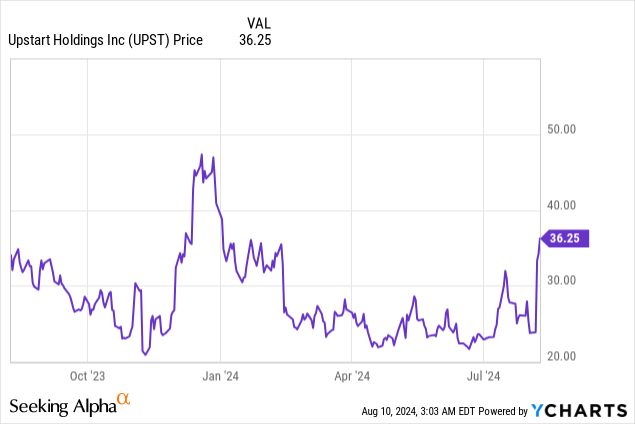

Upstart (NASDAQ:UPST) delivered a good earnings scorecard for the second fiscal quarter on Tuesday, which caused the Fintech’s shares to soar 40% immediately after earnings. The positive market reaction traces back to Upstart’s strong outlook for the upcoming third-quarter, which implies that the AI lending start-up is set to see a major acceleration of its top line growth. Upstart is not profitable at the moment, but a transition to a low-rate world should help the start-up’s earnings prospects. I believe that Upstart will see a boost to its business once the Federal Reserve decides to cut the Federal Fund rate and while more patience is required here, the Fintech is well-positioned to ride the down-cycle in rates. However, given the sharp upward revaluation on Friday, Upstart now has achieved my fair value target and I rate the Fintech a hold.

Previous rating

I rated shares of Upstart a strong buy in May, mainly because the Fintech’s revenue base stabilized at the beginning of the year and finally returned to flat growth in the second-quarter. This reversal in top line growth is set to continue in the third-quarter, as the start-up projects a sequential growth rate of 18%. As much as I like the upswing in revenue, I believe the Fintech is now fairly valued and has limited upside revaluation potential.

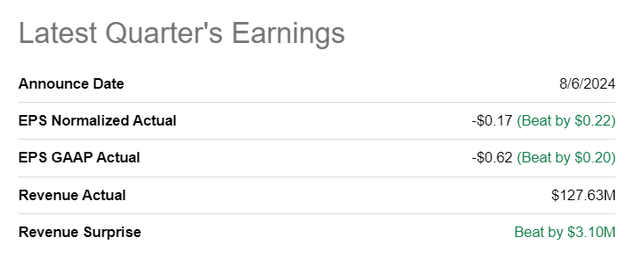

Upstart beat estimates

The Fintech presented a good earnings sheet for the second fiscal quarter. Upstart reported adjusted earnings of $(0.17) per-share, which beat the average prediction by $0.22 per-share. The lending start-up also beat the top line estimate easily: Upstart brought in $127.6M in revenues, which was $3.1M better than the average prediction.

Seeking Alpha

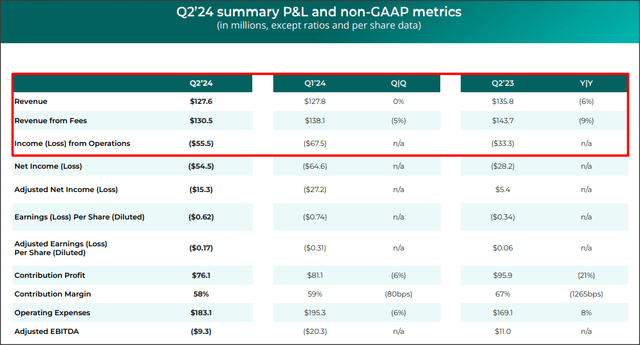

Solid Q2 results, revenue stabilization, strong loan growth

Upstart generated $127.6M in revenues in the second-quarter, showing a flat quarter-over-quarter growth. The change in the revenue trajectory is especially noteworthy because Upstart suffered from slowing loan demand for its AI-supported credit platform last year, with signs of a stabilization emerging earlier this year. While Upstart is not yet profitable, I believe the company’s earnings prospects are set to gradually improve in the second half of the year, as well as in FY 2025, which is when the Federal Reserve should have at least lowered the Federal Fund rate once.

Upstart

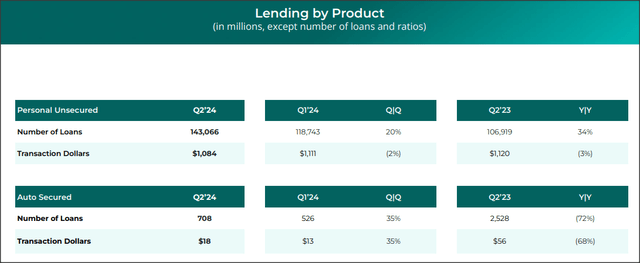

Upstart’s lending business is doing well and the start-up originated 20% more personal loans in the second-quarter, on a Q/Q basis, and 34% more personal loans than in the year-earlier period. Auto loan originations also increased at double-digit rates (+35% Q/Q), but Upstart remains overly focused on personal loans. Volume growth in the personal loan category is set to be a strong driver of profitability growth going forward and as soon as the Federal Reserve cuts back on the Federal Fund rate, possibly in an accelerating manner after last week’s massive surge in market volatility, Upstart could see very favorable business tailwinds unfold fairly soon.

Upstart

Additionally, Upstart improved some of its platform metrics, which further improve the recovery prospects for the Fintech. Upstart had a conversion rate of 15% on its credit platform in the second-quarter, showing a 1 PP gain Q/Q and a massive 6 PP gain Y/Y. The amount of fully automated loans, a key performance metric, increased to 91%, showing a 1 PP gain Q/Q as well (and a 4% gain Y/Y).

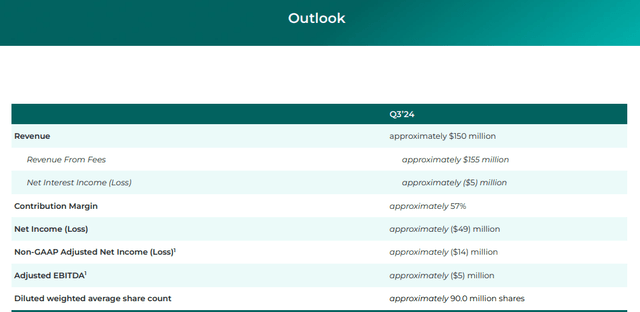

Very positive outlook

Upstart guided for $150M in revenue for the third fiscal quarter, which implies a quarter-over-quarter growth rate of 18%. Since revenues were flat in the previous quarter, the start-up expects a major acceleration of its top line for the current quarter, which is related to the expectation that the Federal Reserve will finally lower the Federal Fund rate.

Upstart

Upstart’s valuation

The Fintech has seen a steep drop in its valuation in the last two years as the market adjusted to a higher-for-longer market environment. Upstart’s shares, however, soared 40% immediately after earnings and have seen further positive momentum between Thursday and Friday. As much as I like Upstart, I believe shares are now fairly valued.

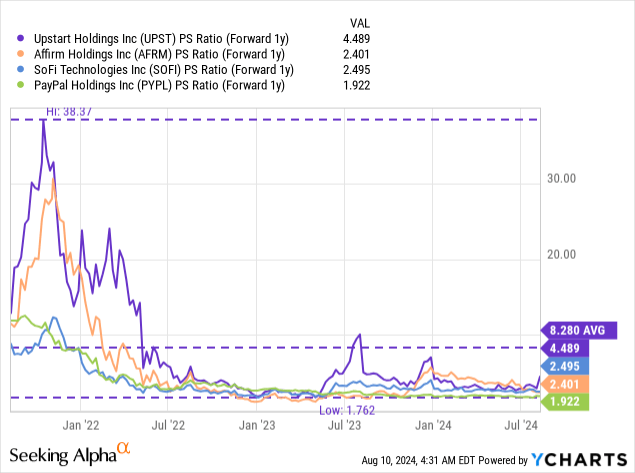

Upstart is currently valued at a price-to-revenue ratio of 4.5X, which is significantly above the industry group average P/S ratio, further indicating that it may now be time to scale back purchases of the Fintech’s shares. The industry group includes other Fintechs like Affirm (AFRM), SoFi Technologies (SOFI) and PayPal (PYPL). The average Fintech in this group trades at a P/S ratio of 2.8X, implying that investors currently pay a 59% premium for Upstart.

In my last work on the Fintech, I said that I saw a fair value P/S ratio for Upstart of 4.0X, given its historical valuation average. The Fintech clearly has upside potential in a lower-rate world, which is when credit demand tends to pick up and leads to higher origination volumes for Upstart. However, at the current time, I believe Upstart is about fairly valued: a 4.0X P/S ratio translates into a fair value estimate of $35 per-share. With Upstart’s shares now trading at $36.25, my fair value target has been achieved, and I am consequently downgrading UPST to hold.

Upstart’s risks

The biggest risk for Upstart, in my opinion, relates to the Federal Reserve’s unwillingness to cut the Federal Fund rate. A higher-for-longer rate setup would likely be the most unfavorable outcome for the AI lending start-up, but one that is increasingly unlikely. After last week’s market crash, there may even be pressure on the Federal Reserve to accelerate any rate cuts in order to calm nervous investors. What would change my mind about the lending platform is if Upstart were to either see decelerating revenue momentum or widening losses, even in a lower-rate world.

Final thoughts

Upstart is not yet out of the woods, but the second-quarter showed improvement in a number of ways. First, Upstart’s revenue trajectory improved in Q2 and the revenue growth rate was no longer negative. Second, Upstart is still losing money, but this could change as the Federal Reserve changes the rate trajectory, which has become more likely last week. Third, Upstart is seeing improving platform KPIs such as conversion rates, which will benefit the Fintech once credit demand picks up. While I like the business setup, I dislike Upstart from a valuation point of view and since shares have reached my fair value estimate, a downgrade to hold is justified, in my opinion.

Read the full article here

Leave a Reply