If you’re new to investing and are interested in growing your wealth over the long term while earning dividends, the Vanguard Dividend Appreciation ETF (NYSEARCA:VIG) might be a good fit for you. This is true even if you aren’t new to investing and would rather have the safety and stability that a high quality ETF offers. I understand there are a lot of investors out there who do not enjoy the process of manually hand picking a basket of holdings for their portfolio and would make rather own a high quality ETF. VIG is like a “set it and forget it” option for wealth building and dividend growth.

Overview

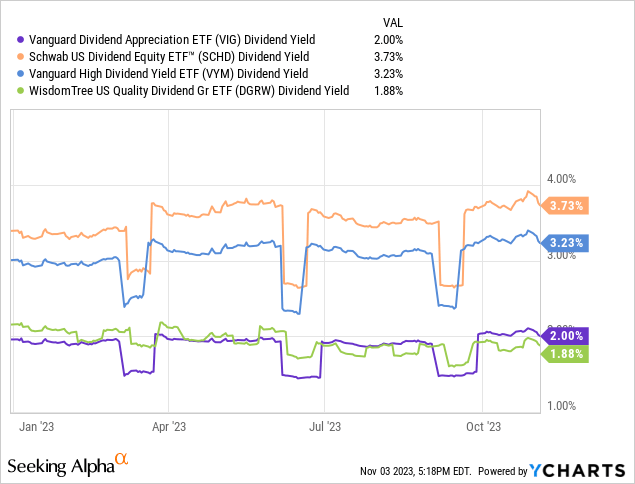

The Vanguard Dividend Appreciation Index Fund (VIG) is an exchange traded fund that focuses on companies in the United States known for growing their earnings and dividends. In simpler terms, it invests in companies that have a track record of regularly increasing their profits which over time has proven to be a successful investment strategy. The starting dividend yield is on the lower end at only 2%, but this is okay as the fund has captured upside price appreciation relatively well over the last decade. Like I mentioned previously, there are a bunch of investors that do not wish to hand pick individual stocks. This is a totally valid choice as individual stocks also welcome individual risks. The cost of owning VIG is relatively low also with an expense ratio of only 0.06%. Ultimately, ETFs like VIG make it very easy to grow your wealth over time and what makes VIG a great fund are three simple things.

- Blended Portfolio Structure

- Focused On Dividend Growth

- Total Return Potential

Portfolio

Vanguard

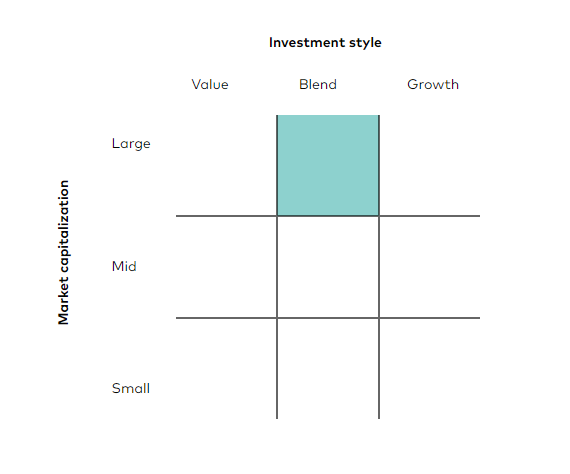

One of the things I really like about VIG is the blended portfolio style between value and growth holdings. This means you will have a mix between companies that grow their earnings exponentially or sporadically as well as companies that slow at a much slower but consistent rate and are known to be stable dividend payers. Taking a looking at the top ten holdings of the ETF as well as taking a look at the sector breakdown, we can see this is true.

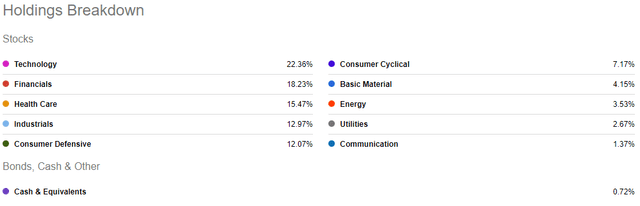

Seeking Alpha

Technology holds the most weight in VIG which helps it capture the huge upside movement produced by stocks like Apple (AAPL), Microsoft (MSFT), or Broadcom (AVGO). Technology accounts for 22% of the total weightings and it is closely followed by financials coming in at 18%. The top ten holdings are currently comprised of well-known, ultra stable, high quality companies that have historically provided shareholders with exponential returns. This top ten includes:

- Microsoft (MSFT): 4.85%

- Apple (AAPL): 4.32%

- Exxon Mobil (XOM): 3.39%

- UnitedHealth Group (UNH): 3.36%

- JPMorgan Chase (JPM): 3.03%

- Johnson & Johnson (JNJ): 2.7%

- Visa (V): 2.55%

- Procter & Gamble (PG): 2.49%

- Broadcom (AVGO): 2.39%

- Mastercard (MA): 2.38%

These top ten holdings account for roughly 32% of the fund’s total portfolio value. The fund’s strategy is to search within the market value range of companies found in the S&P U.S. Dividend Growers Index, valued with a market capitalization between $447 million to $1.8 trillion. The fund’s portfolio turnover rate for 2023 is only 12% and has an expense ratio of only 0.06%.

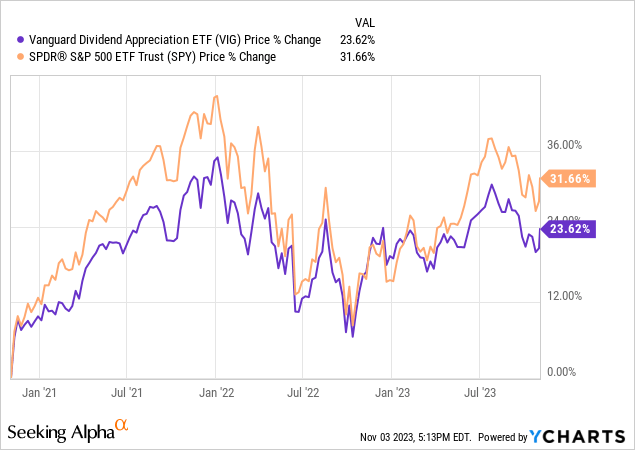

Since the fund has a large portfolio of its holdings in value based positions, that should result in a lower level of volatility. In theory, this means that VIG should hold up better than alternatives during any prolonged market downturn. This has its positives and negatives. The positive being that less volatility means an easier investing experience for shareholders. The negative side of that would mean that you may not be capturing all of the same price growth that the S&P500 (SPY) does as seen by the chart below.

Dividend Growth Benefits

One key advantage of VIG is that it provides a diversified way for investors to put their money into companies that regularly increase their dividends. The top holdings in VIG are known for growing their dividends, which means your dividend income from VIG should increase over time. If you reinvest those dividends, you can steadily build wealth and a snowball of growing dividend income. This is an excellent opportunity for individuals seeking to establish a secure and dependable source of passive income as it grants you peace of mind that you hold top tier companies.

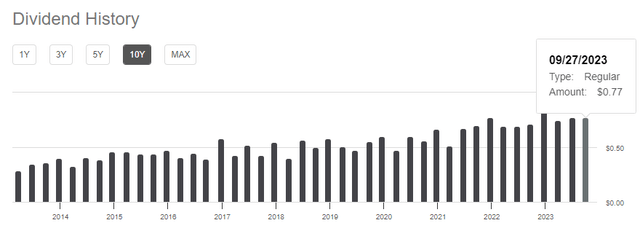

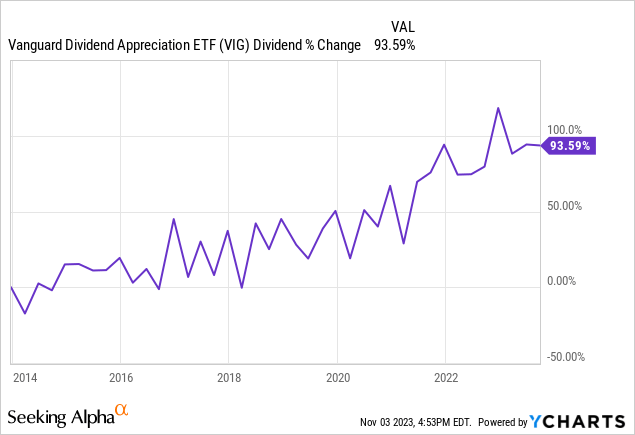

At the moment, the current 5 year CAGR of the dividend sits at 9.52%. This is above the sector median growth of only 5.8%. The dividend has been increased for 9 consecutive years in a row. We can see the dividend per share trajectory slowly curving upward over the last decade.

Seeking Alpha

Forward looking, I expect this to growth to continue as inflation cools down and interest rates start to come down over time. This will result in better earnings growth, increased consumer spend, and a healthier economy to increase the value of the companies. in VIG’s portfolio. VIG is essentially a bet on a growing US economy.

Performance Comparison

We will now test VIG’s performance compared to some of the most popular dividend focused ETFs out there. Although each of these ETFs may share different internal strategies, their overall focus. of distributing dividend income while also providing capital appreciation remains the same. Some of the most popular dividend ETFs out there are:

- Schwab’s High Dividend ETF (SCHD)

- Vanguard’s High Yield Dividend ETF (VYM)

- WisdomTree’s Quality Dividend Growth ETF (DGRW)

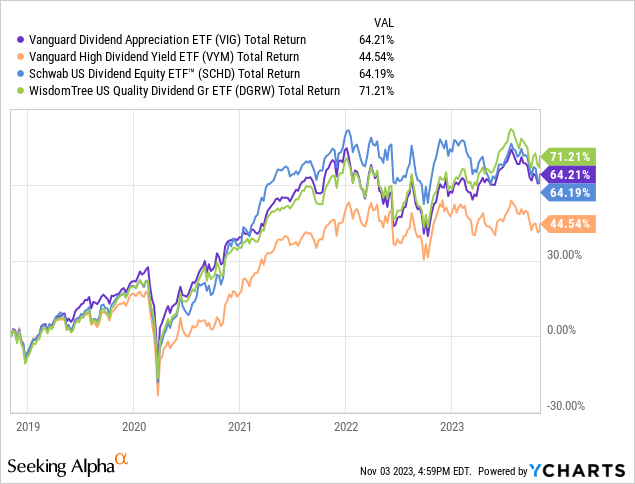

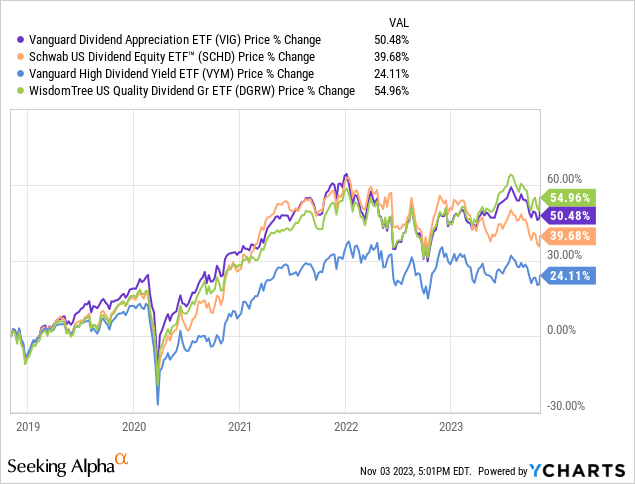

We can see that when compared against the peer group over a five year time period, VIG comes out in the middle of the pack in terms of total return. However over the same timeline, if we only compared price growth, we’d see that VIG captures more upside than both SCHD and VYM. I believe this goes back to the exposure VIG has to growthier companies in the tech sector.

In both of these scenarios, DGRW outperformed VIG by a margin. I do think when comparing these ETFs it ultimately comes down to preference. Each of these ETFs suit different investor needs and ultimately, VIG better suits the investor that wishes to see more price growth in their holding rather than income. Whichever route you go, I think VIG offers a solid choice to support a bet on a growing US economy over the next decade. This is especially true for the investor that wants a stress free portfolio makeup.

Cons

As you’ve just seen, DGRW outperforms the VIG in both total return and capital appreciation. Also, SCHD’s starting dividend yield is nearly double of VIG’s. VYM’s starting dividend yield is also much higher than VIG’s. Depending on when you start a position, it’s entirely possible to get more income from SCHD while simultaneously capturing a total return that is similar to VIG.

This stems back to the portfolio construction and how some of VIG’s value based holdings may soften the growth experienced within other sectors of the portfolio. While this isn’t a direct comparison to SCHD, we should also note that SCHD’s 5-year CAGR of the dividend is higher at 13.7% compared to VIG’s 9.52%.

Takeaway

The Vanguard Dividend Appreciation ETF (VIG) presents a compelling option for investors, whether you’re new to the investment world or seeking a safe and stable income source. VIG’s unique blend of value and growth holdings in a diversified portfolio is like a “set it and forget it” strategy for wealth-building and dividend growth. VIG’s emphasis on dividend growth is especially appealing, with a 5-year CAGR of 9.52%, outperforming the sector median. As inflation cools down and interest rates decrease, VIG is well-positioned for continued growth and increased consumer spending, making it a bet on a flourishing U.S. economy.

When comparing VIG to peer dividend-focused ETFs, it holds its ground in terms of total return, and its exposure to growth-oriented tech companies contributes to stronger price appreciation. While some competitors might offer higher starting dividend yields, VIG’s strategy aims for a balanced approach between income and growth, making it an excellent choice for investors looking for a stress-free portfolio that can thrive over the long term.

However, it’s essential to recognize that certain peers, such as DGRW, outperform VIG in total return and capital appreciation, and SCHD offers a higher starting dividend yield. Ultimately, the choice depends on your investment goals and preferences. Whether you’re new to investing or a seasoned investor seeking a reliable income source, VIG’s stability and dividend growth potential make it a solid choice for those looking to build wealth with peace of mind.

Read the full article here

Leave a Reply