The VTRS Investment Thesis Remains Decent For Dividend Hunters

We previously covered Viatris Inc. (NASDAQ:VTRS) in March 2022, discussing its uncertain prospects as the company delivered an underwhelming FQ4’21 revenues then.

At that point, part of the pessimism was likely also attributed to the sale of its Humira biosimilar, Hulio, to Biocon. With Humira generating an exemplary FY2022 sales of $21.23B for AbbVie Inc. (ABBV), Mr. Market was likely uncertain about VTRS’ growth prospects as its branded/ biosimilar offerings stagnate.

Unfortunately, VTRS has lost another chance at growth, with the US patent office denying two of its challenges to Novo Nordisk’s (NVO) existing patent on the best-selling weight-loss therapy, Wegovy.

For now, NVO’s Wegovy/ Ozempic and Eli Lilly’s (LLY) Mounjaro have been heralded as the next golden goose in the biotech/ pharmaceutical sector, thanks to the unprecedented consumer demand and consequently, tight supply.

Interested investors may read more about the LLY stock in our previous article linked here and here.

Mark Purcell, a Morgan Stanley European Biopharmaceuticals analyst, also projects a drastic expansion in the global weight loss drug market size from $2.4B in 2022 to $77B in 2030, increasing at a CAGR of +54.27%.

These headwinds suggest that VTRS may unfortunately miss the future gravy train for the best selling drugs in the world, naturally hampering its growth prospects.

This is especially since the pharmaceutical company will have no part in the Humira biosimilar sales, with Wegovy/ Ozempic boasting an elongated patent protection through 2031 and Mounjaro through 2036 in the US/ 2037 in the EU.

For now, VTRS’ top five revenue drivers have also been declining over time to $938M in the latest quarter (-3.8% QoQ/ -4.8% YoY), naturally impacting its overall top-line growth to $15.56B (-9.1% sequentially) over the last twelve months, compared to the post spin off FY2021 sales of $17.81B.

Then again, the pharmaceutical company has also attempted to optimize operating costs to $4.43B over the LTM (+1.3% sequentially), compared to FY2021 operating expenses of $4.98B.

These efforts have allowed VTRS to maintain its operating margins steady at 14.8% (-3.3 points sequentially) and Free Cash Flow generation at 13.6% (-4.3 points sequentially) over the LTM, not too far from FY2021 levels of 15.5% and 14.3%, respectively.

These have also allowed the pharmaceutical company to consistently deleverage its balance sheet to $17.24B by the latest quarter (-4.5% QoQ/ -10.2% YoY), down from the post merger levels of $22.42B.

Furthermore, the VTRS management has unlocked another $5.2B through the divestiture announced on October 01, 2023.

Based on the latest update, it appears that the pharmaceutical company may be able to achieve its gross leverage target of 3x by H1’24, down from the current ratio of 3.5x, based on its FQ2’23 annualized adj EBITDA of $4.92B and long-term debts of $17.24B, and FY2021 levels of 3.74x.

In addition, the sustained deleveraging efforts have directly contributed to its lower annualized FQ2’23 interest expenses of $574.8M (-2.2% QoQ/ -1.5% YoY), naturally contributing to its expanding adj EPS of $0.22 by the latest quarter (+15.7% QoQ/ -15.3% YoY).

As a result, while there may be minimal growth moving forward, we believe that the VTRS management’s deleveraging efforts have been commendable, while allowing the dividend payouts to remain sustainable.

So, Is VTRS Stock A Buy, Sell, or Hold?

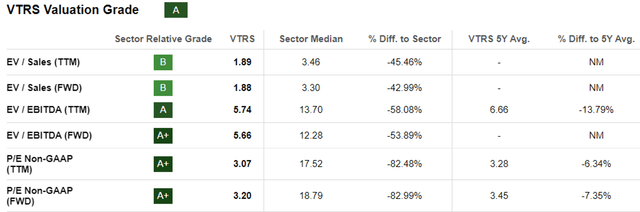

VTRS Valuations

Seeking Alpha

The same growth headwind has also been embedded in VTRS’ lower FWD valuations compared to the sector medians, implying that most of the pessimism is already priced in.

Based on the management’s FY2023 adj EBITDA guidance of $5.2B (-10% YoY) at the midpoint and its FQ2’23 share count of 1.2B, we are looking at an estimated adj EBITDA per share of $4.33.

Combined with its FWD EV/ EBITDA valuation of 5.66x, we are looking at a fair value of $24.50, implying that VTRS is undervalued at current levels. The same has also been suggested in its balance sheet, with the stock trading below its book value of $17.38 (inline QoQ/ +6.3% YoY).

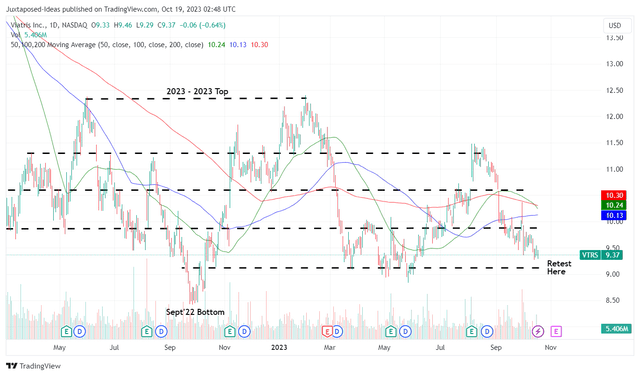

VTRS 2Y Stock Price

Trading View

Despite so, VTRS has also been unable to retain much of its gains since the merger in November 2020, with the stock also currently retesting its critical support levels of $9s.

However, we believe that these levels offer opportunistic investors with the improved upside potential of +148.7% to our long-term price target of $23.31, based on the consensus FY2025 adj EBITDA estimates of $4.95B and the projected adj EBITDA per share of $4.12.

VTRS’s Dividend Per Share Growth for the past three years have also been more than decent at +3.76%, compared to the sector median of +2.86%. Its dividend likely remain safe as well, based on the TTM Free Cash Flow Yield to Dividend Yield Ratio of 3.53%, compared to the sector median of 2.29%.

As a result, we believe that its income investment thesis remain robust, with its FWD dividend yield of 5.09% still excellent compared to the sector median of 1.55%.

With the rich yields, we believe it pays to be patient while holding this stock in the intermediate term, especially given its sideways movement since March 2022.

As a result of the attractive upside potential and tempting dividend yields, we are rating the VTRS stock as a Buy here.

Naturally, the stock is only suitable for those whom are patient, since its reversal may take longer than a few years.

Even then, investors should also size their portfolios accordingly, since we may see its top-line further decline moving forward, partly attributed to its ongoing divestitures, potentially resulting in an impacted bottom line and dividend cash flow.

Only time may tell.

Read the full article here

Leave a Reply