At a Glance

MiMedx Group’s (NASDAQ:MDXG) recent performance in Q2 2023 is characterized by a discernable focus on its Wound & Surgical sector, underpinned by robust revenue growth and operational efficiency. Yet, certain decisions such as the discontinuation of the Regenerative Health division raise queries about the company’s future diversification strategies and how it plans to offset R&D sunken costs. Additionally, despite solid YoY growth, the equity dilution signals a need for caution. Financials suggest sustained liquidity, but a significant pivot in institutional sentiment is apparent, marking an undercurrent of uncertainty that warrants vigilant monitoring. Overall, MiMedx stands at a critical juncture that calls for careful evaluation of both its clinical advancements in the Wound & Surgical sector and broader financial metrics to discern its future trajectory.

Q2 Earnings

To begin my analysis, looking at MiMedx’s most recent earnings report for Q2 2023, net sales increased to $81.3M, up 21.4% YoY. Hospital settings, a traditionally stable reimbursement sector, spearheaded this growth with a rise from $39.9M to $46.6M. Advanced Wound Care, particularly the Tissue/Other category, drove product sales with a jump from $60.3M to $75.5M. Operating expenses saw effective management; SG&A fell from $55.8M to $51.9M. Share dilution remains a concern, with a 2.6% YoY increase in weighted average common shares to 115.9M. Notably, the company disbanded its Regenerative Medicine unit and halted its Knee Osteoarthritis program, indicating a sharpened focus on its Wound & Surgical segment for future profitability.

Financial Health

Turning to MiMedx’s balance sheet, the company’s liquidity is worth noting. As of June 30, 2023, MiMedx has $68.7M in ‘Cash and Cash Equivalents’. When calculating the ‘Current Ratio,’ the firm shows total current assets of $141.2M divided by total current liabilities of $44.5M, giving a healthy ratio of 3.17. Over the last six months, ‘Net Cash Provided by Operating Activities’ comes in at $3.7M.

Given the company’s current ratio and positive cash flow from operating activities, the necessity for securing additional financing in the next twelve months seems low. MiMedx has demonstrated an ability to sustain operations with existing cash reserves. These are my personal observations, and other analysts might interpret the data differently.

Equity Analysis

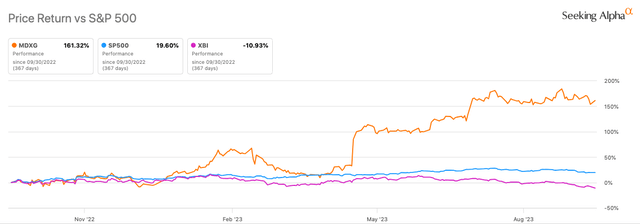

According to Seeking Alpha data, MiMedx has a market capitalization of $845.99M, signaling moderate market confidence given its focused growth in Wound & Surgical. Revenue projections for 2024 show a 13.13% increase, aligning with strategic pivots in portfolio. Relative to SPY, MDXG’s 1Y momentum is striking at +161.32% versus SPY’s +19.60%. The 24-month beta is 1.25, indicating somewhat higher volatility than the market.

Seeking Alpha

Options trading shows moderate volatility with puts at $7.50 indicating some downside protection; generally, the sentiment leans bullish. Short interest is at 3.4%, relatively low but worth monitoring. Ownership is diversified: 44.03% institutions, 6.55% hedge funds, suggesting balanced, strategic holdings. New institutional positions stand at 4,286,919 shares, while sold out positions are at 25,909,955 shares—indicating shifts in institutional confidence. Insider trading shows a net activity of 97,200 shares bought over the last 3 months, a mild positive signal. Overall, the picture is one of calculated growth with hints of investor caution.

MiMedx’s Prescription for Success: Wound Care and Hospital Alliances

MiMedx shows robust expansion in the Wound & Surgical division, with hospitals and Advanced Wound Care standing out. These domains offer financial predictability and are less susceptible to legislative changes, thus creating a competitive edge.

Key Markets

-

Wound & Surgical: This unit leans on tissue allografts and placental-based solutions, meeting rising demand in the wound care sector. The global increase in chronic wounds and diabetes is likely to fuel demand for such specialized offerings.

-

Regenerative Health: This was a high-potential but high-risk segment focusing on knee osteoarthritis. As of mid-2023, this area has been paused, suggesting a portfolio reshuffling.

Growth Drivers

-

Hospital Dominance: Increased sales in the hospital sector are promising, as these entities typically engage in long-term vendor agreements and are less price-sensitive.

-

Section 361 Success: The Advanced Wound Care products under Section 361 (human cell and tissue products) have become the cornerstone of the growth blueprint. If efficacy is sustained, this could spur deeper market entry.

-

Operational Leverage: The company’s ability to keep its SG&A costs in check, even with escalating sales, indicates maturing operational efficiency, which could boost long-term profit margins.

Potential Risks

-

Regenerative Unit Shutdown: While the halt of the Regenerative Health division could be a cautionary move, sunk R&D costs remain a concern.

-

Equity Dilution: Rising weighted average common shares might dilute EPS, affecting market sentiment adversely.

-

Geographic Constraints: Absence of notable international operations could restrict growth in emerging markets. Although the company intends to soon expand its operations beyond its very small presence in Japan.

Neutral Factors

-

Product Mix: The underutilized Section 351 (biological) portfolio could be either a latent growth engine or a flag for another portfolio reassessment.

All in all, MiMedx seems to be sharpening its focus on its most viable and financially sound segments. Though questions arise from the Regenerative Health wind-down and potential dilution of shareholder value, strong YoY growth and operational efficiencies point to a favorable path, particularly in the Wound & Surgical sector.

My Analysis & Recommendation

In synthesizing the fiscal, operational, and market outlook for MiMedx, the company presents a mixed, but generally optimistic, investment landscape. While its Q2 performance has been strong, especially in the Wound & Surgical segment, and the balance sheet shows commendable liquidity, cautionary signals exist—most notably, the significant institutional exits and share dilution. A pivot away from the Regenerative Health division raises queries about future growth vectors and sunk R&D costs, which can’t be ignored.

For the astute investor, the upcoming weeks and months offer a real-time stress test for MiMedx stock. The key metrics warranting close attention include:

-

Institutional Holdings: The disproportionate sell-offs among institutional players signal a diverging viewpoint that should be parsed carefully. Any further institutional exits could be a red flag.

-

Short Interest: Though low at present, any uptick in short interest might reflect growing market skepticism. Given MDXG’s higher-than-market beta, this could amplify stock volatility.

-

Product Efficacy: Keep an eye on clinical outcomes related to their Section 361 offerings. Any drop in product efficacy or safety could jeopardize the company’s main growth engine.

-

SG&A Stability: Continuation of operational leverage is a must. Any uptick in SG&A relative to sales would suggest weakening operational efficacy.

-

International Expansion: Given their current domestic focus, a push into emerging markets could represent a new growth horizon or a potential risk if executed poorly (e.g., markedly elevated expenses threatening profitability).

Given the substantial uncertainty in biotech, especially for a company mid-transition like MiMedx, a “Hold” recommendation seems most prudent at this juncture. While the company’s streamlined focus on its core Wound & Surgical sector has the potential for significant upside, the looming questions regarding institutional sentiment and operational changes warrant a guarded approach. Exercise caution, but also keep the company on your radar for evidence of sustained momentum or operational missteps that could provide a more decisive investment cue.

Read the full article here

Leave a Reply