Welcome to the Vanadium miners news.

December saw flat vanadium prices and a slower month of news dominated by several small capital raisings.

Vanadium uses

Vanadium is traditionally used to harden steel. Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe & China Vanadium Pentoxide [V2O5] Flake 98% one year price chart – Europe = USD 6.10/lb, China = USD 4.95/lb

![Europe & China Vanadium Pentoxide [V2O5] Flake 98% one year price chart](https://finfactories.com/wp-content/uploads/2023/12/37628986-17038161375636718.png)

Vanadiumprice.com

Europe and China Ferrovanadium [FeV] 80% one year price chart – Europe = USD 25.25/kg, China = USD 26.80/kg

![Europe and China Ferrovanadium [FeV] 80% one year price chart - Europe](https://finfactories.com/wp-content/uploads/2023/12/37628986-17038162201367855.png)

Vandiumprice.com

Vanadium demand versus supply

In 2017, Robert Friedland stated: “We think there’s a revolution coming in vanadium redox flow batteries….”

An April 2021, Wood Mackenzie report stated (emphasis added):

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

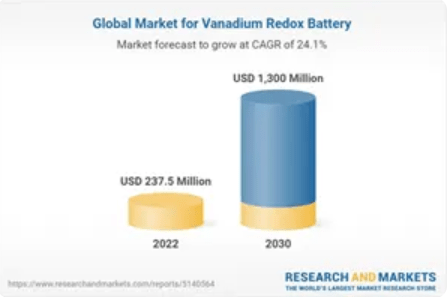

ResearchAndMarkets forecasts VRFBs to grow from US$237.5M in 2022 to US$1,300M by 2030 (source)

ResearchAndMarkets

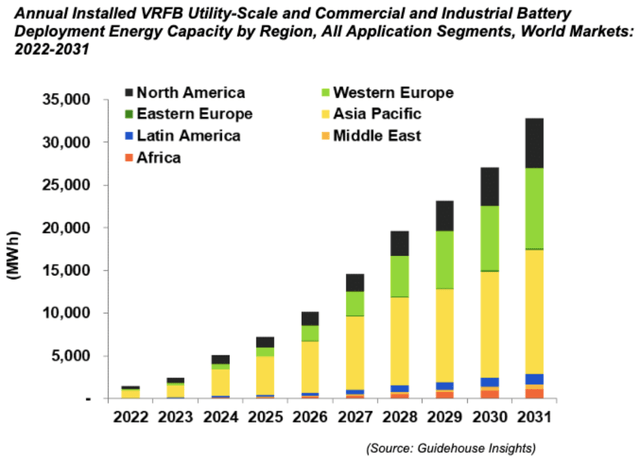

Global VRFB forecast growth by region 2022-2031

Guidehouse Insights

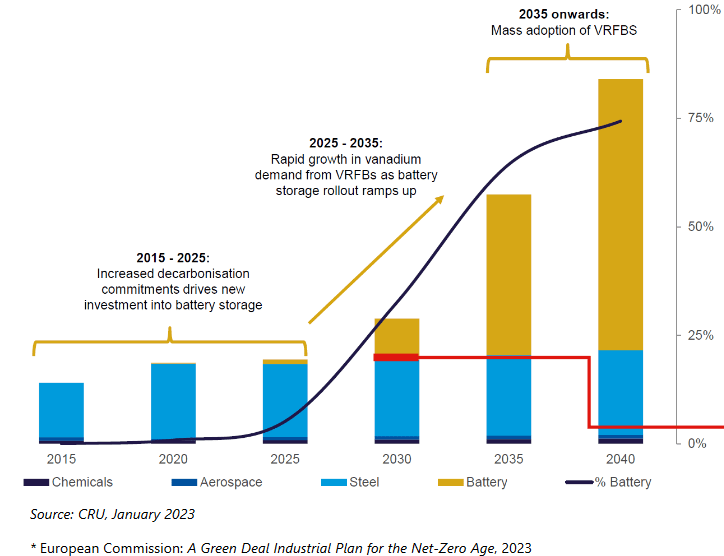

CRU forecasts vanadium demand to double by 2032 mostly due to VRFB’s (source) (As of January 2023)

CRU

Large scale global deployments of VRFB’s are becoming more common (source)

Technology Metals Australia company presentation

Vanadium market news

On December 14, Fastmarkets reported (emphasis added):

The US House of Representatives Select Committee on Strategic Competition between the US and Chinese Communist Party recommended congress to authorize the creation of a critical mineral “Resilient Resource Reserve,” it said in a report with around 150 policy recommendations published on Tuesday December 12. The adoption of such a reserve is intended to “insulate American producers from price volatility and (the People’s Republic of China’s) weaponization of its dominance in critical mineral supply chains,” according to the report. Such a reserve would be used to sustain the price of a critical mineral when prices fall below a certain threshold and would be replenished through contribution from companies when prices are “significantly” higher, the report stated. The fund would target critical metals where there is high price volatility, low US domestic production and import dependence on China. Cobalt, manganese, light and heavy rare earths, vanadium, gallium, graphite, germanium and boron are critical minerals that fall under that category, according to the report.

Note: Bold emphasis by the author.

On December 14, Investing News Network reported:

Vanadium Market Forecast: Top trends that will affect vanadium in 2024… CRU expects to see lower Chinese crude steel production being more than made up for by global production outside of China. “This increase year-over-year will support vanadium demand, though much crude steel production gains will be seen in markets with traditionally lower vanadium intensity, though intensity will rise through the forecast to 2030 in these markets,” Thomas noted. Project Blue also believes that the downside to demand will be very limited…While Project Blue doesn’t see much demand upside coming from Europe, the market may experience an uptick in Chinese demand as early as Q1 2024, spurred on by a rebound ahead of the Spring construction sector. This would prove price supportive, the analyst team explained. “Vanadium inventories are currently low and any demand recovery could also trigger some restocking,” they said. “(However,) this largely depends on the effectiveness of any Chinese economic stimulus measures”…According to CRU research, demand growth for vanadium over the next decade will largely be driven by the rising installation of VRFBs. For its part, Project Blue relays that much of the VRFB capacity installed globally in 2023 happened in China, and that trend is expected to continue in 2024. The Chinese government is highly supportive of VRFB technology for long-duration energy storage.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

No vanadium related news for the month.

AMG Critical Materials N.V. [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process. In January 2023, AMG announced plans to build a Vanadium Electrolyte plant in Germany with production expected to start at the end of 2023.

On December 27, AMG reported:

AMG LIVA Power Management Systems GmbH acquires the Redox Flow Battery activities from J.M. VOITH SE & CO. KG…VOITH has developed a unique technology for controlling and balancing large-scale high-voltage VRFB energy storage systems. The technology compliments LIVA´s large scale VRFB systems. LIVA will integrate this technology into its large-scale energy storage systems.

Bushveld Minerals Limited [LN-AIM:BMN] (OTCPK:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On December 5, Bushveld Minerals Limited announced:

Result of Bookbuild. Bushveld Minerals Limited (AIM: BMN), the AIM quoted, integrated primary vanadium producer, is pleased to announce that further to its announcement at 3.35 p.m. on 29 November 2023, it has raised approximately US$18.4 million (£14.6 million) (before expenses)…The issue price represents a premium of approximately 33.3 per cent to the closing mid-market price per share of 2.25 pence on 04 December 2023.

On December 14, Bushveld Minerals Limited announced:

Option agreement with Portillion. Bushveld Minerals Limited (AIM: BMN), the integrated primary vanadium producer, is pleased to announce that that it has entered into an option agreement (“Option Agreement”) with Portillion Capital Limited (“Portillion”)…

On December 15, Bushveld Minerals Limited announced: “Definitive agreement for the acquisition by Southern Point Resources – Fund 1 SA L.P of a 64% interest in Mokopane.” Highlights include:

- “US$3.7 million will be paid to Bushveld for its 64% interest in Mokopane.

- The parties have agreed to a right of first refusal with respect to ore mined at the Mokopane mine for use at the Vanchem vanadium processing facility.

- The Transaction is conditional upon: SPRF having conducted a satisfactory confirmatory legal due diligence. Completion of the acquisition by SPRF of 50% of the shares in Vanchem, which owns the Vanchem vanadium plant….

On December 15, Bushveld Minerals Limited announced: “Definitive sales and marketing agreement signed with Southern Point Resources.”

On December 19, Bushveld Minerals Limited announced: “Confirmed acquisition of minority interests in Vametco.”

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF)(LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

On December 18, Largo Inc. announced: “Largo provides update on the ongoing exploration program surrounding its Maracás Menchen mine in Brazil.” Highlights include:

- “The Company is working to establish a correlation between the known mineralization intercepted from Novo Amparo North (“NAN”) to the Campbell Pit with the goal of opening a potential mineralized trend measuring more than 7 kilometres (“km”) along strike.

- The Company is also reviewing exploration work south of the Campbell Pit to assess the potential of continued mineralization.”

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels stated they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio,” as well as being a small vanadium producer.

No vanadium related news for the month.

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR stated:

“The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

On December 22, Ferro-Alloy Resources announced:

Trading update. Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer and developer of the large Balasausqandiq vanadium deposit in Southern Kazakhstan announces a trading update for Q4 2023…Nick Bridgen, CEO, commented: “One of the challenges of the vanadium industry is the extreme volatility of pricing, where the current low price for vanadium pentoxide of just over US$5/lb is, unfortunately, beyond our control and is having a negative impact on all producers. The longer term outlook for vanadium, regarded as a critical metal by the UK, EU and the US remains highly encouraging and we continue to make progress towards the completion of the feasibility study, with results so far supporting the very strong financial expectations of our previously announced studies.”

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

On December 12, Western Uranium & Vanadium Corp. announced: “Western Uranium & Vanadium Corp. closes fully subscribed brokered LIFE financing of $7.25 million…”

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On November 29, Neometals announced: “Entitlement offer opens.”

On December 13, Neometals announced:

Results of non-renounceable Entitlement Offer and Shortfall Notice… Neometals received applications from Eligible Shareholders under the Entitlement Offer for 11,390,238 New Shares at the issue price of A$0.19 per New Share (Offer Price), representing an approximate 16.5% take up. Eligible Shareholders were also offered the opportunity to apply for additional New Shares in excess of their Entitlement, at the Offer Price under the Top Up Facility. When combined with the Top Up Facility, valid applications from Eligible Shareholders in respect of the Entitlement Offer were approximately A$3.1 million. New Shares under the Entitlement Offer are expected to be issued on 15 December 2023, with the normal trading of those New Shares expected to begin on 18 December 2023.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTCQB:ATVVF) – merger with Technology Metals Australia by to be completed by February 2024

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

On December 12, Australian Vanadium announced:

AVL increases scheme consideration to best and final proposal. Australian Vanadium Limited (ASX: AVL) (AVL) and Technology Metals Australia Limited (ASX: TMT) (TMT) are pleased to announce AVL has increased the total consideration offered under the scheme of arrangement (Scheme) announced on 25 September 2023 (Announcement Date) from 12 AVL shares for every 1 TMT share (Original Scheme Consideration) to 14 AVL shares for every 1 TMT share (Revised Scheme Consideration). Based on the closing price of AVL Shares on 8 December 2023 (being the last date that AVL and TMT shares traded prior to this announcement), the implied value of the Revised Scheme Consideration is $0.308 per TMT share which represents a premium of 43.3% to the closing TMT share price of $0.215 per TMT share on 8 December 2023.

On December 15, Australian Vanadium announced: “Vanadium electrolyte facility construction complete.” Highlights included:

- “Construction of AVL’s Western Australian vanadium electrolyte manufacturing facility has been completed without injury.

- Facility has potential to produce up to 33MWh of high purity electrolyte per annum.

- Vanadium electrolyte production to deliver product into a growing demand market and allows for qualification of AVL material with battery manufacturers.”

Technology Metals Australia [ASX:TMT] – merger with Australian Vanadium by to be completed by February 2024

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia. Technology Metals Australia has combined the high grade, high quality Yarrabubba deposit with the Gabanintha Vanadium Deposit to form the Murchison Technology Metals Project (MTMP).

On December 5, Technology Metals Australia announced: “Scheme Booklet registered with ASIC…”

On December 20, Technology Metals Australia announced: “Supplementary Scheme Booklet.” Highlights included:

- “The Supreme Court of Western Australia has made orders approving the dispatch of the Supplementary Scheme Booklet.

- The Supplementary Scheme Booklet is expected to be dispatched to TMT shareholders on Thursday, 28 December 2023.

- The Scheme Meeting is expected to be held at 10:00am (AWST) on Tuesday, 16 January 2024.”

Tivan Limited [ASX:TVN] (formerly TNG Ltd [ASX:TNG](OTCPK:TNGZF)

Tivan Limited is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. Tivan Limited is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product. Tivan 100% owns the Speewah Mining Pty Ltd (from King River Resources Limited [ASX:KRR]) the owner of the Speewah Vanadium-Titanium-Iron Project in WA.

On December 8, Tivan Limited announced: “Tivan launches ASX listed options alongside $2m institutional placement.”

On December 11, Tivan Limited announced: “Tivan receives $0.85m Research & Development rebate.”

On December 19, Tivan Limited announced: “Tivan secures Heritage Protection Agreement with the Kimberley Land Council for Speewah Project…”

Vanadium Resources Limited [ASX:VR8] [GR:TR3]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 86.49% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

No significant news for the month.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

VanadiumCorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On December 12, VanadiumCorp Resources Inc. announced:

VanadiumCorp’s electrolyte plant approved for shipment to Quebec…The VanadiumCorp team inspected the assembled equipment and approved it for transport to Val-des-Sources, Québec. Upon arrival the plant will be re-assembled and commissioned. Operator training and full commissioning is planned for Q1 2024.

On December 19, VanadiumCorp Resources Inc. announced: “VanadiumCorp files to close non-brokered private placement financing…”

Richmond Vanadium Technology [ASX:RVT] (“RVT”)

RVT now owns 100% of the Richmond Vanadium Project. It has a global Mineral Resource of

1.8Bt @ 0.36% Vanadium Pentoxide (V2O5).

No news for the month.

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

On December 14, Phenom Resources Corp. announced:

Phenom submits U.S. Federal grant application. Phenom Resources Corp. (TSXV: PHNM) (OTCQX: PHNMF) (FSE: 1PY0) (“Phenom” or the “Company”) is pleased to announce that is has successfully submitted a U.S. Federal grant application to the Department of Energy (DOE) and its Office of Fossil Energy and Carbon Management (FECM) addressing priorities in the Bipartisan Infrastructure Law [BIL] regarding Critical Material Innovation, Efficiency, and Alternatives. DOE’s FECM intends to fund high impact applied RD&D bench and pilot scale projects with this funding opportunity. The Company’s application is directed to support prefeasibility level metallurgical studies for the Carlin Vanadium Project. DOE’s expected date for selection notifications is May 2024.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF, OTCPK:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTC:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Blue Sky Uranium [TSXV:BSK] (OTCQB:BKUCF)

- Critical Minerals Group [ASX:CMG]

- Currie Rose Resources Inc. [TSXV:CUI]

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Manuka Resources [ASX:MKR]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE]

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Santa Fe Minerals [ASX:SFM]

- Strategic Resources [TSXV:SR] (OTCPK:SCCFF)

- Surefire Resources [ASX:SRN]

- Trigon Metals Inc. [TSXV:TM] (OTCQB:PNTZF)

- UVRE [ASX:UVA]

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

- Viking Mines [ASX:VKA]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (IVVGF) (OTCQX:IESVF)

Conclusion

December saw China and Europe V2O5 & ferrovanadium prices flat.

Highlights for the month include:

- The U.S DoE releases proposed interpretive guidance on Foreign Entity of Concern (“FOEC”) rules.

- The U.S to create a critical mineral “Resilient Resource Reserve” to “sustain the price of a critical mineral when prices fall below a certain threshold.” It includes vanadium.

- Vanadium inventories are currently low. The market may experience an uptick in Chinese demand as early as Q1 2024, spurred on by a rebound ahead of the Spring construction sector.

- Bushveld Minerals Definitive agreement for the acquisition by Southern Point Resources – Fund 1 SA L.P of a 64% interest in Mokopane.

- Australian Vanadium (“AVL”) increases scheme consideration to best and final proposal from 12 to 14 AVL shares for every 1 TMT share. Vanadium electrolyte facility construction complete.

- Tivan secures Heritage Protection Agreement with the Kimberley Land Council for Speewah Project.

As usual, all comments are welcome.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply