It was just reported that U.S. companies paid out a record amount of dividends in the first quarter of 2024. This shouldn’t come as a surprise, considering the stout levels of profits and free cash flow domestic large caps are generating as AI investment runs wild and U.S. employment trends remain very healthy.

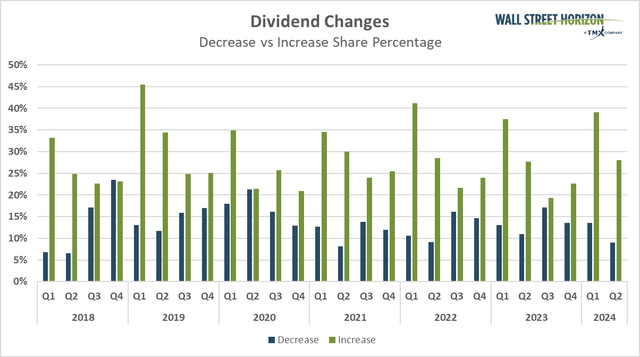

Furthermore, according to data from Wall Street Horizon, the second quarter is tracking as another beefy period of payouts – more firms are announcing dividend hikes since April 1 compared with tracking from a year ago at this time.

I reiterate a buy rating on the Vanguard Dividend Appreciation Index Fund ETF Shares (NYSEARCA:VIG). The fund’s yield is close to 2% while offering investors earnings growth through its diversified construction and management processes. Its technical chart is also encouraging as we enter a historically healthy period of the year.

WSJ: Record Dividend Payments in Q1

WSJ

Q2 Dividend Increase Announcement Tracking High

Wall Street Horizon

According to the issuer, VIG seeks to track the performance of the S&P U.S. Dividend Growers Index and employs a passively managed, full replication indexing approach. The ETF contains large-cap equities, with an emphasis on owning shares of firms that grow their dividends year over year. It can be seen as a “dividend aristocrat” ETF.

Since I last reviewed VIG last winter, total assets under management has increased from $88 billion to $90 billion. Its annual expense ratio is very low at just six basis points, while the fund earns an A ETF Grade from Seeking Alpha as it pertains to its yield. VIG is also a relatively low-risk product when analyzing historical standard deviation trends and its level of diversification.

With an A+ liquidity rating, given average daily volume of more than 700,000 shares and a median 30-day bid/ask spread of only a single basis point. Finally, share-price momentum, which I will detail later, appears quite robust.

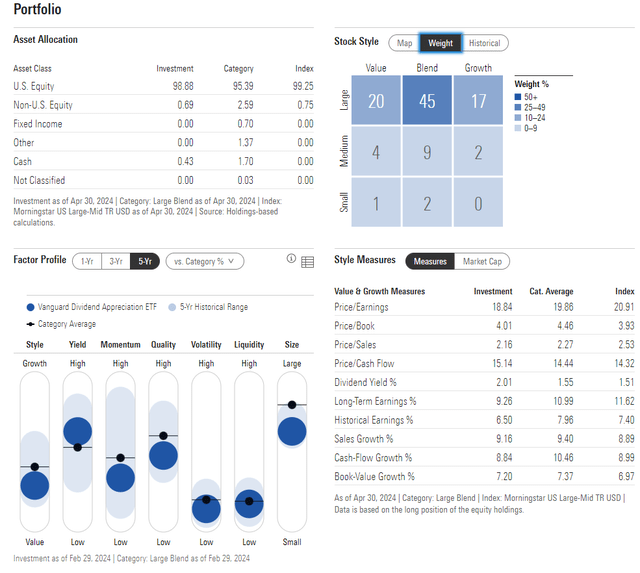

Upon closer inspection of the portfolio, the 3-star, Gold-rated ETF by Morningstar has primarily large-cap U.S. exposure. Still, there’s a material 18% position in domestic SMID caps. What I like about the strategy is that it’s not a high-yield allocation.

Rather, by focusing on dividend aristocrats, investors access firms with potentially fast-growing earnings per share. What’s more, VIG’s price-to-earnings ratio is about unchanged from January – under 19 – while its long-term EPS growth rate is solid above 9%.

VIG: Portfolio & Factor Profiles

Morningstar

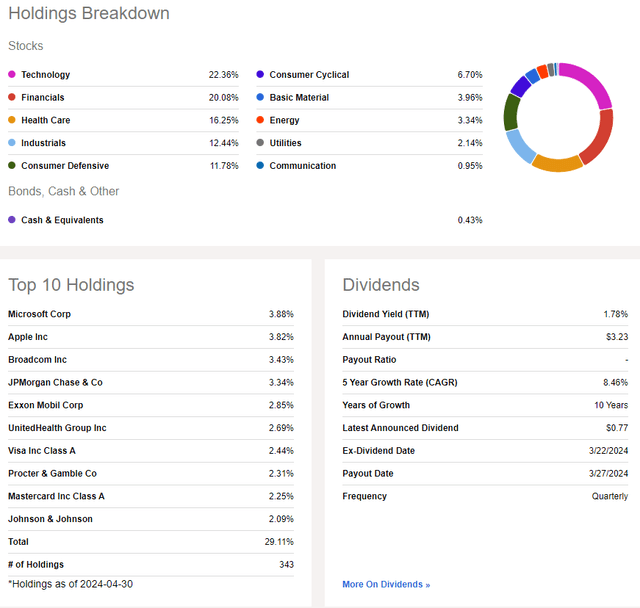

VIG’s current allocation is a mix of growth and value equities. The biggest sector weight is Information Technology at more than 22%, though that is about a seven-percentage-point underweight compared to the S&P 500 (SP500).

I noticed there has been an uptick in both Financials and Health Care in terms of those areas’ net weights compared to several months ago. Utilities, which has been leading the market for much of the year, is just 2% of the fund, however.

VIG: Holdings & Dividend Information

Seeking Alpha

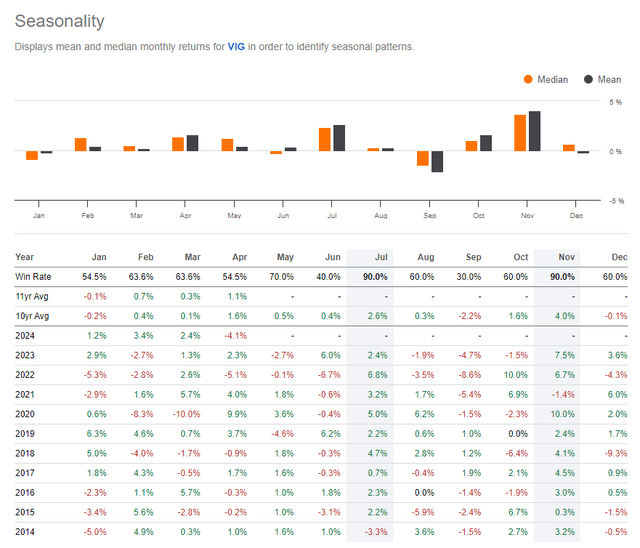

Seasonally, the April through July stretch is historically bullish. Additionally, during election years, U.S. large caps broadly tend to do well starting around Memorial Day.

Finally, when the SPX is up 10% or more through 100 trading days of an election year, per BofA, investors can expect more gains through year-end. So, there are bullish seasonals and analogs to consider for VIG in my view.

VIG: Bullish Seasonality Continues Through July

Seeking Alpha

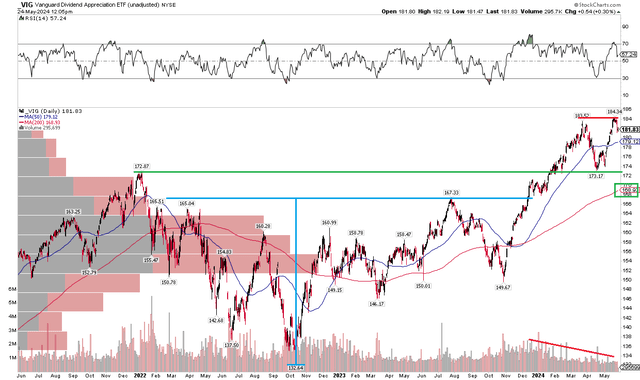

The Technical Take

With a solid GARP-type valuation, a diversified mix of U.S. stocks, and a solid yield, VIG’s technical picture is sanguine. Notice in the chart below that shares rallied through resistance in the low $170s. Shares rose to a new all-time high of $183 in March before successfully retesting the breakout point – just what technicians like to see. Today, a new area of selling pressure has revealed itself – the low to mid-$180s. I don’t see it as much trouble given that the RSI momentum gauge at the top of the graph remains strong and VIG’s long-term 200-day moving average is still positively sloped, suggesting that the bulls are in control.

Also take a look at what could be a long-term price objective. The range high from early 2022 through late last year is near $165 with a base of $133. That $32 range, added on top of the $167 breakout point, would yield an upside measured move price target of $199. So, another 10% more technical upside from today’s price is certainly doable through year-end.

Overall, VIG’s technicals appear favorable for further gains into the end of Q2 and the start of the second half of 2024.

VIG: Bullish Breakout To New All-Time Highs, Rising 200dma

Stockcharts.com

The Bottom Line

I reiterate a buy rating on Vanguard Dividend Appreciation Index Fund ETF Shares. I see this dividend aristocrat ETF as a solid long-term holding with a decent current valuation. Technicals and historical trend analysis also appear conducive to further strong performance.

Read the full article here

Leave a Reply