders as it tries to resolve legal issues and restore its reputation and performance in the market, which could cause further volatility and a bearish trend.

Potential Short-Term Share Volatility Catalysts

Based on my evaluation, VIRT has two main potential drivers of short-term share volatility.

1. Possible Outcome Of The Law Suit

To begin is the possible outcome of the lawsuit. I believe the case could result in significant penalties, damages, or injunctions against VIRT, reputational harm, and loss of customer trust. It could also affect its competitive advantage and market position, as it may face increased regulatory scrutiny and compliance costs or lose access to certain trading venues or liquidity sources.

Based on my experience with similar cases, I believe the most likely outcome of this case would be a settlement. I believe so because a settlement may be preferable for both parties as it may avoid the time, cost, and uncertainty of litigation. The SEC may be willing to accept a settlement that includes a reasonable penalty, an admission or denial of misconduct, and specific corrective activities, such as improving information barriers, rules, and processes or employing an independent compliance expert. VIRT may be willing to reach an agreement that allows it to resolve legal issues and restore its brand and consumer confidence without admitting guilt or suffering harsher penalties.

To support my argument, I will refer to the SEC’s lawsuit against ITG Inc. and AlterNet Securities, Inc., which was similar to VIRT’s. The outcome of this case was a settlement in which ITG and AlterNet agreed to pay $20.3 million in disgorgement, prejudgment interest, and penalties, admit wrongdoing, and retain an independent consultant to monitor their compliance. Although a settlement may appear to be a better outcome, it has adverse effects on the stock performance. While referring to my case study to support my assertion, ITG’s share price declined by 23.5% on July 29, 2015, the day the SEC announced the charges, from $22.58 to $17.27. The share price continued to decline in the following days and weeks, reaching a low of $14.01 on August 24, 2015, which was 38% lower than the closing price on July 28, 2015. Further, ITG’s trading volume remained high in the following days and weeks, averaging 2.4 million shares per day in August 2015.

In conclusion, based on the ITG case, it is possible that Virtu may face a similar or worse outcome, such as a large fine, an admission of wrongdoing, or a loss of customer trust and market share. This may have a negative impact on Virtu’s share price and trading volume in the short term and the long term. Therefore, investors should be cautious and closely monitor the situation before making investment decisions.

2. Expected Q3 Earnings Report

The second catalyst is the release of VIRT’s third-quarter earnings report, expected on November 2, 2023. I expect the earnings report to provide an update on its financial performance and outlook, as well as its business strategy and initiatives. The market may compare its results with the analysts’ expectations and evaluate its growth potential and profitability in the current market environment. The earnings report may also include any guidance or commentary on the SEC’s lawsuit and its implications for its operations and future plans. Depending on the prevailing conditions, especially the lawsuit, the most possible outcome of VIRT’s expected Q3 2023 earnings is that the company will likely miss the consensus estimate of $0.33 per share and report lower earnings per share of about (EPS) of $0.29. This is because the case may have a negative impact on VIRT’s revenue and profitability in Q3 2023, as it may affect its customer confidence and trust, its competitive advantage and market position, and its regulatory scrutiny and compliance costs. In a nutshell, I expect a weak Q3 2023 earnings report.

Technical Analysis

Technical indicators, such as moving averages, trend lines, and oscillators, can be used to analyze VIRT from a valuation perspective. These indicators help determine the direction and strength of the price trend, as well as potential support and resistance levels, breakout or breakdown points, and overbought or oversold conditions. Here is my technical analysis;

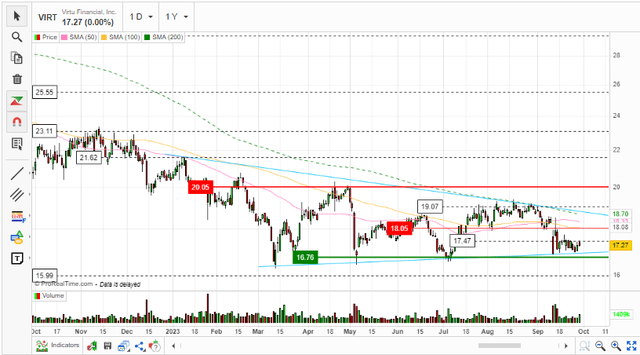

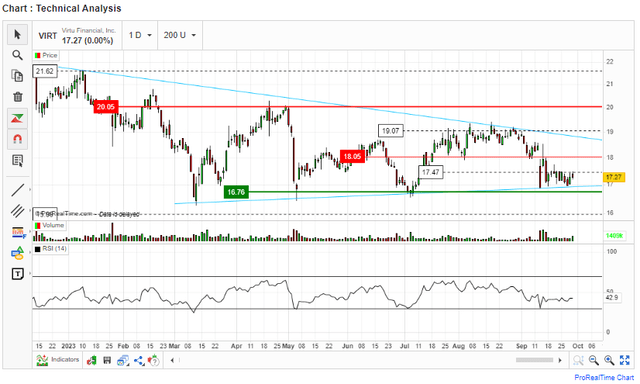

Moving averages: VIRT is currently trading below its 50-, 100-, and 200-day moving averages, indicating that it is in a downtrend with negative momentum. The 50-day moving average is also lower than the 100- and 200-day moving averages, indicating that the short-term trend is weaker than the long-term trend. However, the gap between the moving averages is closing, implying that the downtrend is losing pace and a reversal is possible.

Author’s Technical Analysis On Market Screener

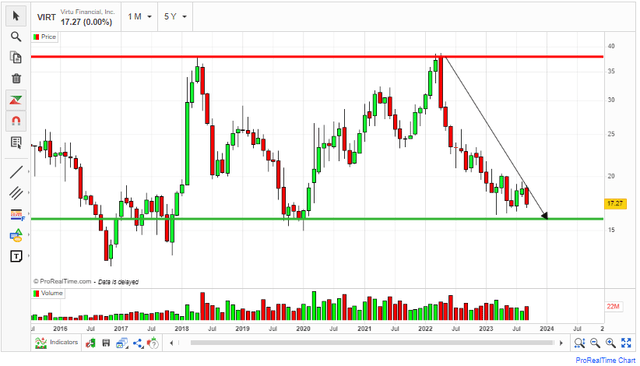

Trend lines: The company has been trading within a descending channel since April 2022, which indicates that it is in a bearish trend and has a negative slope. The upper trend line (red line) acts as a resistance level, while the lower trend line (green line) acts as a support level. VIRT is recently approaching the lower trend, suggesting it may face some buying pressure near the support level. However, with the current lawsuit, it is possible that the company may break the resistance zone and form a new lower line based on the intensity of the adverse effects the suit may have on the company.

Author’s Technical Analysis On Market Screener

Oscillators: VIRT’s relative strength index [RSI] is currently at 42.9, indicating that it is neither overbought nor oversold but is closer to the oversold level than the overbought level. The range is normally 0-100, but a stock is considered oversold when below 30 and overbought when above 70. With this value of 42.9, the stock may have some downward pressure on its price, which may accelerate the lawsuit. If the case turns against the company, it may force the RSI past 30, translating to being oversold.

Author’s Technical Analysis On Market Screener

VIRT’s technical analysis shows it is in a downtrend and has a negative valuation outlook based on its moving averages, trend lines, and oscillators.

Technicals’ Dependency On The Law Suit Outcome

Considering my belief that this case may be resolved through a settlement, I believe this will influence the direction of the technical indicators. For instance, the outcome, as shown by the case study in my analysis, would push the company’s share prices to new lows, which will definitely push VIRT’s support line below its current support line, maybe to as low as $12.79 which has been the lowest support line for the last 10 years. As a result of the bear trend below the current support zone, I expect more investors to sell their shares to avoid losses that may take the RSI to as low as 30 pushing the shares to over sold zone.

Investment Decisions: Buy, Hold, Sell

On evaluating VIRT, it is faced with uncertainties arising from the SEC lawsuit. This is viewed alongside the technical analysis; here are my possible investment decisions for investors depending on their risk tolerance.

Buy Decision: Buy VIRT shares if you believe that the SEC’s lawsuit will be resolved favorably for VIRT and that the company will resume its growth and profitability in the future. You can use the support as an entry point($16.76) and set a stop-loss below the lower trend line or below $16.00 to limit your losses in case of a breakdown.

Sell Decision: Sell VIRT shares if you believe that the SEC’s lawsuit will negatively impact the company’s future reputation and performance. You can exit anywhere above the support zone because the moving average and the RSI point to a downward trend. If you believe the lawsuit will have a negative effect, it will result in a break out past the support line, resulting in a new support zone that will translate to more losses.

Hold decision: Hold VIRT shares if you are uncertain about the outcome of the SEC’s lawsuit and its effect on its business model and operations. You can wait for more clarity and evidence before making any decision.

Given these possibilities, I would opt for a hold decision while I await additional information on the case’s trajectory. This patience will also provide more clarity on technical analysis indicators, allowing for better decisions rather than acting on assumptions and uncertainties.

Read the full article here

Leave a Reply