In a recent article about Verizon Communications Inc. (NYSE:VZ) stock, I had rated the stock a buy as long as the risks are understood. As part of that analysis, I had predicted that Verizon would increase its quarterly dividend within 3 weeks to 66.50 cents/share. Verizon has done exactly that, as Seeking Alpha has covered here. Now, that doesn’t say a thing about my Nostradamus impersonation but says a lot about Verizon’s commitment to its shareholders.

I can envision many readers shaking their heads vehemently and asking what good is a ~2% dividend increase when the stock has lost 15% YTD? Point taken. But investing is all about future returns. Just as past successes do not guarantee future results, past (anemic) returns need not be an indicator of future returns.

I recently profiled another high-yielding stock, Omega Healthcare Investors (OHI) and how its safe and slightly increasing dividends provided satisfactory returns over the last 7 years despite the stock flat-lining. The analysis also included a projection for the next 7 years, assuming its dividend stayed the same at least, if not increase. In my opinion, Verizon falls under that same category: a high-yielding stock with not much hope for sustained capital gains. Hence, in the light of Verizon’s new dividend, I am going to perform the same analysis on Verizon’s stock.

But before that, let’s run some basic numbers to see if Verizon can afford its new current quarterly dividend. I am using both Free Cash Flow [FCF] and Earnings Per Share [EPS] for this.

- Total shares outstanding: 4.204 billion

- New quarterly dividend: 66.50 cents

- FCF required to cover quarterly dividend: $2.79 billion (that is, 4.204 times 66.50 cents)

- Verizon’s average quarterly FCF over the last 5 years: $1.716 billion, which looks disastrous on surface. However, in March 2021 quarter, Verizon paid $45 billion to Federal Communications Commission [FCC], being the top bidder on 5G spectrum, which dented the company’s FCF that quarter and any average that includes that quarter

- Verizon’s average quarterly FCF over the trailing twelve months [TTM]: $3.091 billion, which gives Verizon a FCF based payout ratio of 90%. This is usually a red flag and is to be monitored.

- Based on 2023’s forward EPS estimate of $4.72, Verizon has a payout ratio of 56.50%, which seems more comfortable.

To summarize the section above, Verizon’s FCF is a little concerning as 90% of its FCF will be consumed by its dividend commitment. However, with company reporting an impressive 11% increase in FCF on H1 2023 compared to H1 2022, I am confident in the company’s ability to lower the payout ratio to a slightly more comfortable (say 80%) level over time.

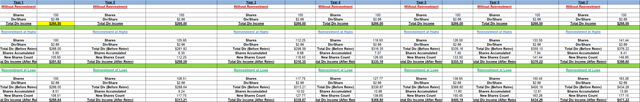

Now, let’s get back to the projections. What will the returns for the next 7 years? There is no crystal ball but I don’t have any reasons to believe Verizon, as a company, would cease to exist or get into existential threat territory. Hence, I am assuming with reasonable certainty that the company will at least maintain the current annual dividend of $2.66/share. Let’s compute what the returns are likely to be for the next 7 years in the three scenarios below:

- No dividend reinvestment [DRIP]

- DRIP but unfortunately, always at market highs (which I am using the current 52-week high of $44.72)

- DRIP but very fortunately, always at market lows (which I am using the current 52-week low of $31.25)

The only other assumptions are that an investor buys 100 shares at the current price of $34.30 for an initial investment of $3,430 and that the stock price has marginally declined to $30/share after 7 years

The returns after 7 years in the three scenarios are as follows (in the same order)

- In the no DRIP scenario, the investor gets a total of $1,862 in dividends, spread equally across each year at $266. Or ~51%

- In the DRIP at highs scenario, the investor accumulates an additional 49.85 shares through a 7-year DRIP. Since the assumed price after 7 years is $30, that’s a return of $1,495.50. Or ~44%.

- In the DRIP at lows scenario, the investor accumulates an additional 77.15 shares through a 7-year DRIP. Since the assumed price after 7 years is $30, that’s a return of $2,314.50. Or ~68%.

- Obviously, neither the 2nd nor 3rd scenarios above are likely to happen. So, let’s take the average of the two to settle at an expected 7-year return of 56%. And that looks like a very satisfactory return to me over 7 years.

To recap the assumptions above, almost all of them are arguably pessimistic:

- that there is no dividend growth when in reality the company has just announced its 17th consecutive increase

- that the stock price declines to $30 at the end of 7 years

If we assume the stock price to flat-line over these 7 years, the returns above will improve to 50% under the High-DRIP scenario and 77% under the low-DRIP scenario.

VZ potential returns over next yrs (Author)

But all the above assumptions are predicated upon the assumption that Verizon, at the very least, operates as it does now and does not get fundamentally worse. The key is to realize that we are talking about a $150 billion behemoth and changes will not be drastic or immediate. I am pointing out a few signs in the company’s most recent earnings results that make me believe Verizon’s management not only knows its issues but is working towards alleviating these issues.

Signs of Improvements In Recent Q2

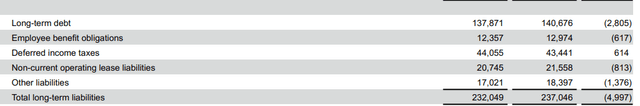

- At the end of Q2 2023, Verizon’s long-term debt went down 2% ($2.8 billion) when compared to Q4 2022. At an interest rate of about 3%, that’s $60 million added straight to the bottom-line every year.

VZ long term debt (verizon.com)

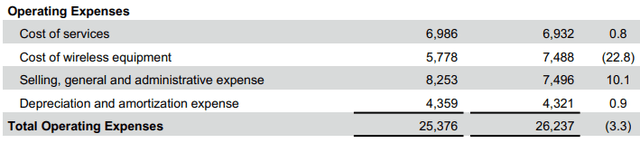

- While operating revenue went down 3.5% YoY in Q2, Verizon’s operating expenses also fell 3.3% as shown below. This tells me that the company’s expenses are mostly variable and will ebb and flow with the demand/revenue in an almost linear manner.

VZ Expenses (Verizon.com)

- Verizon Business was highlighted in the company’s Q2 report with 125,000 postpaid phone net adds. The company sees huge potential in business wireless services with its CEO Hans Vestberg highlighting the potential snowballing effect in this space:

“It usually starts as a Wi-Fi replacement in one factory, and when they see it working, they do it in all factories.“

- Digging deeper into the FCF recovery mentioned earlier in the article, Verizon now needs $11.16 billion in annual FCF to cover its dividends. The company reported $8 billion in H1 2023 FCF and it reported the following in H2 FCF over the last 5 years. Even if Verizon reports just $5 billion in H2 2023 FCF, the payout ratio based on annual FCF should drop to about 80%.

- 2022 -> $5.5 billion

- 2021 -> $5.2 billion

- 2020 -> $7.7 billion

- 2019 -> $9.2 billion

- 2018 -> $8.8 billion

- Finally, Verizon guided for a FY 2023 EPS of $4.55 to $4.85, which places the stock’s forward multiple between 7 and 7.50 assuming a stock price of $34. In my opinion, that’s a steal especially considering the near 8% yield.

Conclusion

As I highlighted in my August review, Verizon does have significant issues with its debt load and high interest expense. Add macro-economic issues like inflation and interest rates, it was already a double-whammy for Verizon investors before the triple-whammy hit in the form of lead cables. However, there comes a point when a stock has been beaten down too far. For me, an 8% yield on a reliable dividend paying stock is one such point. As the saying goes, the safest dividend is the one that has just been raised, especially when you are talking about almost two decades of increasing dividends.

I am sticking with my Buy rating after the dividend increase, with renewed confidence.

Read the full article here

Leave a Reply