The U.S. dollar is the world’s reserve currency, meaning central banks and governments worldwide hold dollars, as the greenback is the currency of choice for cross-border payments. Reserve currencies like the dollar are fiats, deriving their value from the full faith and credit of the governments that issue the legal tender.

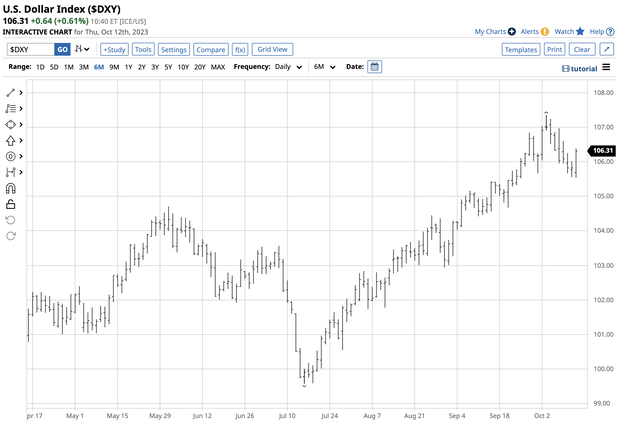

The US Dollar Index (DXY) measures the U.S. dollar against a basket of reserve currencies, including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. However, the index has a 57.6% exposure to the euro, the second-leading reserve currency.

The dollar index has been volatile over the past years, rising to a twenty-year high in January 2022 at 114.745. The U.S. currency ran out of upside steam at the early 2022 high, falling below 100 in July 2023. The Invesco DB US Dollar Index Bullish Fund ETF (NYSEARCA:UUP) moves higher and lower with the dollar index.

The dollar index and UUP have recovered since the July 2023 low

The U.S. dollar index reached a 99.58 low on July 14. The index recovered after probing below the 100 level for the first time since April 2022.

Six-Month Chart of the U.S. Dollar Index (Barchart)

The chart highlights the rally that took the dollar index 7.8% higher to 107.350 on October 3. The index rejected levels below the 100 level. While not a significant technical milestone, 100 is a critical psychological level.

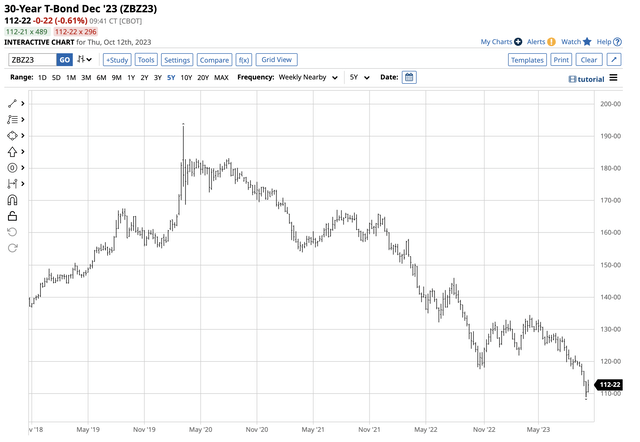

U.S. rates have supported the dollar index

Carnage in the U.S. bond market supports the recent rise in the dollar index. As interest rates rise, the U.S. currency’s increasing yield makes it a more attractive foreign exchange instrument.

Five-Year Chart of the U.S. 30-Year Treasury Bond Futures (Barchart)

The chart shows the significant bearish trend in the U.S. 30-year Treasury bond futures since the March 2020 high. The downward trajectory picked up steam over the past weeks, sending the long bond futures to the lowest level since 2007 at 108-29. At below the 113 level on October 12, the bonds remain at a multiyear low in a bearish trend.

As U.S. rates rise, it puts upward pressure on the U.S. dollar index, which measures the U.S. currency against the other world reserve currencies.

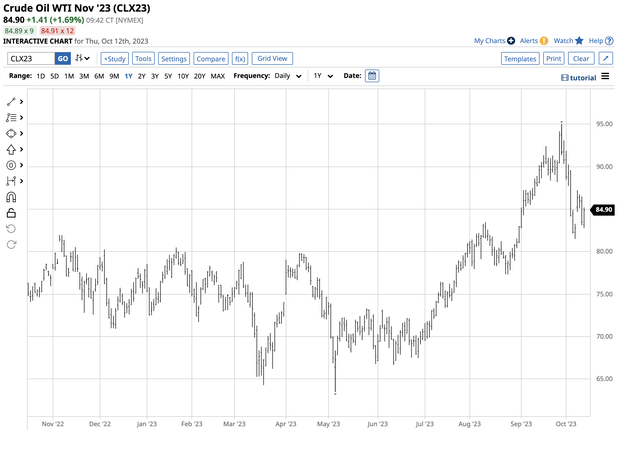

Conflicting factors – Crude oil falls, employment remains robust

Before the vicious and sickening terrorist attack on innocent Israelis and visitors from many other countries, crude oil prices (CL1:COM) had fallen.

One-Year NYMEX Crude Oil Futures Chart (Barchart)

The November NYMEX crude oil futures chart illustrates the 14.2% decline from $95.03 on September 28 to $81.50 on October 6. As war broke out in Israel on October 7, crude oil prices recovered from the low and were around the $85 per barrel level on October 12.

The energy commodity’s recent decline took some pressure off the Fed in its inflation battle. However, the September jobs report sent conflicting signals. While new jobs were far higher than forecasts, wages were weaker than expected. September’s consumer and producer price index data continued to show nagging inflation that is holding steady.

The U.S. central bank remains committed to sending inflation to its 2% target level. However, geopolitical factors, including highly dangerous wars in the Middle East and Ukraine and the bifurcation of the world’s nuclear powers, distort trade and commodity prices, complicating monetary policy’s impact on inflationary pressures. The bottom line is geopolitics is a factor that is beyond the Fed’s monetary policy reach.

Technical levels to watch in the dollar index and UUP ETF

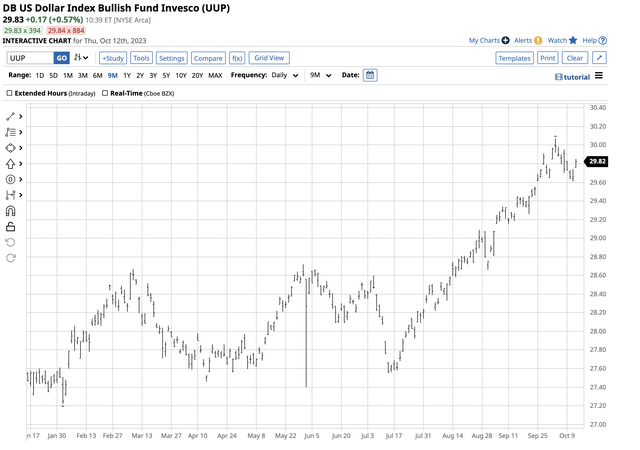

The Invesco DB US Dollar Index Bullish Fund ETF tracks the dollar index on the up and downside. Since the dollar index rallied from the July low, UUP has followed.

Chart of the UUP ETF (Barchart)

As the chart illustrates, the UUP ETF rose 9.1% from $27.55 per share at the July dollar index low to $30.07 in early October, when the index rose to over the 107 level on the most recent high. While UUP is an unleveraged ETF, the 9.1% rally outperformed the dollar index, which rose 7.8% over the period.

At $29.83 per share on October 12, UUP is not far below the recent high and remains in a short-term bullish trend. UUP has nearly $585 million in assets under management. UUP is a highly liquid product, trading an average of over 1.4 million shares daily. UUP charges a 0.77% management fee.

Meanwhile, at $18.36 per share, the Invesco DB US Dollar Index Bearish Fund ETF (UDN) moves higher when the dollar index declines. UDN has around $63.6 million of assets under management. The bearish dollar index ETF trades an average of more than 86,000 shares daily and charges the same 0.77% management fee.

Why the dollar index is losing its mojo

The dollar index has a limited reach, as it only measures the U.S. currency against other reserve currencies. The move towards a BRICS currency with gold backing could diminish the dollar’s dominant worldwide role. Saudi Arabia and other OPEC members are now selling crude oil to China and India in local currencies. The war in Ukraine and U.S. and European sanctions have caused China, Russia, and their allies to seek alternative foreign exchange choices to circumvent future sanctions. Cross-border transactions in BRICS or other non-reserve currencies will decrease the U.S. dollar’s global footprint.

Therefore, the U.S. currency could see its dominance decline. The dollar index may rise, but at the same time, the currency’s dominant role may decrease.

Meanwhile, the short-term trend in the dollar index is bullish in October 2023. Interest rate differentials favor a higher dollar. Historically, geopolitical tensions have caused the dollar and U.S. bonds to rally. While history tends to repeat, the world is changing with the bifurcation of the world’s nuclear powers and wars in Europe and the Middle East. As economics and geopolitics remain turbulent, expect increased price variance in the foreign exchange market.

UUP and UDN are liquid tools for market participants looking for dollar index exposure without venturing into the futures markets. The current trend favors a long risk position in the Invesco DB US Dollar Index Bullish Fund ETF, but expect many bumps and trend changes over the coming days, weeks, and months.

Read the full article here

Leave a Reply