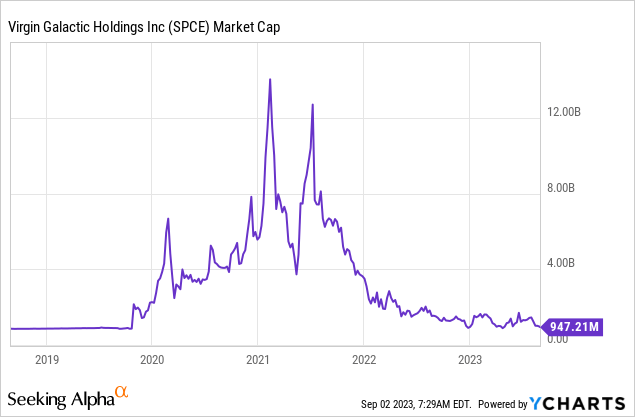

According to this news report from Seeking Alpha, Virgin Galactic (NYSE:SPCE) “is down 27% on a year-to-date basis amid a heightened focus on profitability”. It boggles my mind that as early as 2022 this company was trading at a high of $8 – $10.

Virgin Galactic is not the type of company investors should be looking at for “profitability”. SPCE stock is a speculative bet on the future of space tourism 5 to 10 years from now. The company has made several milestones in the past few months and I believe that this stock is now less risky than it was in 2022.

Commercial Flights Have Started

Virgin Galactic recently released its Q2 2023 financial results. SPCE shares slid after the release, which is a curious case as the company did very well this quarter. More important than any financial results, the company successfully completed two spaceflights in the quarter.

- Unity 25 – In which the astronaut training and spaceflight experience were evaluated by a group of experts

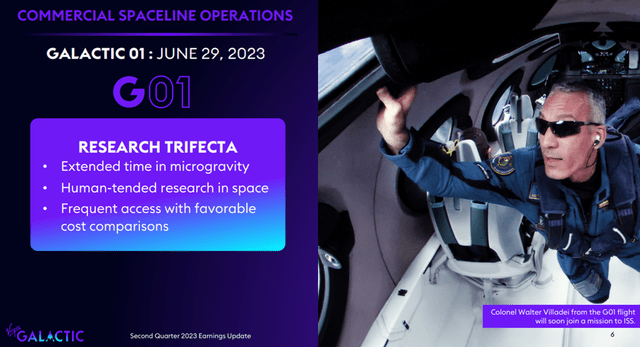

- Galactic 01 – The first official commercial space flight with research crews studying microgravity

The fact that these two flights went off without a hitch is fantastic news for the company and should be considered a significant milestone for SPCE stock. It basically means that Virgin Galactic is able to deliver the product it promises.

There are so many speculative stocks in the market where a company is sold on the promise of a future product, all while Management is carefully crossing its fingers that it would have enough cash on hand until the product is finally here.

I believe this is no longer the case for Virgin Galactic, as the company now has at least a “Minimum Viable Product” that it can sell and market. Therefore, it’s weird to me that the company is trading at all-time lows. SPCE stock reached a high of $60 when the company was nothing more than an idea and presentation. Now that commercial space flights are actually here, the market actually sent the stock down after the results.

Galactic 01 (Q2 Investor Presentation)

Virgin Galactic announced that the Galactic 03 will have a flight window in early September. This is the third commercial spaceflight and the fourth mission in four months. For me, though, this will be the most significant flight so far as it will be the first to fly the company’s first customers. In other words, it’s the first “normal people” flight (not taking into account the huge sum of money paid).

Some of these customers have bought their tickets as early as 2005, so it will be good to see their reactions to this experience as they have waited a long while for it. Assuming the success of Galactic 03, I foresee the company ramping up its number of flights in the coming months.

Liquidity Risk

Looking at the company’s most recent Q2 2023 results, it seems as though Virgin Galactic’s liquidity position is still reasonably solid. The company reported cash equivalents and marketable securities of $980 million as of Q2 2023. This is a small increase from the $874 million reported in Q1 2023.

The company has a strong balance sheet with Total Liabilities of $662 million compared to Total Assets of $1.14 billion. Thanks to the recent increase in short-term interest rates by the Fed, Virgin Galactic’s interest income ($15.7 million YTD) is actually higher than its interest expense ($6.4 million YTD).

The only thing Virgin Galactic needs is a source of Revenue and Income to halt its cash burn rate. In Q2 2023, the company reported Revenues of $2 million compared to $0.4 million at the same time last year, mainly due to the recent commercial spaceflights. The company reported a Net loss of $134 million for the quarter, which is a tad higher than the $111 million loss reported in Q2 2022.

Adjusted EBITDA and Net cash burn for operations were similar, at $(116) million and $(125) million, respectively. Using these metrics for a cash burn of $100 million to $125 million, it would stand to reason that the company has a run rate of about 7.8 to 9.8 quarters before it runs out of liquidity.

However, this is assuming that the company continues to have no operations, which may not be the case. The company is selling tickets at $450,000 a piece for this space flight. Currently, there are 800 people on the waitlist for a flight. It is my view that with a few successful flights on its belt, Virgin Galactic would be able to accelerate ticket sales and even hike up the prices even more.

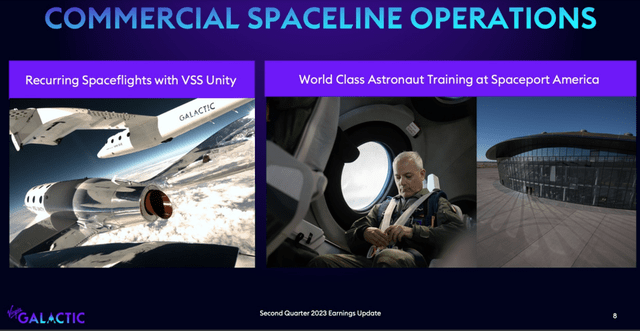

Virgin Galactic images (Q2 Investor Presentation)

The sales of space tickets would not be affected by the current macro-environment, as the ultrarich are practically immune from the effects of a recession or other concerns. What does worry me a bit – and what I view as a key risk, is the possible hesitancy due to the recent Titan submersible tragedy.

News of the Titan tragedy shocked and captivated the world. Especially when it came out that the submersible had a questionable design and that safety concerns were pushed to the side. Space tourism hasn’t had a high-profile disaster quite yet but risk always remains. For example, SpaceX recently had its latest prototype explode in a giant fireball.

While I am confident about the amount of safety and precaution Virgin Galactic has taken, the incident could cast a shadow on this type of “risky” tourism. Ultimately, though, these types of high-risk travel hold an appeal for the ultra-wealthy. I am confident that Virgin Galactic will be able to generate the necessary sales for its trips.

Conclusion

The space tourism industry is expected to grow at a rapid rate of 38.6% CAGR to 2033 reaching a valuation of $13.2 billion. I believe it will continue to grow exponentially for decades to come once more and more its potential is unlocked.

The company is now trading at a Market cap of $947 million, the lowest it’s been for years. If the company can capture even a small portion of the industry, I believe SPCE stock can 2-3x from these levels.

Virgin Galactic is one of the only pure plays in this industry currently listed on the stock market. While I am not sure if SPCE stock will head lower from here, I think the company might be worth a speculative buy at these levels.

Read the full article here

Leave a Reply