Introduction

Viridian Therapeutics (NASDAQ:VRDN) is a biopharmaceutical firm committed to creating best-in-class medicines for rare and serious illnesses, specifically where existing treatments fall short. The company’s lead program, VRDN-001, a monoclonal antibody that inhibits insulin-like growth factor-1 receptor (IGF-1R), targets thyroid eye disease [TED] and has shown encouraging clinical proof-of-concept. Viridian is also developing subcutaneous versions of its drugs for convenient self-administration. With ongoing Phase 3 trials and partnerships for drug delivery, the company aims for market differentiation and enhanced patient outcomes.

Recent Developments: Viridian’s stock dropped 20% after phase 1/2 data on VRDN-001 showed mixed results; company amended future trial design.

The following article analyzes Viridian’s financial health, ongoing trials, and market potential. It details mixed results for its lead drug, VRDN-001, and suggests selling the stock due to high risks.

Q2 Earnings Report

Looking at Viridian’s most recent earnings report, cash and equivalents decreased to $334.3M from $373.9M in the previous quarter, projected to last until the second half of 2025. R&D expenses nearly doubled to $40.1M, driven by manufacturing and clinical trials, among others. G&A expenses also increased to $19.3M, mainly due to personnel and professional fees. These rising expenses contributed to a net loss of $55.1M, up from last year’s $29.5M.

Cash Runway & Liquidity

Turning to Viridian’s balance sheet, as of June 30, 2023, the company has cash and cash equivalents of $87.1M, short-term investments of $247.2M, totaling $334.3M in highly liquid assets. In terms of monthly cash burn, the “Net cash used in operating activities” for the six months ended June 30, 2023, was $107.2M. This equates to a monthly cash burn of approximately $17.9M. Given the negative operating cash burn, the company’s cash runway can be estimated to be around 18 months ($334.3M / $17.9M). It’s worth noting that these values and estimates are based on past data and may not be indicative of future performance.

The company’s liquidity status appears stable for the short term, although the monthly cash burn is a point of concern. Viridian carries long-term debt of $4.7M, which is minimal in comparison to their liquid assets. Based on these numbers, it’s reasonable to speculate that the company is in a position to secure additional financing, if necessary, either through debt or equity channels. These are my personal observations, and other analysts might interpret the data differently.

Capital Structure, Growth, & Momentum

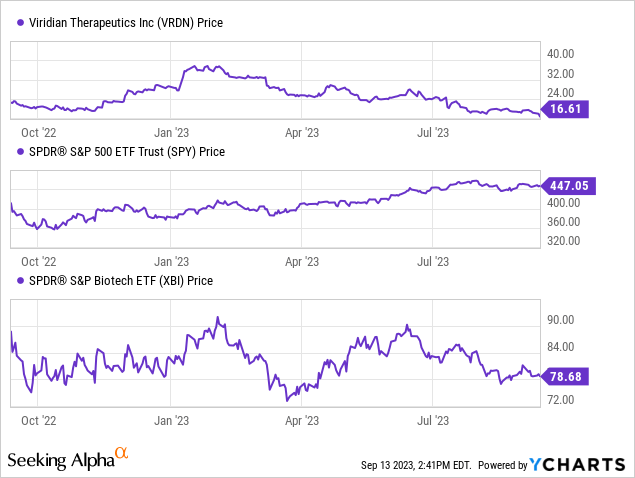

According to Seeking Alpha data, Viridian demonstrates a relatively robust capital structure with significant cash holdings and minimal debt, reflecting an enterprise value of $582.70M. Analysts project revenue growth in 2025, signaling high potential for future earnings, especially with ongoing Phase 3 trials for its lead program, VRDN-001. However, stock momentum is poor, significantly underperforming the S&P 500 across all measured timelines.

Viridian’s Mixed Results in Chronic TED Trial

The Phase 1/2 trial for Viridian’s drug VRDN-001 in chronic TED showed that the drug is generally well-tolerated and led to some reduction in eye protrusion and clinical activity scores. However, it didn’t improve diplopia (double vision) – a key feature of TED. Future Phase 3 trials are planned, and results are anticipated by the end of 2024. Viridian is also advancing subcutaneous versions of the drug, with initial data expected later this year.

The market’s lukewarm response to Phase 1/2 data could be due to a few reasons. First, the drug’s inability to treat diplopia might narrow its clinical utility. Second, the improvements in eye protrusion and activity scores, while promising, do not, in my view, appear drastically better than what’s already available.

Regarding the subcutaneous programs, there’s a sense of cautious optimism. While Viridian has completed formulation work, this doesn’t guarantee clinical success or scalability. Shifting from intravenous to subcutaneous delivery could also bring about new safety concerns and/or dampened efficacy, which may be contributing to market skepticism about the company’s ambitious timelines.

My Analysis & Recommendation

In summary, Viridian presents a conundrum for investors. On one hand, there’s promise in VRDN-001 and its applicability in treating TED. On the other, the recent mixed data and the high cash burn rate raise red flags. Investors should keep a keen eye on the company’s upcoming Phase 3 trial results, expected by the end of 2024, as well as any interim data on subcutaneous drug versions.

Here’s what’s critical in the near term: the market has priced in the mixed results of VRDN-001, making the stock potentially undervalued if the Phase 3 trial succeeds. However, the road to that success is fraught with hurdles such as meeting clinical endpoints and managing safety concerns, particularly with the switch to subcutaneous administration. With the cash runway estimated at 18 months, any hiccup in trials or delays in securing additional funding could spell trouble.

Considering all these factors, my investment recommendation is “Sell.” The current level of risk, in my opinion, outweighs the potential for short- or medium-term gains. While Viridian has decent liquidity, its clinical pipeline still needs to prove itself. Offloading now could mitigate potential downside risk, especially given the recent 20% stock drop. Better to sidestep uncertainty until Viridian demonstrates more compelling clinical efficacy and a clear path to market.

Risks to Thesis

In my evaluation of Viridian, I may have overlooked the potential for strategic partnerships or buyouts that could validate Viridian’s technology and boost stock value. I might also have underestimated the impact of the firm’s robust capital structure, which could attract institutional investors. Positive Phase 3 results, due by end of 2024, could drastically re-rate the stock, making a “Sell” call premature. The firm’s cash runway, although limited, might be sufficient to reach critical value-driving milestones. Underestimating the unmet medical need for TED and the potential market size could be a bias. Given the company’s focus on differentiated drug delivery, they may have a unique value proposition that I’ve undervalued.

Read the full article here

Leave a Reply