Those who have been following my analyses recently are aware of my keen interest in the sustainability sector. However, until now, I haven’t delved into any stocks related to renewable energy production. One company that has recently caught my eye is Atlantica Sustainable Infrastructure (NASDAQ:AY), primarily due to three factors I find crucial: a geographically diversified portfolio, an impressive dividend, and what I believe is an exemplary debt management approach.

After a meticulous examination of the company, its asset portfolio, and financial statements, I’m convinced that it is undoubtedly a worthy buy. The cornerstone of my analysis lies in the dividend discount model, on which I’ve run multiple simulations. Even under the most pessimistic assumptions, the stock appears undervalued.

Business Model

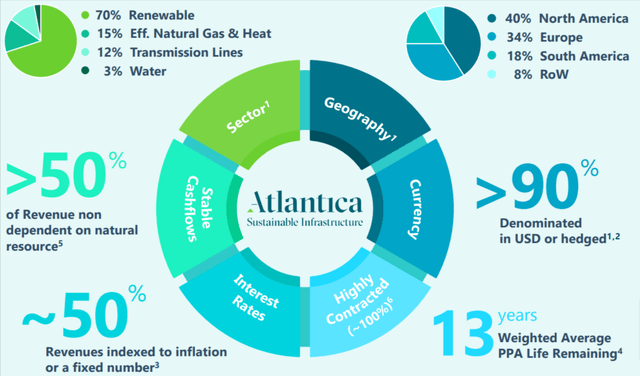

Atlantica’s business blueprint revolves around building a diversified asset portfolio geared towards the climate transition. Renewable energy projects make up 70%, efficient natural gas plants constitute 15%, transmission networks account for 12%, and assets related to water distribution form the remaining 3%.

The company’s operations span North America, South America, and Europe. Revenue distribution for the first half of the year breaks down as follows:

- EMEA: 46.97%

- North America: 36.50%

- South America: 16.53%

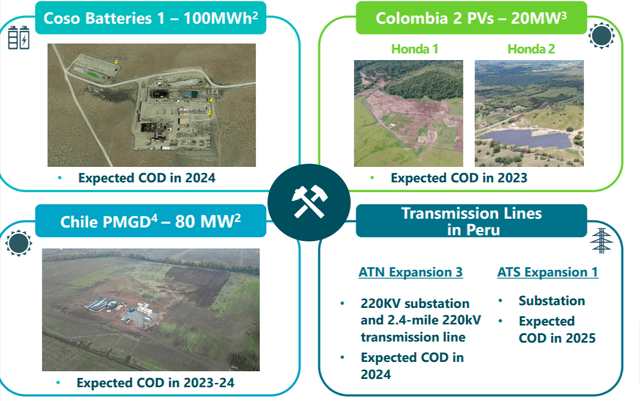

From next year onward, the company intends to branch into the energy storage realm. Their inaugural 100 MWh project is set to launch in the USA. However, their pipeline already forecasts 5.9 GWh of similar projects by 2030. Making up 43% of the pipeline, energy storage will be the prime focus of the company’s future investments, followed by solar (42%) and wind energy (14%). Only 1% of the pipeline is earmarked for other types of investments, such as transmission lines.

Overall, it can be argued that Atlantica boasts a well-balanced portfolio, diversified across various renewable energy forms and geographical regions. This strategy minimizes region-specific risks and ensures less volatile operational outcomes – a factor that has historically helped keep the stock’s volatility low.

Atlantica Sustainable Infrastructure – Investor presentation

Corporate Strategy

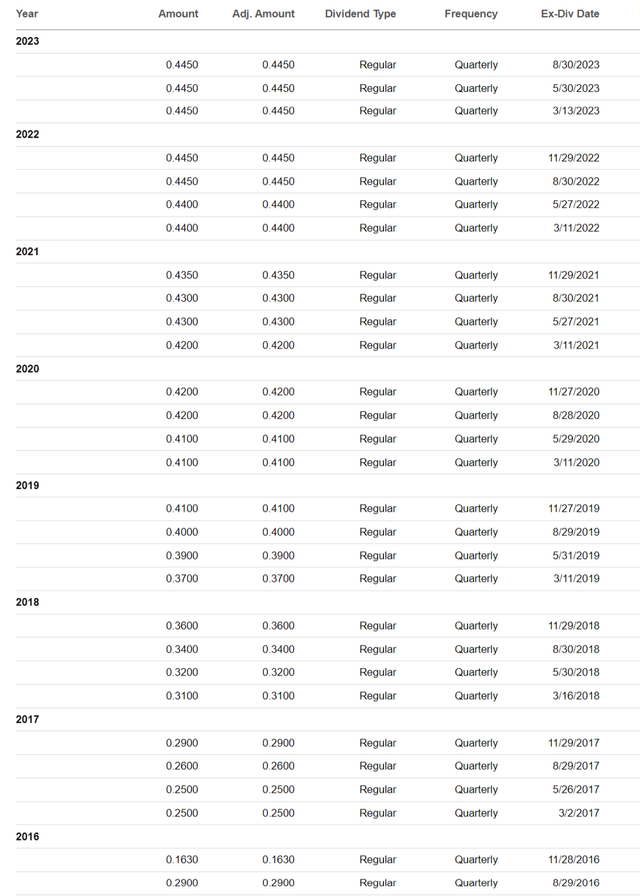

I believe the management’s strategy is commendably efficient. For starters, they do not blindly invest just to achieve notable growth. If there’s excess liquidity that cannot yield attractive returns, it’s distributed to shareholders. This philosophy has ensured consistently generous dividends over the years, the history of which can be found at the end of this section.

Two key guidelines shape Atlantica’s organic growth trajectory, as gleaned from the latest earnings call:

- Maintain a Net Debt/CAFD ratio between 3 and 4.

- Roughly keep an investment pace on the pipeline of $300 million.

The company takes a cautious approach to funding its operations. An average of 80% of its debts are project financings, with the remaining 20% at the corporate level. Each project has a clear debt repayment schedule, mostly at fixed rates, with maturities set before the end of the project’s useful life. To secure slightly more favorable interest rates than the market, 78% of the debt is in the form of green financing.

Each project falls under a specific subsidiary, and the company hedges its entire net exposure to the euro. Hedging isn’t done for minor currencies, such as those in South American projects, but each project has contractually guaranteed profitability or a kWh price indexed to inflation.

Even if market winds blow in a certain direction, Atlantica remains steadfast in emphasizing the importance – a stance I wholeheartedly agree with – of maintaining a geographically diversified portfolio.

Overall, Atlantica’s strategy leans towards prudence. It’s more about predictability and risk management than sheer growth. This implies that during unfavorable conditions in the renewables market, the blow isn’t too harsh.

The dividend history is as follows (Source: Seeking Alpha):

Seeking Alpha

A Closer Look at the Financials

An essential aspect to consider when examining the financials of a renewable energy company is the favorable depreciation system these firms can employ for their assets. Much like with Real Estate Investment Trusts (REITs), metrics such as EBITDA or net income can be misleading. This is why it’s valuable to primarily focus on revenues, free cash flow, and indebtedness.

|

Dec 2018 |

Dec 2019 |

Dec 2020 |

Dec 2021 |

Dec 2022 |

TTM |

|

|

Revenue |

1,043.80 |

1,011.50 |

1,013.30 |

1,211.70 |

1,102.00 |

1,101.40 |

|

Long-Term Debt |

5,554.70 |

5,063.70 |

6,197.60 |

5,589.60 |

5,239.20 |

5,149.90 |

|

Debt/Assets |

0.58 |

0.59 |

0.64 |

0.63 |

0.62 |

0.62 |

|

Unlevered FCF |

701.9 |

460.9 |

542.4 |

393.1 |

646.6 |

505.7 |

|

FCF/Share |

$4.68 |

$3.82 |

$4.26 |

$4.32 |

$4.45 |

$3.31 |

Revenue growth has been relatively stagnant in recent years, which stands out as the sole concern. However, this is expected to change in 2023-24 when four projects will be inaugurated: the battery storage center in California, two solar projects in Colombia, a scheme of small energy production centers in Chile, and the expansion of the ATN transmission line in Peru.

Atlantica Sustainable Infrastructure – Investor presentation

As I’ll illustrate using the discounted dividend model, growth isn’t a prerequisite. More importantly, it shouldn’t overshadow the profitability of investment projects. Atlantica is leveraging a significant portion of its liquidity to repay debts, anticipating a substantial decline in the coming years: by 2028, the company aims to reduce total indebtedness to $2 billion.

It’s worth noting that only $36 million of the corporate debt is due in 2023-24. Subsequent maturities are set at $153 million in 2025 and $316 million in 2026, but refinancing by then is expected to be considerably more cost-effective than today.

Dividend Discount Model

In my DDM, I have considered three scenarios: an optimistic one forecasting dividend growth from 2025, a neutral scenario without any growth rate, and a pessimistic one where dividends significantly drop in the first two years.

It’s crucial to understand that interest rate trends play a vital role, as one might guess. During the last earnings call, the management underscored that neither inflation nor interest rates are current concerns. But we all know growth isn’t the same when financing a project at 6% compared to 3%. Renewable energy businesses rely on expensive assets that demand substantial initial investments and generate liquidity based on the difference between financing costs and the asset’s net profitability. A shift in either of these variables significantly impacts the overall picture, and it’s no coincidence that 2023 was the first year without a dividend increase.

Firstly, I’ll detail the WACC calculation I used to discount future dividends. I used the 5-year average Beta value, the 10-year Treasuries yield as the risk-free rate, and arbitrarily set 4% as the risk premium.

|

Total debt |

5,569.00 |

|

% debt |

73.00% |

|

Cost of debt |

5.85% |

|

Tax Rate |

20% |

|

Equity |

2,060.00 |

|

% Equity |

27.00% |

|

Cost of Equity |

8.18% |

|

Risk free rate |

4.70% |

|

Beta |

0.87 |

|

Risk premium |

4% |

|

TOT (Equity + Debt) |

7,629.00 |

|

WACC |

5.63% |

Optimistic Scenario

In the optimistic scenario, I assumed that the company would maintain its dividend steady throughout 2023 and gradually regain its growth momentum when economic policies likely become more favorable. Both the US and Europe have earmarked 2030 as the reference year for many of their climate impact goals. Therefore, it’s reasonable to expect an acceleration in investments leading up to that year. I projected the calculations up to 2032, and thereafter, I calculated the terminal value with a perpetual growth rate of 2%.

|

Dividened |

Present value |

Growth rate |

|

|

2023 |

1.74 |

1.74 |

|

|

2024 |

1.74 |

1.65 |

0% |

|

2025 |

1.79 |

1.61 |

3% |

|

2026 |

1.88 |

1.60 |

5% |

|

2027 |

1.98 |

1.59 |

5% |

|

2028 |

2.07 |

1.58 |

5% |

|

2029 |

2.14 |

1.54 |

3% |

|

2030 |

2.20 |

1.50 |

3% |

|

2031 |

2.27 |

1.46 |

3% |

|

2032 |

64.33 |

39.29 |

2% |

|

TOT |

53.55 |

||

|

Upside |

201.85% |

Neutral Scenario

In the neutral scenario, I factored in a zero growth rate, both for the projected years and the perpetual growth rate. In this case, the calculations suggest a significant upside potential for the stock.

|

Dividendo |

Present value |

Growth rate |

|

|

2023 |

1.74 |

1.74 |

0% |

|

2024 |

1.74 |

1.65 |

0% |

|

2025 |

1.74 |

1.56 |

0% |

|

2026 |

1.74 |

1.48 |

0% |

|

2027 |

1.74 |

1.40 |

0% |

|

2028 |

1.74 |

1.32 |

0% |

|

2029 |

1.74 |

1.25 |

0% |

|

2030 |

1.74 |

1.19 |

0% |

|

2031 |

1.74 |

1.12 |

0% |

|

2032 |

30.91 |

18.88 |

0% |

|

TOT |

31.58 |

||

|

Upside |

78.03% |

Pessimistic Scenario

For the pessimistic scenario, I took into account a significant decrease in the dividend in 2024-25, with a null growth rate in 2026. I then used a 2% growth rate in the years leading up to the 2030 climate targets, before bringing it back to zero for 2031-32 and the perpetual growth rate.

|

Dividendo |

Present value |

Growth rate |

|

|

2023 |

1.74 |

1.74 |

|

|

2024 |

1.5 |

1.42 |

-13,79% |

|

2025 |

1.35 |

1.21 |

-10% |

|

2026 |

1.35 |

1.15 |

0% |

|

2027 |

1.38 |

1.11 |

2% |

|

2028 |

1.40 |

1.07 |

2% |

|

2029 |

1.43 |

1.03 |

2% |

|

2030 |

1.46 |

1.00 |

0% |

|

2031 |

1.46 |

0.94 |

0% |

|

2032 |

25.93 |

15.84 |

0% |

|

TOT |

26.50 |

||

|

Upside |

49.37% |

Conclusions and Final Thoughts

A drastic drop in Atlantica’s results would be required to justify its current valuation, a drop which isn’t consistent with the rapid expansion of the renewable sector. I can only infer two potential explanations: first, the markets might be using an unsustainably high rate to discount future cash flows, or they expect a significant increase in the stock’s volatility and thus the risk premium. Considering Atlantica’s remarkable FCF/share and its debt repayment plan, I can only view this stock as a BUY.

As always, my philosophy revolves around the intrinsic value of the stock I’m buying. The possibility of the shares declining further in the upcoming weeks or months doesn’t deter me, and it could be an opportunity to keep buying at ever-decreasing prices.

Risks Associated with the Analysis

Atlantica Sustainable has already announced a reconsideration of its business strategy, with new guidance to be presented in the near future. A specific date has not been provided yet. This inevitably introduces an element of uncertainty regarding the company’s future actions, but it’s highly unlikely that the strategic revision will be detrimental.

Another risk to note is that the company has decided to invest a significant portion of its pipeline in energy storage, an area it hasn’t ventured into yet. This could lead to unforeseen challenges and setbacks, typical of entering a new line of business.

Lastly, there’s always the climate risk. Photovoltaic and solar installations are vulnerable to potential floods, hurricanes, and other atmospheric phenomena that can cause substantial damage. Extreme weather events have been on the rise over the years, making it increasingly difficult to predict their next point of impact.

Read the full article here

Leave a Reply