Note:

Valaris Limited (NYSE:VAL) has been covered by me previously, so investors should view this as an update to my earlier articles on the company.

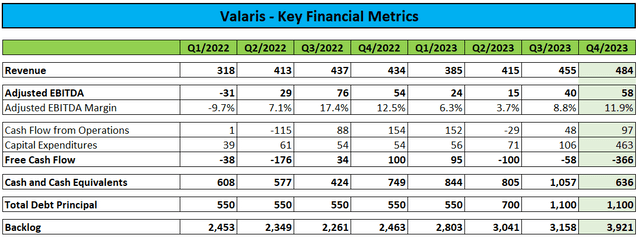

A few weeks ago, leading offshore driller Valaris Limited or “Valaris” reported better-than-expected Q4 2023 results:

Company Press Releases / Regulatory Filings

While revenues came in roughly in line with expectations, Adjusted EBITDA of $58 million was well ahead of the $45 million to $50 million range provided by management on the Q3 conference call.

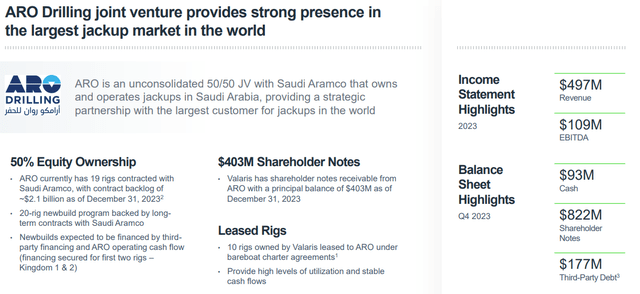

The company’s bottom line outperformance was largely a function of lower-than-expected contract drilling expenses and a higher earnings contribution from ARO Drilling, Valaris’ unconsolidated 50:50 joint venture with Saudi Aramco (ARMCO).

Company Presentation

However, revenue efficiency of 93% was nothing to write home about, likely due to some carryover from a number of subsea equipment issues experienced in Q3.

While Valaris generated $97 million in cash from operating activities, free cash flow was negative a whopping $366 million, mostly due to the company’s decision to exercise purchase options for the newbuild drillships Valaris DS-13 and Valaris DS-14 at an aggregate price of $337 million.

As a result, cash and cash equivalents decreased by more than $400 million on a quarter-over-quarter basis to $636 million, while outstanding debt of $1.1 billion remained unchanged.

During the quarter, Valaris utilized $51.2 million for share buybacks, thus bringing full year repurchases to the $200 million targeted by management.

Following the recently authorized increase to $600 million, the company has $400 million available under its buyback program.

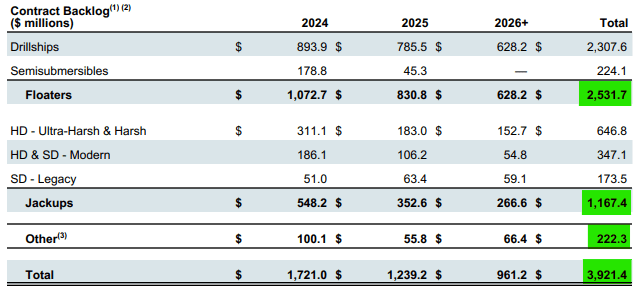

Backlog increased by almost 25% sequentially to $3.9 billion mostly due to a $519 million contract award for the drillship Valaris DS-4 offshore Brazil.

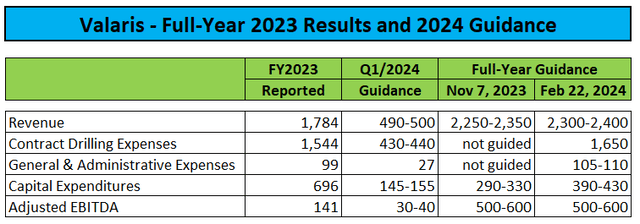

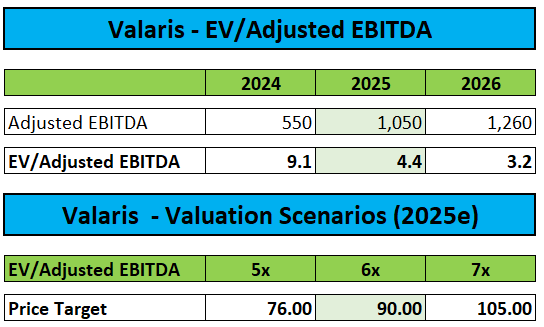

On the conference call, management reiterated previously stated expectations for Adjusted EBITDA to increase to a range of $500 million to $600 million this year, up from just $141 million recorded in 2023.

Conference Call Transcript

However, capital expenditure guidance was increased by $100 million to a new range of $390 million to $430 million mostly due to three major factors:

- $40 million in aggregate contract preparation expenses for Valaris DS-4 and Valaris 108.

- $20 million in capex spending slipping from 2023 into 2024

- $40 million in newbuild capex mostly related to the mobilization of Valaris DS-13 and Valaris DS-14 from Korea to their stacking location in Las Palmas.

Consequently, I would expect free cash flow generation to be very limited this year, particularly after giving effect to $92 million in interest payments.

However, with $636 million in unrestricted cash and cash equivalents, Valaris could easily continue share repurchases at last year’s $200 million clip.

On the call, management also commented on Saudi Arabia’s surprise decision to leave maximum oil production capacity unchanged at 12 million barrels per day and no longer pursue an increase to 13 million barrels.

In response, state-controlled Saudi Aramco lowered its upstream capex budget for the 2024-2028 time frame by 20% or $40 billion. The reduction is expected to be achieved through deferral of planned field development and decreased infill drilling activity (both onshore and offshore).

While Saudi Aramco expects its rig count to remain roughly flat, the company has stated that it would release a number of offshore oil rigs while increasing the number of gas rigs (with gas drilling in the kingdom still mostly an onshore activity at this point).

Consequently, market participants expect Saudi Aramco’s jackup rig count to decrease going forward with Norway-listed Shelf Drilling apparently being one of the first companies to feel the pain (emphasis added by author):

Shelf Drilling, Ltd. (…) announced today that it has received a notice of suspension of operations of four jack-up rigs from a customer in the Middle East. The Company is in active discussions with the customer to determine which rigs will be suspended and the exact timing of the suspensions. Shelf Drilling understands that during the suspension period it will have the right to actively market the rigs to other customers and opportunities and to terminate the applicable contracts.

It is anticipated that the suspensions will impact the financial guidance given in Shelf Drilling’s Q4 2023 reports and therefore, once precise details on the rigs and timing are known, the Company will assess the impact and provide an update to the guidance as part of its Q1 2024 reporting. (…)

While certainly a disaster for Shelf Drilling, the upcoming release of a meaningful number of jackup rigs by Saudi Aramco also has broader market implications with a temporary supply overhang likely to put pressure on dayrates as already indicated by the disappointing terms of domestic competitor ADES Holding’s most recent contract announcement.

However, Valaris management wasn’t overly concerned regarding potential fallout as the company’s ARO Drilling joint venture is expected to remain unscathed:

Regarding our business, we have eight rigs leased to ARO, our unconsolidated joint venture with Saudi Aramco with an additional two rigs scheduled to commence leases this year.

For context, the charter revenue on all our lease rigs accounts for just 5% of our contract backlog. Aramco and the Kingdom remain fully committed to ARO, including its newbuild program, which is a cornerstone project of the Saudi Vision 2030 program. And we think that the recent Saudi announcement will have minimal, if any, impact on our business.

Please note also that the ten jackup rigs bareboat-chartered to ARO Drilling only account for just 5% of the company’s $3.9 billion backlog:

Fleet Status Report

With direct impact likely to remain limited and approximately 65% of the company’s total backlog related to the floater fleet, I tend to agree with management’s take.

In addition, a meaningful part of the company’s jackup fleet is working in the North Sea, a region which is unlikely to see a material influx of rigs from Saudi Arabia.

While the floater market has experienced a lull in contracting activity in recent months, dayrates for premium assets have remained near multi-year highs, as also outlined by management on the conference call:

Looking at pricing, leading edge day rates continue to be in the mid to high-400s as demonstrated by our two most recent drillship fixtures and we believe that they will continue to move higher over time as the remaining stacked and newbuild capacity continues to diminish and the total supply and demand balance further tightens.

We believe that 2- to 3-year programs are likely to be awarded at or close to leading edge rates, while we may see lower rates for some of the 5-year plus opportunities as some contractors may be willing to accept a lower rate to secure long-term duration and backlog. Similarly, we may see somewhat lower rates on shorter term gap fill jobs to avoid rigs becoming idle.

However, there are a meaningful number of 6th and 7th generation drillships available in the market today, but customers have shown ongoing willingness to contract high-specification rigs with strong track records at premium rates, as also evidenced by Transocean’s (RIG) latest contract announcement for the ultra-deepwater drillship Deepwater Asgard this week.

With Saudi Aramco fallout likely to be limited for Valaris and floater rates holding up well, I continue to expect 2025 being a year of major earnings inflection for Valaris and the industry as a whole.

Author’s Estimates

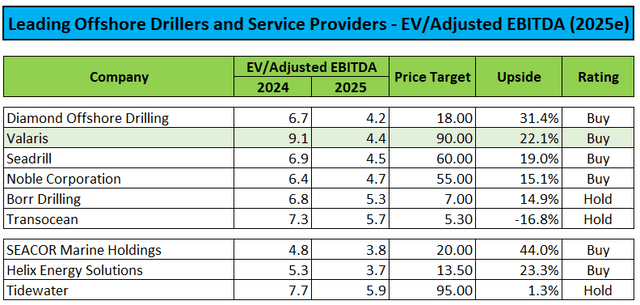

Consequently, I am reiterating my “Buy” rating on Valaris Limited shares with an unchanged price target of $90 based on an EV/Adjusted EBITDA multiple of 6x my 2025 estimates:

Author’s Estimates

Bottom Line

Valaris reported better-than-expected fourth quarter results and reiterated its previously communicated 2024 Adjusted EBITDA outlook. However, a material increase in capital expenditure guidance is likely to result in free cash flow generation to remain limited this year.

With floater dayrates holding up well and impact from recent developments at Saudi Aramco likely to be limited, I continue to expect 2025 being a year of major earnings inflection for Valaris Limited and the industry as a whole.

Consequently, I am reiterating my “Buy” rating on Valaris Limited shares with an unchanged price target of $90.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply