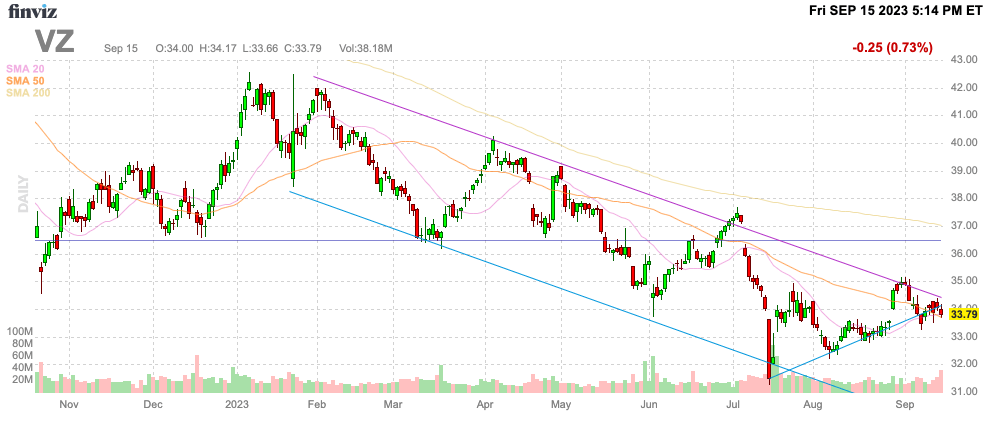

Despite a large debt load and a dividend that already approaches 8%, Verizon Communications (NYSE:VZ) announced another annual dividend hike recently. The stock already trades at decade lows, in part due to hefty payouts for dividends while the wireless giant spends heavily on capex and wireless spectrum. My investment thesis remains Neutral on Verizon due to misguided plan to hike dividends annually, regardless of the cheap financials.

Source: Finviz

Blind Dividend Hikes

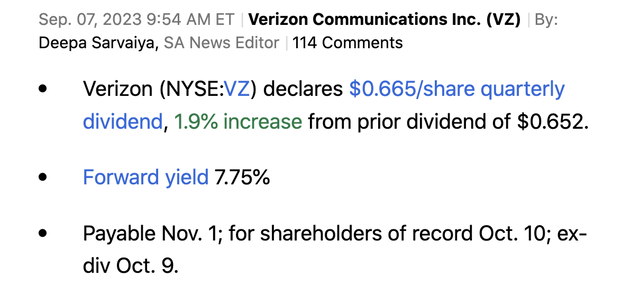

Like clockwork, Verizon announces annual dividend hikes in the 2% range. The BoD approved a 1.9% hike this year to a quarterly dividend of $0.665 as follows:

Source: Seeking Alpha

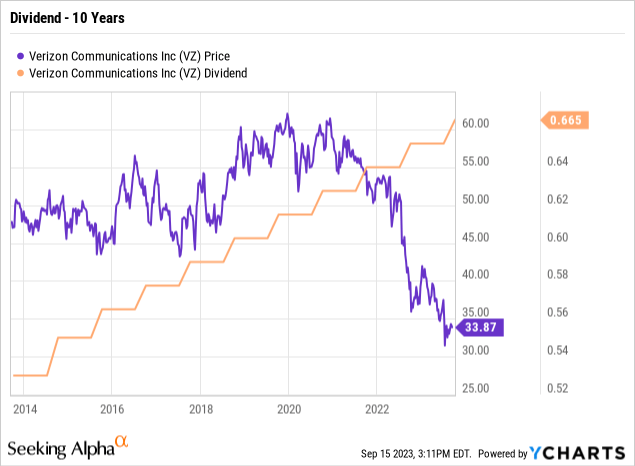

Going back to 2016, Verizon has blindly hiked dividends $0.0125 per quarter leading to annual increases of $0.05. The company hasn’t produced consistent profits growth this period to warrant standard annual dividend hikes.

The stock peaked after a Covid boost in 2020 making this the 4th consecutive hike where the stock has only trended lower. Verizon was a $60+ stock back in 2020 and now the stock hardly tops $30.

Back on September 3, 2020, Verizon hiked the dividend 2% to $0.6275 per quarter. The dividend yield was only 4.14%, at that point.

The annual dividend is now $2.66, up from $2.51 back in 2020. The dividend yield has nearly doubled to 7.81% during this period with the actual payout only rising 6% due to the stock collapsing nearly 50% over the last 3 years and despite these 4 annual dividend hikes.

Not Sustainable

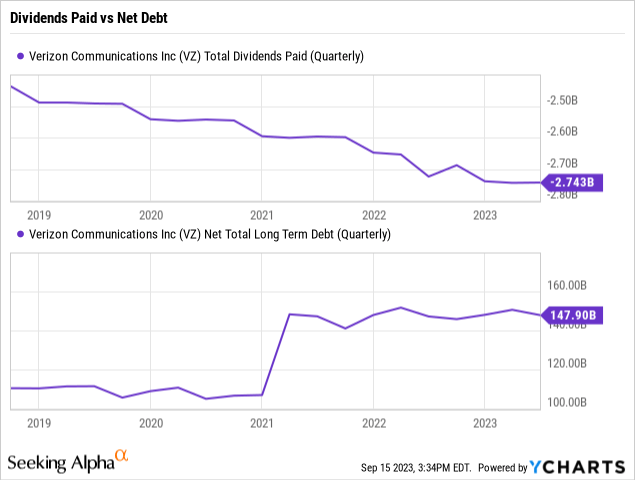

A lot of investors look at the annual dividend hikes of Verizon and encourage the company to continue hiking payouts annually to remain a dividend aristocrat. The problem here is that the wireless giant shouldn’t actually hike dividends annually with earnings dipping and the large debt level.

Verizon ended June 2023 with a net debt load of $148 billion. The debt levels have only risen since 2020 due to large spending on wireless spectrum for the 5G network.

The problem here is that Verizon now spends nearly $11.2 billion on dividend payouts helping to prevent the company from ever paying down debt. While the company has the EBITDA to cover the debt payments, the company is always handicapped from making growth investments, such as an area like cloud services and data centers.

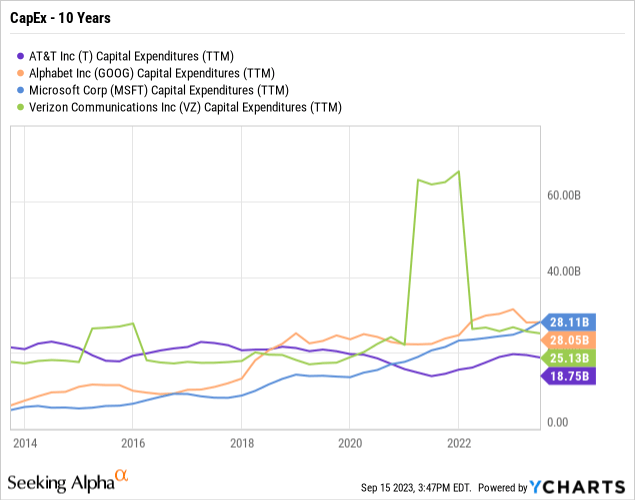

Back a decade ago, Verizon and AT&T (T) easily outspent the tech giants on capex for telecom networks. Now a decade later, Alphabet (GOOG, GOOGL) and Microsoft (MSFT) are outspending the wireless giants due to aggressive investing in cloud services, an area where the telecom giants were probably better positioned to exploit at one point.

* chart incorrectly shows a spike in Verizon capex.

Either way, the problem here is that a tech giant like Alphabet has $100+ billion in net cash despite now spending over $28 billion annually on capex. The tech giant outspends Verizon on capex and has a far better balance sheet not encumbered with debt

The headwind is that not only is Verizon spending $11.2 billion on dividend payouts, the company now spends $5.0 billion on interest payments. If Verizon got stuck paying an additional 100 basis points in interest rates, interest expenses would soar nearly $1.5 billion annually.

Sure, Verizon is now trying to expand services with 5G home internet, but the company spent the last decade focused on becoming a media player that didn’t fit with a telecom/wireless company. As long as the company has a massive debt level, Verizon can’t effectively invest in growth opportunities.

The risk is Verizon ends up cutting the dividend payment similarly to both AT&T and Lumen Technologies (LUMN) in the telecom space. Verizon has a payout ratio of 66% now using the free cash flow guidance for 2023 of $17 billion, up from just $14 billion last year.

The wireless giant plans to cut capex going forward now that 5G is effectively implemented, but the large tech companies generally constantly expand spending to further grow the business. Verizon is targeting forward capex basically in line with levels where the business started a decade ago.

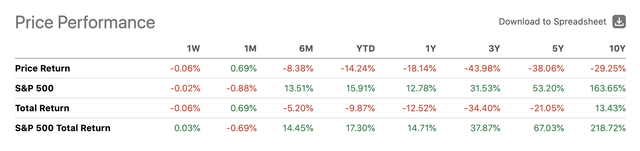

Verizon is probably worse off now than a decade ago, yet the total return has failed to keep up with the S&P 500. Over the last 10 years, Verizon had a total return of just 13.4% while the S&P 500 total return is 218.7%

Source: Seeking Alpha

If anything, the debt position is worse now due to massive spectrum costs for 5G and Verizon is now struggling to compete with T-Mobile (TMUS) where the network was a market leader before 5G allowing the company to charge premium prices. Also, the industry could face toxic lead cable replacement costs in the years ahead cutting into the profits.

The consensus EPS estimates have earnings declining the next couple of years with no growth from the $5.18 earned in 2022 all the way through 2026. Verizon has promised growth, although mostly limited, for years now without really delivering gains, including the big promises of 5G that haven’t led to any growth.

Source: Seeking Alpha

While a $0.05 annual dividend hike is only $200 million, Verizon doesn’t have the improved earnings to warrant paying out higher dividends. The company needs to pay down debt and invest in growth initiatives to sustain higher payouts over the long term.

Takeaway

The key investor takeaway is that Verizon needs to cut the dividend and begin investing in growth opportunities to turn around the prospects of the business. The company needs to adopt the mentality of Alphabet and Microsoft and build new business to product higher profits warranting the growth of the dividend.

Investors shouldn’t expect much upside on the stock and the dividend hike shouldn’t be celebrated as the level of payouts are now harmful to the business. The best opportunity for investors is to just collect the large dividend with no capital losses and this may not even be possible.

Read the full article here

Leave a Reply