Investment updates

Since the last Utah Medical Products, Inc. (NASDAQ:UTMD) publication there have been several updates that need close attention. The stock has pushed 14% lower as I write and trades at its lowest mark in ’23.

Chief among these updates is the ongoing lawsuits concerning UTMD’s Filshie clip system. The company originally disclosed that cases had been brought against it regarding Filshie clip in its annual report. Since then, there’s been a number of additional updates, that will be discussed in detail here today.

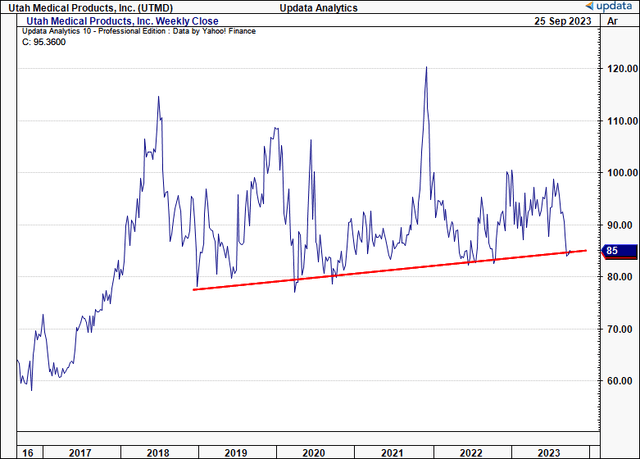

It’s no secret litigations can have a materially negative impact on company stock prices. Sentiment is one of the 3 or 4 factors required to see a stock sell higher in the first place, so a change in sentiment is often tied to a repricing of equity to the downside. UTMD has certainly been at the brunt of these lawsuits since its most recent update in August, and it’s not unreasonable to suggest a resulting change in sentiment towards the company’s equity stock. Over the long term, however, UTMD continues to trade within the range shown in Figure 1. Moreover, the company’s economics are an attractive proposition in my view, warranting a constructive view.

This report will unpack all of the moving parts of the Filshie saga and derive an opinion on what’s in store next for the company. Net-net, I continue to rate UTMD a buy.

Figure 1. UTMD long-term price line

Data: Updata

Risks to investment thesis:

Investors must realize the following set of risks before proceeding any further:

- A number of lawsuits have been brought against UTMD concerning its Filshie clip system, as mentioned. This is a risk investors simply cannot overlook, especially in the near term. Should the outcome of these cases be negative, or be unfavourable to UTMD, there is good reason to suspect its equity stock will take a hit. We have seen this already since the latest updates in August, so it is advisable to keep a very close eye on these cases moving forward. This cannot be stressed enough.

- Similarly, the Filshie clip segment made up >20% of UTMD’s revenues last year. Say there is a regulatory change to its status in the U.S. or abroad, this would hurt the company’s top-line numbers by at least this amount in my opinion. This cannot be overlooked either.

- It’s equally advisable to consider the macroeconomic risks currently impacting global equity markets, namely, the inflation/rates axis, and global equity flows away from risk assets.

These risks should not be ignored and must be realized in full before proceeding any further.

UTMD recent developments

1. Filshie Clip lawsuits continue

Filshie clips are a silicone-lined titanium device used in fertility control procedures for women. In 2019, as part of its acquisition of Femcare Group, UTMD acquired exclusive U.S. distribution rights for the Filshie clip system from CooperSurgical (CSI). In fact, point (3) of UTDM’s plan for 2023 in its annual report stated it would “focus on effectively differentiating the benefits of the Filshie Clip System in the U.S.”. In 2022, Filshie clip sales were 24% of total UTMD’s revenues, so it is an important component of the company’s operational breakdown.

The device is used to occlude the fallopian tubes and thus prevent pregnancy. It has been widely used in these kinds of procedures since 1981. But, like any device inserted into the body, there are post-operative complications.

Sharma et al. (2020) illustrate that “[c]omplications related to [Filshie clip] surgery are often related to misapplication of the clip, which can lead to future pregnancies. Complications related to the clip [itself] are more varied and often present as pain or abscess formation secondary to extrusion or migration of the clip…[m]igration of Filshie clips used during TL is estimated to occur in 25% of all patients”.

Across 2022 and ’23, several law firms, including Griffin Purnell, Handley Law, and Fisher Rushmer P.A., among others, initiated a number of civil suits against UTMD and CSI on behalf of patients regarding 1) the Filshie clip and 2) negative symptoms reported by said patients, likely due to the clip ‘migration’ described above. The claims allege the clip and/or surgery caused these patients undue stress with symptoms like pain, pelvic dysfunction and so forth.

On its website, Griffin Purnell asserts “[a]s we’ve maintained all along, Defendants have long known that Filshie Clips have an unacceptably high failure rate, with the inventor estimating a 25% migration risk…[t]he accumulating rulings make clear that Defendants must soon face their day in court for the deliberate efforts they undertook to maximize profits at the cost of women’s safety.”

Critically, there’s been a total of 17 lawsuits filed to date, tallying 117 claimants. But not all of these are still open, as various courts have moved to dismiss in several instances. Of the original 17, only 12 remain open, with 63 claimants, as seen in Table 1.

Table 1. Number of remaining vs. original suits

| Number |

Originally filed |

Currently Open |

| Lawsuits |

17 |

12 |

| States |

14 |

11 |

| Claimants |

117 |

63 |

Source: Adapted directly from UTMD announcement on Filshie Clip lawsuits, August 31st 2023.

But the run down from the original filing to the present day hasn’t been smooth for UTMD:

- Originally, in January this year, there were 14 lawsuits filed across 12 states. The lawsuits involved a total of 71 claimants, filed in both state and federal courts, with 1 lawsuit in Utah State court encompassing 50 claimants alone. As a reminder, UTMD is located in Utah.

- UTMD has moved for dismissal in most of the cases. Several suits have already been dismissed, and management believes more will be granted on the grounds of “lack of jurisdiction or U.S. FDA preemption“. In fact, in late August, the State Court of Utah dismissed the case of 50 complaints filed there. A total of 3 out of the original 14 federal lawsuits have also been dismissed.

- But this hasn’t slowed the number of suits brought against the firm. For starters, the law firms involved have continued soliciting claimants through social media. Consequently, a number of additional claimants have stepped forward.

- Since the company’s last annual report, where it originally disclosed all of this, 2 more federal lawsuits and 1 more state lawsuit have been filed.

- One of the federal lawsuits in New York has already been dismissed. This brings the number of dismissals to 5. But the state lawsuit, lodged in Connecticut, now involves 43 new claimants along with re-filings by 3 claimants whose federal lawsuits were previously dismissed.

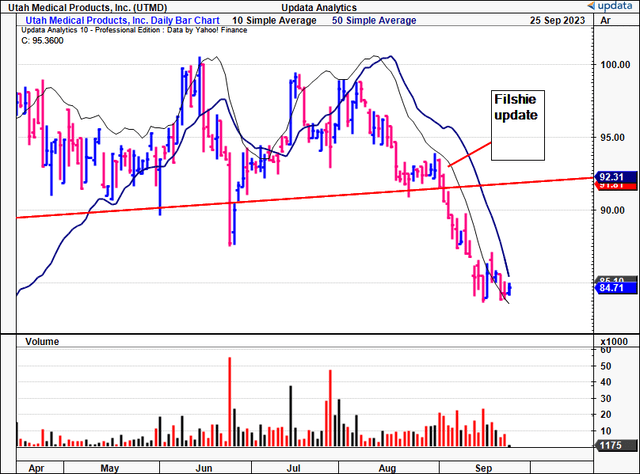

Whilst UTMD is pushing to dismiss as many of the cases it can, there’s no denying the impact on its stock price. You can see in Figure 2 the sharp selloff in the days that followed its August update, breaking a key support level in doing so. The stock looks to have found a short-term bottom, but further negative updates or outcomes could materially impact the company’s equity price even further.

Figure 2. Sharp selloff immediately following Filshie announcements in late August. Now trading at lowest marks in ’23.

Data: Updata

2. Q2 FY’23 and economic insights

UTMD put up Q2 revenues of $12.9mm, down 4.2% YoY. As we’ve seen throughout the last few quarters for UTMD, international sales surpassed domestic sales, growing ~450bps on last year, with U.S. revenues down ~10.5%. It pulled this to gross of 60.1% and operating income of 34%, both flat in Q2 last year.

To be perfectly honest, UTMD’s Q2 numbers were largely unremarkable. But this isn’t unusual for the company. It is a slow-growing, high-margin business that adds a few million in sales onto its clip each passing year. A longer-term view is absolutely essential to take in order to understand the economic value of this name.

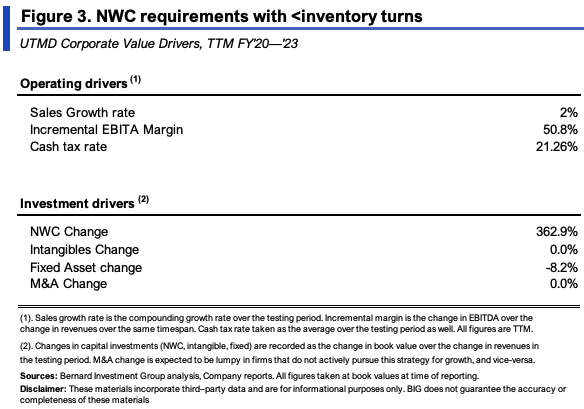

To illustrate this, Figure 3 depicts the company’s core value drivers over the last 3 years. Sales have compounded at a 2% growth rate, on exceptionally high operating margins of ~51%. Moreover, with every $1 in new sales, the company has managed to reduce its fixed asset intensity by $0.08.

Critically, the company’s NWC requirements are statistically high. Every dollar in sales growth has required $3.63 in additional NWC. This tells me the bulk of UTMD’s capital allocation is geared towards working capital, and therefore towards the day-to-day operations of the company.

BIG Insights

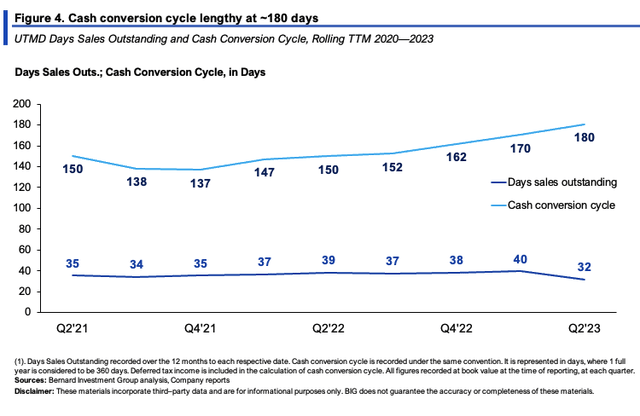

The impact of this NWC density is seen in Figure 4. The company’s cash conversion cycle has widened to ~180 days in Q2 from 150 days in 2020, meaning it takes around half a year to recycle $1 of NWC back to cash. In my view, this is quite interesting for a company with such a small fixed asset base. It doesn’t imply a high rate of capital turnover, but does square off with the economics of UTMD’s business. Mostly, UTMD is both a distributor and manufacturer for a number of products, and doesn’t necessarily hold high levels of inventory. What products it manufactures include injection moulding, silicone and plastics and some electrical components. So what NWC is required to run the business isn’t necessarily ‘efficient’.

BIG Insights

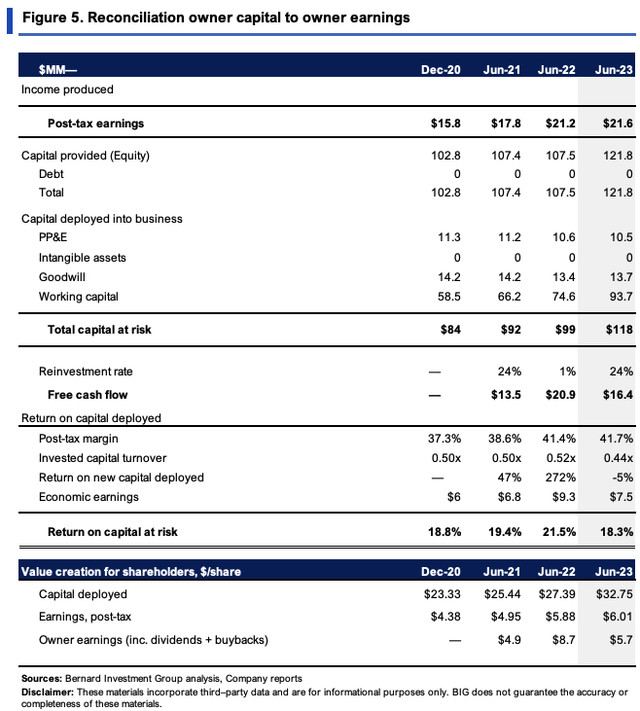

A deeper analysis of the firm’s economic performance provides more insight:

- In Q2, it had $118mm or $32.75/share of capital put at risk in operations, the bulk of which is tied up in NWC, as mentioned earlier.

- This produced $6.01/share in trailing NOPAT last period, an attractive 18% return on investment. I had discussed this at length in my last two publications on UTMD, so the trend was consistent into Q2 FY’23. It also threw off ~$16.5mm in trailing FCF by Q2 as well.

- Critically, UTMD’s return on capital is a function of remarkably high post-tax margins, around 38-41% on average since 2021. This more than compensates for the light capital turnover and lengthy cash conversion cycle outlined before. In other words, whilst the efficiency of UTMD’s investments is soft, what profits are generated off each $1 investment are high-$0.38-$0.41 on the dollar, as mentioned.

These are attractive economics in my view. Provided it can maintain a decent clip of sales growth, then it will continue adding value for shareholders on these numbers, supporting a buy rating for the long-term investor.

BIG Insights

Valuation and conclusion

The stock sells at 17.7x earnings and ~11x EBIT, both discounts of 39% and 46% to the sector as I write. These are compressed multiples that don’t reflect the underlying economics of UTMD’s ability to compound capital in my view. The question I ask when allocating our capital to a company’s equity stock is “will this company be a good custodian of the money?”

Let’s think about the answer to this in first principles.

- In UTMD, you have (i) a high-margin name, (ii) that regularly spins back 18-20% returns on capital invested, and (iii) is regularly FCF-positive.

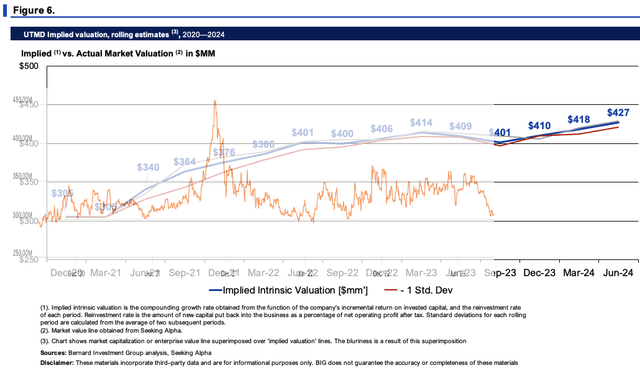

- A firm can also compound its intrinsic value at the function of its ROIC and reinvestment rate. The steady-state numbers shown in Figure 3 are reasonable expectations to carry forward in my opinion. Applying the calculus to UTMD, and extending its intrinsic value at the [ROIC x reinvestment rate] function, gets me to a market value of $409mm ($111/share) at the time of writing.

- Extending these out to FY’24, I get to $427mm or $118mm per share.

To me, UTMD is undervalued on these expectations.

BIG Insights

In short, UTMD faces a number of lawsuits regarding its Filshie clip system, which it is the distributor of in the U.S. and elsewhere. There is a risk to the company’s equity stock in the near term given these cases, and we’ve seen this in H2 FY’23. This should not be overlooked. For those investors keeping a longer-term view, however, UTMD offers quite attractive economics at a slow-growing clip. This is a high-margin, low capital turnover business, where most capital allocation is geared toward NWC versus fixed assets or acquisitions. Given the factors presented here today, I reiterate UTMD as a long-term buy.

Read the full article here

Leave a Reply