Introduction

San Antonio-based Valero Energy Corporation (NYSE:VLO) released its third-quarter 2023 results on October 26, 2023.

Note: This article updates my article published on August 26, 2023. I have followed VLO on Seeking Alpha since December 2017.

Among the three refiners I track on a quarterly basis are Valero Energy, Marathon Petroleum (MPC), and Phillips 66 (PSX). The first company to release its 3Q23 results is Valero Energy.

1 – 3Q23 Results Snapshot

The U.S. refiner reported third-quarter 2023 adjusted earnings of $5.40 per share, a significant decrease from $11.36 per share in the year-ago quarter. Nonetheless, the results beat analysts’ expectations again.

Total revenues decreased from $51,641 million last year’s quarter to $34,509 million in 2Q23, over the consensus estimate.

VLO increased its refinery throughput volumes slightly this quarter to 3,022 thousand barrels daily from 3,005K bpd in 3Q22. Valero’s refineries ran efficiently, utilizing 95% of their throughput capacity.

The Chief Executive Officer, Lane Riggs, said in the conference call:

We are pleased to report strong financial results for the third quarter. In fact, we set a record for third quarter earnings per share. Finding margins were supported by strong product demand against the backdrop of low product inventories, which remained at 5-year lows despite high refinery utilization rates globally. The strength in demand was evident in our U.S. wholesale system, which matched the second quarter record of over 1 million barrels per day of sales volume. Our refineries operated well and achieved 95% throughput capacity utilization in the third quarter

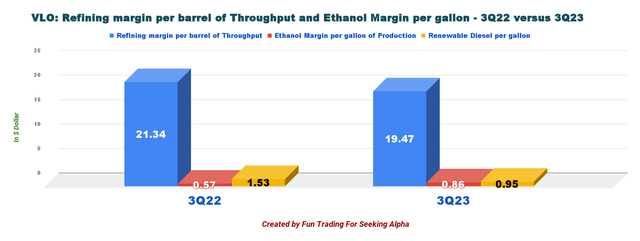

While the ethanol margin increased to $0.86 from $0.57 last year, the refining margin per throughput barrel fell to $19.47 from $21.34 this year.

VLO Refining Margins per Barrel of Throughput 3Q22 versus 3Q23 (Fun Trading)

2 – Investment Thesis

I have been a long-term shareholder in Valero Energy Corporation for more than 20 years, as I have stated in previous articles, and I plan to maintain a sizable portion of my long position. With a 3.29% dividend yield, VLO offers a safe and comparatively high yield, which explains the long-term investment decision.

Nonetheless, I have frequently traded LIFO, or between 30% and 40% of my long position, in order to profit from the volatility associated with the refining sector. Just glancing at the chart will convince you that you must trade some of your position.

The main issue at hand is the extreme volatility of the refining industry, which calls for a particular approach to trading and investing.

I am well above my comfort zone when it comes to my assessment of VLO’s valuation. Though I’m sure many investors will tell me that VLO still has a lot of room to grow, I’m not convinced despite what Valero Energy considers a solid business outlook.

Lane Riggs said in the conference call:

margins were supported by strong product demand against the backdrop of low product inventories, which remained at 5-year lows despite high refinery utilization rates globally. The strength in demand was evident in our U.S. wholesale system, which matched the second quarter record of over 1 million barrels per day of sales volume.

The demand outlook, which will rely on the severity of any global economic slowdown and the rate of its recovery over the coming years, remains, as usual, the largest source of uncertainty for refiners.

The United States’ consumption of gasoline and distillate has returned to its five-year average following over a year of low demand brought on by the COVID pandemic, which also forced the closure of refining facilities.

In addition, for the fourth quarter, Valero Energy intends to run its fourteen oil refineries in North America and the UK at a maximum of 96.5% of their combined daily throughput capacity of 3.2 million barrels.

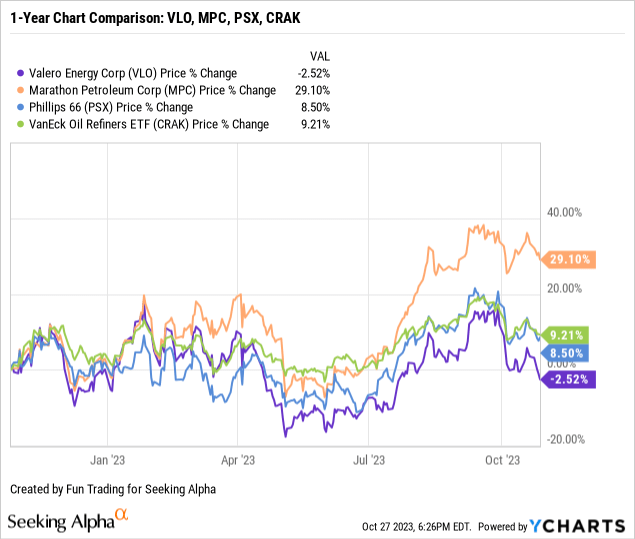

3 – Stock performance

VLO is now down 2.5% on a one-year basis, underperforming Phillips 66 and Marathon significantly.

Valero Energy: Selected Financial History: The Raw Numbers (Third Quarter Of 2023)

| Valero Energy | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

| Total Revenues in Billions | 44.45 | 41.75 | 36.44 | 34.51 | 38.41 |

| Net Income in Millions | 2,817 | 3,113 | 3,067 | 1,944 | 2,622 |

| EBITDA $ Million | 4,498 | 5,020 | 4,832 | 3,534 | 4,296 |

| EPS diluted in $/share | 7.19 | 8.15 | 8.29 | 5.40 | 7.49 |

| Operating cash flow in millions | 2,045 | 4,096 | 3,170 | 1,512 | 3,308 |

| CapEx in $ Million | 463 | 417 | 265 | 170 | 220 |

| Free Cash Flow in the Million | 1,582 | 3,679 | 2,905 | 1,342 | 3,088* |

| Total Cash: $ Billion | 3.969 | 4.862 | 5.521 | 5,075 | 5,831 |

| Total L.T. Debt (incl. current) in billions | 11.58 | 9.24 | 11.42 | 11.32 | 9,150 |

| Dividend per share in $ | 0.98 | 1.02 | 1.02 | 1.02 | 1.02 |

| Shares Outstanding (Diluted) in Millions | 390 | 381 | 369 | 358 | 349 |

| Oil, N.G., and Ethanol Production | 3Q22 | 4Q22 | 1Q23 | 2Q23 | 3Q23 |

| Throughput volume in K Bop/d | 3,005 | 3,042 | 2,930 | 2,969 | 3,022 |

| Ethanol in K gallon p/d | 3,498 | 4,062 | 4,183 | 4,443 | 4,329 |

| Brent price ($/b) | 97.59 | 88.81 | 82.20 | 77.98 | 86.18 |

| WTI price ($/b) | 91.76 | 82.85 | 76.11 | 73.76 | 82.46 |

| Natural gas price ($/MM Btu) | 7.31 | 4.46 | 2.25 | 2.00 | 2.38 |

Source: VLO PR.

* Estimated by Fun Trading.

Revenues, Earnings Details, Free Cash Flow, Throughput Volume, Ethanol Production, And Margins

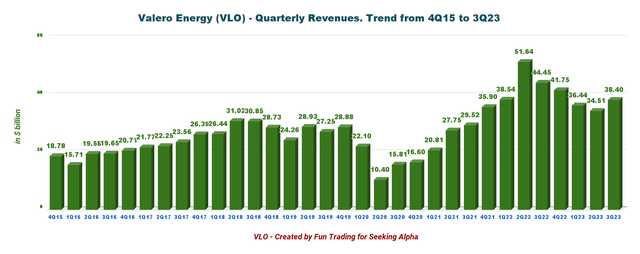

1 – Revenues were $38.404 billion in 3Q23

VLO Quarterly Revenue History (Fun Trading)

Valero Energy’s revenue for the third quarter was $38.404 billion. The company reported a 4.2% increase in quarterly income to $7.49 per diluted share from $7.19 in the previous year. The results were better than analysts had predicted.

For the third quarter of 2023, adjusted net income attributable to Valero stockholders was $2.8 billion, or $7.14 per share.

The total cost of sales fell to $34.634 billion from $40.431 billion last year. Net cash from operating activities was $3.308 billion in the third quarter of 2023, versus $2.045 billion last year.

Review of the different segments:

- The refining segment: adjusted operating income was $3,445 million, down significantly from $3,810 million in the year-ago quarter. A lower refining margin per barrel of throughput impacted the segment.

- The Ethanol segment: Valero declared an adjusted operating profit of $123 million, down from $212 million in the year-ago quarter. It was due to lower ethanol production volumes.

- The Renewable Diesel segment, which consists of the Diamond Green Diesel joint venture (DGD), increased to $197 million from $1 million in the year-ago quarter. Renewable diesel sales volumes increased to 4,329 thousand gallons per day, up 23.8% from 3,498 thousand gallons per day a year ago.

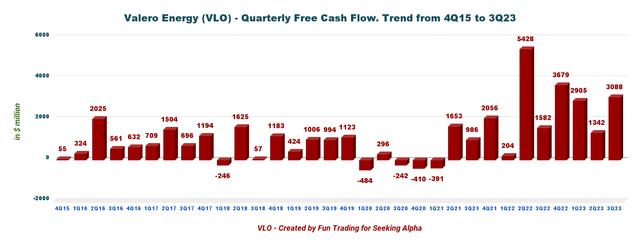

2 – Free cash flow in 3Q23 was estimated at $3,088 million.

VLO Quarterly Free Cash Flow History (Fun Trading)

Note: The cash from operating activities less capital expenditures is the generic free cash flow.

VLO had $11,014 million in trailing 12-month TTM free cash flow. The second quarter’s free cash flow, which is $3,088 million, is much higher than the prior quarter.

The quarterly dividend remained unchanged at $1.02 per share.

Also, $951 million worth of VLO shares were purchased, or approximately 8.4 million shares of common stock, in 2Q23. In the press release, the company said:

Valero returned $2.2 billion to stockholders in the third quarter of 2023, of which $360 million was paid as dividends and $1.8 billion was for the purchase of approximately 13 million shares of common stock, resulting in a payout ratio of 68 percent of adjusted net cash provided by operating activities.

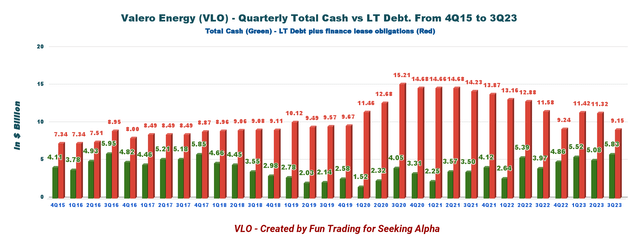

3 – Net debt decreased significantly to $3.32 billion as of September 30, 2023

VLO Quarterly Cash versus Debt History (Fun Trading)

Valero Energy had total cash of $5,831 million in 3Q23, up from $3,969 million last year. Total debt was significantly down to $9,150 million, or $11,441 million (including total lease obligations), compared to $11,592 million last year.

The debt-to-capitalization ratio, net of cash and cash equivalents, was 17% as of September 30, 2023.

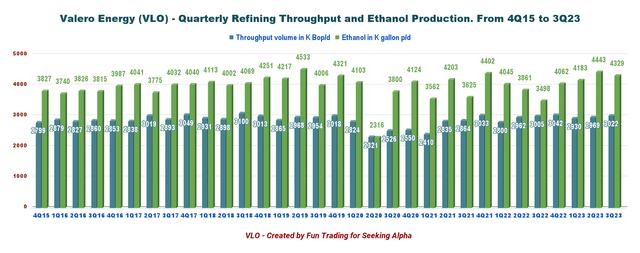

4 – Throughput and ethanol production in 3Q23

VLO Quarterly Throughput and Ethanol Production (Fun Trading)

During the third quarter, refining throughput volumes increased to 3,022K barrels per day from 3,005K barrels per day in the previous year.

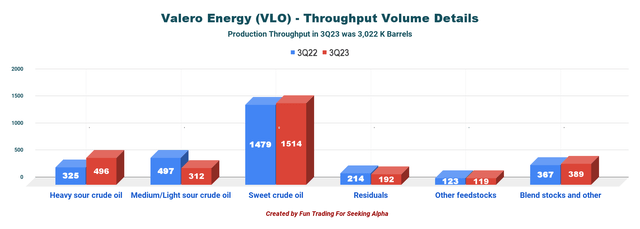

The most important component is sweet crude oil, as the graph below illustrates.

VLO Throughput volume 3Q22 versus 3Q23 (Fun Trading)

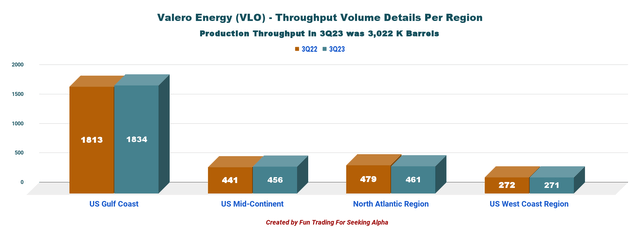

In 3Q23, the U.S. Gulf Coast supplied about 60.6% of the total throughput volume.

VLO Throughput Detail per Region 3Q22 versus 3Q23 (Fun Trading)

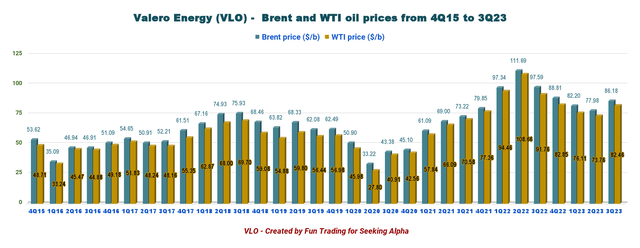

VLO Quarterly Brent and WTI Prices History (Fun Trading)

Technical Analysis (Short-Term) And Commentary

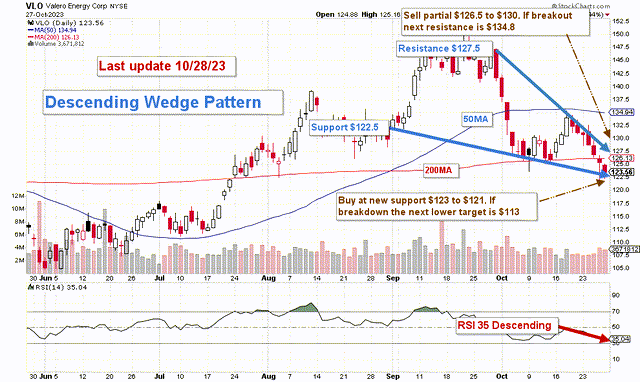

VLO TA Chart (Fun Trading StockCharts)

Note: The dividend has been taken into account in the chart.

VLO forms a descending wedge pattern, with resistance at $127.5 and support at $122.5. RSI shows 35/descending, suggesting that a collapse might occur in 4Q23. If it does, though, it might run counter to the bullish pattern.

When a security’s price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move. The trend lines drawn above the highs and below the lows on the price chart pattern can converge as the price slide loses momentum and buyers step in to slow the rate of decline. Before the lines converge, the price may breakout above the upper trend line.

I frequently advise holding onto a key position for the long run and using about 40%–60% to trade LIFO while waiting for a higher final price target for your core position that you may keep as a well-secured dividend provider.

Thus, the trading strategy is to sell about 40%–50% between $126.5 and $130 with possible higher resistance at $134.8 and wait for a retracement between $123 and $121 with possible lower support at $113.

Valero Energy Corporation’s stock is highly sensitive to the United States’ demand for oil, and the rest of 2023 is probably going to see some extreme fluctuations. It will therefore be very advantageous to trade half of your position using TA charts and patterns.

Warning: The T.A. chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the T.A. chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Read the full article here

Leave a Reply